Answered step by step

Verified Expert Solution

Question

1 Approved Answer

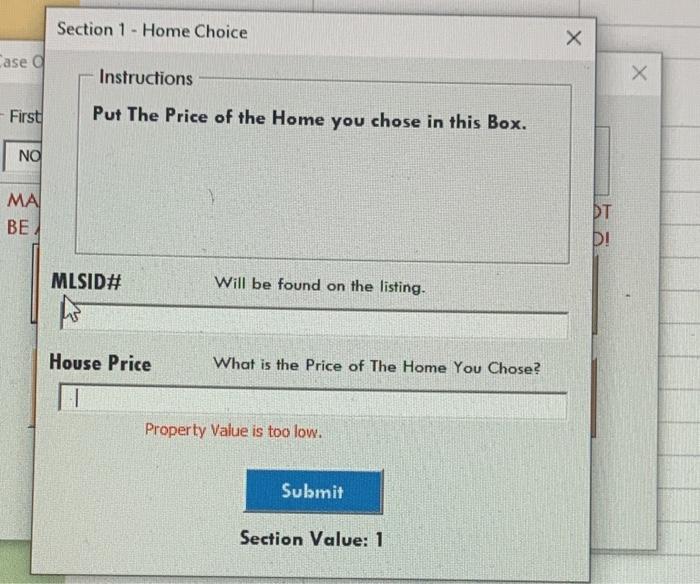

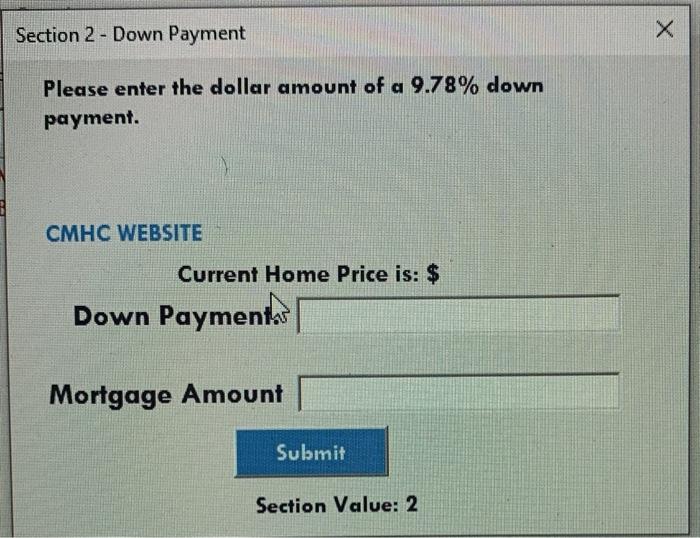

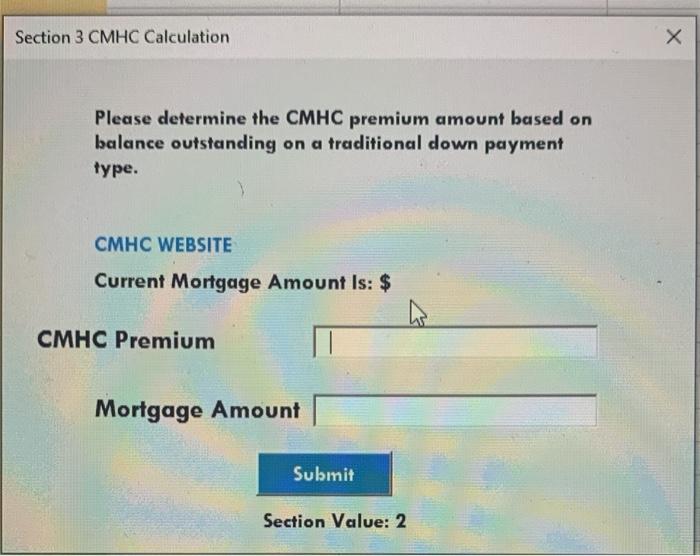

