It will be very helpful if you explain and explain how to solve it on excel. Thank you.

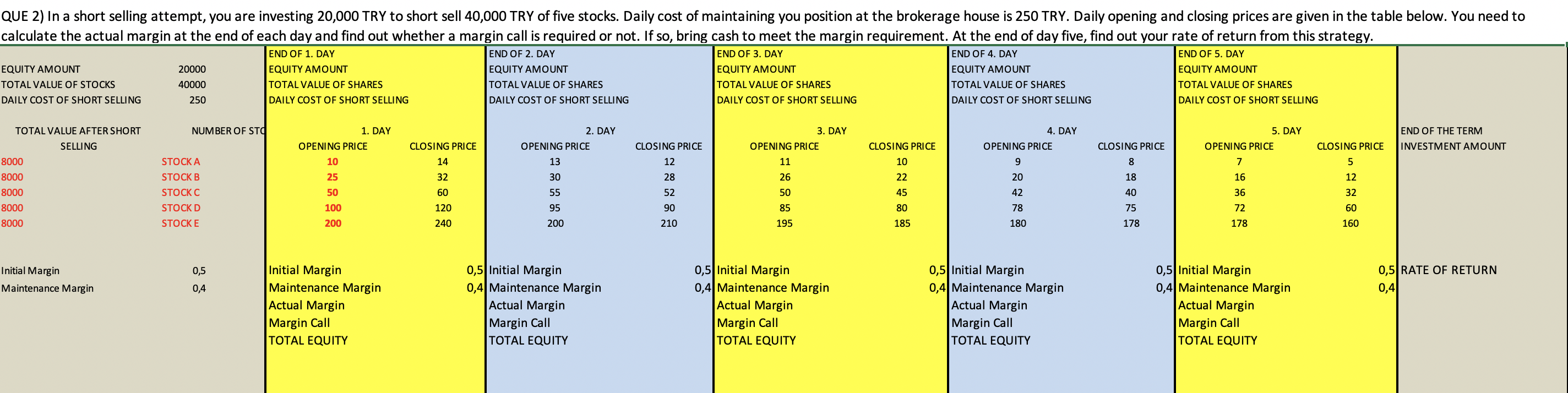

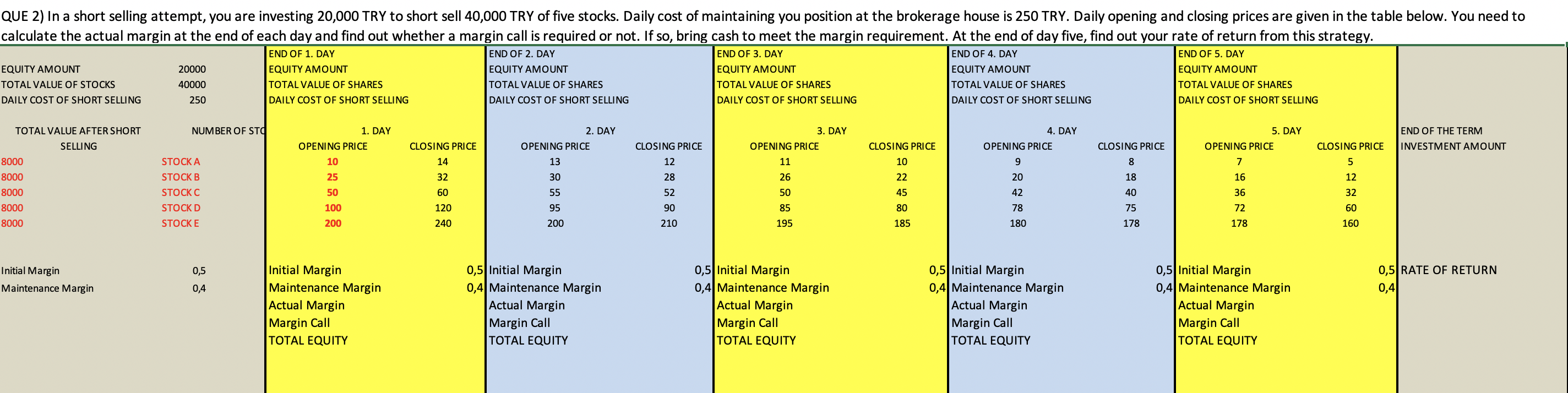

QUE 2) In a short selling attempt, you are investing 20,000 TRY to short sell 40,000 TRY of five stocks. Daily cost of maintaining you position at the brokerage house is 250 TRY. Daily opening and closing prices are given in the table below. You need to calculate the actual margin at the end of each day and find out whether a margin call is required or not. If so, bring cash to meet the margin requirement. At the end of day five, find out your rate of return from this strategy. END OF 2. DAY END OF 3. DAY END OF 4. DAY EQUITY AMOUNT TOTAL VALUE OF STOCKS DAILY COST OF SHORT SELLING 20000 40000 250 END OF 1. DAY EQUITY AMOUNT TOTAL VALUE OF SHARES DAILY COST OF SHORT SELLING EQUITY AMOUNT TOTAL VALUE OF SHARES EQUITY AMOUNT TOTAL VALUE OF SHARES EQUITY AMOUNT TOTAL VALUE OF SHARES DAILY COST OF SHORT SELLING END OF 5. DAY EQUITY AMOUNT TOTAL VALUE OF SHARES DAILY COST OF SHORT SELLING DAILY COST OF SHORT SELLING DAILY COST OF SHORT SELLING NUMBER OF ST 2. DAY OPENING PRICE 13 5. DAY OPENING PRICE END OF THE TERM INVESTMENT AMOUNT CLOSING PRICE CLOSING PRICE 14 CLOSING PRICE CLOSING PRICE 12 CLOSING PRICE 10 3. DAY OPENING PRICE 11 26 TOTAL VALUE AFTER SHORT SELLING 8000 8000 8000 8000 8000 8 4. DAY OPENING PRICE 9 20 7 1. DAY OPENING PRICE 10 25 50 100 200 32 30 28 18 STOCK A STOCK B STOCK C STOCKD STOCK E 16 5 12 32 60 52 50 22 45 80 55 95 36 42 78 120 90 210 60 40 75 178 85 195 72 178 240 200 185 180 160 Initial Margin Maintenance Margin 0,5 0,4 0,5 RATE OF RETURN 0,4 Initial