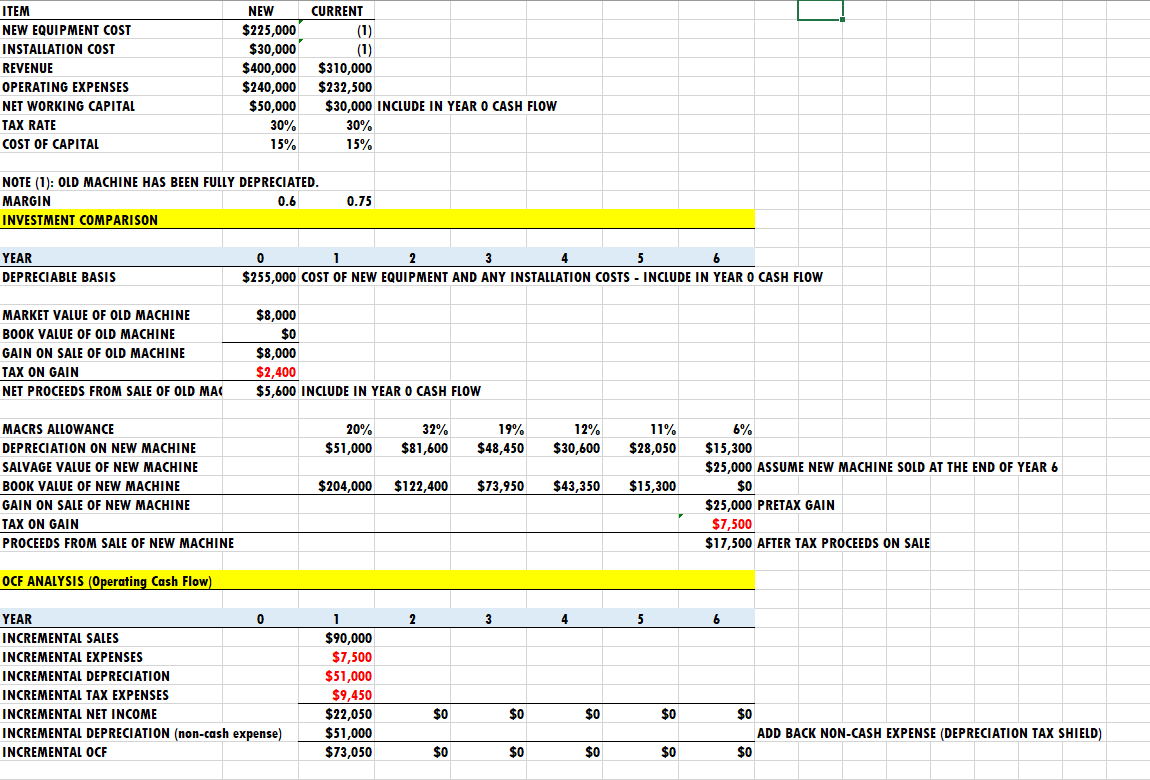

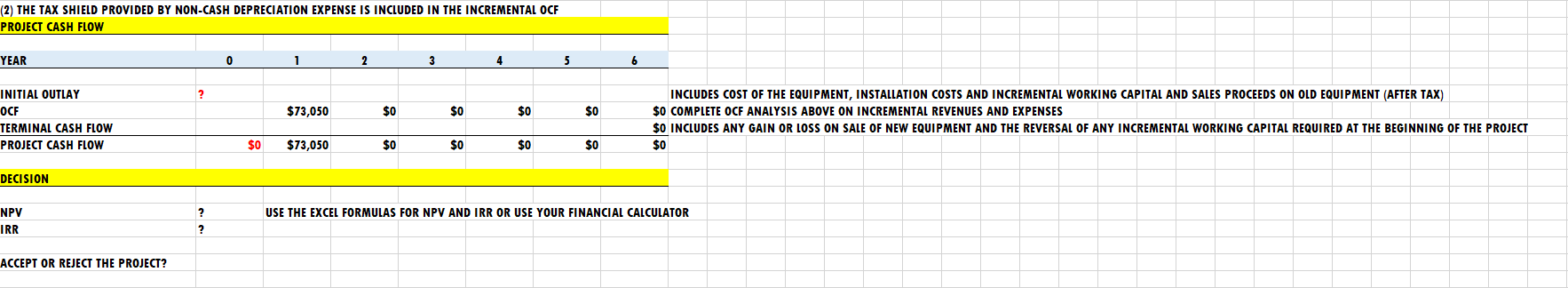

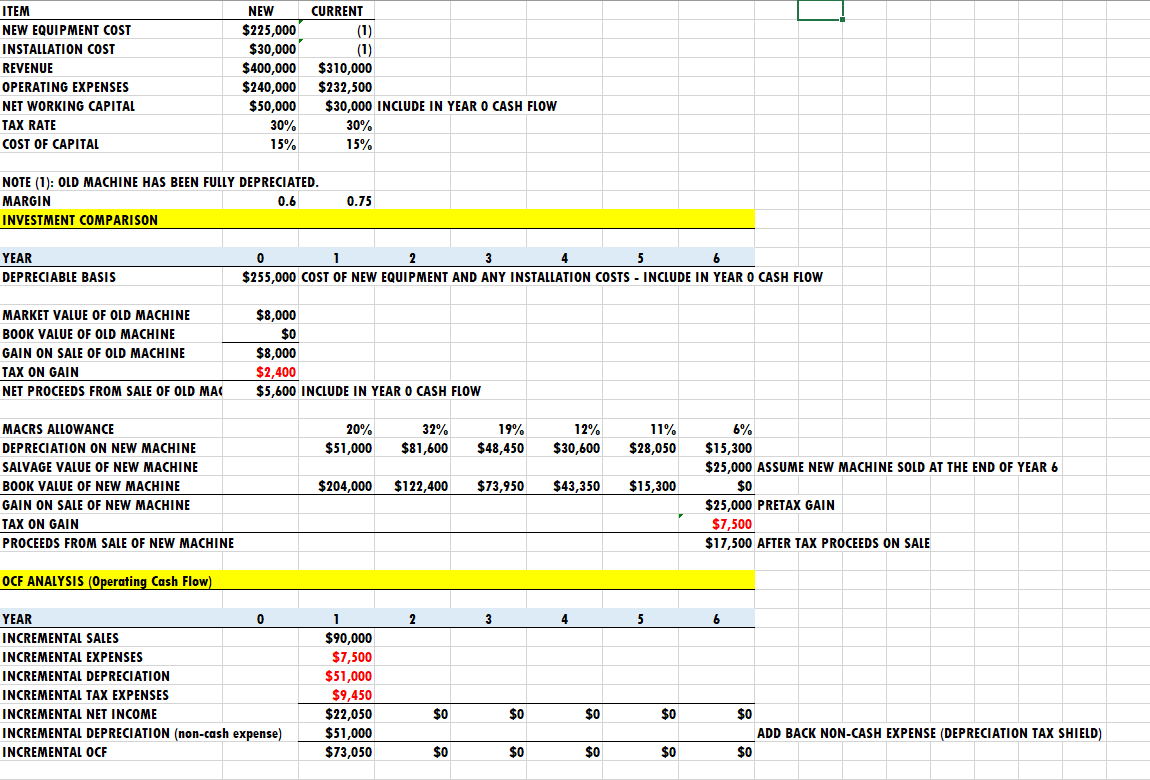

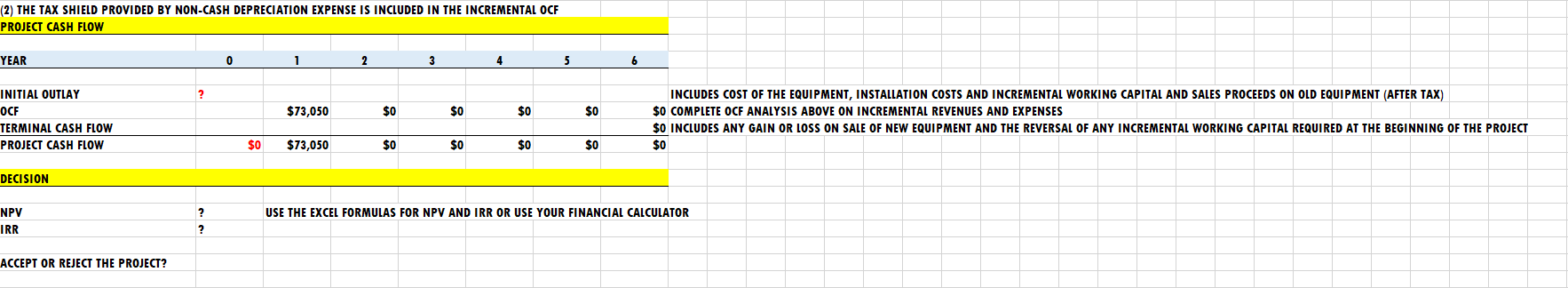

ITEM NEW EQUIPMENT COST INSTALLATION COST REVENUE OPERATING EXPENSES NET WORKING CAPITAL TAX RATE COST OF CAPITAL NEW CURRENT $225,000 (1) $30,000 (1) 1 $400,000 $310,000 $240,000 $232,500 $50,000 $30,000 INCLUDE IN YEAR O CASH FLOW 30% 30% 15% 15% NOTE (1): OLD MACHINE HAS BEEN FULLY DEPRECIATED. MARGIN 0.6 INVESTMENT COMPARISON 0.75 YEAR DEPRECIABLE BASIS 0 1 2 3 5 $255,000 COST OF NEW EQUIPMENT AND ANY INSTALLATION COSTS - INCLUDE IN YEAR O CASH FLOW MARKET VALUE OF OLD MACHINE BOOK VALUE OF OLD MACHINE GAIN ON SALE OF OLD MACHINE TAX ON GAIN NET PROCEEDS FROM SALE OF OLD MAC $8,000 $0 $8,000 $2,400 $5,600 INCLUDE IN YEAR O CASH FLOW 20% $51,000 32% $81,600 19% $48,450 12% $30,600 11% $28,050 MACRS ALLOWANCE DEPRECIATION ON NEW MACHINE SALVAGE VALUE OF NEW MACHINE BOOK VALUE OF NEW MACHINE GAIN ON SALE OF NEW MACHINE TAX ON GAIN PROCEEDS FROM SALE OF NEW MACHINE $ 204,000 $122,400 $73,950 $43,350 $15,300 6% $15,300 $25,000 ASSUME NEW MACHINE SOLD AT THE END OF YEAR 6 $0 $25,000 