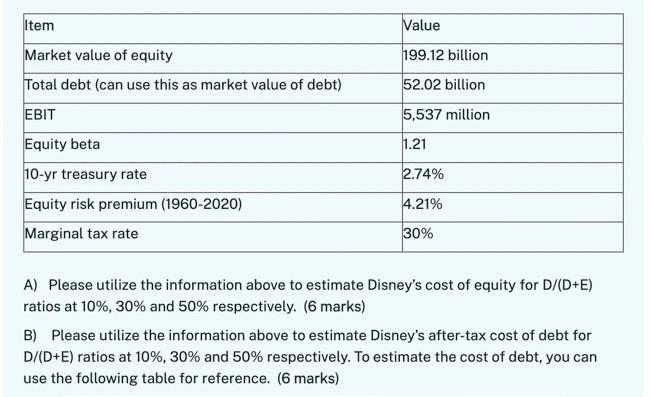

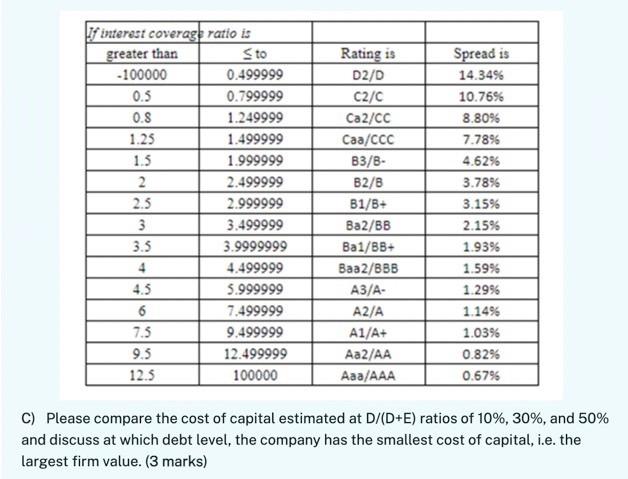

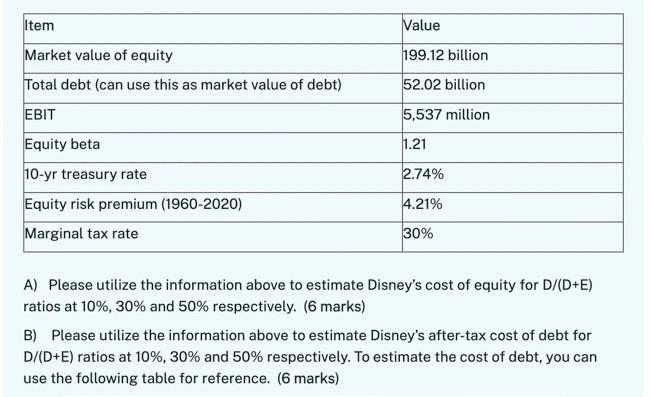

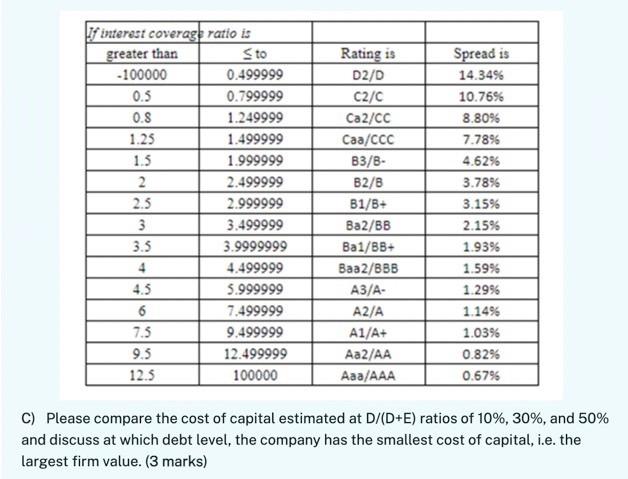

Item Value Market value of equity 199.12 billion Total debt (can use this as market value of debt) 52.02 billion EBIT 5,537 million Equity beta 1.21 10-yr treasury rate 2.74% Equity risk premium (1960-2020) 4.21% Marginal tax rate 30% A) Please utilize the information above to estimate Disney's cost of equity for D/(D+E) ratios at 10%, 30% and 50% respectively. (6 marks) B) Please utilize the information above to estimate Disney's after-tax cost of debt for D/(D+E) ratios at 10%, 30% and 50% respectively. To estimate the cost of debt, you can use the following table for reference. (6 marks) If interest coverage ratio is greater than S to Rating is Spread is -100000 0.499999 D2/D 14.34% 0.5 0.799999 C2/C 10.76% 0.8 1.249999 Ca2/CC 8.80% 1.25 1.499999 Caa/CCC 7.78% 1.5 1.999999 83/8- 4.62% 2 2.499999 B2/B 3.78% 2.5 2.999999 B1/B+ 3.15% 3 3.499999 Ba2/BB 2.15% 3.5 3.9999999 Bal/BB+ 1.93% 4 4.499999 Baa2/BBB 1.59% 4.5 5.999999 A3/A- 1.29% 6 7.499999 A2/A 1.14% 7.5 9.499999 A1/A+ 1.03% 9.5 12.499999 Aa2/AA 0.82% 12.5 100000 Aaa/AAA 0.67% C) Please compare the cost of capital estimated at D/(D+E) ratios of 10%, 30%, and 50% and discuss at which debt level, the company has the smallest cost of capital, i.e. the largest firm value. (3 marks) Item Value Market value of equity 199.12 billion Total debt (can use this as market value of debt) 52.02 billion EBIT 5,537 million Equity beta 1.21 10-yr treasury rate 2.74% Equity risk premium (1960-2020) 4.21% Marginal tax rate 30% A) Please utilize the information above to estimate Disney's cost of equity for D/(D+E) ratios at 10%, 30% and 50% respectively. (6 marks) B) Please utilize the information above to estimate Disney's after-tax cost of debt for D/(D+E) ratios at 10%, 30% and 50% respectively. To estimate the cost of debt, you can use the following table for reference. (6 marks) If interest coverage ratio is greater than S to Rating is Spread is -100000 0.499999 D2/D 14.34% 0.5 0.799999 C2/C 10.76% 0.8 1.249999 Ca2/CC 8.80% 1.25 1.499999 Caa/CCC 7.78% 1.5 1.999999 83/8- 4.62% 2 2.499999 B2/B 3.78% 2.5 2.999999 B1/B+ 3.15% 3 3.499999 Ba2/BB 2.15% 3.5 3.9999999 Bal/BB+ 1.93% 4 4.499999 Baa2/BBB 1.59% 4.5 5.999999 A3/A- 1.29% 6 7.499999 A2/A 1.14% 7.5 9.499999 A1/A+ 1.03% 9.5 12.499999 Aa2/AA 0.82% 12.5 100000 Aaa/AAA 0.67% C) Please compare the cost of capital estimated at D/(D+E) ratios of 10%, 30%, and 50% and discuss at which debt level, the company has the smallest cost of capital, i.e. the largest firm value