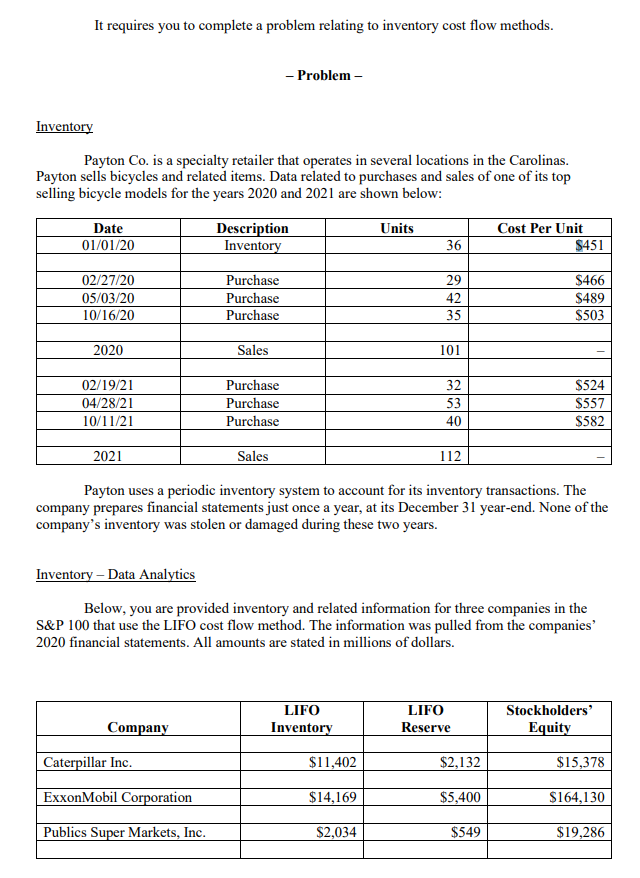

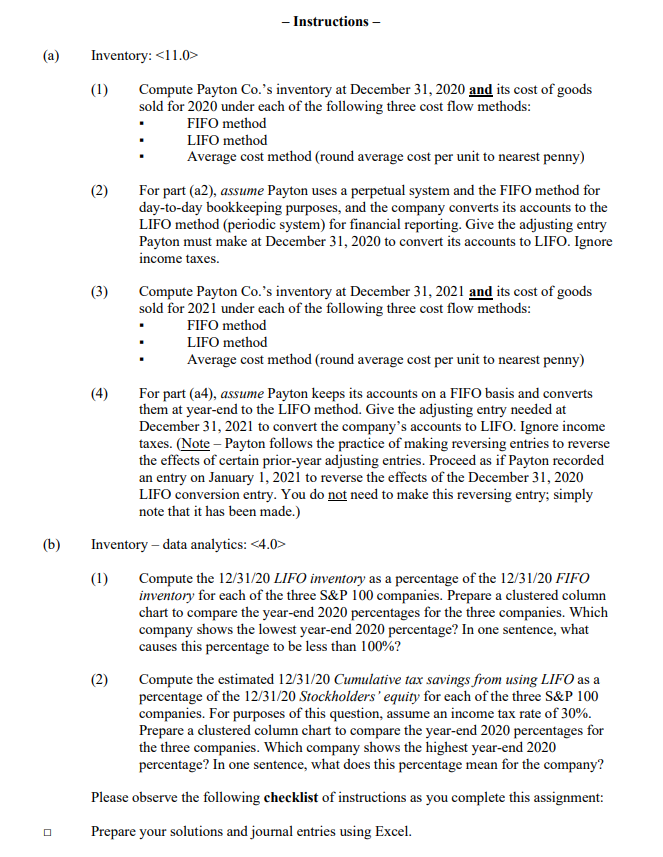

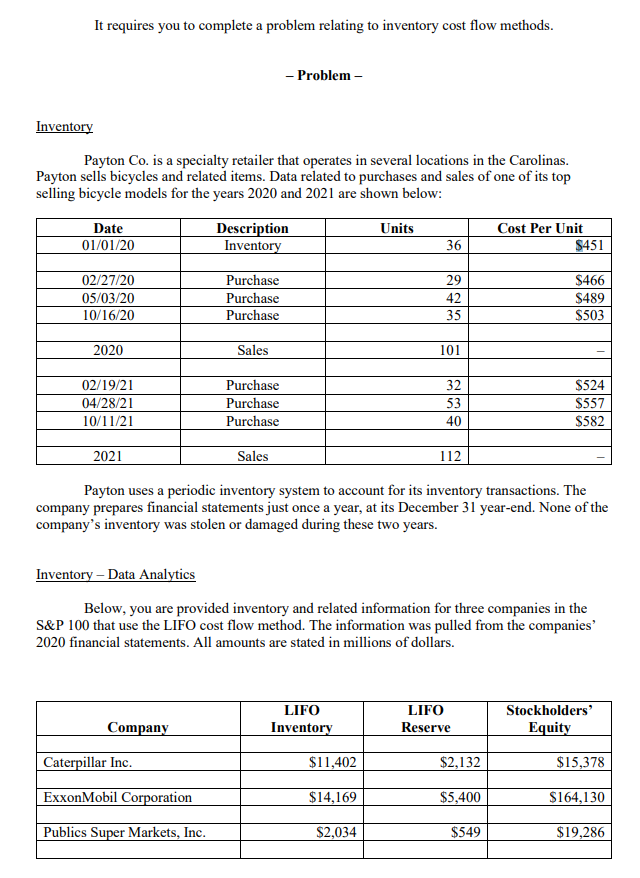

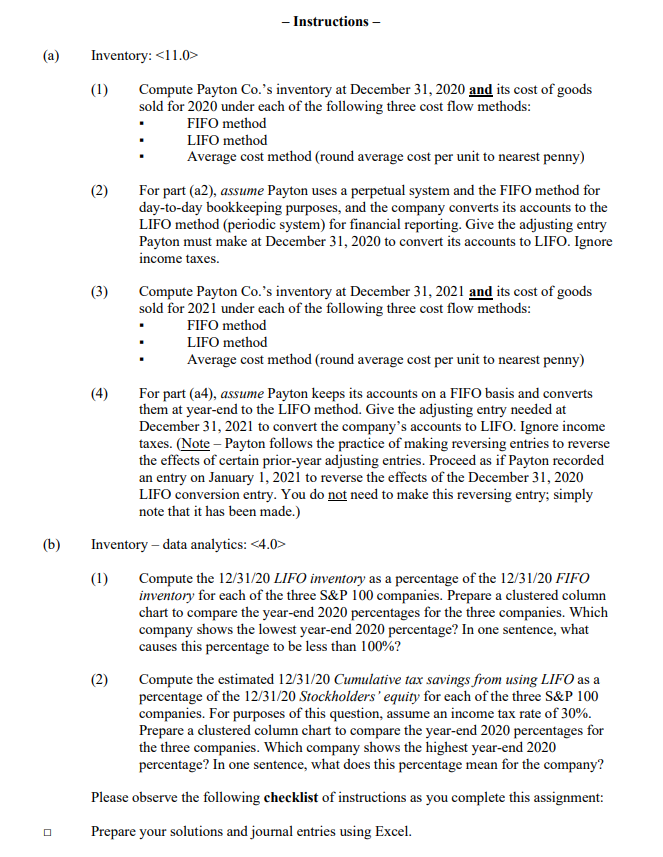

It requires you to complete a problem relating to inventory cost flow methods. - Problem - Inventory Payton Co. is a specialty retailer that operates in several locations in the Carolinas. Payton sells bicycles and related items. Data related to purchases and sales of one of its top selling bicycle models for the years 2020 and 2021 are shown below: Units Date 01/01/20 Description Inventory Cost Per Unit $451 36 02/27/20 05/03/20 10/16/20 Purchase Purchase Purchase 29 42 35 S466 $489 $503 2020 Sales 101 02/19/21 04/28/21 10/11/21 Purchase Purchase Purchase 32 53 40 $524 $557 $582 2021 Sales 112 Payton uses a periodic inventory system to account for its inventory transactions. The company prepares financial statements just once a year, at its December 31 year-end. None of the company's inventory was stolen or damaged during these two years. Inventory - Data Analytics Below, you are provided inventory and related information for three companies in the S&P 100 that use the LIFO cost flow method. The information was pulled from the companies' 2020 financial statements. All amounts are stated in millions of dollars. LIFO Inventory LIFO Reserve Stockholders Equity Company Caterpillar Inc. $11,402 $2,132 $15,378 ExxonMobil Corporation $14,169 $5,400 $164,130 Publics Super Markets, Inc. $2,034 $549 $19,286 - Instructions - ( (a) (2) (4) Inventory: (1) Compute Payton Co.'s inventory at December 31, 2020 and its cost of goods sold for 2020 under each of the following three cost flow methods: FIFO method LIFO method Average cost method (round average cost per unit to nearest penny) ( For part (a), assume Payton uses a perpetual system and the FIFO method for day-to-day bookkeeping purposes, and the company converts its accounts to the LIFO method (periodic system) for financial reporting. Give the adjusting entry Payton must make at December 31, 2020 to convert its accounts to LIFO. Ignore income taxes. (3) Compute Payton Co.'s inventory at December 31, 2021 and its cost of goods sold for 2021 under each of the following three cost flow methods: FIFO method LIFO method Average cost method (round average cost per unit to nearest penny) 4 For part (a4), assume Payton keeps its accounts on a FIFO basis and converts them at year-end to the LIFO method. Give the adjusting entry needed at December 31, 2021 to convert the company's accounts to LIFO. Ignore income taxes. (Note - Payton follows the practice of making reversing entries to reverse the effects of certain prior-year adjusting entries. Proceed as if Payton recorded an entry on January 