Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ITS ONE QUESTION JUST DIVIDED INTO 3 PARTS I ANSWERED PART A BUT NEED HELP WITH B AND C! THANK YOU!! FN4320 CHAPTER 6 10/5/2020

ITS ONE QUESTION JUST DIVIDED INTO 3 PARTS I ANSWERED PART "A" BUT NEED HELP WITH "B" AND "C"! THANK YOU!!

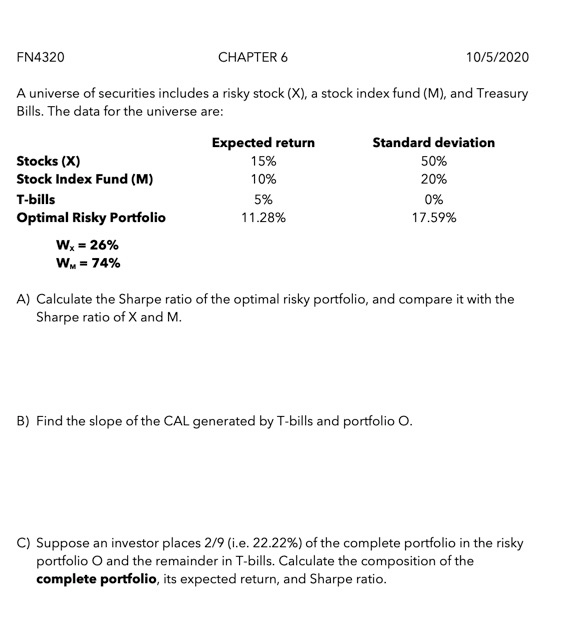

FN4320 CHAPTER 6 10/5/2020 A universe of securities includes a risky stock (X), a stock index fund (M), and Treasury Bills. The data for the universe are: Expected return Standard deviation Stocks (X) 15% 50% Stock Index Fund (M) 10% 20% T-bills 5% 0% Optimal Risky Portfolio 11.28% 17.59% W - 26% W = 74% A) Calculate the Sharpe ratio of the optimal risky portfolio, and compare it with the Sharpe ratio of X and M. B) Find the slope of the CAL generated by T-bills and portfolio O. C) Suppose an investor places 2/9 (i.e. 22.22%) of the complete portfolio in the risky portfolio O and the remainder in T-bills. Calculate the composition of the complete portfolio, its expected return, and Sharpe ratio. FN4320 CHAPTER 6 10/5/2020 A universe of securities includes a risky stock (X), a stock index fund (M), and Treasury Bills. The data for the universe are: Expected return Standard deviation Stocks (X) 15% 50% Stock Index Fund (M) 10% 20% T-bills 5% 0% Optimal Risky Portfolio 11.28% 17.59% W - 26% W = 74% A) Calculate the Sharpe ratio of the optimal risky portfolio, and compare it with the Sharpe ratio of X and M. B) Find the slope of the CAL generated by T-bills and portfolio O. C) Suppose an investor places 2/9 (i.e. 22.22%) of the complete portfolio in the risky portfolio O and the remainder in T-bills. Calculate the composition of the complete portfolio, its expected return, and Sharpe ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started