Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It's a full question it's a full question 4. GH6,000 of directors loan is to be cancelled. The balance is to be settled by issue

It's a full question

it's a full question

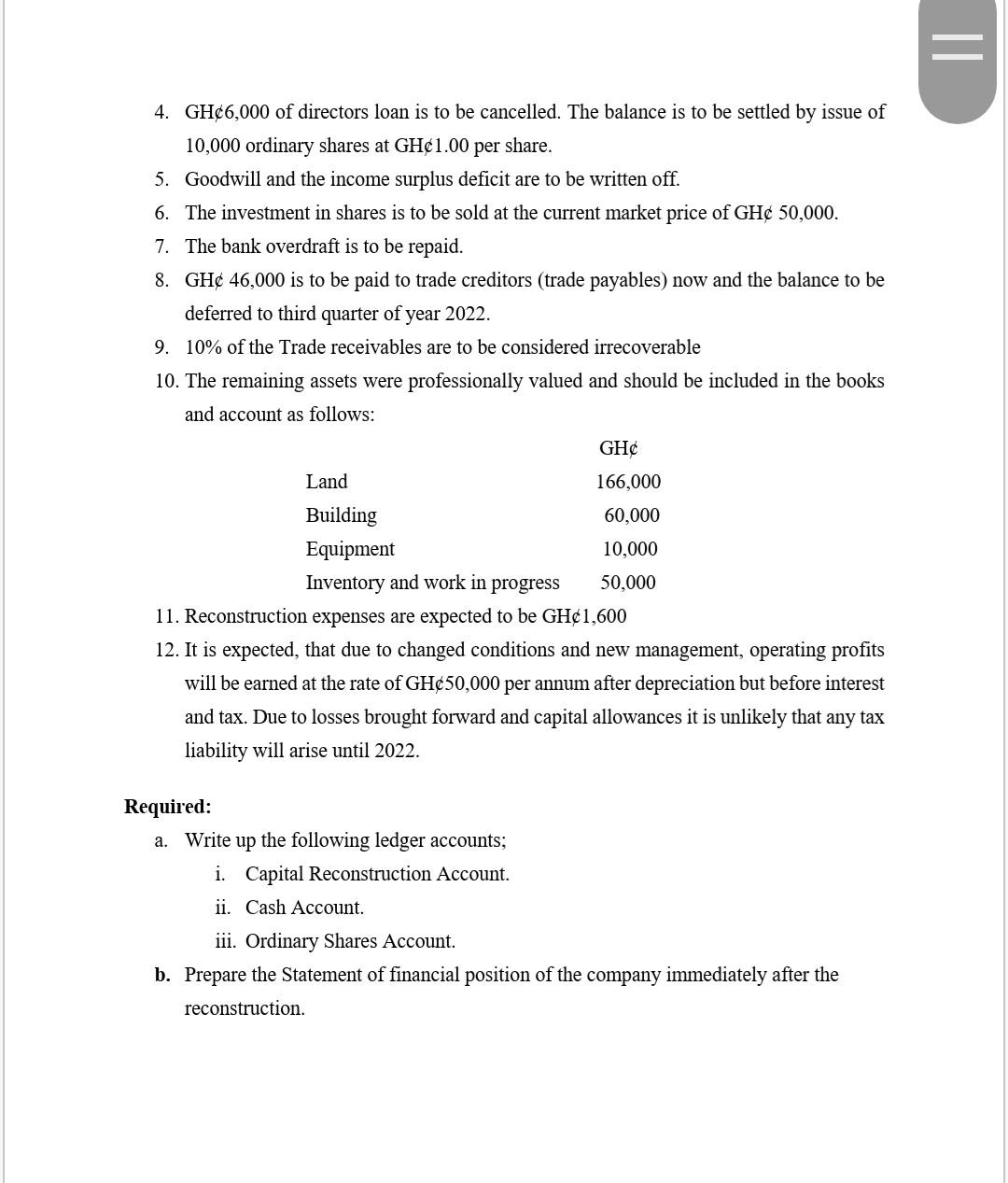

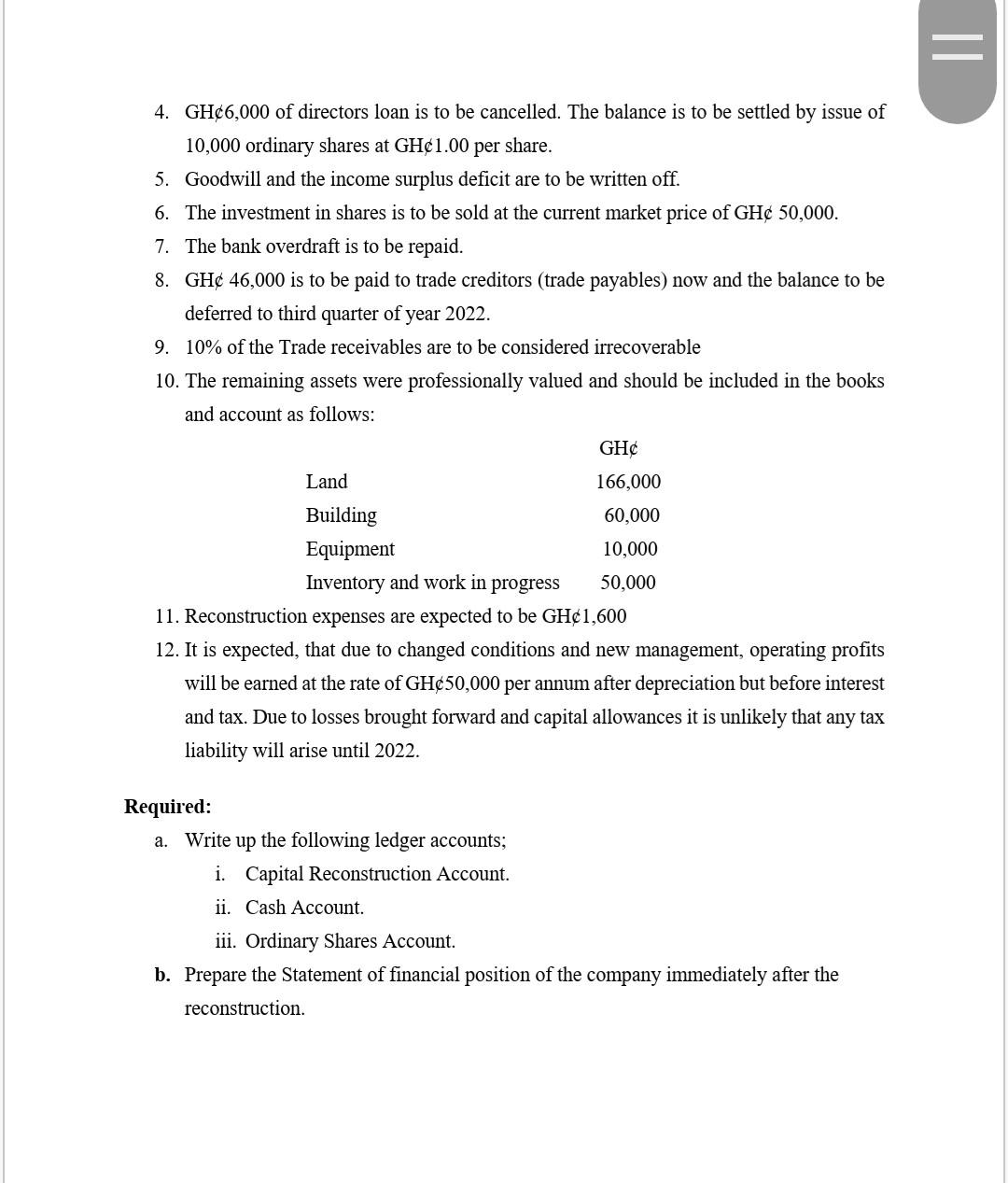

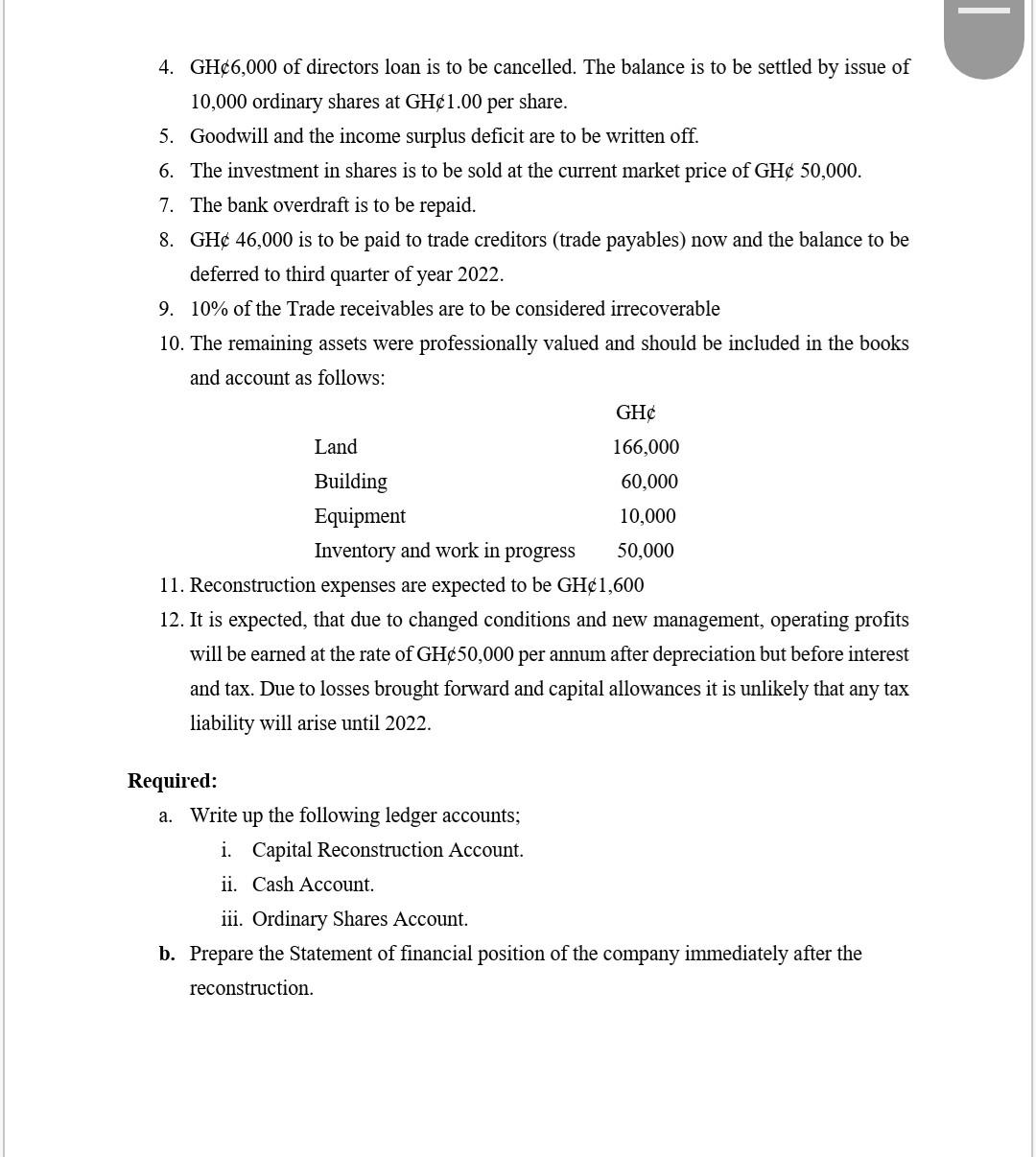

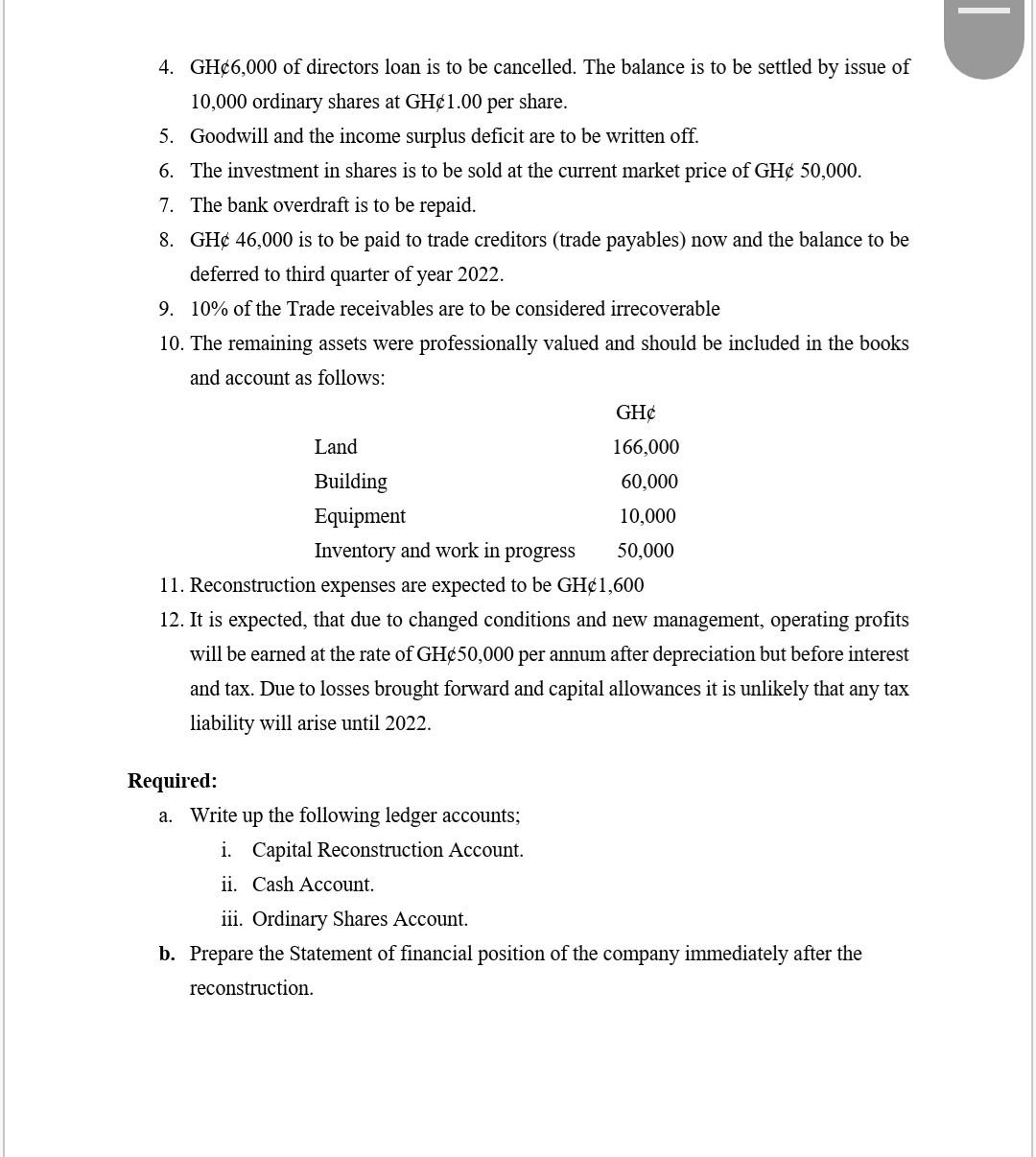

4. GH6,000 of directors loan is to be cancelled. The balance is to be settled by issue of 10,000 ordinary shares at GH1.00 per share. 5. Goodwill and the income surplus deficit are to be written off. 6. The investment in shares is to be sold at the current market price of GH 50,000. 7. The bank overdraft is to be repaid. 8. GH 46,000 is to be paid to trade creditors (trade payables) now and the balance to be deferred to third quarter of year 2022. 9. 10% of the Trade receivables are to be considered irrecoverable 10. The remaining assets were professionally valued and should be included in the books and account as follows: GH Land 166,000 Building 60,000 Equipment 10,000 Inventory and work in progress 50,000 11. Reconstruction expenses are expected to be GH1,600 12. It is expected, that due to changed conditions and new management, operating profits will be earned at the rate of GH50,000 per annum after depreciation but before interest and tax. Due to losses brought forward and capital allowances it is unlikely that any tax liability will arise until 2022. Required: a. Write up the following ledger accounts; i. Capital Reconstruction Account. ii. Cash Account. iii. Ordinary Shares Account. b. Prepare the Statement of financial position of the company immediately after the reconstruction. || 4. GH6,000 of directors loan is to be cancelled. The balance is to be settled by issue of 10,000 ordinary shares at GH1.00 per share. 