PRETAX GAIN $7,500 $17,500 AFTER TAX PROCEEDS ON SALE OCH ANALYSIS (Operating Cash Flow) 2 3 4 5 6 YEAR 0 0 INCREMENTAL SALES INCREMENTAL EXPENSES INCREMENTAL DEPRECIATION INCREMENTAL TAX EXPENSES INCREMENTAL NET INCOME INCREMENTAL DEPRECIATION (non-cash expense) INCREMENTAL OCF 1 $90,000 $7,500 $51,000 $9,450 $22,050 $51,000 $73,050 $0 $0 $0 $0 $0 0 ADD BACK NON-CASH EXPENSE (DEPRECIATION TAX SHIELD) 0 $0 $0 $0 $0 $0 (2) THE TAX SHIELD PROVIDED BY NON-CASH DEPRECIATION EXPENSE IS INCLUDED IN THE INCREMENTAL OCF PROJECT CASH FLOW YEAR 0 1 2 3 4 5 6 ? $73,050 $0 $0 $0 $0 INITIAL OUTLAY OCF TERMINAL CASH FLOW PROJECT CASH FLOW INCLUDES COST OF THE EQUIPMENT, INSTALLATION COSTS AND INCREMENTAL WORKING CAPITAL AND SALES PROCEEDS ON OLD EQUIPMENT (AFTER TAX) $0 COMPLETE OCF ANALYSIS ABOVE ON INCREMENTAL REVENUES AND EXPENSES $0 INCLUDES ANY GAIN OR LOSS ON SALE OF NEW EQUIPMENT AND THE REVERSAL OF ANY INCREMENTAL WORKING CAPITAL REQUIRED AT THE BEGINNING OF THE PROJECT $0 $0 $73,050 $0 $0 $0 $0 DECISION USE THE EXCEL FORMULAS FOR NPV AND IRR OR USE YOUR FINANCIAL CALCULATOR NPV IRR ? ? ACCEPT OR REJECT THE PROJECT? Question 7 4 pts Based on the