Margin Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY QUE 2) In a short selling attempt, you are investing 20,000 TRY to short sell 40,000 TRY of five stocks. Daily cost of maintaining you position at the brokerage house is 250 TRY. Daily opening and closing prices are given in the table below. You need to calculate the actual margin at the end of each day and find out whether a margin call is required or not. If so, bring cash to meet the margin requirement. At the end of day five, find out your rate of return from this strategy. END OF 2. DAY END OF 3. DAY END OF 4. DAY EQUITY AMOUNT TOTAL VALUE OF STOCKS DAILY COST OF SHORT SELLING 20000 40000 250 END OF 1. DAY EQUITY AMOUNT TOTAL VALUE OF SHARES DAILY COST OF SHORT SELLING EQUITY AMOUNT TOTAL VALUE OF SHARES EQUITY AMOUNT TOTAL VALUE OF SHARES EQUITY AMOUNT TOTAL VALUE OF SHARES DAILY COST OF SHORT SELLING END OF 5. DAY EQUITY AMOUNT TOTAL VALUE OF SHARES DAILY COST OF SHORT SELLING DAILY COST OF SHORT SELLING DAILY COST OF SHORT SELLING NUMBER OF ST 2. DAY OPENING PRICE 13 5. DAY OPENING PRICE END OF THE TERM INVESTMENT AMOUNT CLOSING PRICE CLOSING PRICE 14 CLOSING PRICE CLOSING PRICE 12 CLOSING PRICE 10 3. DAY OPENING PRICE 11 26 TOTAL VALUE AFTER SHORT SELLING 8000 8000 8000 8000 8000 8 4. DAY OPENING PRICE 9 20 7 1. DAY OPENING PRICE 10 25 50 100 200 32 30 28 18 STOCK A STOCK B STOCK C STOCKD STOCK E 16 5 12 32 60 52 50 22 45 80 55 95 36 42 78 120 90 210 60 40 75 178 85 195 72 178 240 200 185 180 160 Initial Margin Maintenance Margin 0,5 0,4 0,5 RATE OF RETURN 0,4 Initial Margin Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY 0,5 Initial Margin 0,4 Maintenance Margin Actual Margin Margin Call TOTAL EQUITY