Answered step by step

Verified Expert Solution

Question

1 Approved Answer

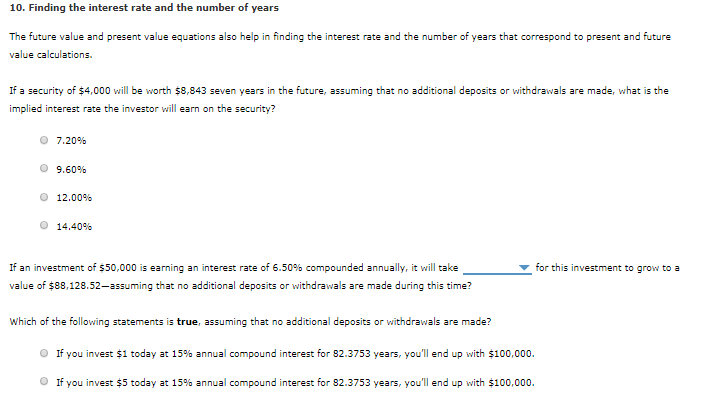

IT WILL TAKE - OPTIONS ARE - FOR THIS INVESTEMENT... 0.3 years 1.8 years 5.7 years 9.0 years Average: /3 Attempts: 12. Non annual compounding

IT WILL TAKE - OPTIONS ARE - FOR THIS INVESTEMENT...

0.3 years

1.8 years

5.7 years

9.0 years

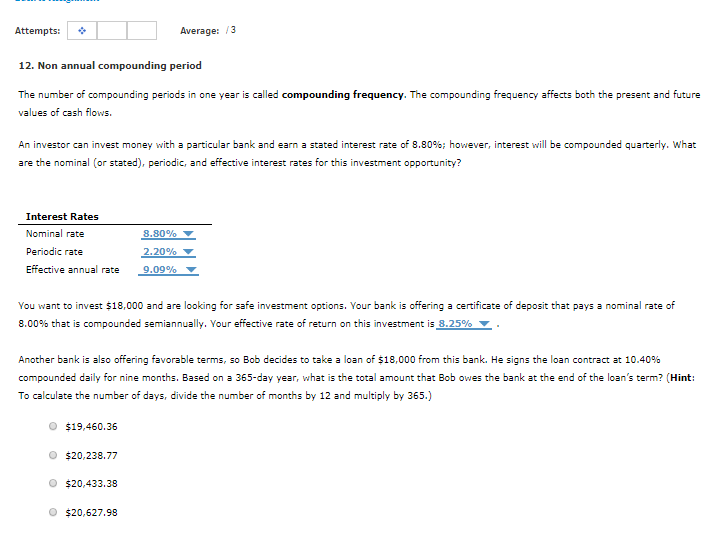

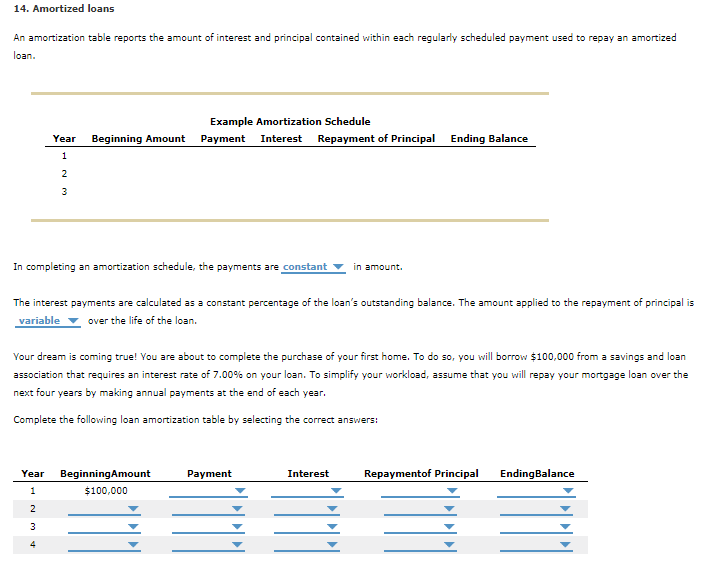

Average: /3 Attempts: 12. Non annual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of 8.80% ; however , interest will be compounded quarterly. What are the nominal (or stated), periodic, and effective interest rates for this investment opportunity? Interest Rates 8.80% Nominal rate Periodic rate 2.20% Effective annual rate 9.09% looking for safe investment options. Your bank is offering a certificate of deposit that pays a nominal rate of You want to invest $18,000 and are 8.00% that is compounded semiannually. Your effective rate of return on this investment is 8.25% Another bank is also offering favorable terms, so Bob decides to take a loan of $18,000 from this bank. He signs the loan contract at 10.40 % compounded daily for nine months. Based on a 365-day year, what is the total amount that Bob owes the bank at the end of the loan's term? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) $19,460.36 $20,238.77 O $20,433.38 $20,627.98 14. Amortized loans An amortization table reports the amount of interest and principal contained within each regularly scheduled payment used to repay an amortized loan. Example Amortization Schedule Repayment of Principal Ending Balance Year Beginning Amount Payment Interest 1 2. 3 In completing an amortization schedule, the payments are constant in amount. The interest payments are calculated as a constant percentage of the loan's outstanding balance. The amount applied to the repayment of principal is variable over the life of the loan. Your dream is coming true! You are about to complete the purchase of your first home. To do so, you will borrow $100,000 from a savings and loan association that requires an interest rate of 7.00% on your loan. To simplity your workload, assume that you will repay your mortgage loan over the next four years by making annual payments at the end of each year Complete the following loan amortization table by selecting the correct answers: BeginningAmount Payment Repaymentof Principal EndingBalance Year Interest $100,000 1 3 4 N 10. Finding the interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations If a security of $4,000 will be worth $8,843 seven years in the future, assuming that no additional deposits or withdrawals are made, what is the implied interest rate the investor will earn on the security? O 7.20% 9.60% 12.00% O 14.40 If an investment of $50,000 is earning an interest rate of 6.50 % compounded annually, it will take for this investment to grow to a value of $88,128.52-assuming that no additional deposits or withdrawals are made during this time? Which of the following statements is true, assuming that no additional deposits or withdrawals are made? O If you invest $1 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000. O If you invest $5 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started