5. Goodwill and the income surplus deficit are to be written off. 6. The investment in shares is to be sold at the current market price of GH 50,000. 7. The bank overdraft is to be repaid. 8. GH 46,000 is to be paid to trade creditors (trade payables) now and the balance to be deferred to third quarter of year 2022. 9. 10% of the Trade receivables are to be considered irrecoverable 10. The remaining assets were professionally valued and should be included in the books and account as follows: GH Land 166,000 Building 60,000 Equipment 10,000 Inventory and work in progress 50,000 11. Reconstruction expenses are expected to be GH1,600 12. It is expected, that due to changed conditions and new management, operating profits will be earned at the rate of GH50,000 per annum after depreciation but before interest and tax. Due to losses brought forward and capital allowances it is unlikely that any tax liability will arise until 2022. Required: a. Write up the following ledger accounts; i. Capital Reconstruction Account. ii. Cash Account. iii. Ordinary Shares Account. b. Prepare the Statement of financial position of the company immediately after the reconstruction. || 4. GH6,000 of directors loan is to be cancelled. The balance is to be settled by issue of 10,000 ordinary shares at GH1.00 per share. 5. Goodwill and the income surplus deficit are to be written off. 6. The investment in shares is to be sold at the current market price of GH 50,000. 7. The bank overdraft is to be repaid. 