It's one question : i added the text and the tables ( you may have no need to use the tables )

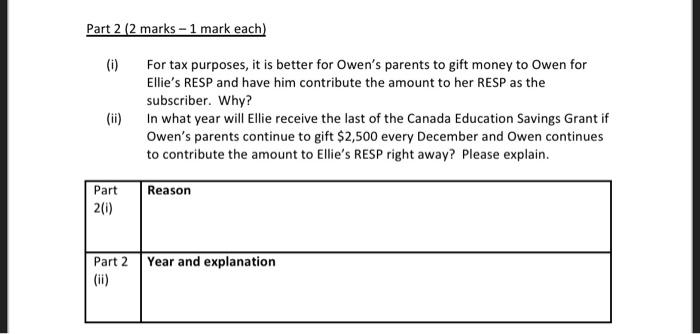

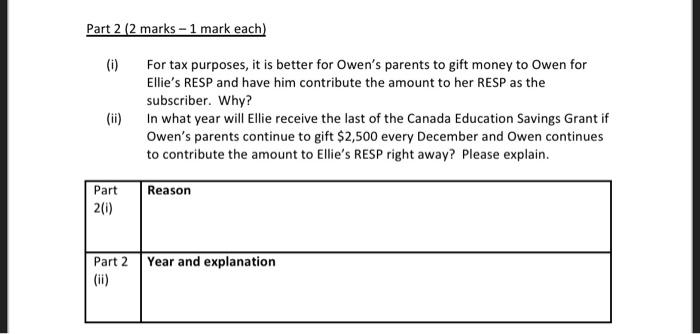

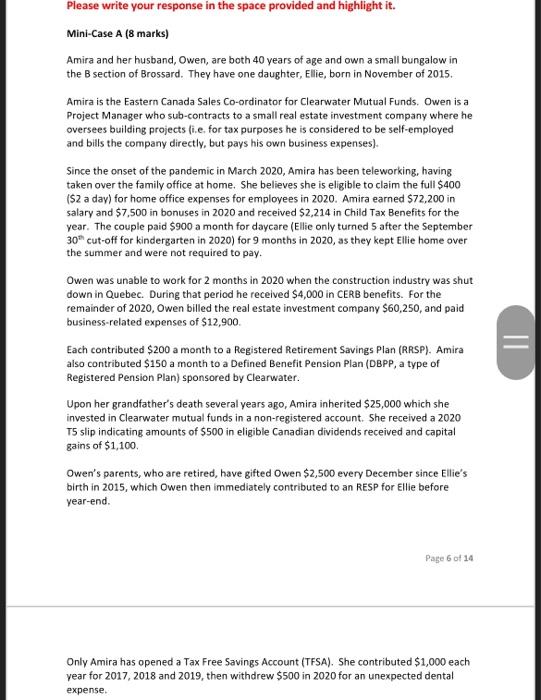

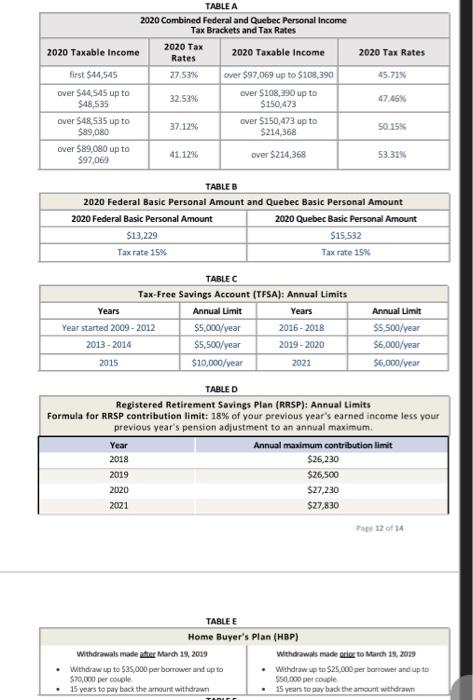

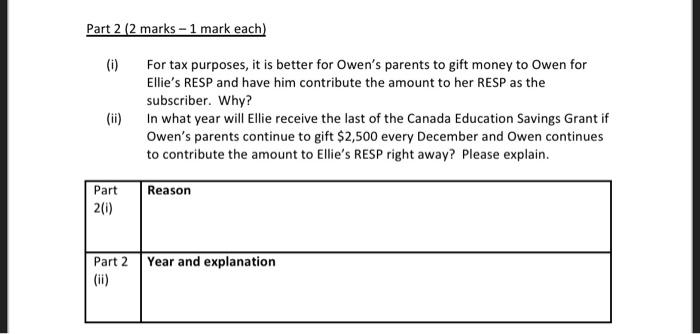

Part 2 (2 marks - 1 mark each) () For tax purposes, it is better for Owen's parents to gift money to Owen for Ellie's RESP and have him contribute the amount to her RESP as the subscriber. Why? In what year will Ellie receive the last of the Canada Education Savings Grant if Owen's parents continue to gift $2,500 every December and Owen continues to contribute the amount to Ellie's RESP right away? Please explain. Reason Part 201) Part 2 Year and explanation Please write your response in the space provided and highlight it. Mini-Case A (8 marks) Amira and her husband, Owen, are both 40 years of age and own a small bungalow in the B section of Brossard. They have one daughter, Ellie, born in November of 2015. Amira is the Eastern Canada Sales Co-ordinator for Clearwater Mutual Funds. Owen is a Project Manager who sub-contracts to a small real estate investment company where he oversees building projects (ie for tax purposes he is considered to be self-employed and bills the company directly, but pays his own business expenses). Since the onset of the pandemic in March 2020, Amira has been teleworking, having taken over the family office at home. She believes she is eligible to claim the full $400 ($2 a day) for home office expenses for employees in 2020. Amira earned $72,200 in salary and $7,500 in bonuses in 2020 and received $2,214 in Child Tax Benefits for the year. The couple paid $900 a month for daycare (Ellie only turned 5 after the September 30 cut-off for kindergarten in 2020) for 9 months in 2020, as they kept Ellie home over the summer and were not required to pay. Owen was unable to work for 2 months in 2020 when the construction industry was shut down in Quebec. During that period he received $4,000 in CERB benefits. For the remainder of 2020, Owen billed the real estate investment company $60,250, and paid business-related expenses of $12,900 = Each contributed $200 a month to a Registered Retirement Savings Plan (RRSP). Amira also contributed $150 a month to a Defined Benefit Pension Plan (DBPP, a type of Registered Pension Plan) sponsored by Clearwater. Upon her grandfather's death several years ago, Amira inherited $25,000 which she invested in Clearwater mutual funds in a non-registered account. She received a 2020 T5 slip indicating amounts of $500 in eligible Canadian dividends received and capital gains of $1,100 Owen's parents, who are retired, have gifted Owen $2,500 every December since Ellie's birth in 2015, which Owen then immediately contributed to an RESP