it's complete!!!

then you have to prepare a balance statement and an income statement

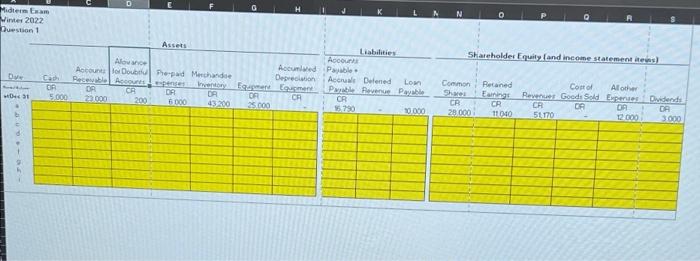

A/p + Accruals payable is 16,790

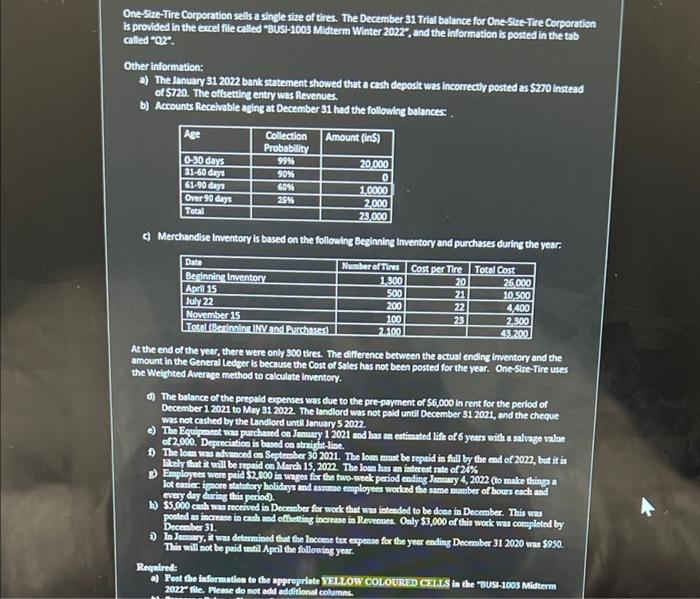

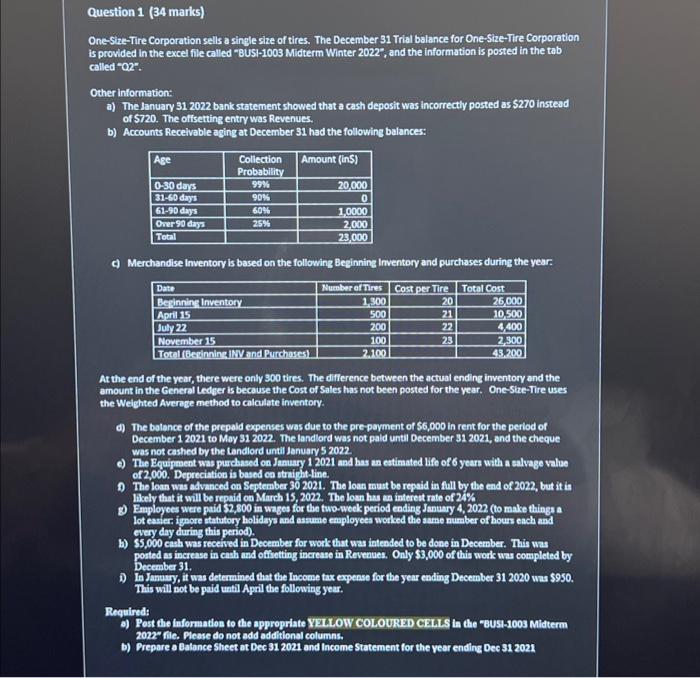

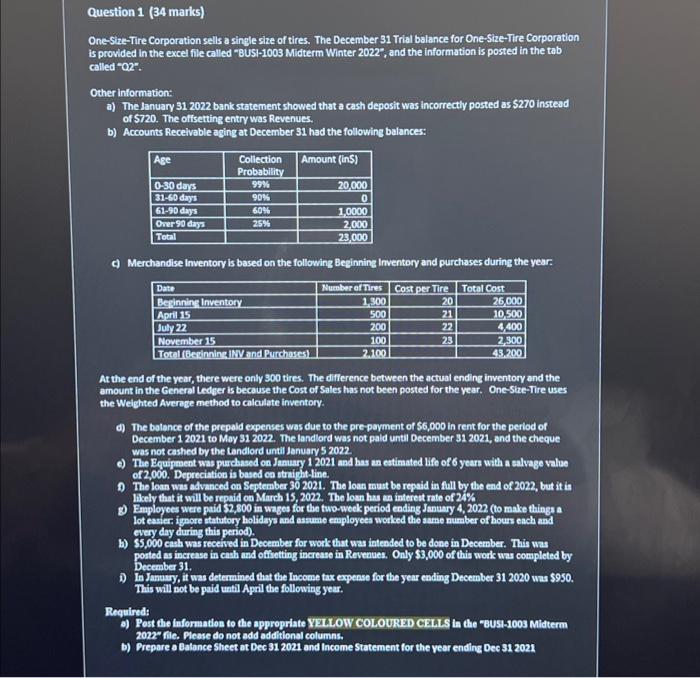

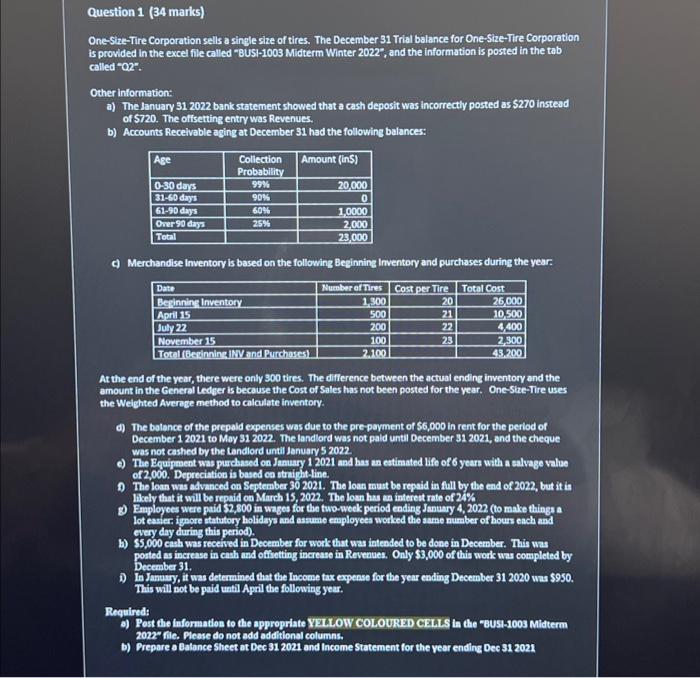

One-Size-Tire Corporation sells a single size of tires. The December 31 Trial balance for One-Size-Tire Corporation is provided in the excel file called "BUSI-1003 Midterm Winter 2022", and the information is posted in the tab called "02". Other Information: a) The January 31 2022 bank statement showed that a cash deposit was incorrectly posted as $270 instead of $720. The offsetting entry was Revenues. b) Accounts Receivable aging at December 31 had the following balances: Age Amount (ins) 0-90 days 31-60 days 61-90 days Over 90 days Total Collection Probability 99% 90% 60% 25% 20.000 0 1.0000 2000 23,000 Merchandise Inventory is based on the following Beginning Inventory and purchases during the year. Data Berinning Inventory April 15 July 22 November 15 Total Beginning INV and Purchases Number of Tires Cost per Tire 1.300 20 500 21 200 22 100 23 201001 Total Cost 25,000 10.500 4.400 2.300 43.200 At the end of the year, there were only 300 tires. The difference between the actual ending inventory and the amount in the General Ledger is because the cost of Sales has not been posted for the year. One-Size-Tire uses the Weighted Average method to calculate Inventory. d) The balance of the prepaid expenses was due to the pre-payment of $6,000 in rent for the period of December 1 2021 to May 31 2022. The landlord was not paid until December 31 2021, and the cheque was not cashed by the Landlord until January 5 2022 e) The Equipment was purchased on January 1 2021 and has an estimated life of 6 years with a salvage value of 2,000. Depreciation is based on straight-line. The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022 The loan has an interest rate of 24% Employees were paid $2,800 in wages for the two-week period ending January 4, 2022 (to make things a lot easier ignore statutory holidays and assume employees worked the same mumber of hours each and every day during this period). 1) $5,000 cash was received in December for work that was intended to be done in December. This was posted an increase in cash and offsetting increase in Revenues. Only $3,000 of this work was completed by December 31. 