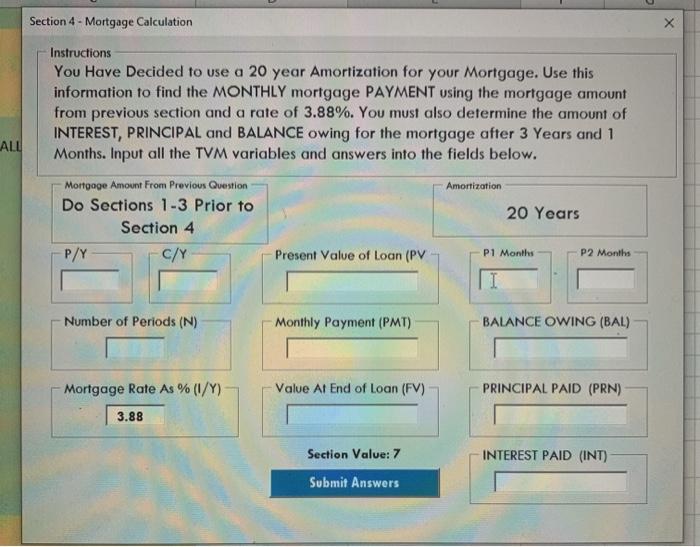

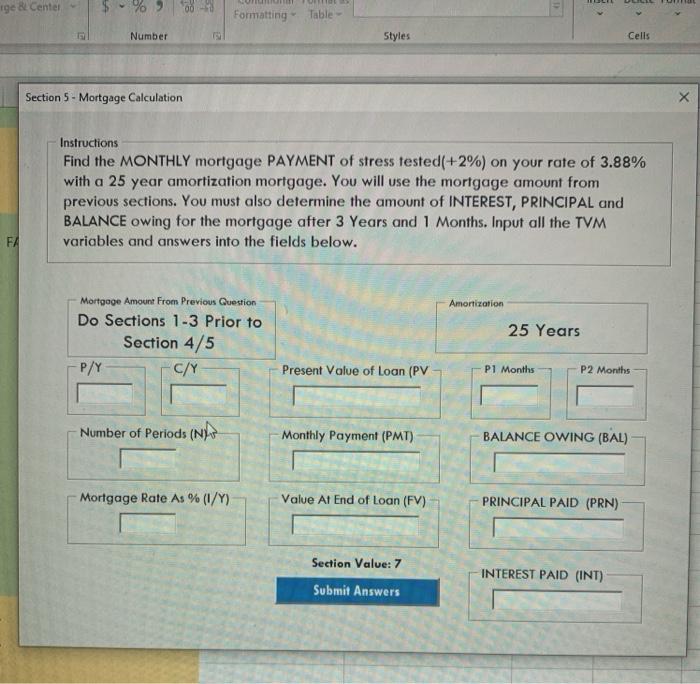

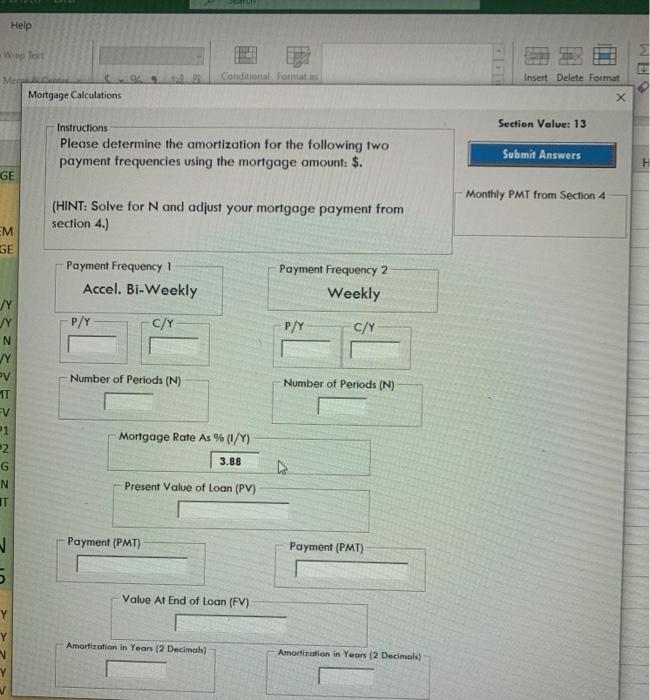

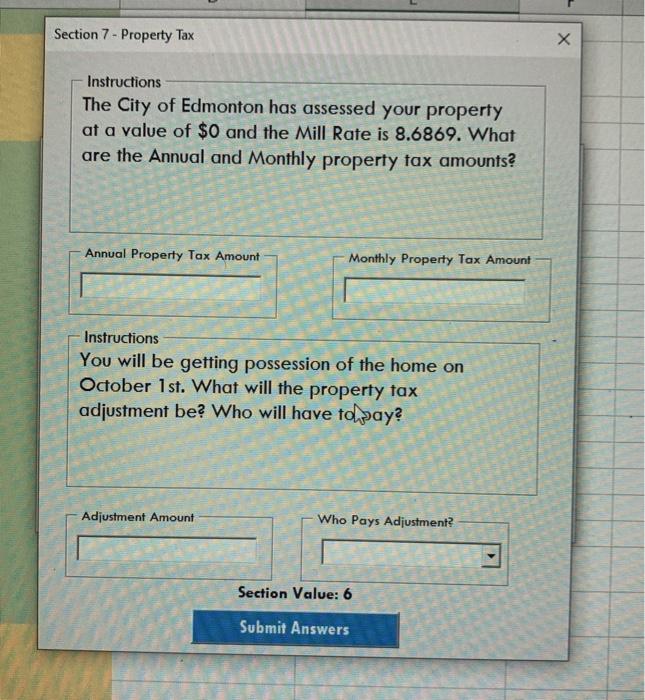

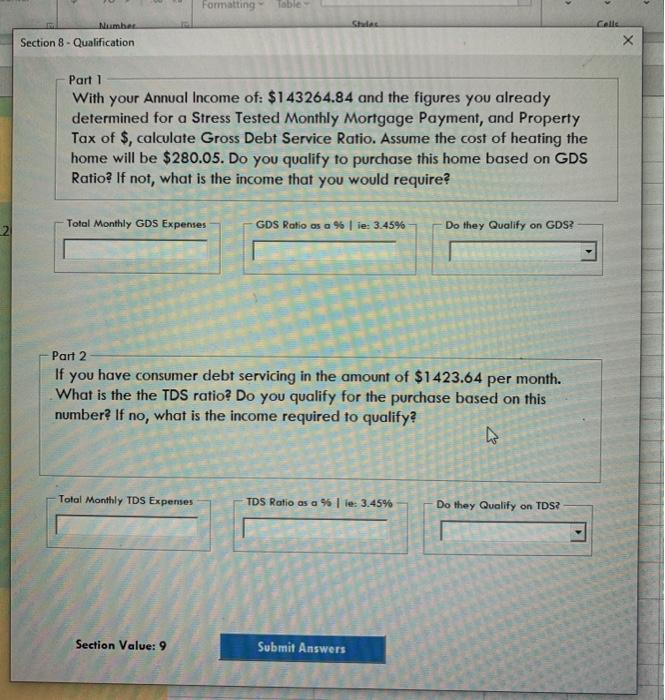

