Answered step by step

Verified Expert Solution

Question

1 Approved Answer

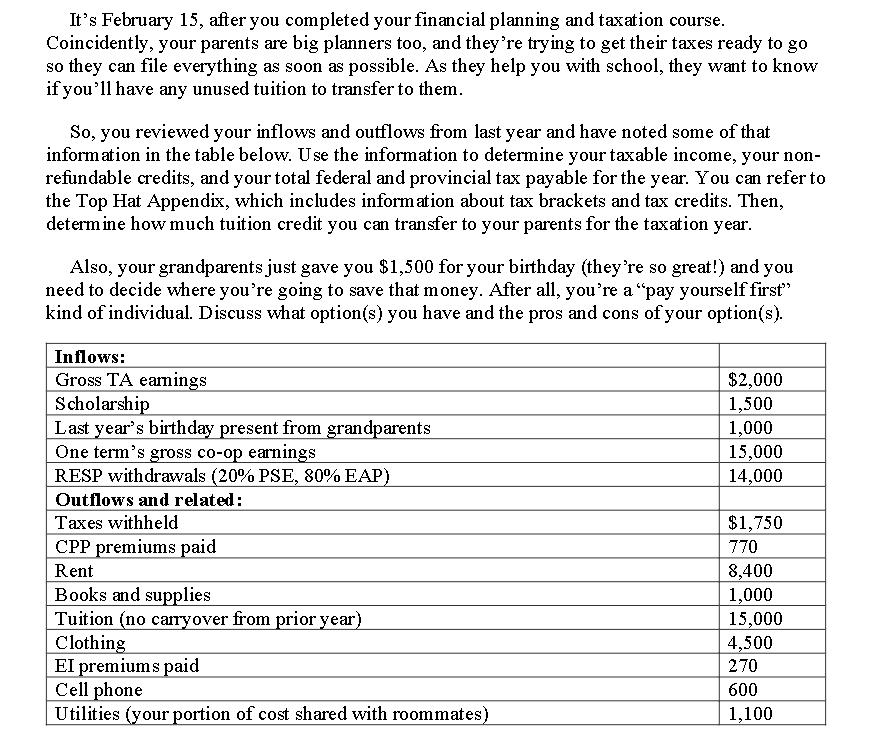

It's February 15, after you completed your financial planning and taxation course. Coincidently, your parents are big planners too, and they're trying to get

It's February 15, after you completed your financial planning and taxation course. Coincidently, your parents are big planners too, and they're trying to get their taxes ready to go so they can file everything as soon as possible. As they help you with school, they want to know if you'll have any unused tuition to transfer to them. So, you reviewed your inflows and outflows from last year and have noted some of that information in the table below. Use the information to determine your taxable income, your non- refundable credits, and your total federal and provincial tax payable for the year. You can refer to the Top Hat Appendix, which includes information about tax brackets and tax credits. Then, determine how much tuition credit you can transfer to your parents for the taxation year. Also, your grandparents just gave you $1,500 for your birthday (they're so great!) and you need to decide where you're going to save that money. After all, you're a "pay yourself first" kind of individual. Discuss what option(s) you have and the pros and cons of your option(s). Inflows: Gross TA eamings Scholarship Last year's birthday present from grandparents One term's gross co-op earnings RESP withdrawals (20% PSE, 80% EAP) Outflows and related: Taxes withheld CPP premiums paid Rent Books and supplies Tuition (no carryover from prior year) Clothing EI premiums paid Cell phone Utilities (your portion of cost shared with roommates) $2,000 1,500 1,000 15,000 14,000 $1,750 770 8,400 1,000 15,000 4,500 270 600 1,100

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine your taxable income we need to subtract your deductions from your gross income From the inflows table we can see that you had 2000 in gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started