Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it would be of great help if you can help! Use the following information to answer Questions 13-19 Neural Image manufactures medical imaging equipment. The

it would be of great help if you can help!

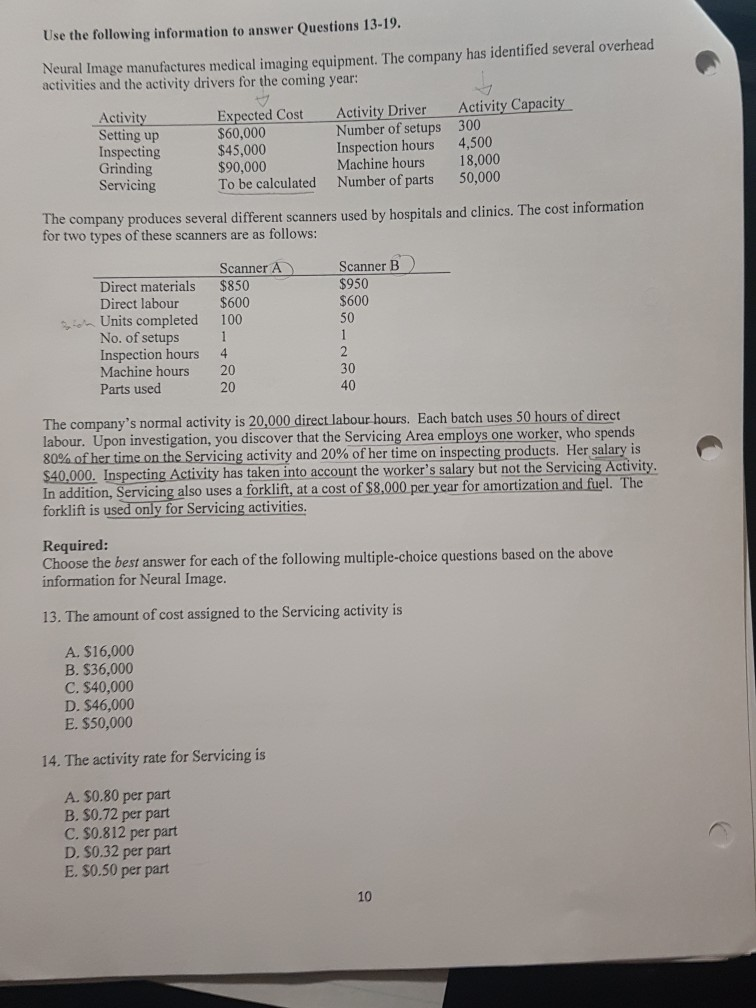

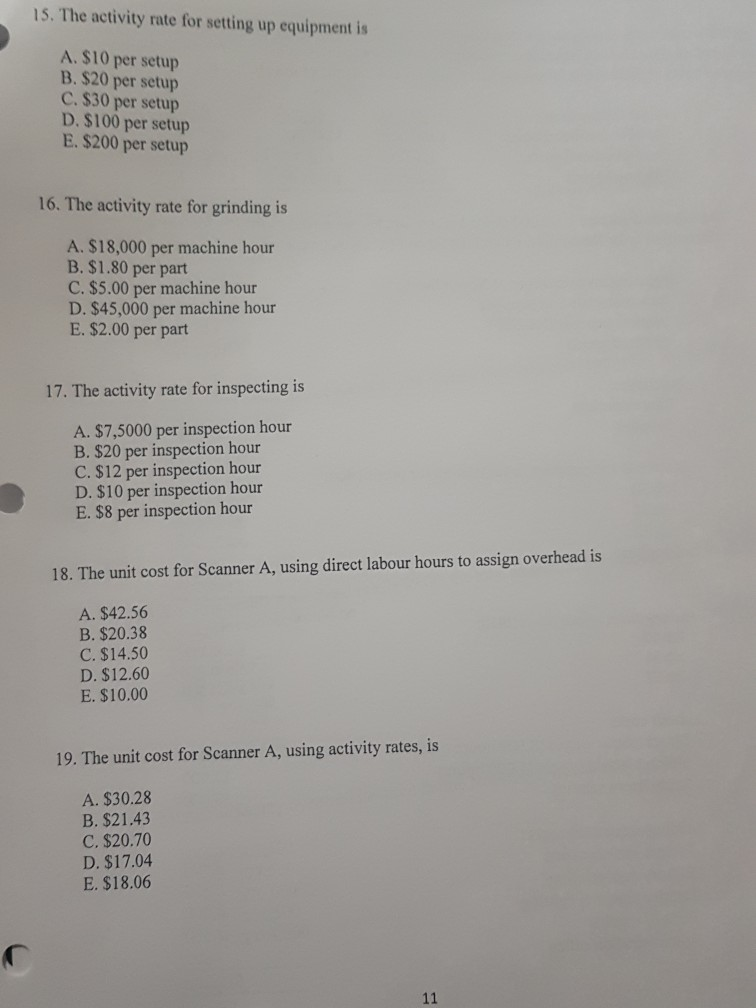

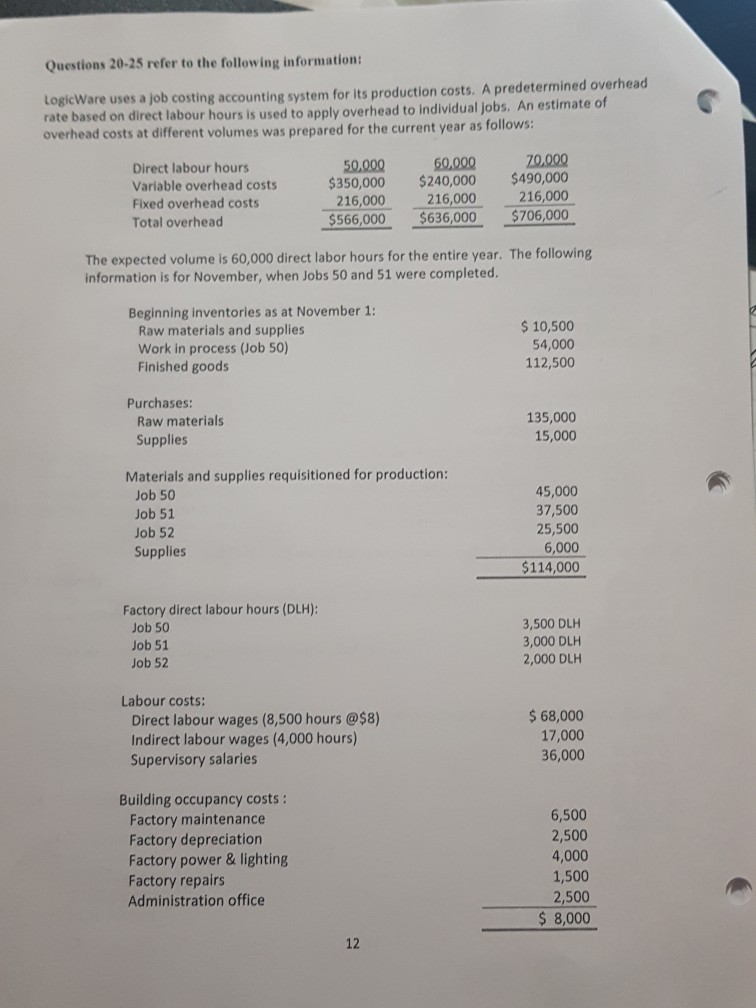

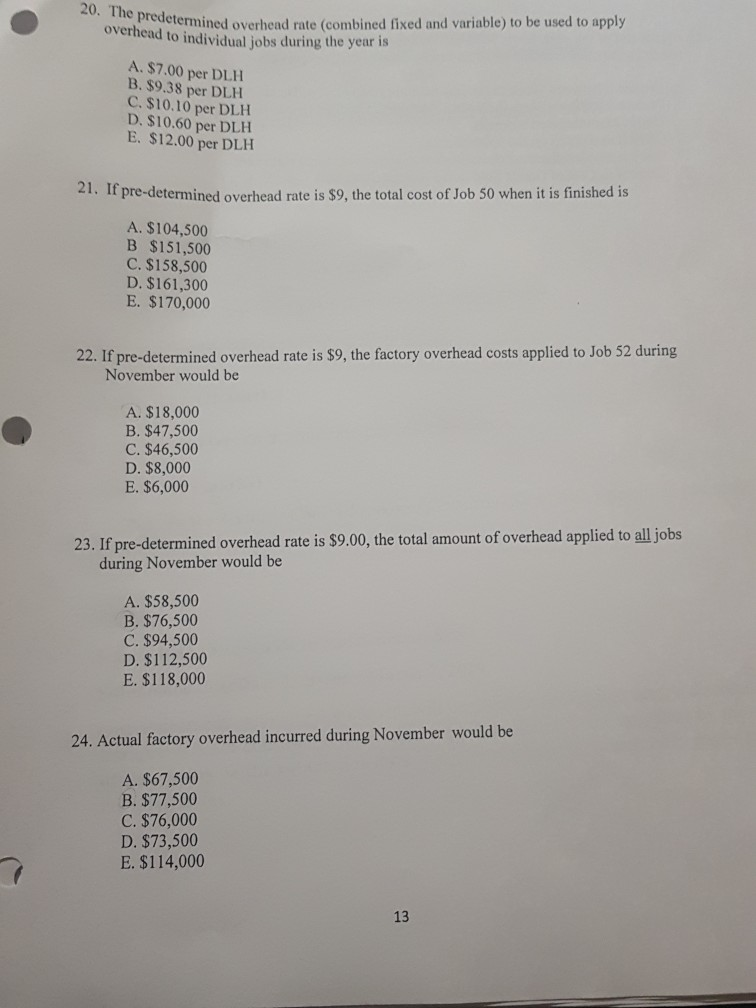

Use the following information to answer Questions 13-19 Neural Image manufactures medical imaging equipment. The company has identified several overhead activities and the activity drivers for the coming year: Activit Setting up Inspecting Grinding Servicing Activity Driver Number of setups Inspection hours Machine hours Number of parts Activity Capacity 300 4,500 18,000 50,000 Expected Cost $60,000 $45,000 90,000 To be calculated l he company produces several different scanners used by hospitals and clinics. The cost information for two types of these scanners are as follows: Scanner A $850 $600 Scanner B $950 $600 50 Direct materials Direct labour Units completed No. of setups Inspection hours Machine hours Parts used 100 4 20 20 2 30 40 The company's normal activity is 20,000 direct labour hours. Each batch uses 50 hours of direct labour. Upon investigation, you discover that the Servicing Area employs one worker, who spends ng activity and 20% of her time on inspecting products. He salary is salary but not the Servicing Activity $40,000. Inspecting Activity has taken into account the worker's In addition, Servicing also uses a forklift, at a cost of $8,000 per year for amortization and fuel. The forklift is used only for Servicing activities. Required: Choose the best answer for each of the following multiple-choice questions based on the above information for Neural Image. 