Its time to get a new laptop. The laptop is $2500. You decide to put money aside for it each month for one year. If you put the money in an account that earns 5%, how much will you have to save each month?

(this is question 3)please show the step and state what formula you use from the formula sheet.

question 4 )Instead of saving up, you decide to finance the laptop. What will your monthly payments be if you finance $2500 at 7% for 3 years?

(only answer this )

What are the acquisition costs for questions 3 and 4? In other words, how much out of pocket will you pay to pay for the laptop?

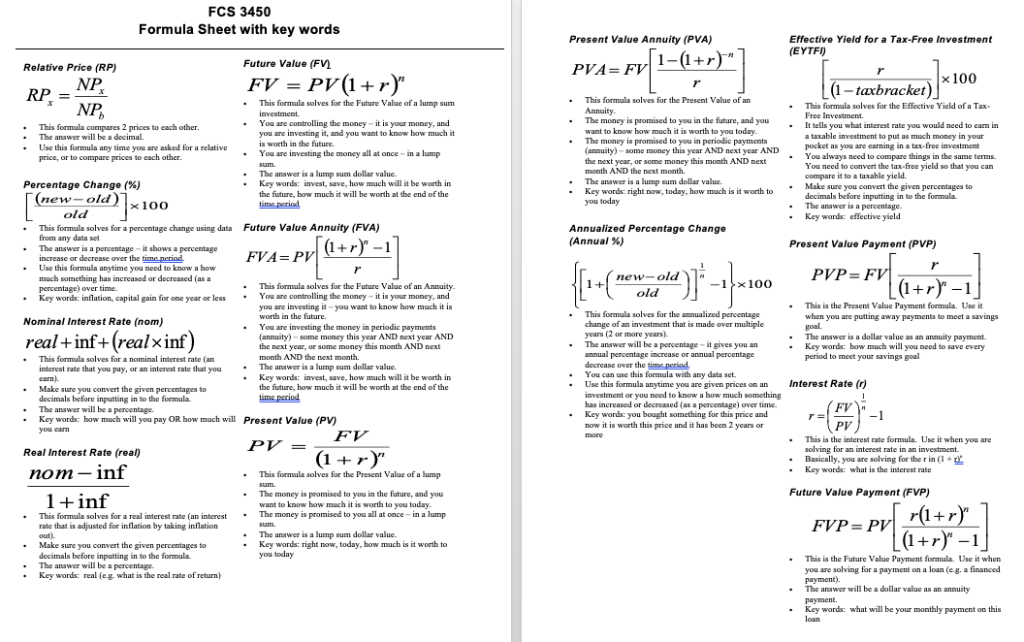

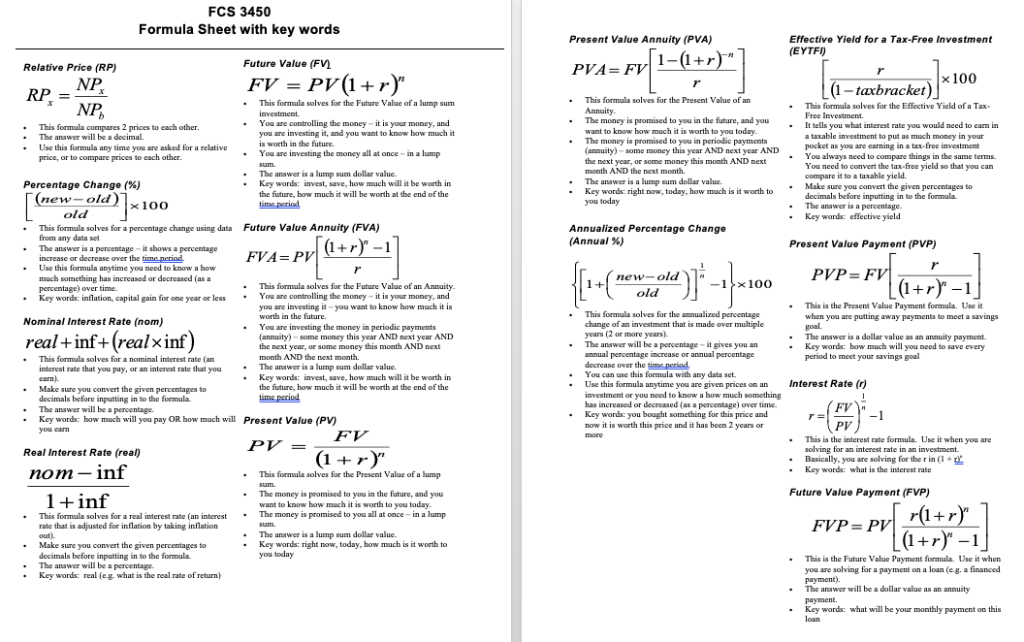

FCS 3450 Formula Sheet with key words Relative Price (RP) Future Value (FV v1=(+) *"] NP, NP FV = PV(1+r)" } . Present Value Annuity (PVA) Effective Yield for a Tax-Free Investment (EYTFI) 1-(1+r) PVA=FV r x 100 r taxbracket) This formula solves for the Present Value of an This formula solves for the Effective Yield of a Tax Annuity Free Investment The money is promised to you in the future, and you want to know how much it is worth to you today . It tells you what interest rate you would need to cam in The money is promised to you in periodic payments a taxable investment to put as much money in your (annuity) - some money this year AND next year AND . You always need to compare things in the same terms. pocket as you are carning in a tax-free investment the next year, or some money this month AND next You need to convert the tax free yield so that you can month AND the next month. compare it to a taxable yield The answer is a lump sum dollar value . Key words: right now, today, how much is it worth to . Make sure you convert the given percentages to you today decimals before inputting in to the formula The answer is a percentage. Key words: effective yield Annualized Percentage Change (Annual %) Present Value Payment (PVP) r new-old PVP=FV 1+ - 1x100 old This is the Present Value Payment formula. Usein This formula solves for the annualized percentage when you are putting away payments to meet a savings change of an investment that is made over multiple goal years (2 or more years) The answer is a dollar value as an annuity payment. The answer will be a percentage - it gives you an Key words: how much will you need to save every annual percentage increase or annual percentage period to meet your savings goal decrease over the time period You can use this formula with any data set . Use this formula anytime you are given prices on an Interest Rate (1) investment or you need to know a how much something 1 has increased or decreased as a percentage) over time. FV Key words: you bought something for this price and now it is worth this price and it has been 2 years or 2 PV) more This is the interest rate formule. Use it when you are solving for an interest rate in an investment. Basically, you are solving for the rin (1+ . Key words: what is the interest rate . -))-- = RP This formula solves for the Future Value of a lump sum investment This formula compares 2 prices to each other. You are controlling the money - it is your money, and The answer will be a decimal you are investing it, and you want to know how much it Use this formula any time you are asked for a relative is worth in the future. price, or to compare prices to each other You are investing the money all at once in a lump sum The answer is a lump sum dollar value Percentage Change (%) Key words: invest, save, how much will it be worth in (new-old)] the future, how much it will be worth at the end of the x 100 time period old This formula solves for a percentage change using data Future Value Annuity (FVA) from any data set The answer is a percentage - it shows a percentage (1+r)" - 1 increase or decrease over the time period FVA=PV Use this formula anytime you need to know a how much something has increased or decreased as a percentage) over time. This formula solves for the Future Value of an Annuity . Key words: inflation, capital gain for one year or less You are controlling the money - it is your money, and you are investing it-you want to know how much it is Nominal Interest Rate (nom) worth in the future. You are investing the money in periodic payments (annuity) - some money this year AND next year AND the next year, or some money this month AND next This formula solves for a nominal interest rate an month AND the next month. interest rate that you pay, or an interest rate that you The answer is a lump sum dollar value carn) Key words: invest, wave, how much will it be worth in Make sure you convert the given percentages to the future, how much it will be worth at the end of the decimals before inputting in to the formula. time period The answer will be a percentage . Key words: how much will you pay OR how much will Present Value (PV) you can FV Real Interest Rate (real) PV = = (1 + r)" nom-inf This formula solves for the Present Value of a lump suam 1+inf The money is promised to you in the future, and you want to know how much it is worth to you today . This formula solves for a real interest rate (an interest The money is promised to you all at once in a lump rate that is adjusted for inflation by taking inflation sum out). The answer is a lump sum dollar value. Make sure you convert the given percentages to Key words: right now, today, how much is it worth to decimals before inputting in to the formula. you today The answer will be a percentage Key words: real (eg. what is the real rate of return) (1+r)" - 1 real+inf+(real x inf) . Future Value Payment (FVP) FVP= PV (1+r)" - 1 pv[ r(1+r)" . This is the Future Value Payment formula. Use it when you are solving for a payment on a loan (eg, a financed payment). The answer will be a dollar value as an annuity payment Key words: what will be your monthly payment on this loan