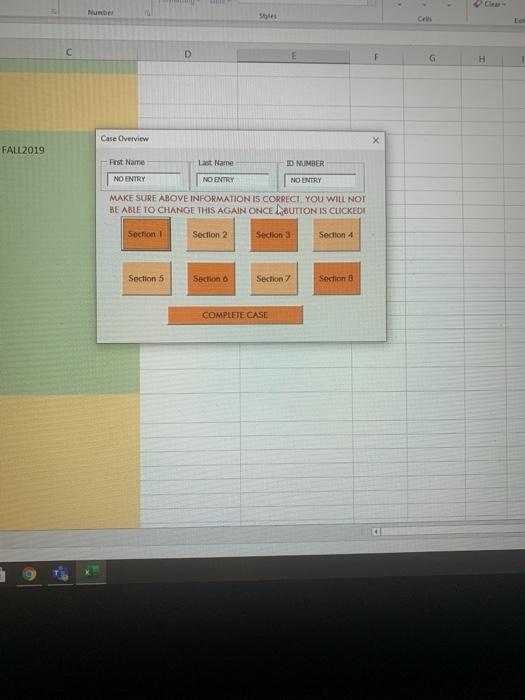

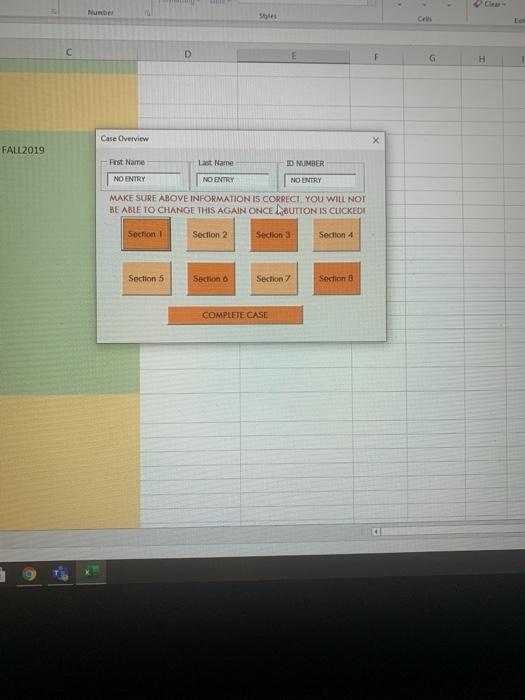

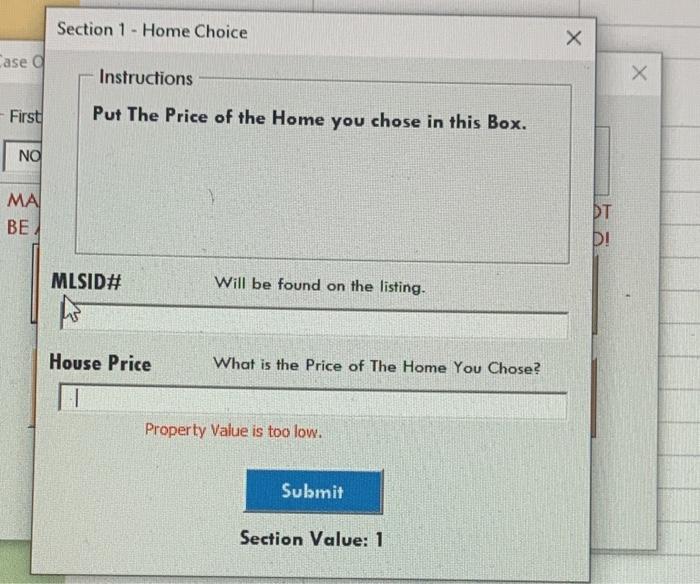

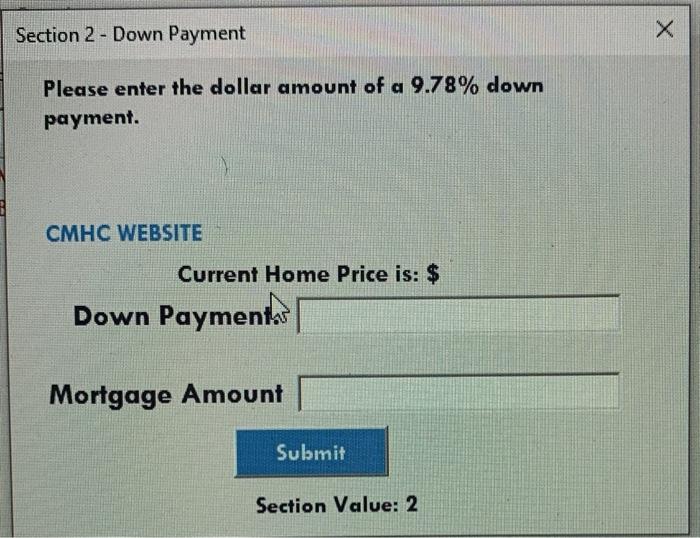

its an mortgage case we need to choose our own price and do the mortgage payments i am adding all the pictures of the sections

its an mortgage case we need to choose our own price and do the mortgage payments

