Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[ITA: 18(1)(b), (e), (1), (n); 19(1); 20(1)(a), (e), (cc), 20(10), 67.1, 67.6] Central Products Ltd., which sells goods Canada-wide, is in the process of

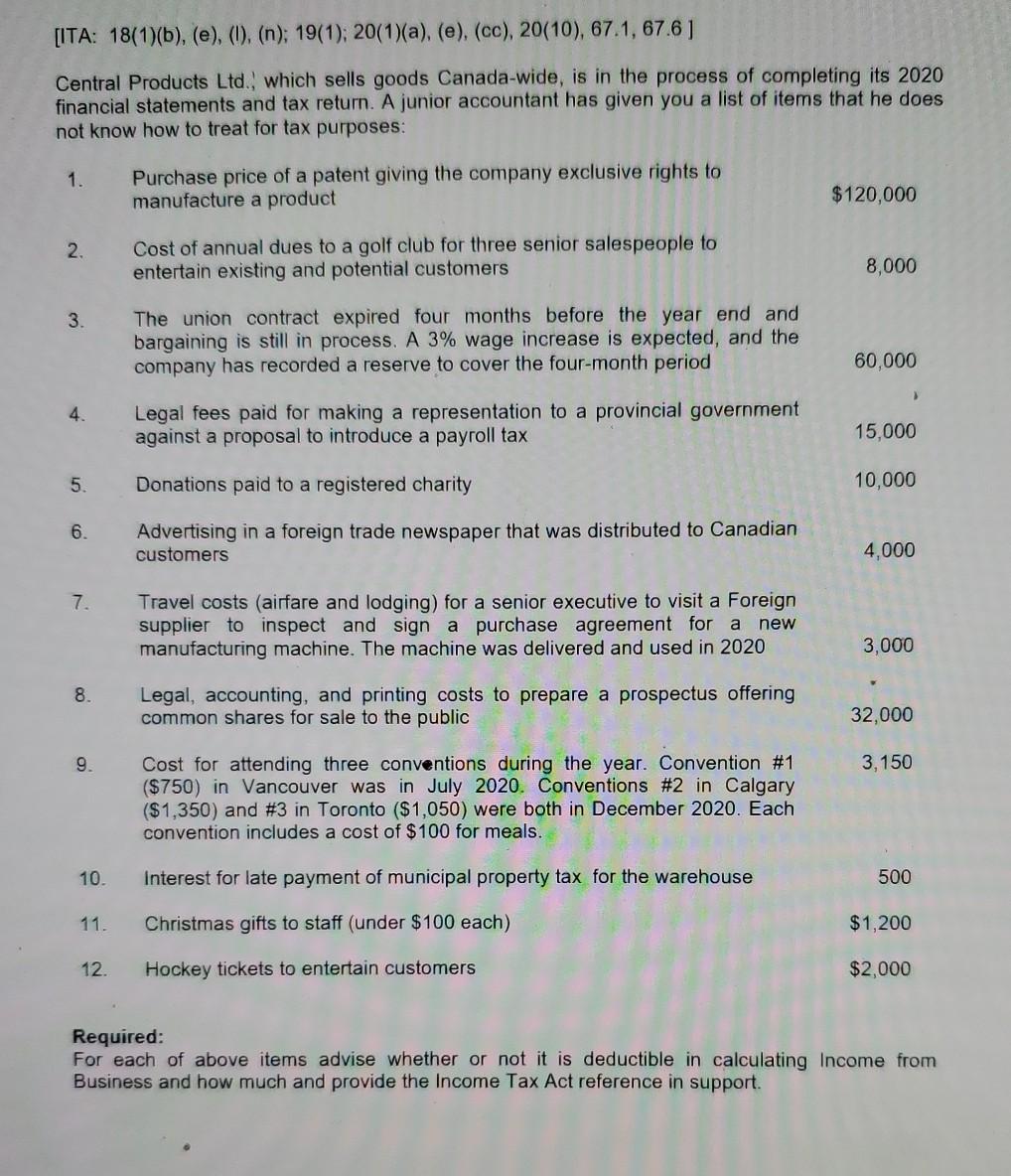

[ITA: 18(1)(b), (e), (1), (n); 19(1); 20(1)(a), (e), (cc), 20(10), 67.1, 67.6] Central Products Ltd., which sells goods Canada-wide, is in the process of completing its 2020 financial statements and tax return. A junior accountant has given you a list of items that he does not know how to treat for tax purposes: 1. Purchase price of a patent giving the company exclusive rights to manufacture a product $120,000 2. Cost of annual dues to a golf club for three senior salespeople to entertain existing and potential customers 8,000 3. The union contract expired four months before the year end and bargaining is still in process. A 3% wage increase is expected, and the company has recorded a reserve to cover the four-month period 60,000 4. Legal fees paid for making a representation to a provincial government against a proposal to introduce a payroll tax 15,000 5. Donations paid to a registered charity 10,000 6. Advertising in a foreign trade newspaper that was distributed to Canadian customers 4,000 7. Travel costs (airfare and lodging) for a senior executive to visit a Foreign supplier to inspect and sign a purchase agreement for a new manufacturing machine. The machine was delivered and used in 2020 3,000 8. Legal, accounting, and printing costs to prepare a prospectus offering common shares for sale to the public 32,000 9. Cost for attending three conventions during the year. Convention #1 ($750) in Vancouver was in July 2020. Conventions #2 in Calgary ($1,350) and #3 in Toronto ($1,050) were both in December 2020. Each convention includes a cost of $100 for meals. 3,150 10. Interest for late payment of municipal property tax for the warehouse 500 11. Christmas gifts to staff (under $100 each) $1,200 12. Hockey tickets to entertain customers $2,000 Required: For each of above items advise whether or not it is deductible in calculating Income from Business and how much and provide the Income Tax Act reference in support.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started