1, 2021 to reverse the effects of the December 31, 2020 LIFO conversion entry. You do not need to make this reversing entry; simply note that it has been made.) Inventory - data analytics: (1) Compute the 12/31/20 LIFO inventory as a percentage of the 12/31/20 FIFO inventory for each of the three S&P 100 companies. Prepare a clustered column chart to compare the year-end 2020 percentages for the three companies. Which company shows the lowest year-end 2020 percentage? In one sentence, what causes this percentage to be less than 100%? (2) Compute the estimated 12/31/20 Cumulative tax savings from using LIFO as a percentage of the 12/31/20 Stockholders' equity for each of the three S&P 100 companies. For purposes of this question, assume an income tax rate of 30%. Prepare a clustered column chart to compare the year-end 2020 percentages for the three companies. Which company shows the highest year-end 2020 percentage? In one sentence, what does this percentage mean for the company? Please observe the following checklist of instructions as you complete this assignment: Prepare your solutions and journal entries using Excel. (b) ( Give careful attention to your formatting of information. Formatting includes effective presentation of information, correct spelling and capitalization, and proper use of dollar signs, commas, and underscoring. Round all dollar amounts you present in your solutions and journal entries to the nearest dollar. It requires you to complete a problem relating to inventory cost flow methods. - Problem - Inventory Payton Co. is a specialty retailer that operates in several locations in the Carolinas. Payton sells bicycles and related items. Data related to purchases and sales of one of its top selling bicycle models for the years 2020 and 2021 are shown below: Units Date 01/01/20 Description Inventory Cost Per Unit $451 36 02/27/20 05/03/20 10/16/20 Purchase Purchase Purchase 29 42 35 S466 $489 $503 2020 Sales 101 02/19/21 04/28/21 10/11/21 Purchase Purchase Purchase 32 53 40 $524 $557 $582 2021 Sales 112 Payton uses a periodic inventory system to account for its inventory transactions. The company prepares financial statements just once a year, at its December 31 year-end. None of the company's inventory was stolen or damaged during these two years. Inventory - Data Analytics Below, you are provided inventory and related information for three companies in the S&P 100 that use the LIFO cost flow method. The information was pulled from the companies' 2020 financial statements. All amounts are stated in millions of dollars. LIFO Inventory LIFO Reserve Stockholders Equity Company Caterpillar Inc. $11,402 $2,132 $15,378 ExxonMobil Corporation $14,169 $5,400 $164,130 Publics Super