Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It was June 25, 2019, and Mike Ireland, owner of Ireland Renovations (IR), was contemplating the future of his construction and renovation company. Ireland's

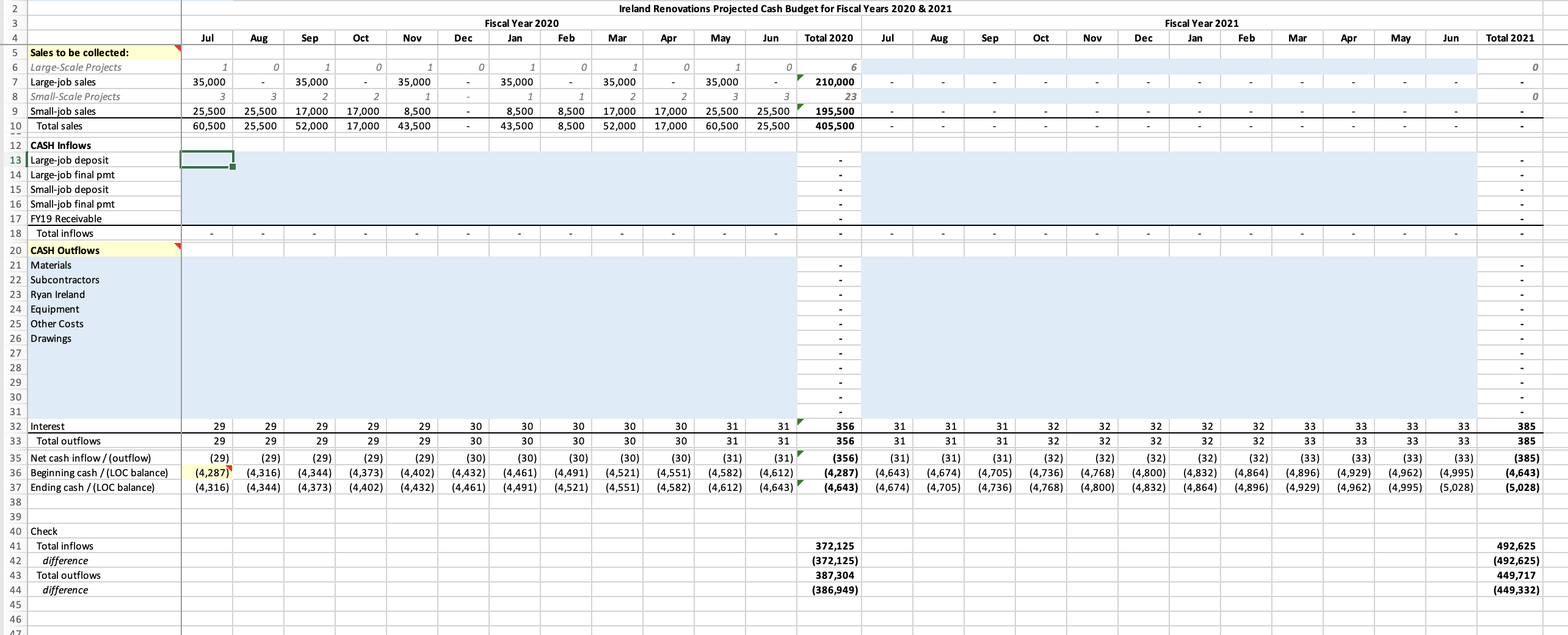

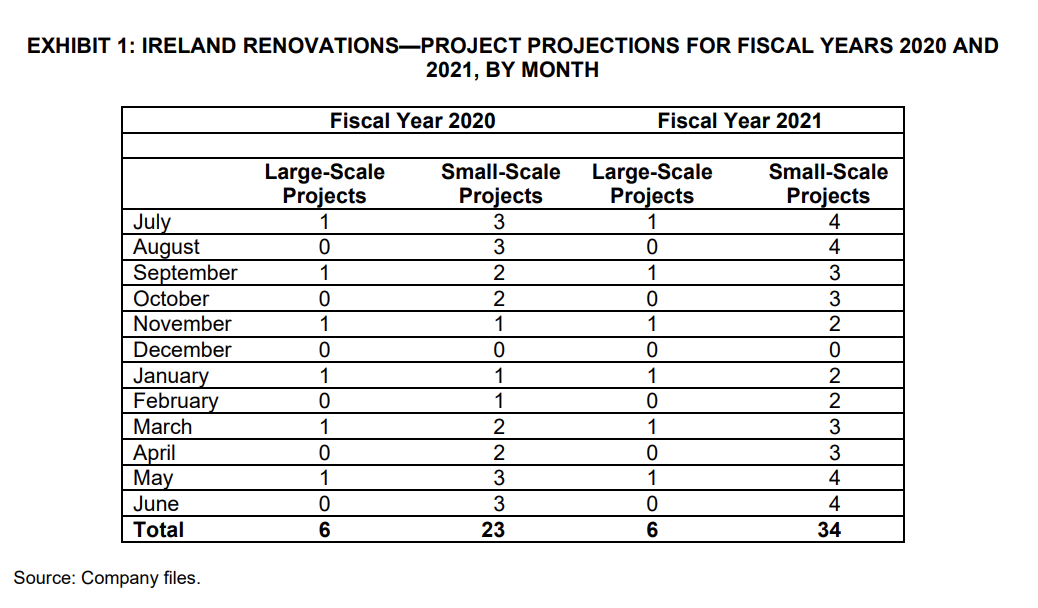

It was June 25, 2019, and Mike Ireland, owner of Ireland Renovations (IR), was contemplating the future of his construction and renovation company. Ireland's youngest son, Ryan, was about to enter the workforce and had shown an interest in working for the family business. Ryan, along with Ireland's two older sons, had often worked part-time on renovation projects during the summer months. Ireland wondered whether he could afford to employ Ryan full-time given the current financial state of IR. Ireland decided to project and analyze cash budgets for fiscal years (FYs) 2020 and 2021 to determine whether hiring Ryan would be a feasible option. IRELAND RENOVATIONS IR was a construction and renovation company serving London and Middlesex County, Ontario.' The company was established in 2002 and provided a wide array of services, including but not limited to interior and exterior renovations of residential, commercial, and industrial buildings; basement development; window and door installation; construction of fences, decks, pool houses, and sheds; cabinet assembly and installation; flooring installation; and concrete services. IR offered free estimates with no commitment or money down until the project began. At the commencement of the project, IR required a down payment of 25 per cent of the total estimated project value, with the remainder due within 30 days of the project's completion. The majority of IR's customers came from referrals. As such, it was rare for customers not to pay their outstanding bill upon completion of the project. Mike Ireland Mike Ireland was an Energy Star certified, insured, and fully licensed general contractor with more than 40 years of experience in the industry. A general contractor was a person who contracted and took responsibility for completing a construction project. The general contractor would hire, supervise, and pay all subcontractors and suppliers. Ireland was skilled and licensed in numerous areas of construction and could often complete many aspects of the construction projects by himself. However, areas where Ireland was not licensed would require a subcontractor (e.g., a plumber or electrician) to complete the project. Up 1 London and Middlesex County was located approximately 200 kilometres west of Toronto, Ontario, and had a combined population of approximately 455,526. 2 Energy Star was a partnership between the Government of Canada and industry to make energy-efficient products visible and readily available to Canadians. The program promoted the protection of the environment by helping to reduce greenhouse gas emissions and other pollutants. Energy Star-certified contractors were licensed to provide energy-efficient products and services to customers. 23 Fiscal Year 2020 Ireland Renovations Projected Cash Budget for Fiscal Years 2020 & 2021 Feb Mar Apr May Jun Total 2020 Jul Aug Sep Oct Nov Dec Fiscal Year 2021 Jan Feb Mar Apr May Jun 4 Jul Aug Sep Oct Nov Dec Jan 5 Sales to be collected: 6 Large-Scale Projects 1 0 0 1 0 0 1 0 0 6 7 Large-job sales 35,000 35,000 35,000 35,000 8 Small-Scale Projects 3 3 2 2 1 1 1 35,000 2 2 35,000 3 210,000 3 23 9 Small-job sales 25,500 10 Total sales 60,500 25,500 17,000 25,500 52,000 17,000 17,000 8,500 8,500 8,500 17,000 17,000 25,500 25,500 195,500 43,500 43,500 8,500 52,000 17,000 60,500 25,500 405,500 12 CASH Inflows 13 Large-job deposit 14 Large-job final pmt 15 Small-job deposit 16 Small-job final pmt 17 FY19 Receivable 18 Total inflows 20 CASH Outflows 21 22 Materials Subcontractors 23 Ryan Ireland 24 Equipment 25 Other Costs 26 Drawings 27 28 29 30 31 Total 2021 - 0 0 - - - 32 Interest 