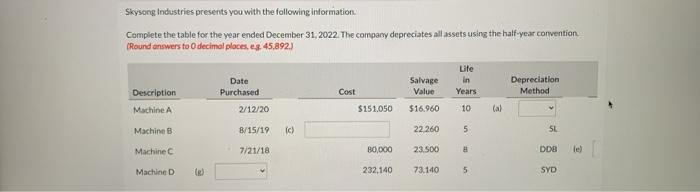

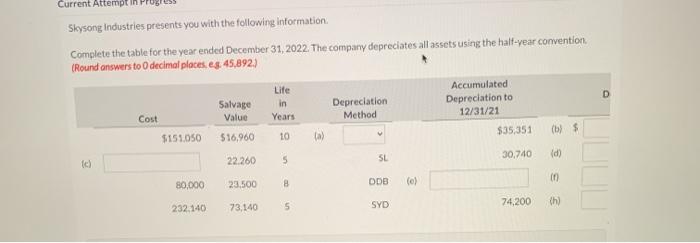

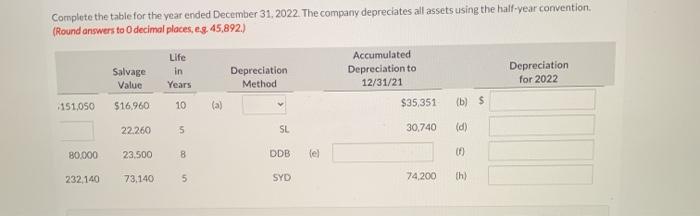

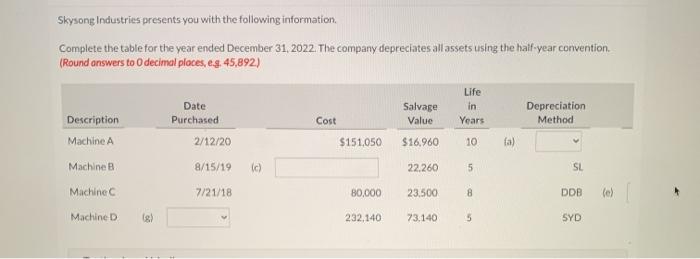

its the table is too long to fix in one picture

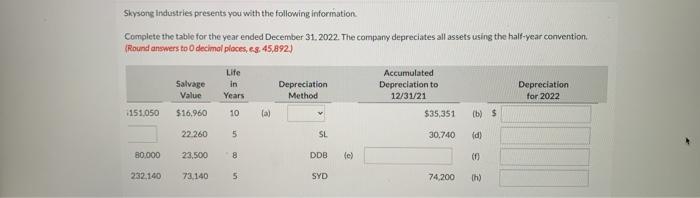

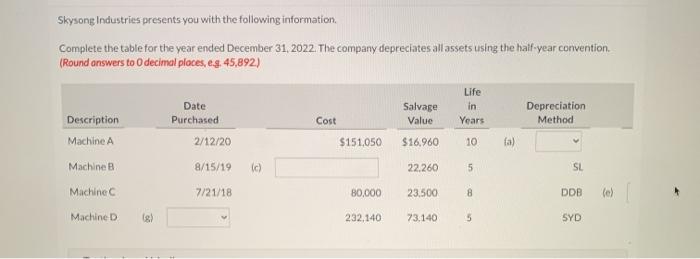

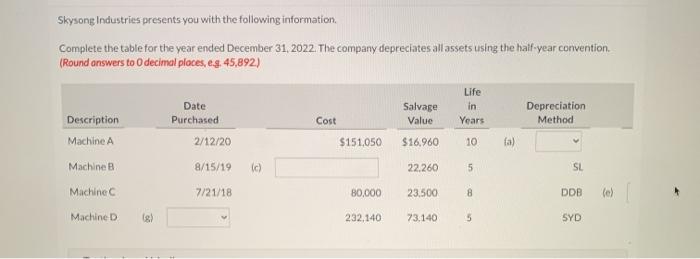

Skysong Industries presents you with the following information. Complete the table for the year ended December 31, 2022. The company depreciates all assets using the half-year convention (Round answers to decimal places, es 45,892.) Life Date Purchased Salvage Value Depreciation Method Cost Description Machine A Years 10 2/12/20 $151.050 $16.960 Machine B B/15/19 (c) 22260 5 SL 7/21/18 80,000 Machine 23.500 DDB el Machine D 232,140 73.140 5 SYD Skysong Industries presents you with the following information Complete the table for the year ended December 31, 2022. The company depreciates all assets using the half-year convention Round answers to decimal places, s. 45,892) Lite Salvage in Accumulated Depreciation to 12/31/21 Depreciation Method Value Years Depreciation for 2022 1151.050 $16.960 10 (a) $35,351 (b) $ 22.260 5 SL 30.740 Id 80.000 23.500 8 DDB le) 232.140 73,140 5 SYD 74,200 th) Skysong Industries presents you with the following information Complete the table for the year ended December 31, 2022. The company depreciates all assets using the half-year convention (Round answers to decimal places, eg. 45,892) Date Purchased 2/12/20 Salvage Value Life in Years Depreciation Method Description Machine A Machine B Cost $151.050 $16.960 10 fa) 8/15/19 c) 22,260 5 SL Machine 7/21/18 80,000 23.500 8 DDB Machine D is! 232,140 73.140 5 SYD Current Attempt Skysong industries presents you with the following information. Complete the table for the year ended December 31, 2022. The company depreciates all assets using the half-year convention (Round answers to decimal places, eg. 45,892) D Salvage Value Life in Years Accumulated Depreciation to 12/31/21 Depreciation Method Cost $35,351 (b) $ $151.050 $16,960 10 a) 30,740 (d) SL 5 te) 22.260 in 23,500 DDB B 80,000 232.140 73,140 th) 5 SYD 74.200 Complete the table for the year ended December 31, 2022. The company depreciates all assets using the half-year convention. (Round answers to decimal places, e... 45,892.) Salvage Life in Years Depreciation Method Accumulated Depreciation to 12/31/21 Depreciation for 2022 Value 151.050 $16.960 10 (a) $35,351 (b) $ 22.260 5 SL 30,740 (d) 80.000 23.500 8 DDB lel 232140 73,140 5 SYD 74.200 th)