Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Its a full questionn 4) Receivables include an amount of GH12,000 resulting from the bankruptcy of a major customer. Aboto Ltd is not likely to

Its a full questionn

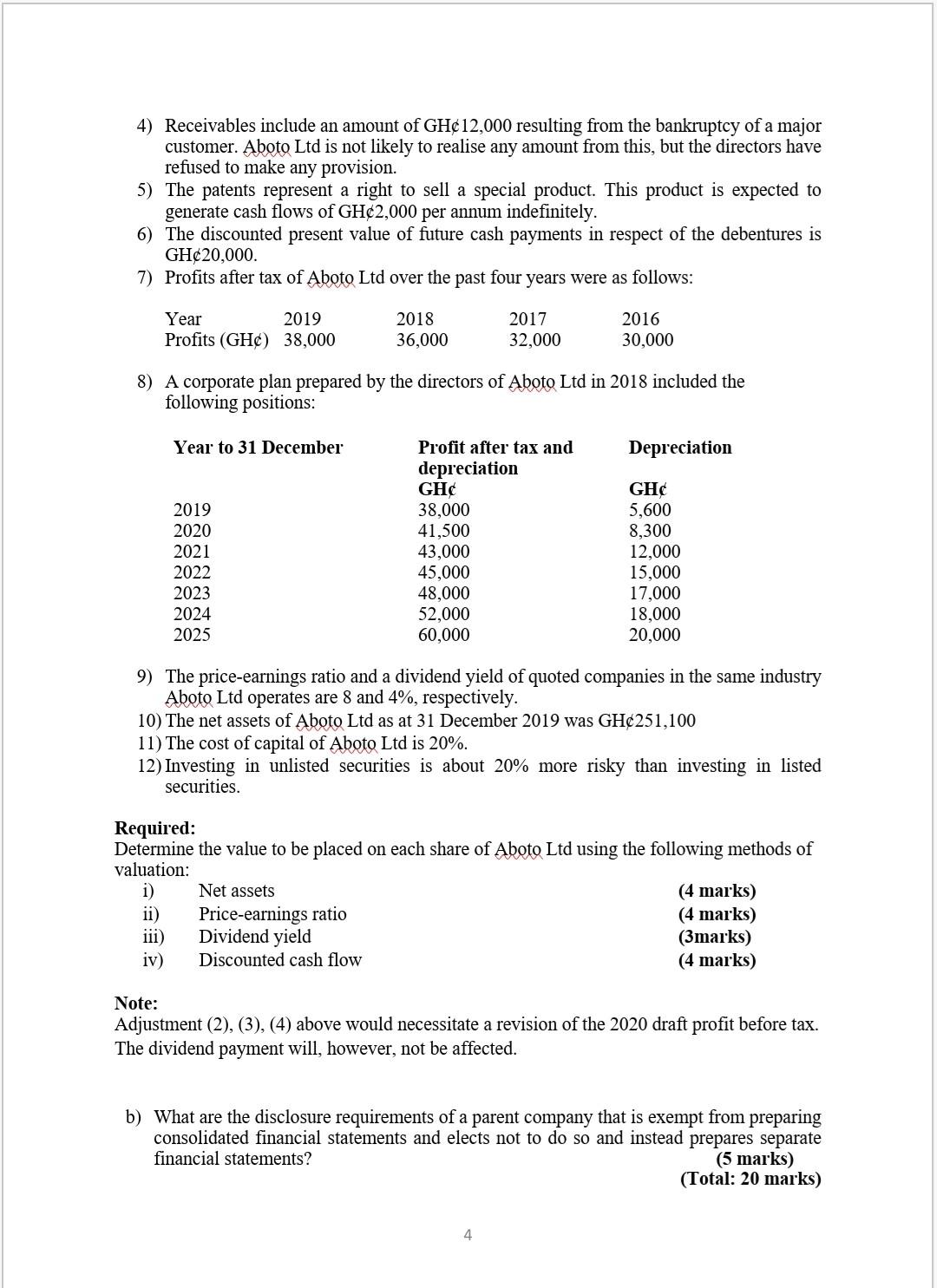

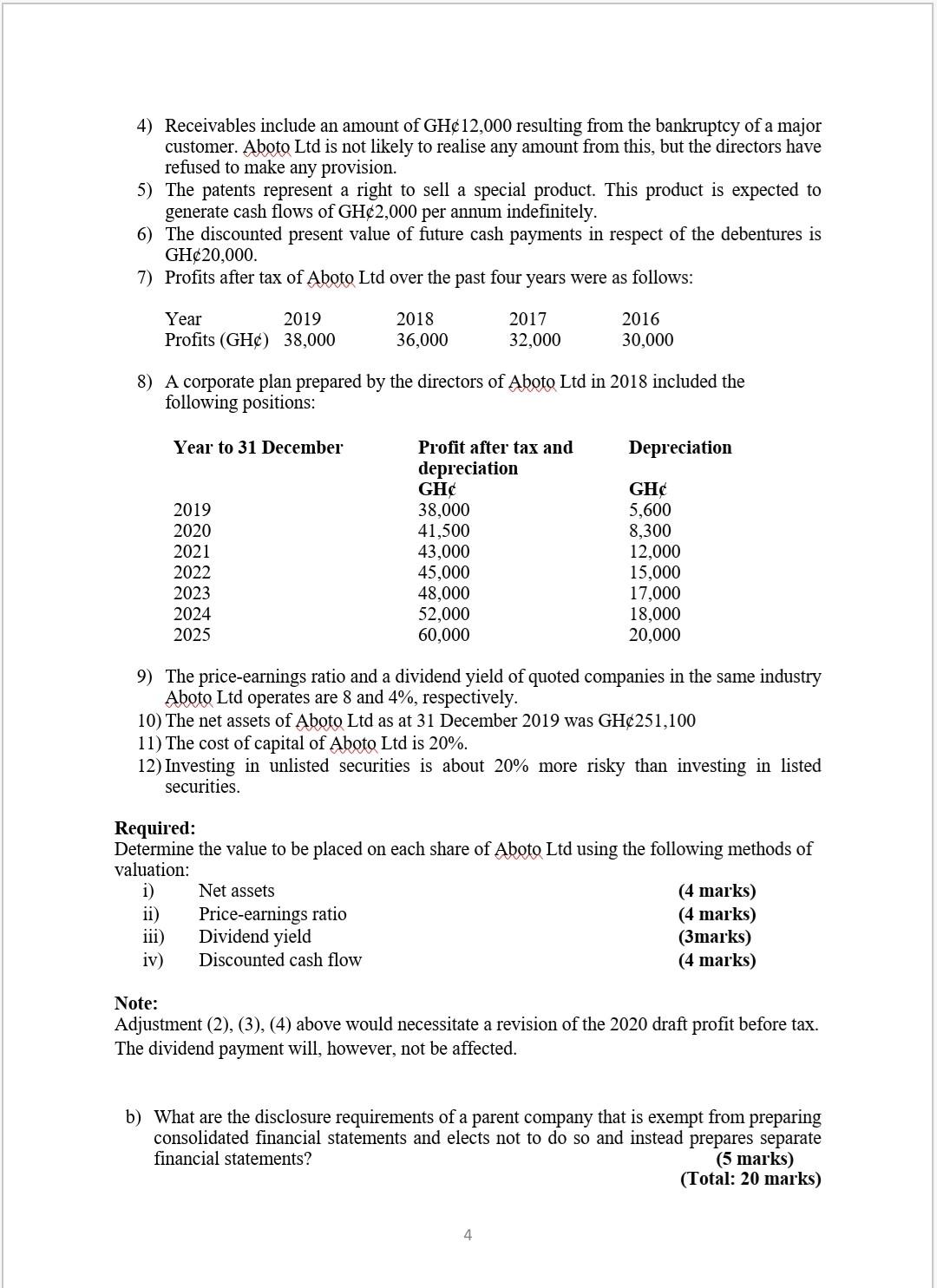

4) Receivables include an amount of GH12,000 resulting from the bankruptcy of a major customer. Aboto Ltd is not likely to realise any amount from this, but the directors have refused to make any provision. 5) The patents represent a right to sell a special product. This product is expected to generate cash flows of GH2,000 per annum indefinitely. 6) The discounted present value of future cash payments in respect of the debentures is GH20,000. 7) Profits after tax of Aboto Ltd over the past four years were as follows: 2019 2018 2017 2016 Year Profits (GHC) 38,000 36,000 32,000 30,000 8) A corporate plan prepared by the directors of Aboto Ltd in 2018 included the following positions: Year to 31 December Profit after tax and Depreciation depreciation GH GH 2019 38,000 5,600 2020 41,500 8,300 2021 43,000 12,000 2022 45,000 15,000 2023 48,000 17,000 2024 18,000 52,000 60,000 2025 20,000 9) The price-earnings ratio and a dividend yield of quoted companies in the same industry Aboto Ltd operates are 8 and 4%, respectively. 10) The net assets of Aboto Ltd as at 31 December 2019 was GH251,100 11) The cost of capital of Aboto Ltd is 20%. 12) Investing in unlisted securities is about 20% more risky than investing in listed securities. Required: Determine the value to be placed on each share of Aboto Ltd using the following methods of valuation: i) Net assets ii) Price-earnings ratio (4 marks) (4 marks) (3marks) (4 marks) iii) Dividend yield iv) Discounted cash flow Note: Adjustment (2), (3), (4) above would necessitate a revision of the 2020 draft profit before tax. The dividend payment will, however, not be affected. b) What are the disclosure requirements of a parent company that is exempt from preparing consolidated financial statements and elects not to do so and instead prepares separate financial statements? (5 marks) (Total: 20 marks) 4 4) Receivables include an amount of GH12,000 resulting from the bankruptcy of a major customer. Aboto Ltd is not likely to realise any amount from this, but the directors have refused to make any provision. 5) The patents represent a right to sell a special product. This product is expected to generate cash flows of GH2,000 per annum indefinitely. 6) The discounted present value of future cash payments in respect of the debentures is GH20,000. 