Answered step by step

Verified Expert Solution

Question

1 Approved Answer

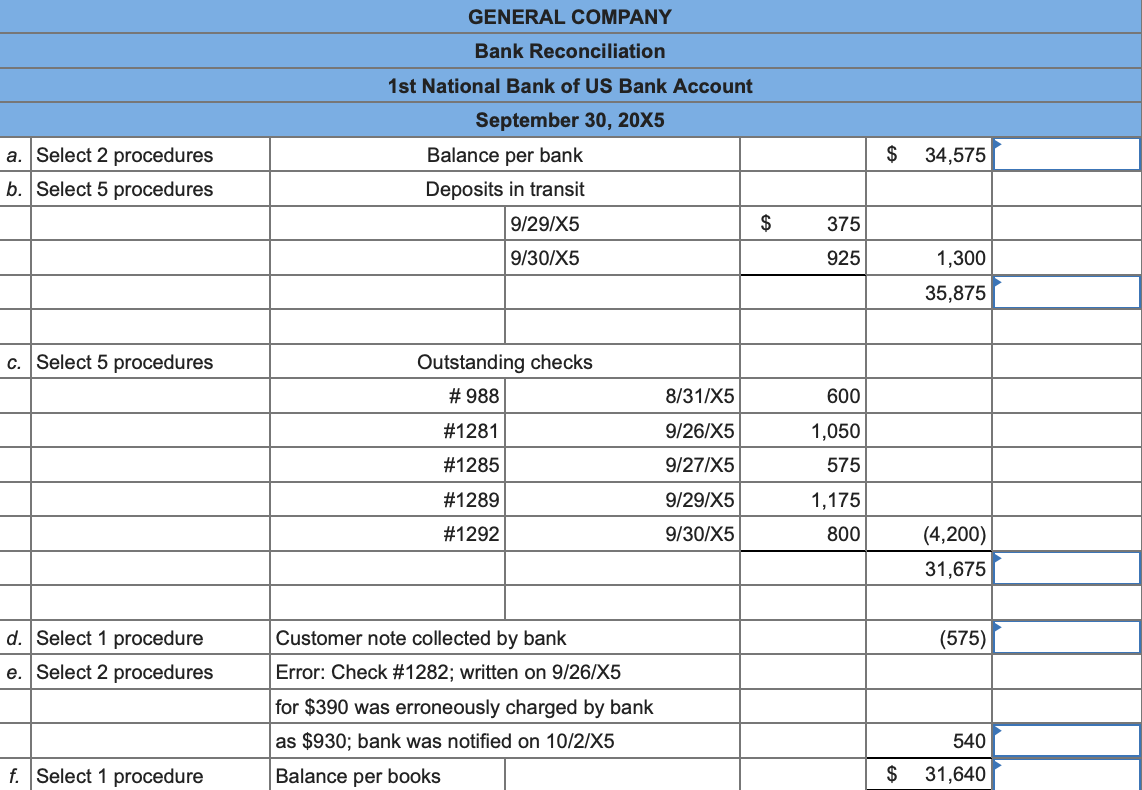

Items a through f represent the items that an auditor ordinarily would find on a client-prepared bank reconciliation. The accompanying List of Auditing Procedures represents

Items a through f represent the items that an auditor ordinarily would find on a client-prepared bank reconciliation. The accompanying List of Auditing Procedures represents substantive auditing procedures. For each item, select one or more procedures, as indicated, that the auditor most likely would perform to gather evidence in support of that item. The procedures on the list may be selected once, more than once, or not at all.

Assume

- The client prepared the bank reconciliation on 10/2/X5.

- The bank reconciliation is mathematically accurate.

- The auditor received a cutoff bank statement dated 10/7/X5 directly from the bank on 10/11/X5.

- The 9/30/X5 deposit in transitoutstanding checks #1281, #1285, #1289, and #1292and the correction of the error regarding check #1282 appeared on the cutoff bank statement.

- The auditor assessed control risk concerning the financial statement assertions related to cash at the maximum.

| List of Auditing Procedures | |

| A. | Trace to cash receipts journal. |

| B. | Trace to cash disbursements journal. |

| C. | Compare to 9/30/X5 general ledger. |

| D. | Confirm directly with bank. |

| E. | Inspect bank credit memo. |

| F. | Inspect bank debit memo. |

| G. | Ascertain reason for unusual delay. |

| H. | Inspect supporting documents for reconciling item not appearing on cutoff statement. |

| I. | Trace items on the bank reconciliation to cutoff statement. |

| J. | Trace items on the cutoff statement to bank reconciliation. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started