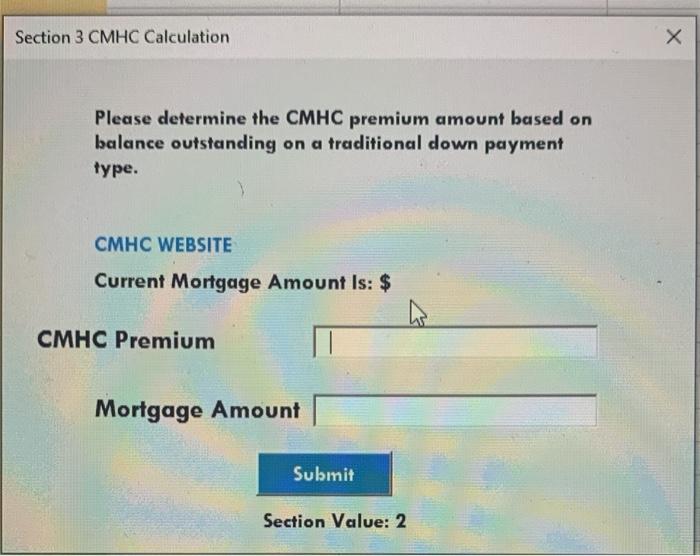

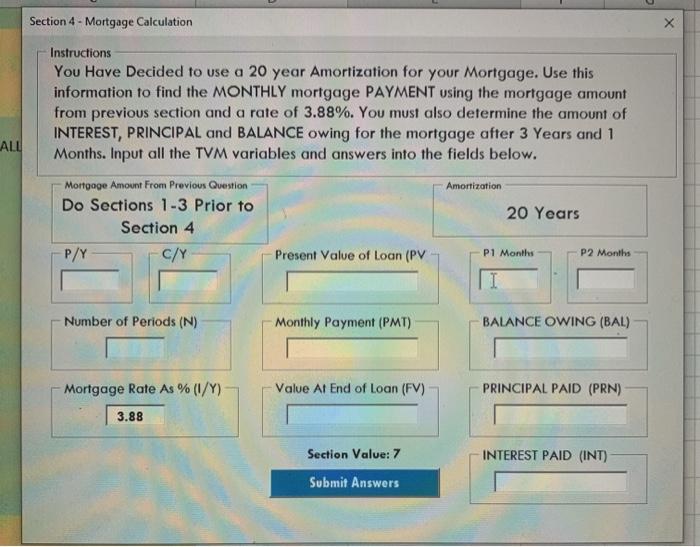

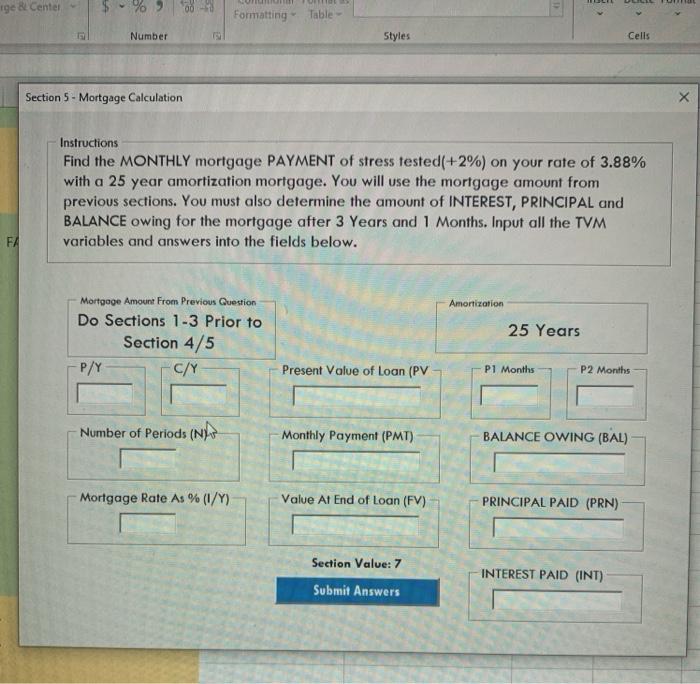

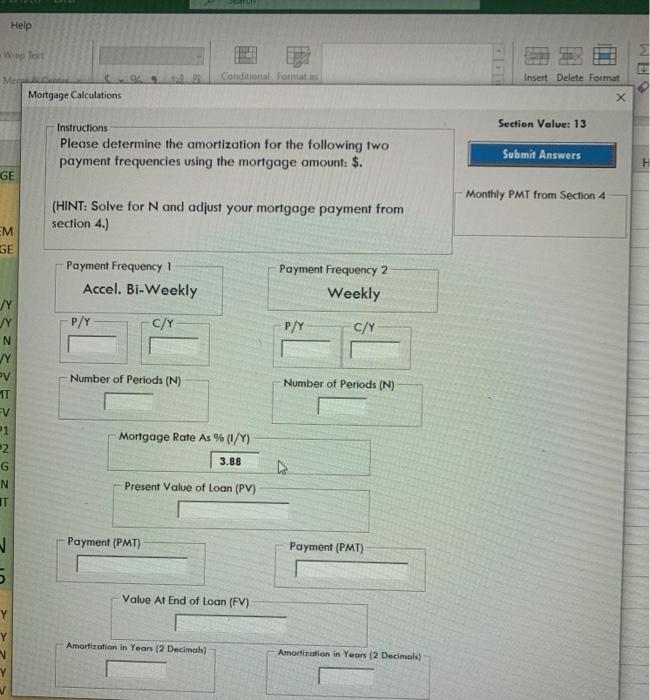

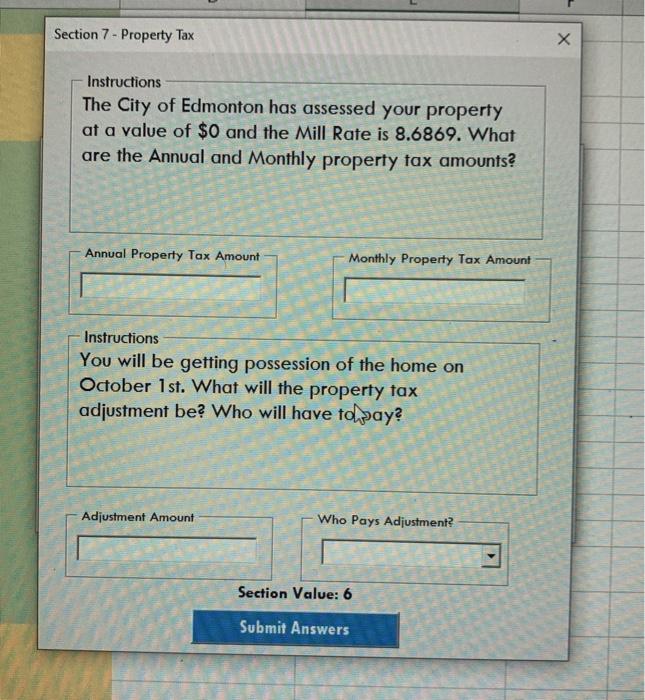

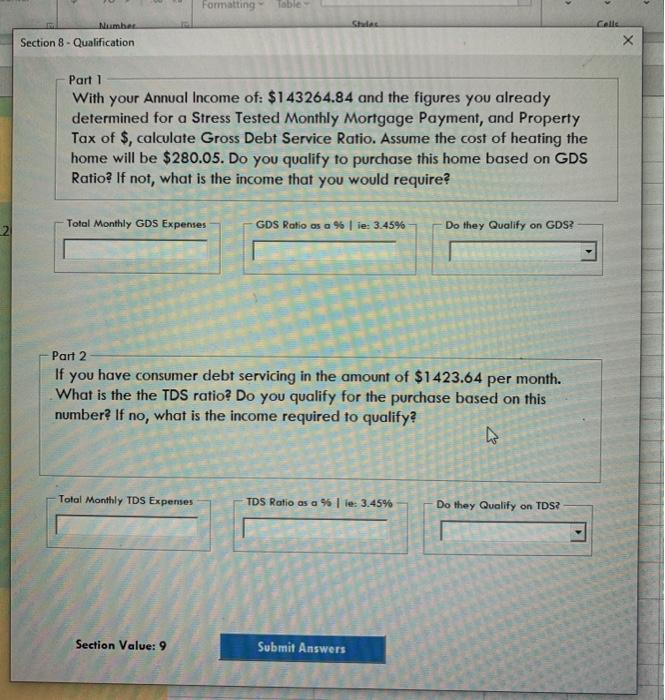

Cla Styles Criti D G H Case Overview X FALL 2019 - First Name Last Name ED NUMBER NO ENTRY NO ENTRY NO ENTRY MAKE SURE ABOVE INFORMATION IS CORRECT YOU WILL NOT BE ABLE TO CHANGE THIS AGAIN ONCE BUTTON IS CLICKED Section! Section 2 Section 3 Section 4 Section 5 Section 6 Section 7 Section 3 COMPLETE CASE Section 1 - Home Choice Case o Instructions First Put The Price of the Home you chose in this Box. MA BE DT D! MLSID# Will be found on the listing. A House Price What is the Price of The Home You Chose? Property Value is too low. Submit Section Value: 1 Section 2 - Down Payment Please enter the dollar amount of a 9.78% down payment. CMHC WEBSITE Current Home Price is: $ Down Payment Mortgage Amount Submit Section Value: 2 Section 3 CMHC Calculation Please determine the CMHC premium amount based on balance outstanding on a traditional down payment type. . CMHC WEBSITE Current Mortgage Amount Is: $ CMHC Premium Mortgage Amount Submit Section Value: 2 Section 4 - Mortgage Calculation Instructions You Have Decided to use a 20 year Amortization for your Mortgage. Use this information to find the MONTHLY mortgage PAYMENT using the mortgage amount from previous section and a rate of 3.88%. You must also determine the amount of INTEREST, PRINCIPAL and BALANCE owing for the mortgage after 3 Years and 1 Months. Input all the TVM variables and answers into the fields below. ALL Amortization Mortgage Amount From Previous Question Do Sections 1-3 Prior to Section 4 P/Y c/r 20 Years Present Value of Loan (PV P1 Months P2 Months I Number of Periods (N) Monthly Payment (PMT) BALANCE OWING (BAL) Mortgage Rate As % (I/Y) Value At End of Loan (FV) PRINCIPAL PAID (PRN) 3.88 Section Value: 7 INTEREST PAID (INT) Submit Answers 19e & Center 00-3 Formatting Table Number Styles Cells Section 5 - Mortgage Calculation Instructions Find the MONTHLY mortgage PAYMENT of stress tested(+2%) on your rate of 3.88% with a 25 year amortization mortgage. You will use the mortgage amount from previous sections. You must also determine the amount INTEREST, PRINCIPAL and BALANCE owing