1) In January, it was determined that the Income tax expense for the year ending December 31 2020 was $950. This will not be paid until April the following year. Required al Post the information to the appropriate YELLOW COLOURED CELLS in the "BUSI-1003 Midterm 2027" file. Please do not add additional columns 13!! Para Question 1 (34 marks) One-Size-Tire Corporation sells a single size of tires. The December 31 Trial balance for One-Size-Tire Corporation is provided in the excel file called "BUSI-1003 Midterm Winter 2022", and the information is posted in the tab called "02". Other information: a) The January 31 2022 bank statement showed that a cash deposit was incorrectly posted as $270 instead of $720. The offsetting entry was Revenues. b) Accounts Receivable aging at December 31 had the following balances: Age Collection Amount (ins) Probability 0-30 days 99% 20,000 31-60 days 90% 0 61-90 days 60% 1,0000 Over 90 day 25% 2.000 Total 23,000 Merchandise Inventory is based on the following Beginning Inventory and purchases during the year. Date Number of Tres Cost per Tire Total Cost Beginning Inventory 1.900 20 26.000 April 15 500 21 10.500 July 22 200 22 4.400 November 15 100 23 2.300 Total (Bextinning INV and Purchases) 2.100 43,200 At the end of the year, there were only 300 tires. The difference between the actual ending inventory and the amount in the General Ledger is because the cost of Sales has not been posted for the year. One-Size-Tire uses the Weighted Average method to calculate inventory. d) The balance of the prepaid expenses was due to the pre-payment of $6,000 in rent for the period of December 1 2021 to May 31 2022. The landlord was not pald unth December 31 2021, and the cheque was not cashed by the Landlord until January 5 2022. e) The Equipment was purchased on January 1 2021 and has an estimated life of 6 years with a salvage value of 2,000. Depreciation is based on straight-line. The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022. The loan has an interest rate of 24% Employees were paid $2,800 in wages for the two-weck period ending January 4, 2022 (to make things a lot easier ignore statutory holidays and assume employees worked the same number of hours each and every day during this period). b) $5,000 cash was received in December for work that was intended to be done in December. This was posted as increase in cash and offsetting increase in Revenues. Only $3,000 of this work was completed by December 31. In January, it was determined that the Income tax expense for the year ending December 31 2020 was $950. This will not be paid until April the following year. Required: -) Post the Information to the appropriate YELLOW COLOURED CELLS in the "BUSI-1003 Midterm 2022" file. Please do not add additional columns. b) Prepare a Balance Sheet at Dec 31 2021 and Income Statement for the year ending Dec 31 2021 E N Midterm Exam Winter 2022 Duestion 1 Assets Shareholder Equity and income statement is ACE Account Doll Pepad Merchandise Acco About Med Payable Depression Accrue Detened LOM Pere Part OR CR 25.000 529 20.000 