for Ellie before year-end. Page 6 of 14 Only Amira has opened a Tax Free Savings Account (TFSA). She contributed $1,000 each year for 2017, 2018 and 2019, then withdrew $500 in 2020 for an unexpected dental expense. TABLEA 2020 Combined Federal and Quebec Personal Income Tax Brackets and Tax Rates 2020 Tax 2020 Taxable income 2020 Taxable income 2020 Tax Rates Rates first $44,545 27.53% over $97,069 up to $108,390 45.71% over $44.545 up to $48,535 32.5396 over $108,390 up to $150,473 47.46% over $48,535 up to $89,080 37.1296 over $150,473 up to $214,368 50.15% over 589,080 up to $97,069 41.1296 over $214,368 53.31% TABLE B 2020 Federal Basic Personal Amount and Quebec Basic Personal Amount 2020 Federal Basic Personal Amount 2020 Quebec Basic Personal Amount $13,229 $15,532 Tax rate 15% Tax rate 15% TABLEC Tax-Free Savings Account (TFSA): Annual Limits Years Annual Limit Years Annual Limit Year started 2009-2012 $5,000/year 2016-2018 $5,500/year 2013-2014 $5,500/year 2019-2020 $6,000/year 2015 $10,000/year 2021 $6.000/year TABLED Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum Year Annual maximum contribution limit 2018 2019 $26,230 $26,500 $27,230 $27,830 2020 2021 Page 12 of 14 TABLE E Home Buyer's Plan (HBP) Withdrawals made after March 19, 2019 Withdrawals made ale to March 19, 2019 Withdraw up to $25,000 per borrower and up to $70,000 per couple 15 years to pay back the amount withdrawn Withdraw up to $25.000 per borrower and up to $50,000 per couple 15 years to pay back the amount withdrawn TIDI Part 2 (2 marks - 1 mark each) () For tax purposes, it is better for Owen's parents to gift money to Owen for Ellie's RESP and have him contribute the amount to her RESP as the subscriber. Why? In what year will Ellie receive the last of the Canada Education Savings Grant if Owen's parents continue to gift $2,500 every December and Owen continues to contribute the amount to Ellie's RESP right away? Please explain. Reason Part 201) Part 2 Year and explanation Please write your response in the space provided and highlight it. Mini-Case A (8 marks) Amira and her husband, Owen, are both 40 years of age and own a small bungalow in the B section of Brossard. They have one daughter, Ellie, born in November of 2015. Amira is the Eastern Canada Sales Co-ordinator for Clearwater Mutual Funds. Owen is a Project Manager who sub-contracts to a small real estate investment company where he oversees building projects (ie for tax purposes he is considered to be self-employed and bills the company directly, but pays his own business expenses). Since the onset of the pandemic in March 2020, Amira has been teleworking, having taken over the family office at home. She believes she is eligible to claim the full $400 ($2 a day) for home office expenses for employees in 2020. Amira earned $72,200 in