8. GH 46,000 is to be paid to trade creditors (trade payables) now and the balance to be deferred to third quarter of year 2022. 9. 10% of the Trade receivables are to be considered irrecoverable 10. The remaining assets were professionally valued and should be included in the books and account as follows: GH Land 166,000 Building 60,000 Equipment 10,000 Inventory and work in progress 50,000 11. Reconstruction expenses are expected to be GH1,600 12. It is expected, that due to changed conditions and new management, operating profits will be earned at the rate of GH50,000 per annum after depreciation but before interest and tax. Due to losses brought forward and capital allowances it is unlikely that any tax liability will arise until 2022. Required: a. Write up the following ledger accounts; i. Capital Reconstruction Account. ii. Cash Account. iii. Ordinary Shares Account. b. Prepare the Statement of financial position of the company immediately after the reconstruction. | 4. GH6,000 of directors loan is to be cancelled. The balance is to be settled by issue of 10,000 ordinary shares at GH1.00 per share. 5. Goodwill and the income surplus deficit are to be written off. 6. The investment in shares is to be sold at the current market price of GH 50,000. 7. The bank overdraft is to be repaid. 8. GH 46,000 is to be paid to trade creditors (trade payables) now and the balance to be deferred to third quarter of year 2022. 9. 10% of the Trade receivables are to be considered irrecoverable 10. The remaining assets were professionally valued and should be included in the books and account as follows: GH Land 166,000 Building 60,000 Equipment 10,000 Inventory and work in progress 50,000 11. Reconstruction expenses are expected to be GH1,600 12. It is expected, that due to changed conditions and new management, operating profits will be earned at the rate of GH50,000 per annum after depreciation but before interest and tax. Due to losses brought forward and capital allowances it is unlikely that any tax liability will arise until 2022. Required: a. Write up the following ledger accounts; i. Capital Reconstruction Account. ii. Cash Account. iii. Ordinary Shares Account. b. Prepare the Statement of financial position of the company immediately after the reconstruction. || 4. GH6,000 of directors loan is to be cancelled. The balance is to be settled by issue of 10,000 ordinary shares at GH1.00 per share. 5. Goodwill and the income surplus deficit are to be written off. 6. The investment in shares is to be sold at the current market price of GH 50,000. 7. The bank overdraft is to be repaid. 8. GH 46,000 is to be paid to trade creditors (trade payables) now and the balance to be deferred to third quarter of year 2022. 9. 10% of the Trade receivables are to be considered irrecoverable 10. The remaining assets were professionally valued and should be included in the books and account as follows: GH Land 166,000 Building 60,000 Equipment 10,000 Inventory and work in progress 50,000 11. Reconstruction expenses are expected to be GH1,600 12. It is expected, that due to changed conditions and new management, operating profits will be earned at the rate of GH50,000 per annum after depreciation but before interest and tax. Due to losses brought forward and capital allowances it is