7) Profits after tax of Aboto Ltd over the past four years were as follows: 2019 2018 2017 2016 Year Profits (GHC) 38,000 36,000 32,000 30,000 8) A corporate plan prepared by the directors of Aboto Ltd in 2018 included the following positions: Year to 31 December Profit after tax and Depreciation depreciation GH GH 2019 38,000 5,600 2020 41,500 8,300 2021 43,000 12,000 2022 45,000 15,000 2023 48,000 17,000 2024 18,000 52,000 60,000 2025 20,000 9) The price-earnings ratio and a dividend yield of quoted companies in the same industry Aboto Ltd operates are 8 and 4%, respectively. 10) The net assets of Aboto Ltd as at 31 December 2019 was GH251,100 11) The cost of capital of Aboto Ltd is 20%. 12) Investing in unlisted securities is about 20% more risky than investing in listed securities. Required: Determine the value to be placed on each share of Aboto Ltd using the following methods of valuation: i) Net assets ii) Price-earnings ratio (4 marks) (4 marks) (3marks) (4 marks) iii) Dividend yield iv) Discounted cash flow Note: Adjustment (2), (3), (4) above would necessitate a revision of the 2020 draft profit before tax. The dividend payment will, however, not be affected. b) What are the disclosure requirements of a parent company that is exempt from preparing consolidated financial statements and elects not to do so and instead prepares separate financial statements? (5 marks) (Total: 20 marks) 4 4) Receivables include an amount of GH12,000 resulting from the bankruptcy of a major customer. Aboto Ltd is not likely to realise any amount from this, but the directors have refused to make any provision. 5) The patents represent a right to sell a special product. This product is expected to generate cash flows of GH2,000 per annum indefinitely. 6) The discounted present value of future cash payments in respect of the debentures is GH20,000. 7) Profits after tax of Aboto Ltd over the past four years were as follows: 2019 2018 2017 2016 Year Profits (GHC) 38,000 36,000 32,000 30,000 8) A corporate plan prepared by the directors of Aboto Ltd in 2018 included the following positions: Year to 31 December Profit after tax and Depreciation depreciation GH GH 2019 38,000 5,600 2020 41,500 8,300 2021 43,000 12,000 2022 45,000 15,000 2023 48,000 17,000 2024 18,000 52,000 60,000 2025 20,000 9) The price-earnings ratio and a dividend yield of quoted companies in the same industry Aboto Ltd operates are 8 and 4%, respectively. 10) The net assets of Aboto Ltd as at 31 December 2019 was GH251,100 11) The cost of capital of Aboto Ltd is 20%. 