calculations and analysis above, management should REJECT the proposal. True False ITEM NEW EQUIPMENT COST INSTALLATION COST REVENUE OPERATING EXPENSES NET WORKING CAPITAL TAX RATE COST OF CAPITAL NEW CURRENT $225,000 (1) $30,000 (1) 1 $400,000 $310,000 $240,000 $232,500 $50,000 $30,000 INCLUDE IN YEAR O CASH FLOW 30% 30% 15% 15% NOTE (1): OLD MACHINE HAS BEEN FULLY DEPRECIATED. MARGIN 0.6 INVESTMENT COMPARISON 0.75 YEAR DEPRECIABLE BASIS 0 1 2 3 5 $255,000 COST OF NEW EQUIPMENT AND ANY INSTALLATION COSTS - INCLUDE IN YEAR O CASH FLOW MARKET VALUE OF OLD MACHINE BOOK VALUE OF OLD MACHINE GAIN ON SALE OF OLD MACHINE TAX ON GAIN NET PROCEEDS FROM SALE OF OLD MAC $8,000 $0 $8,000 $2,400 $5,600 INCLUDE IN YEAR O CASH FLOW 20% $51,000 32% $81,600 19% $48,450 12% $30,600 11% $28,050 MACRS ALLOWANCE DEPRECIATION ON NEW MACHINE SALVAGE VALUE OF NEW MACHINE BOOK VALUE OF NEW MACHINE GAIN ON SALE OF NEW MACHINE TAX ON GAIN PROCEEDS FROM SALE OF NEW MACHINE $ 204,000 $122,400 $73,950 $43,350 $15,300 6% $15,300 $25,000 ASSUME NEW MACHINE SOLD AT THE END OF YEAR 6 $0 $25,000 PRETAX GAIN $7,500 $17,500 AFTER TAX PROCEEDS ON SALE OCH ANALYSIS (Operating