Common OR 5 000 Aloha we DA 2009 CA 200 DR 5000 DA Retained Earnings CB CR 28.000 11040 Cost of Reverse Good Sold Expenses Dividende CR CA OR DA 51170 12.000 3.000 d 1 9 One-Size-Tire Corporation sells a single size of tires. The December 31 Trial balance for One-Size-Tire Corporation is provided in the excel file called "BUSI-1003 Midterm Winter 2022", and the information is posted in the tab called "02". Other Information: a) The January 31 2022 bank statement showed that a cash deposit was incorrectly posted as $270 instead of $720. The offsetting entry was Revenues. b) Accounts Receivable aging at December 31 had the following balances: Age Amount (ins) 0-90 days 31-60 days 61-90 days Over 90 days Total Collection Probability 99% 90% 60% 25% 20.000 0 1.0000 2000 23,000 Merchandise Inventory is based on the following Beginning Inventory and purchases during the year. Data Berinning Inventory April 15 July 22 November 15 Total Beginning INV and Purchases Number of Tires Cost per Tire 1.300 20 500 21 200 22 100 23 201001 Total Cost 25,000 10.500 4.400 2.300 43.200 At the end of the year, there were only 300 tires. The difference between the actual ending inventory and the amount in the General Ledger is because the cost of Sales has not been posted for the year. One-Size-Tire uses the Weighted Average method to calculate Inventory. d) The balance of the prepaid expenses was due to the pre-payment of $6,000 in rent for the period of December 1 2021 to May 31 2022. The landlord was not paid until December 31 2021, and the cheque was not cashed by the Landlord until January 5 2022 e) The Equipment was purchased on January 1 2021 and has an estimated life of 6 years with a salvage value of 2,000. Depreciation is based on straight-line. The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022 The loan has an interest rate of 24% Employees were paid $2,800 in wages for the two-week period ending January 4, 2022 (to make things a lot easier ignore statutory holidays and assume employees worked the same mumber of hours each and every day during this period). 1) $5,000 cash was received in December for work that was intended to be done in December. This was posted an increase in cash and offsetting increase in Revenues. Only $3,000 of this work was completed by December 31. 1) In January, it was determined that the Income tax expense for the year ending December 31 2020 was $950. This will not be paid until April the following year. Required al Post the information to the appropriate YELLOW COLOURED CELLS in the "BUSI-1003 Midterm 2027" file. Please do not add additional columns 13!! Para Question 1 (34 marks) One-Size-Tire Corporation sells a single size of tires. The December 31 Trial balance for One-Size-Tire Corporation is provided in the excel