Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It says, based on market value weighings, calculate Monkey's weighted average cost of capital. 36. A Dozen Monkeys Ltd. has the following right-hand side of

It says, based on market value weighings, calculate Monkey's weighted average cost of capital.

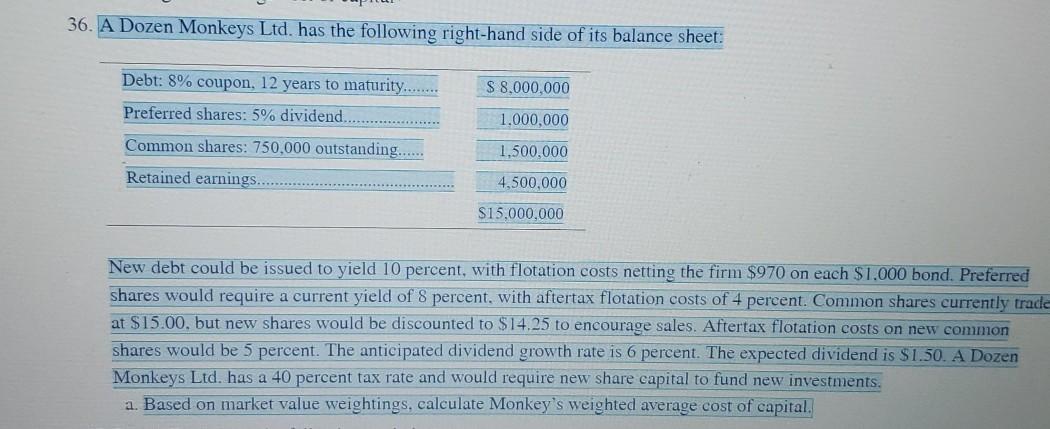

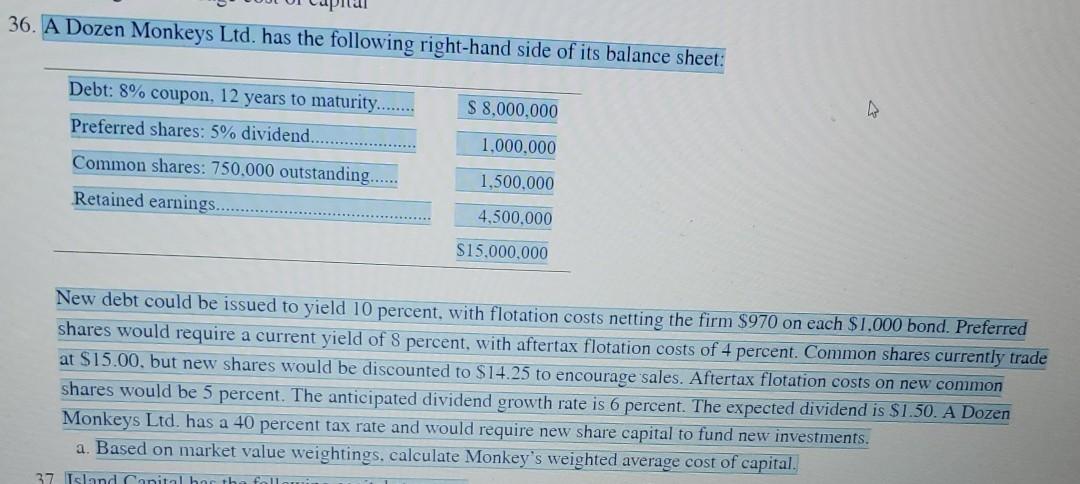

36. A Dozen Monkeys Ltd. has the following right-hand side of its balance sheet: Debt: 8% coupon, 12 years to maturity... $ 8.000.000 Preferred shares: 5% dividend. 1.000,000 Common shares: 750.000 outstanding...... 1,500,000 Retained earnings.. 4,500,000 $15,000,000 New debt could be issued to yield 10 percent, with flotation costs netting the firm $970 on each $1.000 bond. Preferred shares would require a current yield of 8 percent, with aftertax flotation costs of 4 percent. Common shares currently trade at $15.00. but new shares would be discounted to $14.25 to encourage sales. Aftertax flotation costs on new common shares would be 5 percent. The anticipated dividend growth rate is 6 percent. The expected dividend is $1.50. A Dozen Monkeys Ltd. has a 40 percent tax rate and would require new share capital to fund new investments. a. Based on market value weightings, calculate Monkey's weighted average cost of capital. 36. A Dozen Monkeys Ltd. has the following right-hand side of its balance sheet: Debt: 8% coupon, 12 years to maturity........ Preferred shares: 5% dividend.. S 8.000.000 1.000.000 Common shares: 750.000 outstanding...... Retained earnings. 1.500.000 4.500.000 $15.000.000 New debt could be issued to yield 10 percent, with flotation costs netting the firm $970 on each $1.000 bond. Preferred shares would require a current yield of 8 percent, with aftertax flotation costs of 4 percent. Common shares currently trade at $15.00, but new shares would be discounted to $14.25 to encourage sales. Aftertax flotation costs on new common shares would be 5 percent. The anticipated dividend growth rate is 6 percent. The expected dividend is $1.50. A Dozen Monkeys Ltd. has a 40 percent tax rate and would require new share capital to fund new investments. a. Based on market value weightings, calculate Monkey's weighted average cost of capital. 37 Island Canital hortStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started