Answered step by step

Verified Expert Solution

Question

1 Approved Answer

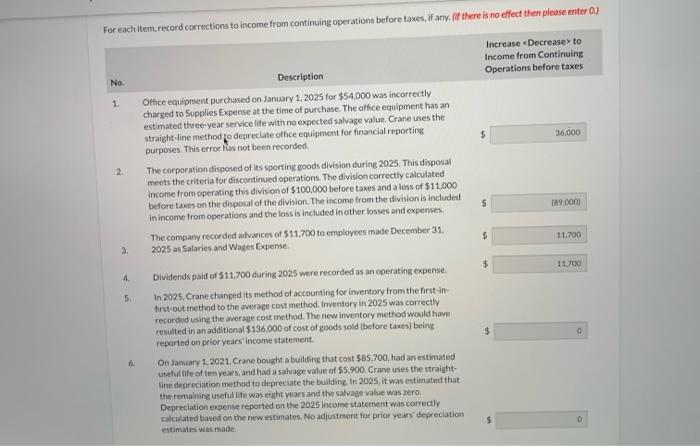

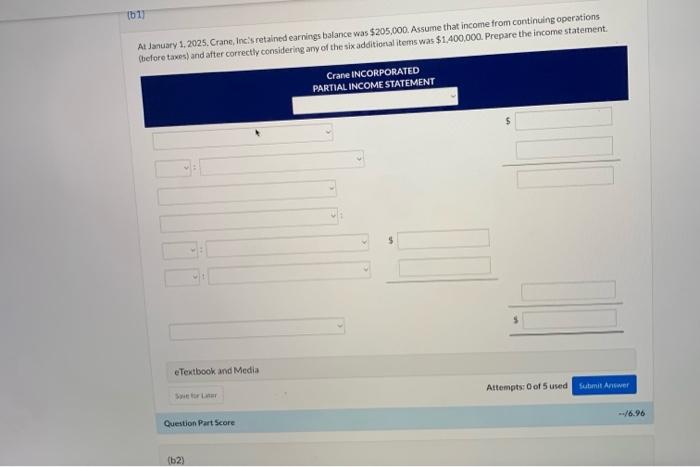

its a simple partial income statement based on the info in the first picture and the description above in the second picture For each item,

its a simple partial income statement based on the info in the first picture and the description above in the second picture

For each item, record correcticns to income from continuing operations before faxes, if any, fif there is no effect then please enter 0 . Increase to Income from Continuing Operations before taxes Deseription 1. Offce equipment purchased on January 1,2025 for $54,000 was incorrectly charged to Supplies Expense at the time of purchase. The office equipment has an estimated three-year service life with no expected salvage value. Crare uses the straight-line method fo depreciate office equipnent for financial reporting purposes. This error has not been recorded. 2. The corporation disposed of its sporting goods division during 2025. This disposal ments the criteria for discontimed operations. The division correctly calculated income from operating this division of $100,000 before taxes and a loss of $11,000 before taxes on the disposal of the division. The income from the division is included inincome from operations and the loss is inceluded in other losses and expenses. The compary recorded advances of $11,700 to employees made December 31 . 3. 2025 as 5 alaries and Wages Expense. 4. Dividends paid of 511,700 during 2025 were recorded as an operating expense. 5. In 2025, Crane chansed its method of accounting for inventory from the first-intirst-out method to the average cost method. Inventory in 2025 was correctly recarded usine the arerage cost methad. The new inventory method would have resulted in an additional \$136,000 of cost of goods sold (belore taxes) being reperted on peior years' income statement. 6. On January 1, 2021. Crane bought a building that cost $85.700, had an estlmated ustul life of ten years, and had a satvage value of $5.900. Crane uses the straightline depreciation method to depreciate the building. In 2025 , it was estimated that the remalning useful life was eight vears and the salvage value was zero. Depreciation expense reported on the 2025 income statement was correctly calculated based on the new estimates, No adjustnent for pricr years' depreciation estirates was made. A. January 1. 2025. Crane, incis retained earnings balance was $205,000. Assume that income from continuing operations ah the sixadditional items was $1,400,000. Prepare the income statement: For each item, record correcticns to income from continuing operations before faxes, if any, fif there is no effect then please enter 0 . Increase to Income from Continuing Operations before taxes Deseription 1. Offce equipment purchased on January 1,2025 for $54,000 was incorrectly charged to Supplies Expense at the time of purchase. The office equipment has an estimated three-year service life with no expected salvage value. Crare uses the straight-line method fo depreciate office equipnent for financial reporting purposes. This error has not been recorded. 2. The corporation disposed of its sporting goods division during 2025. This disposal ments the criteria for discontimed operations. The division correctly calculated income from operating this division of $100,000 before taxes and a loss of $11,000 before taxes on the disposal of the division. The income from the division is included inincome from operations and the loss is inceluded in other losses and expenses. The compary recorded advances of $11,700 to employees made December 31 . 3. 2025 as 5 alaries and Wages Expense. 4. Dividends paid of 511,700 during 2025 were recorded as an operating expense. 5. In 2025, Crane chansed its method of accounting for inventory from the first-intirst-out method to the average cost method. Inventory in 2025 was correctly recarded usine the arerage cost methad. The new inventory method would have resulted in an additional \$136,000 of cost of goods sold (belore taxes) being reperted on peior years' income statement. 6. On January 1, 2021. Crane bought a building that cost $85.700, had an estlmated ustul life of ten years, and had a satvage value of $5.900. Crane uses the straightline depreciation method to depreciate the building. In 2025 , it was estimated that the remalning useful life was eight vears and the salvage value was zero. Depreciation expense reported on the 2025 income statement was correctly calculated based on the new estimates, No adjustnent for pricr years' depreciation estirates was made. A. January 1. 2025. Crane, incis retained earnings balance was $205,000. Assume that income from continuing operations ah the sixadditional items was $1,400,000. Prepare the income statement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started