29 33 Total outflows 29 22 29 29 29 29 22 29 29 29 29 30 30 30 30 30 30 30 30 30 30 31 31 31 356 31 31 31 32 32 31 356 31 31 31 32 32 32 32 32 32 32 32 33 33 33 33 385 33 33 33 33 385 35 Net cash inflow/(outflow) (29) (29) (29) (29) (29) (30) (30) (30) (30) (30) (31) (31) (356) (31) (31) (31) (32) (32) (32) (32) (32) (33) (33) (33) (33) (385) 36 Beginning cash / (LOC balance) (4,287) (4,316) (4,344) (4,373) (4,402) (4,432) (4,461) (4,491) (4,521) (4,551) (4,582) (4,612) 37 Ending cash / (LOC balance) (4,316) (4,344) (4,373) (4,402) (4,432) (4,461) (4,491) (4,521) (4,551) (4,582) (4,612) (4,643) (4,287) (4,643) (4,643) (4,674) (4,705) (4,674) (4,705) (4,736) (4,736) (4,768) (4,768) (4,800) (4,832) (4,864) (4,896) (4,929) (4,962) (4,995) (4,643) (4,800) (4,832) (4,864) (4,896) (4,929) (4,962) (4,995) (5,028) (5,028) 38 39 40 Check 41 Total inflows 42 difference 43 Total outflows 372,125 (372,125) 387,304 492,625 (492,625) 44 difference (386,949) 449,717 (449,332) 45 46 17 to that point, Ireland had not needed to employ anyone full-time within IR. Aside from the subcontractors, whenever Ireland required the assistance of a general labourer, one of his three sons or his father would work for him on an as-needed basis. Similar to the experience of his own children, Ireland had begun working part-time in construction as a general labourer at 16 years of age. On graduation from high school, he worked full-time in this same role for his father. His father had also been a general contractor, but mainly took on projects related to bricklaying and stonework. In 1978, Ireland and his father moved to California for a year to work for Ireland's uncle, who had secured contracts on several projects that were too large to complete on his own. Upon returning to Canada, Ireland decided that he wanted to follow in his father's footsteps and work toward owning his own construction and renovation company in the future. He founded IR in 2002. CANADA'S HOME RENOVATION AND IMPROVEMENT INDUSTRY In 2017, the home renovation and improvement industry in Canada was worth more than $78 billion, and the number of Canadians planning a home renovation had continued to increase. According to a poll conducted by the Canadian Imperial Bank of Commerce, during 2018, 45 per cent of Canadians planned to renovate their home in some way during the next 12 months, and Ontarians planned to spend an average of $13,600 on their renovations.* Many of the homeowners planning a renovation were aged 55 and older and preferred to stay in homes and neighbourhoods that they loved rather than downsize to a new home. Topping the list of renovation and home improvement projects were basic maintenance (i.e., painting, flooring, general repairs, and replacing appliances), landscaping (including decks, patios, and driveways), bathroom and kitchen renovations, and window and door replacements. The construction industry in Canada employed more than 1.4 million Canadians in a wide variety of construction trades and professions. Typically, construction firms in this industry were small, with 70 per cent of firms in the residential sector employing fewer than five employees. FUTURE OUTLOOK IR's cash flow needed to be monitored closely. Typically, IR needed to pay for materials and subcontract work related to a project prior to being paid by the customer. This payment structure often made it difficult to maintain a positive cash balance throughout the year. To finance these deficit months, Ireland had utilized a line of credit since the inception of the business in 2002. The line of credit had a limit of $65,000. Interest on the line of credit was charged at an annual rate of 8 per cent based on the outstanding balance at the end of each month. Interest payments were due 14 days after the end of the month. Currently, the line of credit had an outstanding balance of $4,287. Ireland did not anticipate this balance changing before