13. The amount of cost assigned to the Servicing activity is A. $16,000 B. $36,000 C. $40,000 D. $46,000 E. $50,000 14. The activity rate for Servicing is A. $0.80 per part B. $0.72 per part C. $0.812 per part D. $0.32 per part E. $0.50 per part 10 15. The activity rate for setting up equipment is A. $10 per setup B. $20 per setup C. $30 per setup D. $100 per setup E. $200 per setup 16. The activity rate for grinding is A. $18,000 per machine hour B. $1.80 per part C. $5.00 per machine hour D. $45,000 per machine hour E. $2.00 per part 17. The activity rate for inspecting is A. $7,5000 per inspection hour B. $20 per inspection hour C. $12 per inspection hour D. $10 per inspection hour E. $8 per inspection hour 18. The unit cost for Scanner A, using direct labour hours to assign overhead is A. $42.56 B. $20.38 C. $14.50 D. $12.60 E. $10.00 19. The unit cost for Scanner A, using activity rates, is A. $30.28 B. $21.43 C. $20.70 D. $17.04 E. $18.06 Questions 20-25 refer to the following informations LogicWare uses a job costing accounting system for its production costs. A predetermined overhead rate based on direct labour hours is used to apply overhead to individual jobs. An estimate of overhead costs at different volumes was prepared for the current year as follows: Direct labour hours Variable overhead costs Fixed overhead costs Total overhead 50,00060,000 70,000 350,000 $240,000 $490,000 216,000 216,000 $566,000 $636,000 $706,000 The expected volume is 60,000 direct labor hours for the entire year. The following information is for November, when Jobs 50 and 51 were completed. Beginning inventories as at November 1 Raw materials and supplies Work in process (Job 50) Finished goods $10,500 54,000 112,500 Purchases: Raw materials Supplies 135,000 15,000 Materials and supplies requisitioned for production: Job 50 Job 