unlikely that any tax liability will arise until 2022. Required: a. Write up the following ledger accounts; i. Capital Reconstruction Account. ii. Cash Account. iii. Ordinary Shares Account. b. Prepare the Statement of financial position of the company immediately after the reconstruction. || 4. GH6,000 of directors loan is to be cancelled. The balance is to be settled by issue of 10,000 ordinary shares at GH1.00 per share. 5. Goodwill and the income surplus deficit are to be written off. 6. The investment in shares is to be sold at the current market price of GH 50,000. 7. The bank overdraft is to be repaid. 8. GH 46,000 is to be paid to trade creditors (trade payables) now and the balance to be deferred to third quarter of year 2022. 9. 10% of the Trade receivables are to be considered irrecoverable 10. The remaining assets were professionally valued and should be included in the books and account as follows: GH Land 166,000 Building 60,000 Equipment 10,000 Inventory and work in progress 50,000 11. Reconstruction expenses are expected to be GH1,600 12. It is expected, that due to changed conditions and new management, operating profits will be earned at the rate of GH50,000 per annum after depreciation but before interest and tax. Due to losses brought forward and capital allowances it is unlikely that any tax liability will arise until 2022. Required: a. Write up the following ledger accounts; i. Capital Reconstruction Account. ii. Cash Account. iii. Ordinary Shares Account. b. Prepare the Statement of financial position of the company immediately after the reconstruction. |Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started