for the mortgage after 3 Years and 1 Months. Input all the TVM variables and answers into the fields below. FA Amortization Mortgage Amount From Previous Question Do Sections 1-3 Prior to Section 4/5 P/Y c/y 25 Years Present Value of Loan (PV P1 Months P2 Months Number of Periods (NA Monthly Payment (PMT) BALANCE OWING (BAL) Mortgage Rate As % (1/Y) Value At End of Loan (FV) PRINCIPAL PAID (PRN) Section Value: 7 INTEREST PAID (INT) Submit Answers Help Wap Test Conditional Formatas Insert Delete Format Mere Mortgage Calculations Section Value: 13 Instructions Please determine the amortization for the following two payment frequencies using the mortgage amount: $. Submit Answers H GE Monthly PMT from Section 4 (HINT: Solve for N and adjust your mortgage payment from section 4.) M GE Payment Frequency 1 Accel. Bi-Weekly Payment Frequency 2 Weekly P/Y C/Y P/Y C// NY NY N MY V Number of Periods (N) Number of Periods (N) Mortgage Rate As % 0/Y) EV 1 2 G N IT 3.88 Present Value of Loan (PV) Payment (PMT) Payment (PMT) Value At End of Loan (FV) Amortization in Years (2 Decimals) Amorfization in Years (2 Decimals Y V Section 7 - Property Tax Instructions The City of Edmonton has assessed your property at a value of $0 and the Mill Rate is 8.6869. What are the Annual and Monthly property tax amounts? Annual Property Tax Amount Monthly Property Tax Amount Instructions You will be getting possession of the home on October 1st. What will the property tax adjustment be? Who will have to pay? Adjustment Amount Who Pays Adjustment? Section Value: 6 Submit Answers Formatting Table Number Section 8 - Qualification Cells Part 1 With your Annual Income of: $143264.84 and the figures you already determined for a Stress Tested Monthly Mortgage Payment, and Property Tax of $, calculate Gross Debt Service Ratio. Assume the cost of heating the home will be $280.05. Do you qualify to purchase this home based on GDS Ratio? If not, what is the income that you would require? Total Monthly GDS Expenses GDS Ratio us a % le: 3.45% Do they Qualify on GDS? 2 Part 2 If you have consumer debt servicing in the amount of $1423.64 per month. What is the the TDS ratio? Do you qualify for the purchase based on this number? If no, what is the income required to qualify? Total Monthly TDS Expenses TDS Ratio as a % le: 3.45% Do they Qualify