Markets, Inc. $2,034 $549 $19,286 - Instructions - ( (a) (2) (4) Inventory: (1) Compute Payton Co.'s inventory at December 31, 2020 and its cost of goods sold for 2020 under each of the following three cost flow methods: FIFO method LIFO method Average cost method (round average cost per unit to nearest penny) ( For part (a), assume Payton uses a perpetual system and the FIFO method for day-to-day bookkeeping purposes, and the company converts its accounts to the LIFO method (periodic system) for financial reporting. Give the adjusting entry Payton must make at December 31, 2020 to convert its accounts to LIFO. Ignore income taxes. (3) Compute Payton Co.'s inventory at December 31, 2021 and its cost of goods sold for 2021 under each of the following three cost flow methods: FIFO method LIFO method Average cost method (round average cost per unit to nearest penny) 4 For part (a4), assume Payton keeps its accounts on a FIFO basis and converts them at year-end to the LIFO method. Give the adjusting entry needed at December 31, 2021 to convert the company's accounts to LIFO. Ignore income taxes. (Note - Payton follows the practice of making reversing entries to reverse the effects of certain prior-year adjusting entries. Proceed as if Payton recorded an entry on January 1, 2021 to reverse the effects of the December 31, 2020 LIFO conversion entry. You do not need to make this reversing entry; simply note that it has been made.) Inventory - data analytics: (1) Compute the 12/31/20 LIFO inventory as a percentage of the 12/31/20 FIFO inventory for each of the three S&P 100 companies. Prepare a clustered column chart to compare the year-end 2020 percentages for the three companies. Which company shows the lowest year-end 2020 percentage? In one sentence, what causes this percentage to be less than 100%? (2) Compute the estimated 12/31/20 Cumulative tax savings from using LIFO as a percentage of the 12/31/20 Stockholders' equity for each of the three S&P 100 companies. For purposes of this question, assume an income tax rate of 30%. Prepare a clustered column chart to compare the year-end 2020 percentages for the three companies. Which company shows the highest year-end 2020 percentage? In one sentence, what does this percentage mean for the company? Please observe the following checklist of instructions as you complete this assignment: Prepare your solutions and journal entries using Excel. (b) ( Give careful attention to your formatting of information. Formatting includes effective presentation of information, correct spelling and capitalization, and proper use of dollar signs, commas, and underscoring. Round all dollar amounts you present in your solutions and journal entries to the nearest dollar