Question

It's December 30th, 2007 and you are an analyst from a famous investment bank returning home after a long day's work. When you arrive at

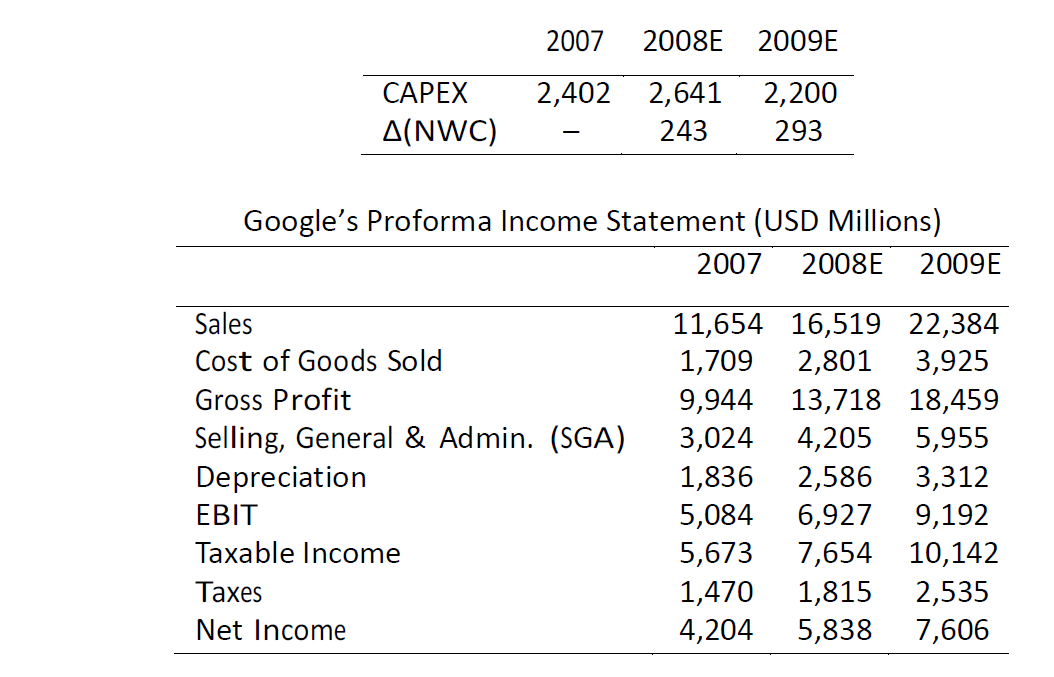

It's December 30th, 2007 and you are an analyst from a famous investment bank returning home after a long day's work. When you arrive at your house you find a spaceship parked on your lawn and Chewbacca waiting for you with a business proposal: news has reached even his planet that this funny-named company, Google Inc., is taking over the Earth. Chewbacca wants your opinion on whether he should invest in it or not. After defeating the Empire he has become a successful business manager and owner of an intergalactic conglomerate of several companies. Following the initial shock of meeting Chewbacca in person, you negotiate a handsome fee (and some pics of you and him to show around) and get down to work. You promise Chewbacca a valuation based on proforma estimates for 2008 and 2009. Assume a tax rate of 35%, a market risk premium of 5%, and a risk free rate of 3.96%. Google's current share price is $581.29 and it has 317.93 million shares outstanding, with a total market capitalization worth $184.81Bi. The firm's equity beta is 1.27. Analysing Google's balance sheet you find that it currently has no debt outstanding. You've also computed the following data for CAPEX and changes in NWC:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started