on TDS? Section Value: 9 Submit Answers Cla Styles Criti D G H Case Overview X FALL 2019 - First Name Last Name ED NUMBER NO ENTRY NO ENTRY NO ENTRY MAKE SURE ABOVE INFORMATION IS CORRECT YOU WILL NOT BE ABLE TO CHANGE THIS AGAIN ONCE BUTTON IS CLICKED Section! Section 2 Section 3 Section 4 Section 5 Section 6 Section 7 Section 3 COMPLETE CASE Section 1 - Home Choice Case o Instructions First Put The Price of the Home you chose in this Box. MA BE DT D! MLSID# Will be found on the listing. A House Price What is the Price of The Home You Chose? Property Value is too low. Submit Section Value: 1 Section 2 - Down Payment Please enter the dollar amount of a 9.78% down payment. CMHC WEBSITE Current Home Price is: $ Down Payment Mortgage Amount Submit Section Value: 2 Section 3 CMHC Calculation Please determine the CMHC premium amount based on balance outstanding on a traditional down payment type. . CMHC WEBSITE Current Mortgage Amount Is: $ CMHC Premium Mortgage Amount Submit Section Value: 2 Section 4 - Mortgage Calculation Instructions You Have Decided to use a 20 year Amortization for your Mortgage. Use this information to find the MONTHLY mortgage PAYMENT using the mortgage amount from previous section and a rate of 3.88%. You must also determine the amount of INTEREST, PRINCIPAL and BALANCE owing for the mortgage after 3 Years and 1 Months. Input all the TVM variables and answers into the fields below. ALL Amortization Mortgage Amount From Previous Question Do Sections 1-3 Prior to Section 4 P/Y c/r 20 Years Present Value of Loan (PV P1 Months P2 Months I Number of Periods (N) Monthly Payment (PMT) BALANCE OWING (BAL) Mortgage Rate As % (I/Y) Value At End of Loan (FV) PRINCIPAL PAID (PRN) 3.88 Section Value: 7 INTEREST PAID (INT) Submit Answers 19e & Center 00-3 Formatting Table Number Styles Cells Section 5 - Mortgage Calculation Instructions Find the MONTHLY mortgage PAYMENT of stress tested(+2%) on your rate of 3.88% with a 25 year amortization mortgage. You will use the mortgage amount from previous sections. You must also determine the amount INTEREST, PRINCIPAL and BALANCE owing for the mortgage after 3 Years and 1 Months. Input all the TVM variables and answers into the fields below. FA Amortization Mortgage Amount From Previous Question Do Sections 1-3 Prior to Section 4/5 P/Y c/y 25 