Question

It is your 25th birthday (end of 25 years) and you decide that you want to retire on your 65th birthday (end of 65 years

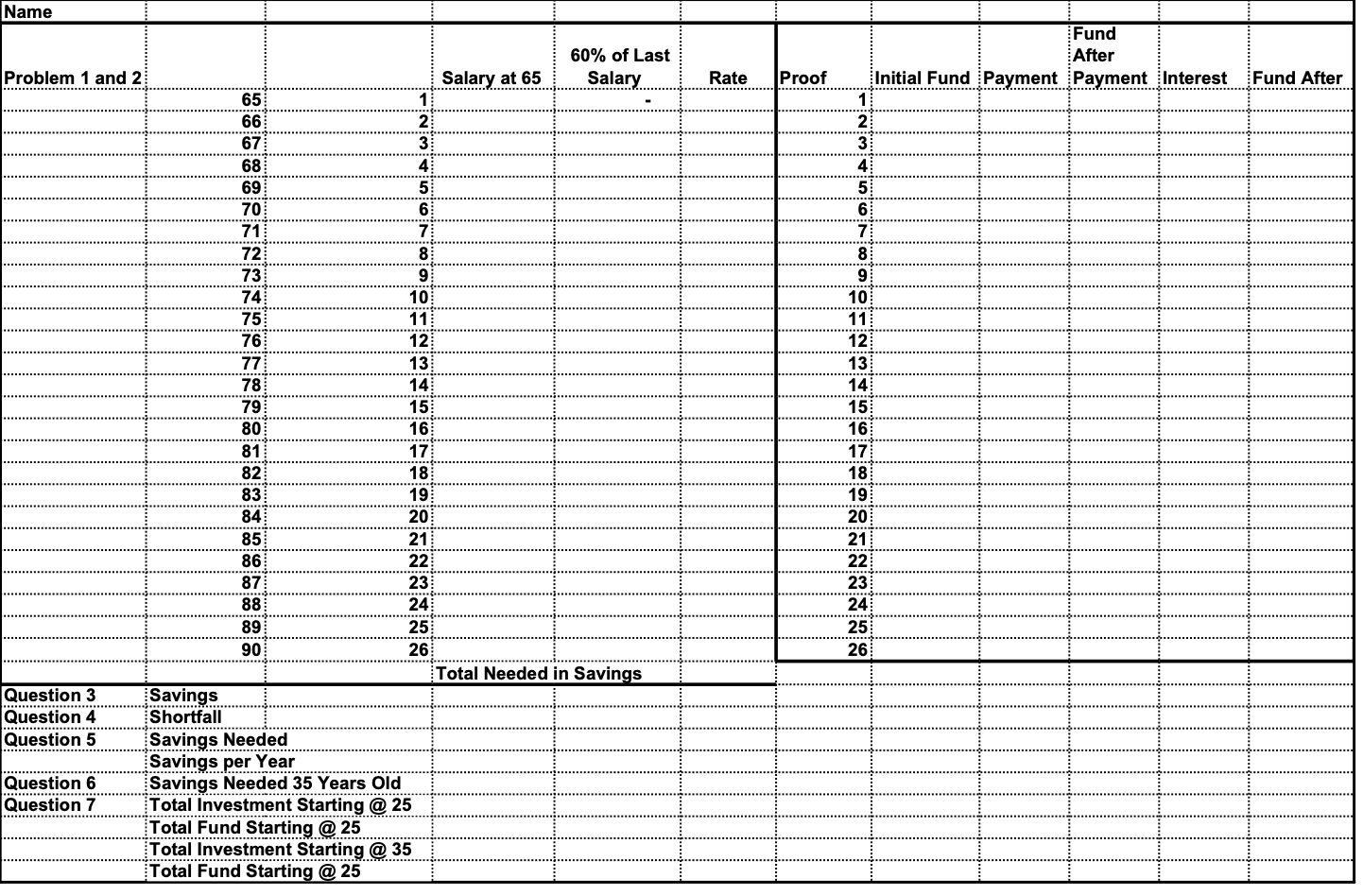

It is your 25th birthday (end of 25 years) and you decide that you want to retire on your 65th birthday (end of 65 years - 40 years later). Your current salary is $60,000 per year and you expect your salary to increase by 3% each year for the next 40 years. When you retire, you want your retirement fund to provide an annual payment equal to 60% of your salary at age 65 and to increase by 2% a year (to cover inflation) through the end of your retirement (Social Security will cover the rest). You estimate your retirement will last 25 years (Age 65-89 - 25 payments). You want to leave your children the sum of $900,000 when you die on your 90th birthday. You do not want to work during your retirement and since you dont want to work during your retirement, you need to have all your money in the retirement fund on the day you retire (65 years old) when you also make the first retirement payment to yourself. All calculations take place at the end of each year therefore you can use the rate tables.

Your expected rate of return (investment rate) for the entire period of time (65 years) is 5%. You are determined to save $15,000 a year for the first 20 years and $25,000 a year for the remaining 20 years until you retire.

2) How much will do you need in your retirement fund on the day you retire in order to receive the amounts in question #1 and leave the inheritance to your children? Show proof for the 26 payments (including inheritance) that you have enough in the fund?

3) How much will you have saved (retirement fund) on the day you retire?

4) If the answers to Questions #2 and #3 are different, how much are you either over or short in your retirement fund?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started