file called "BUSI-1003 Midterm Winter 2022", and the information is posted in the tab called "02". Other information: a) The January 31 2022 bank statement showed that a cash deposit was incorrectly posted as $270 instead of $720. The offsetting entry was Revenues. b) Accounts Receivable aging at December 31 had the following balances: Age Collection Amount (ins) Probability 0-30 days 99% 20,000 31-60 days 90% 0 61-90 days 60% 1,0000 Over 90 day 25% 2.000 Total 23,000 Merchandise Inventory is based on the following Beginning Inventory and purchases during the year. Date Number of Tres Cost per Tire Total Cost Beginning Inventory 1.900 20 26.000 April 15 500 21 10.500 July 22 200 22 4.400 November 15 100 23 2.300 Total (Bextinning INV and Purchases) 2.100 43,200 At the end of the year, there were only 300 tires. The difference between the actual ending inventory and the amount in the General Ledger is because the cost of Sales has not been posted for the year. One-Size-Tire uses the Weighted Average method to calculate inventory. d) The balance of the prepaid expenses was due to the pre-payment of $6,000 in rent for the period of December 1 2021 to May 31 2022. The landlord was not pald unth December 31 2021, and the cheque was not cashed by the Landlord until January 5 2022. e) The Equipment was purchased on January 1 2021 and has an estimated life of 6 years with a salvage value of 2,000. Depreciation is based on straight-line. The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022. The loan has an interest rate of 24% Employees were paid $2,800 in wages for the two-weck period ending January 4, 2022 (to make things a lot easier ignore statutory holidays and assume employees worked the same number of hours each and every day during this period). b) $5,000 cash was received in December for work that was intended to be done in December. This was posted as increase in cash and offsetting increase in Revenues. Only $3,000 of this work was completed by December 31. In January, it was determined that the Income tax expense for the year ending December 31 2020 was $950. This will not be paid until April the following year. Required: -) Post the Information to the appropriate YELLOW COLOURED CELLS in the "BUSI-1003 Midterm 2022" file. Please do not add additional columns. b) Prepare a Balance Sheet at Dec 31 2021 and Income Statement for the year ending Dec 31 2021 E N Midterm Exam Winter 2022 Duestion 1 Assets Shareholder Equity and income statement is ACE Account Doll Pepad Merchandise Acco About Med Payable Depression Accrue Detened LOM Pere Part OR CR 25.000 529 20.000 Common OR 5 000 Aloha we DA 2009 CA 200 DR 5000 DA Retained Earnings CB CR 28.000 11040 Cost of Reverse Good Sold Expenses Dividende CR CA OR DA 51170 12.000 3.000 d 1 9