Years Present Value of Loan (PV P1 Months P2 Months Number of Periods (NA Monthly Payment (PMT) BALANCE OWING (BAL) Mortgage Rate As % (1/Y) Value At End of Loan (FV) PRINCIPAL PAID (PRN) Section Value: 7 INTEREST PAID (INT) Submit Answers Help Wap Test Conditional Formatas Insert Delete Format Mere Mortgage Calculations Section Value: 13 Instructions Please determine the amortization for the following two payment frequencies using the mortgage amount: $. Submit Answers H GE Monthly PMT from Section 4 (HINT: Solve for N and adjust your mortgage payment from section 4.) M GE Payment Frequency 1 Accel. Bi-Weekly Payment Frequency 2 Weekly P/Y C/Y P/Y C// NY NY N MY V Number of Periods (N) Number of Periods (N) Mortgage Rate As % 0/Y) EV 1 2 G N IT 3.88 Present Value of Loan (PV) Payment (PMT) Payment (PMT) Value At End of Loan (FV) Amortization in Years (2 Decimals) Amorfization in Years (2 Decimals Y V Section 7 - Property Tax Instructions The City of Edmonton has assessed your property at a value of $0 and the Mill Rate is 8.6869. What are the Annual and Monthly property tax amounts? Annual Property Tax Amount Monthly Property Tax Amount Instructions You will be getting possession of the home on October 1st. What will the property tax adjustment be? Who will have to pay? Adjustment Amount Who Pays Adjustment? Section Value: 6 Submit Answers Formatting Table Number Section 8 - Qualification Cells Part 1 With your Annual Income of: $143264.84 and the figures you already determined for a Stress Tested Monthly Mortgage Payment, and Property Tax of $, calculate Gross Debt Service Ratio. Assume the cost of heating the home will be $280.05. Do you qualify to purchase this home based on GDS Ratio? If not, what is the income that you would require? Total Monthly GDS Expenses GDS Ratio us a % le: 3.45% Do they Qualify on GDS? 2 Part 2 If you have consumer debt servicing in the amount of $1423.64 per month. What is the the TDS ratio? Do you qualify for the purchase based on this number? If no, what is the income required to qualify? Total Monthly TDS Expenses TDS Ratio as a % le: 3.45% Do they Qualify on TDS? Section Value: 9 Submit Answers i am adding all the pictures of the sections need to be filled i posted 8 pictures please help me in these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started