the end of June 2019. Future Contracts Ireland classified IR's projects as large- and small-scale projects. Large-scale contracts typically lasted an average of two months and included kitchen renovations and basement development. Ireland quoted these types of projects to customers at an amount between $20,000 and $50,000, depending on the size of the project, quality of materials, and the amount of subcontracted work required. IR's average large-scale contract was quoted at $35,000. Small-scale projects typically lasted between one day and one month and included bathroom renovations, window and door installations, fences and decks, and pool houses and sheds. These projects were usually quoted at an average cost of $8,500. Due to the outdoor nature of many of these small-scale projects, IR often experienced a slowdown during the colder months of November to February, and Ireland would use these slower months, particularly December, to take vacation time and catch up on any outstanding administrative work. IR took on only one large-scale project at a time. When working on a large-scale project, Ireland would frequently find himself unable to proceed with the next step until certain requirements had been met, such as work being completed by a subcontractor or materials becoming available from the supplier. As a result, Ireland liked to have small-scale projects lined up to fill this downtime. At the time, IR was able to take on three small-scale projects at a time, which often meant that IR was turning away work during the busy summer months. Bringing Ryan on would increase IR's capacity, and although Ireland was still hesitant to take on more than one large-scale project at a time, he projected that having Ryan full-time would allow IR to take on up to five small-scale projects simultaneously. See Exhibit 1 for a breakdown of IR's projected projects for FY 2020 and FY 2021. At the beginning of FY 2020, IR was owed $12,000 from projects completed in FY 2019. Ireland expected to be paid in full before the end of July 2019. Materials Upon taking on a project, IR would need to purchase all the materials upfront. Depending on the size of the project and the quality of the materials selected by the client, the materials could represent thousandsif not tens of thousands of dollars. The material costs could vary drastically depending on the customer's taste. For example, a customer requesting a marble countertop could expect to pay far more than a customer requesting a laminate countertop. It was imperative that during the free initial consultation, both Ireland and the customer left with a shared understanding of the materials that the project required, as well as the cost of those materials. On average, Ireland estimated that the material costs would be 50 per cent of the project quote. Subcontractors The majority of IR's projects required work to be completed by a subcontractor. Throughout Ireland's time in the construction industry, he had developed working relationships with professionals he could count on to provide high-quality work for his clients. Ireland was mindful to pay these subcontractors as quickly as possible to ensure they would continue to provide IR with their services in the future. Subcontractor wages averaged 10 per cent of the project quote for both large- and small-scale projects. Since this work was often done near the beginning of a project, subcontractors were usually paid during the same month the project began. Ryan Ireland Ireland was excited about the prospect of his youngest son joining the family business, but he was concerned about IR's ability to have enough cash resources to pay him a decent salary. Working as a general labourer was difficult work, and Ireland wanted to ensure his son was being fairly compensated. If hired full-time, Ryan would be paid $3,200 per month in FY 2020 and $3,500 per month in FY 2021. While working for Ireland