salary and $7,500 in bonuses in 2020 and received $2,214 in Child Tax Benefits for the year. The couple paid $900 a month for daycare (Ellie only turned 5 after the September 30 cut-off for kindergarten in 2020) for 9 months in 2020, as they kept Ellie home over the summer and were not required to pay. Owen was unable to work for 2 months in 2020 when the construction industry was shut down in Quebec. During that period he received $4,000 in CERB benefits. For the remainder of 2020, Owen billed the real estate investment company $60,250, and paid business-related expenses of $12,900 = Each contributed $200 a month to a Registered Retirement Savings Plan (RRSP). Amira also contributed $150 a month to a Defined Benefit Pension Plan (DBPP, a type of Registered Pension Plan) sponsored by Clearwater. Upon her grandfather's death several years ago, Amira inherited $25,000 which she invested in Clearwater mutual funds in a non-registered account. She received a 2020 T5 slip indicating amounts of $500 in eligible Canadian dividends received and capital gains of $1,100 Owen's parents, who are retired, have gifted Owen $2,500 every December since Ellie's birth in 2015, which Owen then immediately contributed to an RESP for Ellie before year-end. Page 6 of 14 Only Amira has opened a Tax Free Savings Account (TFSA). She contributed $1,000 each year for 2017, 2018 and 2019, then withdrew $500 in 2020 for an unexpected dental expense. TABLEA 2020 Combined Federal and Quebec Personal Income Tax Brackets and Tax Rates 2020 Tax 2020 Taxable income 2020 Taxable income 2020 Tax Rates Rates first $44,545 27.53% over $97,069 up to $108,390 45.71% over $44.545 up to $48,535 32.5396 over $108,390 up to $150,473 47.46% over $48,535 up to $89,080 37.1296 over $150,473 up to $214,368 50.15% over 589,080 up to $97,069 41.1296 over $214,368 53.31% TABLE B 2020 Federal Basic Personal Amount and Quebec Basic Personal Amount 2020 Federal Basic Personal Amount 2020 Quebec Basic Personal Amount $13,229 $15,532 Tax rate 15% Tax rate 15% TABLEC Tax-Free Savings Account (TFSA): Annual Limits Years Annual Limit Years Annual Limit Year started 2009-2012 $5,000/year 2016-2018 $5,500/year 2013-2014 $5,500/year 2019-2020 $6,000/year 2015 $10,000/year 2021 $6.000/year TABLED Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned income less your previous year's pension adjustment to an annual maximum Year Annual maximum contribution limit 2018 2019 $26,230 $26,500 $27,230 $27,830 2020 2021 Page 12 of 14 TABLE E Home Buyer's Plan (HBP) Withdrawals made after March 19, 2019 Withdrawals made ale to March 19, 2019 Withdraw up to $25,000 per borrower and up to $70,000 per couple 15 years to pay back the amount withdrawn Withdraw up to $25.000 per borrower and up to $50,000 per couple 15 years to pay back the amount withdrawn TIDI