12) Investing in unlisted securities is about 20% more risky than investing in listed securities. Required: Determine the value to be placed on each share of Aboto Ltd using the following methods of valuation: i) Net assets ii) Price-earnings ratio (4 marks) (4 marks) (3marks) (4 marks) iii) Dividend yield iv) Discounted cash flow Note: Adjustment (2), (3), (4) above would necessitate a revision of the 2020 draft profit before tax. The dividend payment will, however, not be affected. b) What are the disclosure requirements of a parent company that is exempt from preparing consolidated financial statements and elects not to do so and instead prepares separate financial statements? (5 marks) (Total: 20 marks) 4 4) Receivables include an amount of GH12,000 resulting from the bankruptcy of a major customer. Aboto Ltd is not likely to realise any amount from this, but the directors have refused to make any provision. 5) The patents represent a right to sell a special product. This product is expected to generate cash flows of GH2,000 per annum indefinitely. 6) The discounted present value of future cash payments in respect of the debentures is GH20,000. 7) Profits after tax of Aboto Ltd over the past four years were as follows: 2019 2018 2017 2016 Year Profits (GHC) 38,000 36,000 32,000 30,000 8) A corporate plan prepared by the directors of Aboto Ltd in 2018 included the following positions: Year to 31 December Profit after tax and Depreciation depreciation GH GH 2019 38,000 5,600 2020 41,500 8,300 2021 43,000 12,000 2022 45,000 15,000 2023 48,000 17,000 2024 18,000 52,000 60,000 2025 20,000 9) The price-earnings ratio and a dividend yield of quoted companies in the same industry Aboto Ltd operates are 8 and 4%, respectively. 10) The net assets of Aboto Ltd as at 31 December 2019 was GH251,100 11) The cost of capital of Aboto Ltd is 20%. 12) Investing in unlisted securities is about 20% more risky than investing in listed securities. Required: Determine the value to be placed on each share of Aboto Ltd using the following methods of valuation: i) Net assets ii) Price-earnings ratio (4 marks) (4 marks) (3marks) (4 marks) iii) Dividend yield iv) Discounted cash flow Note: Adjustment (2), (3), (4) above would necessitate a revision of the 2020 draft profit before tax. The dividend payment will, however, not be affected. b) What are the disclosure requirements of a parent company that is exempt from preparing consolidated financial statements and elects not to do so and instead prepares separate financial statements? (5 marks) (Total: 20 marks) 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started