Answered step by step

Verified Expert Solution

Question

1 Approved Answer

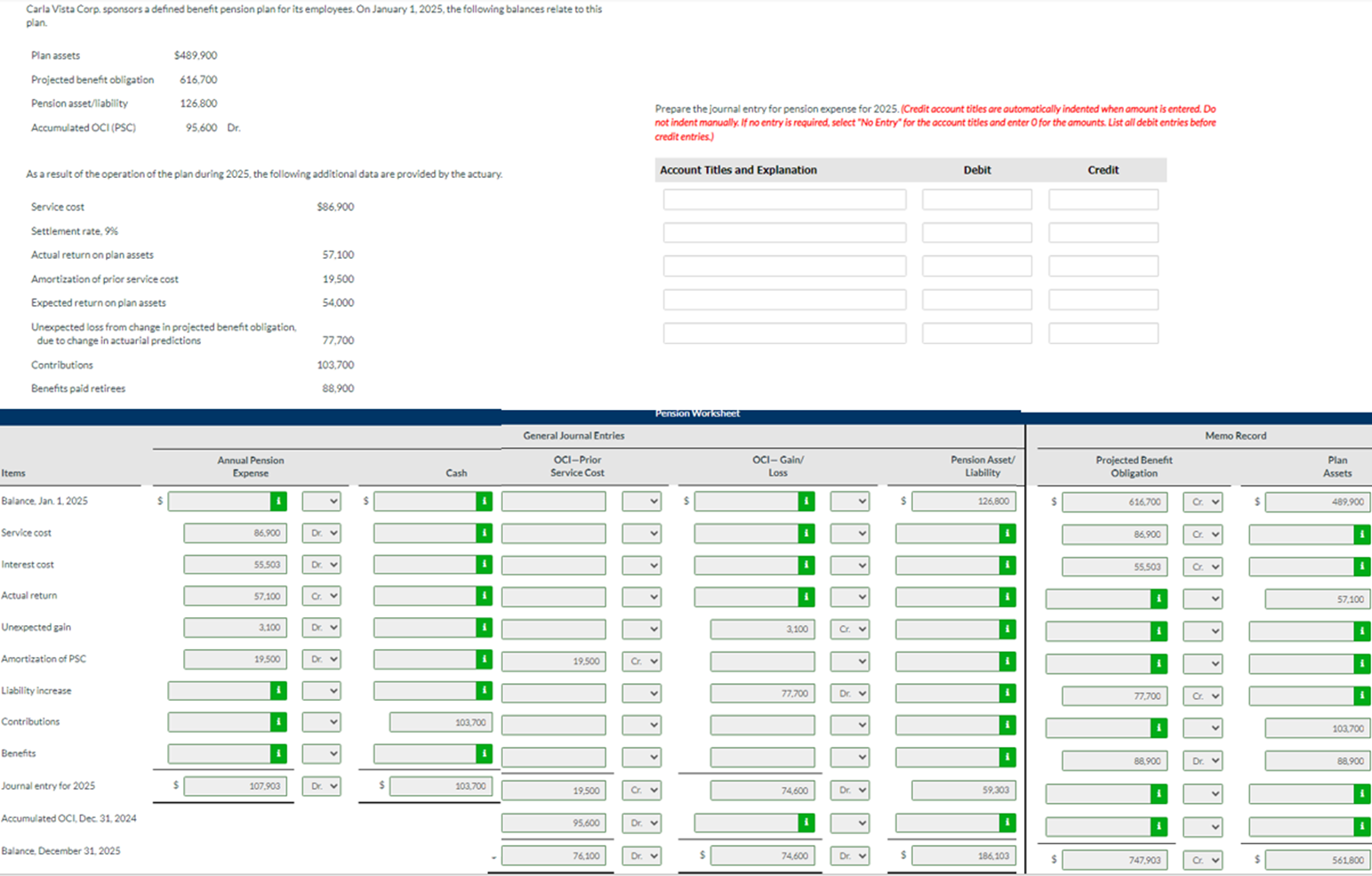

Items Carla Vista Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2025, the following balances relate to this plan.

Items Carla Vista Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2025, the following balances relate to this plan. Plan assets Projected benefit obligation $489,900 616,700 Pension asset/liability 126.800 Accumulated OCI (PSC) 95,600 Dr. As a result of the operation of the plan during 2025, the following additional data are provided by the actuary. Service cost Settlement rate, 9% $86,900 Actual return on plan assets 57.100 Amortization of prior service cost 19.500 Expected return on plan assets 54,000 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 77,700 Contributions 103,700 Benefits paid retirees 88,900 Balance, Jan. 1, 2025 $ Service cost Interest cost Annual Pension Expense 86.900 Dr. Cash 55.503 Dr. i Actual return 57.100 Cr Unexpected gain 3.100 Dr. Amortization of PSC 19.500 Dr. Liability increase Contributions Benefits Journal entry for 2025 Accumulated OCI, Dec. 31, 2024 Balance, December 31, 2025 103,700 Prepare the journal entry for pension expense for 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Pension Worksheet General Journal Entries OCI-Prior Service Cost 19.500 107,903 Dr. 103,700 19,500 95,600 Dr. Debit Credit Memo Record OCI-Gain/ Loss Pension Asset/ Liability Projected Benefit Obligation Plan Assets $ 126,800 616,700 8. $ 489,900 i i 3,100 Cr. 77,700 Dr. 74,600 Dr. 59.303 76,100 Dr. 74,600 Dr. 86,900 Cr. 55.503 8. i i 77,700 ar. i 57,100 i i 103,700 88,900 Dr. 88,900 i 186,103 747,903 $ 561,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started