part-time, Ryan had begun posting many of IR's completed projects on social media. This medium had increased the number of potential customers contacting IR for free estimates and had secured work for the upcoming summer months. It had been agreed that if brought on full-time, Ryan would manage IR's social media presence whenever Ireland did not require Ryan's assistance on the job site. During FYs 2020 and 2021, Ireland intended to run an online marketing campaign that Ryan would manage. The budget for this campaign would be $600 per year spread evenly among August, December, and April. To do this, IR would need to purchase a laptop in July 2019 at a cost of $2,000. The laptop would be depreciated using the straight-line method over a useful life of three years, with no residual value. Equipment Each year, IR needed to replace certain pieces of equipment that had become broken or outdated. Equipment expenditures for each of FY 2020 and FY 2021 would be $5,000. New equipment would be purchased and paid for each July. Equipment would be depreciated using the straight-line method over a useful life of seven years, with no residual value. Other Costs In FY 2016, IR had purchased a Ford F-150 pickup truck to travel to job sites. Fuel costs averaged $175 per month and were paid for at the time of purchase. Car insurance on the F-150 and general liability insurance totalled $2,120 annually. Both insurance policies renewed every August and were paid for in full. Ireland's company phone plan and Internet cost $80 and $100 per month, respectively. These costs were paid for monthly. Drawings In FY 2020, Ireland planned to draw $7,500 monthly from the company. In the past, if the company was experiencing a slow period, Ireland would occasionally avoid taking drawings that month to prevent dipping too far into IR's line of credit. Ireland hoped that Ryan's online marketing campaign could help prevent this situation in the future. If possible, Ireland planned to increase his monthly drawings by $500 during FY 2021. Other Options Ireland wondered whether changing his customer payment structure would have any impact on his cash position. Customers often did not want to pay for a large portion of the project upfront for fear that the contractor would not complete the job. He thought it was unlikely to receive payment for small-scale projects any quicker than IR already did but wondered what the effect on cash would be if he asked for a second deposit on large-scale projects. With this proposed option, IR would ask for a deposit of 25 per cent of the project estimate at the commencement of the project, and a second 25 per cent deposit would have to be paid 30 days into the project; the remainder would be due within 30 days of the project's completion. CONCLUSION Ireland realized that bringing Ryan on full-time might not make the most financial sense, given the company's regular reliance on the line of credit. However, Ireland was nearing retirement and hoped to pass the business on to one of his sons within the next five to 10 years. If Ireland did not take Ryan on now, it was unlikely to happen in the future, as Ryan was also contemplating moving to Alberta to work for his older brother. Ireland had promised Ryan that he would have an answer for him by the end of the week, so Ireland sat down to project and analyze the monthly cash budgets for FYs 2020 and 2021 using both customer payment options. EXHIBIT 1: IRELAND RENOVATIONS-PROJECT PROJECTIONS FOR FISCAL YEARS 2020 AND 2021, BY MONTH Fiscal Year 2020 Fiscal Year 2021 Large-Scale Projects Small-Scale Large-Scale Small-Scale Projects Projects Projects July 1 3 1 4 August 0 3 0 4 September 1 2 1 3 October 0 2 0 3 November 1 1 1 2 December 0 0 0 0 January 1 1 1 2 February 0 1 0 2 March 1 2 1 3 April 0 2 0 3 May 1 3 1 4 June 0 3 0 4 Total 6 23 6 34 Source: Company files.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started