its five years from now for part A

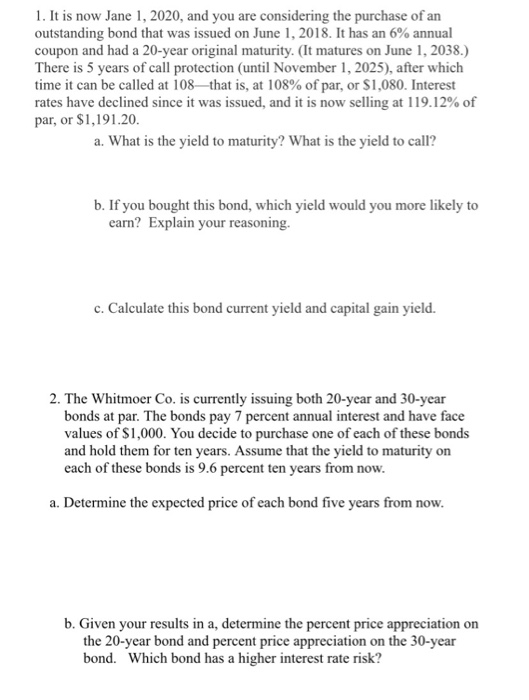

1. It is now Jane 1, 2020, and you are considering the purchase of an outstanding bond that was issued on June 1, 2018. It has an 6% annual coupon and had a 20-year original maturity. (It matures on June 1, 2038.) There is 5 years of call protection (until November 1, 2025), after which time it can be called at 108that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 119.12% of par, or $1,191.20. a. What is the yield to maturity? What is the yield to call? b. If you bought this bond, which yield would you more likely to earn? Explain your reasoning. c. Calculate this bond current yield and capital gain yield. 2. The Whitmoer Co. is currently issuing both 20-year and 30-year bonds at par. The bonds pay 7 percent annual interest and have face values of $1,000. You decide to purchase one of each of these bonds and hold them for ten years. Assume that the yield to maturity on each of these bonds is 9.6 percent ten years from now. a. Determine the expected price of each bond five years from now. b. Given your results in a, determine the percent price appreciation on the 20-year bond and percent price appreciation on the 30-year bond. Which bond has a higher interest rate risk? 1. It is now Jane 1, 2020, and you are considering the purchase of an outstanding bond that was issued on June 1, 2018. It has an 6% annual coupon and had a 20-year original maturity. (It matures on June 1, 2038.) There is 5 years of call protection (until November 1, 2025), after which time it can be called at 108that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 119.12% of par, or $1,191.20. a. What is the yield to maturity? What is the yield to call? b. If you bought this bond, which yield would you more likely to earn? Explain your reasoning. c. Calculate this bond current yield and capital gain yield. 2. The Whitmoer Co. is currently issuing both 20-year and 30-year bonds at par. The bonds pay 7 percent annual interest and have face values of $1,000. You decide to purchase one of each of these bonds and hold them for ten years. Assume that the yield to maturity on each of these bonds is 9.6 percent ten years from now. a. Determine the expected price of each bond five years from now. b. Given your results in a, determine the percent price appreciation on the 20-year bond and percent price appreciation on the 30-year bond. Which bond has a higher interest rate risk