Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its the same question with 3 requirments please solve it quickly its there 1. Khalid Company would like to compare its days' sales in receivables

its the same question with 3 requirments

please solve it quickly

its there

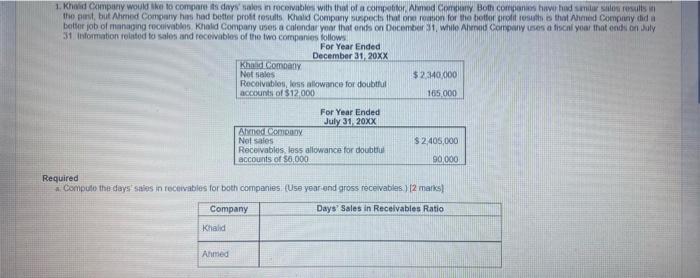

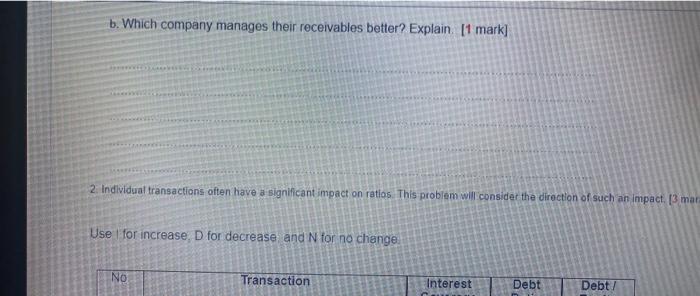

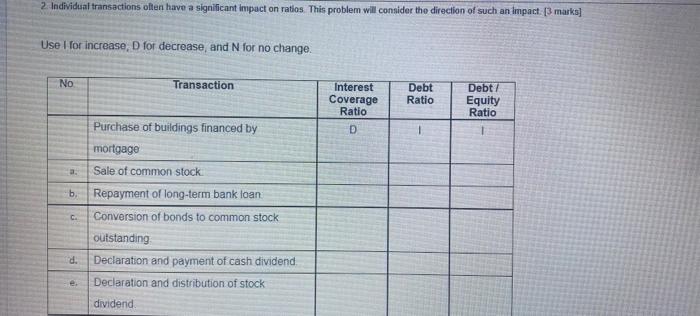

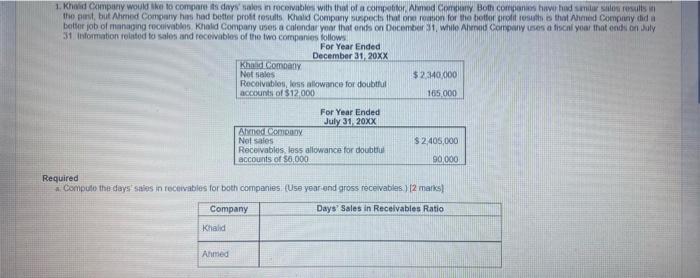

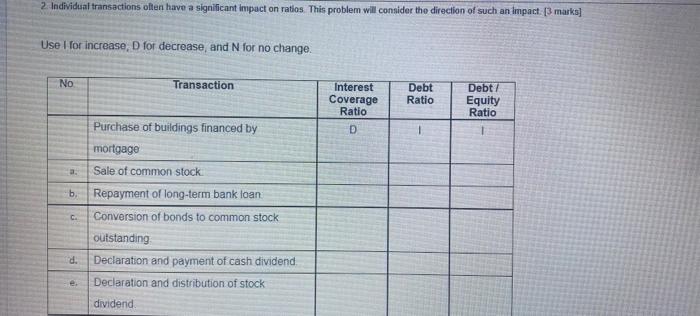

1. Khalid Company would like to compare its days' sales in receivables with that of a competitor, Ahmed Company. Both companies have had sanitar salos results in the past, but Ahmed Company has had better profit results, Khalid Company suspects that one reason for the botter profit results is that Ahmed Company did a botter job of managing receivables, Khalid Company uses a calendar year that ends on December 31, while Ahmed Company uses a fiscal year that ends on July 31 Information related to sales and receivables of the two companies follows For Year Ended December 31, 20XX Khaid Company Net sales Receivables, less allowance for doubtful accounts of $12,000 $2,340,000 165,000 For Year Ended July 31, 20XX Ahmed Company Net sales $2,405,000 Receivables, less allowance for doubtful accounts of $6,000 90,000 Required Compute the days sales in receivables for both companies. (Use year-end gross receivables.) [2 marks] Company Days' Sales in Receivables Ratio Khalid Ahmed b. Which company manages their receivables better? Explain. [1 mark] 2. Individual transactions often have a significant impact on ratios. This problem will consider the direction of such an impact. [3 mara Use for increase, D for decrease and N for no change. No Transaction Interest Debt Debt/ 2. Individual transactions often have a significant impact on ratios. This problem will consider the direction of such an impact [3 marks] Use I for increase, D for decrease, and N for no change. No Transaction Interest Coverage Ratio Debt Ratio Debt/ Equity Ratio Purchase of buildings financed by D 1 mortgage Sale of common stock. Repayment of long-term bank loan Conversion of bonds to common stock outstanding Declaration and payment of cash dividend Declaration and distribution of stock dividend a. b. C d. e Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started