Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It's time to buy a house! Pick a home value and assume that you have 20% of that value to use for a down

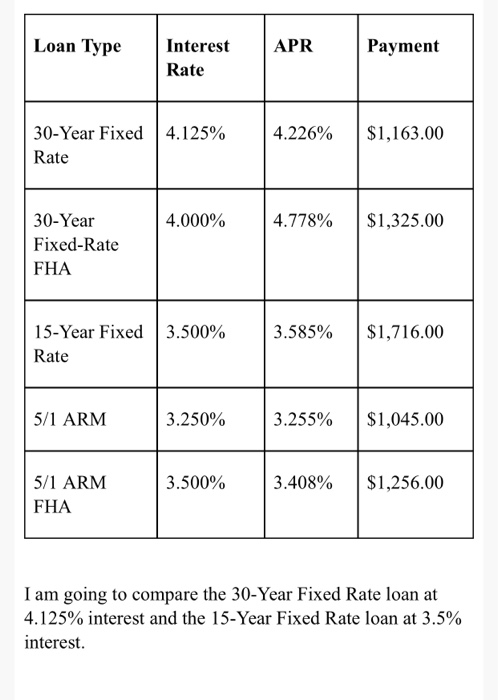

It's time to buy a house! Pick a home value and assume that you have 20% of that value to use for a down payment. Investigate and find two mortgage options. Limit your choices to Fixed Rate loans. Post a screenshot and the source for your loan options. Based on the information you find, assuming you only are responsible for the monthly payment, how much would you pay in total for your home? Which mortgage option would you chose, and why? What are some pros and cons of each options? For example, I wish to purchase a $300,000 home and have a $60,000 down payment. I decided to explore Wells Fargo to see what mortgage options they offer. I found the following: $240,000 for a loan in Union County, NJ Loan Type Interest Rate 30-Year Fixed 4.125% Rate 30-Year Fixed-Rate FHA 15-Year Fixed 3.500% Rate 5/1 ARM 4.000% 5/1 ARM FHA 3.250% 3.500% APR Payment 4.226% $1,163.00 4.778% $1,325.00 3.585% $1,716.00 3.255% $1,045.00 3.408% $1,256.00 I am going to compare the 30-Year Fixed Rate loan at 4.125% interest and the 15-Year Fixed Rate loan at 3.5% interest.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Monthly amount paid for 30 Year loan 116316 Total p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started