Cash Flow) 2 3 4 5 6 YEAR 0 0 INCREMENTAL SALES INCREMENTAL EXPENSES INCREMENTAL DEPRECIATION INCREMENTAL TAX EXPENSES INCREMENTAL NET INCOME INCREMENTAL DEPRECIATION (non-cash expense) INCREMENTAL OCF 1 $90,000 $7,500 $51,000 $9,450 $22,050 $51,000 $73,050 $0 $0 $0 $0 $0 0 ADD BACK NON-CASH EXPENSE (DEPRECIATION TAX SHIELD) 0 $0 $0 $0 $0 $0 (2) THE TAX SHIELD PROVIDED BY NON-CASH DEPRECIATION EXPENSE IS INCLUDED IN THE INCREMENTAL OCF PROJECT CASH FLOW YEAR 0 1 2 3 4 5 6 ? $73,050 $0 $0 $0 $0 INITIAL OUTLAY OCF TERMINAL CASH FLOW PROJECT CASH FLOW INCLUDES COST OF THE EQUIPMENT, INSTALLATION COSTS AND INCREMENTAL WORKING CAPITAL AND SALES PROCEEDS ON OLD EQUIPMENT (AFTER TAX) $0 COMPLETE OCF ANALYSIS ABOVE ON INCREMENTAL REVENUES AND EXPENSES $0 INCLUDES ANY GAIN OR LOSS ON SALE OF NEW EQUIPMENT AND THE REVERSAL OF ANY INCREMENTAL WORKING CAPITAL REQUIRED AT THE BEGINNING OF THE PROJECT $0 $0 $73,050 $0 $0 $0 $0 DECISION USE THE EXCEL FORMULAS FOR NPV AND IRR OR USE YOUR FINANCIAL CALCULATOR NPV IRR ? ? ACCEPT OR REJECT THE PROJECT? Question 7 4 pts Based on the calculations and analysis above, management should REJECT the proposal. True False