Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It's May, the S&P/ASX 200 index is trading at 7,050. The dividend yield on the index is 2% p.a. and the volatility is 16%

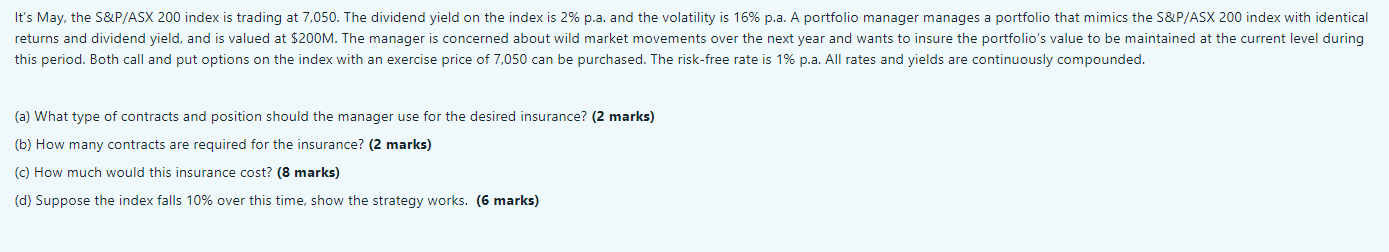

It's May, the S&P/ASX 200 index is trading at 7,050. The dividend yield on the index is 2% p.a. and the volatility is 16% p.a. A portfolio manager manages a portfolio that mimics the S&P/ASX 200 index with identical returns and dividend yield, and is valued at $200M. The manager is concerned about wild market movements over the next year and wants to insure the portfolio's value to be maintained at the current level during this period. Both call and put options on the index with an exercise price of 7,050 can be purchased. The risk-free rate is 1% p.a. All rates and yields are continuously compounded. (a) What type of contracts and position should the manager use for the desired insurance? (2 marks) (b) How many contracts are required for the insurance? (2 marks) (c) How much would this insurance cost? (8 marks) (d) Suppose the index falls 10% over this time, show the strategy works. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started