51 Job 52 Supplies 45,000 37,500 25,500 6,000 114,000 Factory direct labour hours (DLH): Job 50 Job 51 Job 52 3,500 DLH 3,000 DLH 2,000 DLH Labour costs: Direct labour wages (8,500 hours @$8) Indirect labour wages (4,000 hours) Supervisory salaries $68,000 17,000 36,000 Building occupancy costs: Factory maintenance Factory depreciation Factory power & lighting Factory repairs Administration office 6,500 2,500 4,000 1,500 2,500 $ 8,000 12 20. The predetermined overhead rate (combined fixed and variable) to be used to apply overhead to individual jobs during the year is A. $7.00 per DLH B. $9.38 per DLH C. $10.10 per DLH D. $10.60 per DLH E. $12.00 per DLH 21. If pre-determined overhead rate is $9, the total cost of Job 50 when it is finished is A. $104,500 B $151,500 C. $158,500 D. $161,300 E. $170,000 22. If pre-determined overhead rate is $9, the factory overhead costs applied to Job 52 during November would be A. $ 18,000 B. $47,500 C. $46,500 D. $8,000 E. $6,000 23. If pre-determined overhead rate is $9.00, the total amount of overhead applied to all jobs during November would be A. $58,500 B. $76,500 C. $94,500 D. $112,500 E. $118,000 24. Actual factory overhead incurred during November would be A. $67,500 B. $77,500 C. $76,000 D. $73,500 E. $114,000 13 25. At the end of the year, Logic Ware had an amount of $1,000 over-applied overhead. What would be the most common treatment of the overapplied overhead? A. Prorate it between Work in Process Inventory and Cost of Goods Manufactured accounts B. Prorate it between Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Manufactured accounts C. Carry it as a credit on the balance sheet as miscellaneous operating revenue on the income statement E. Credit it to Cost of Goods Sold in the Income StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started