Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its urgent guys! due in 30 minutes QUESTION 1 The imate goal of the capital budgeting process is to determine how the consequences of making

its urgent guys! due in 30 minutes

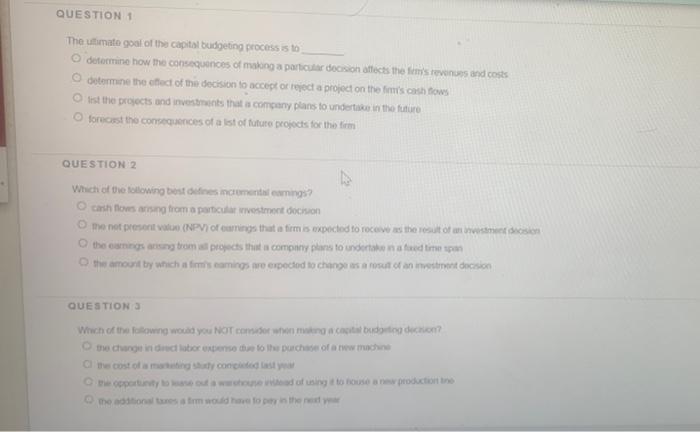

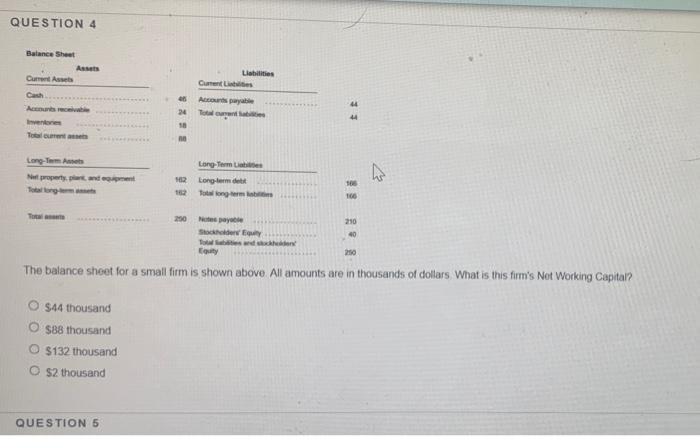

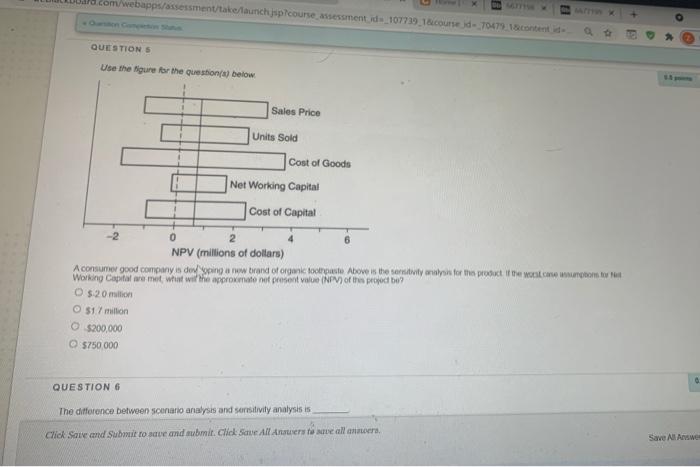

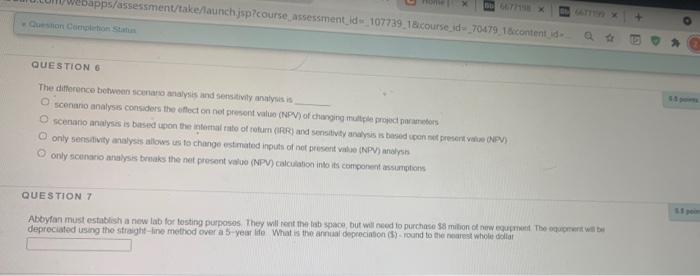

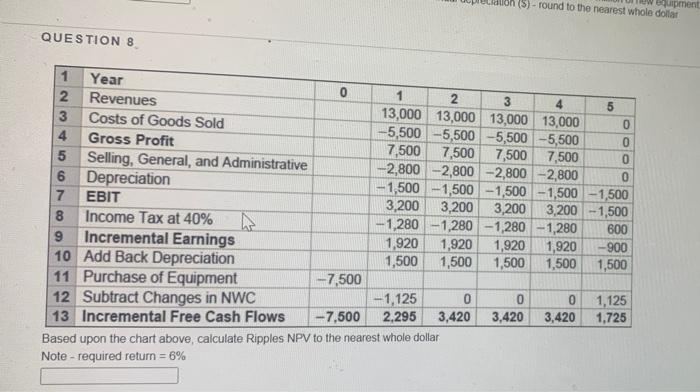

QUESTION 1 The imate goal of the capital budgeting process is to determine how the consequences of making a particular decision afects the fem revenues and costs determine the ctect of the decision to accept or reject a project on the schows list the projects and investments that is company plans to undertake in the future forest the consequences of a list of future projects for the fem QUESTION 2 Which of the following best is incremental coming cash flow ng from a particular vivestment on me not presentato (NPV/of curing that timis expected to receives the rest of us decision the ans ansingtrom projects this company plans to undertaken a feed time the amount by which aims caminos are expected to change is a set of an intent decision QUESTIONS Wouch of the following woad you NOT com.down king cabuda tooden? the change in die hoor extenso to the purchase of two ruchu the cost of my con las Oportunity to wwwad of goose production O motores mode to the rest QUESTION 4 Balance Sheet Assets Current Aw Liabilities Current Ato pay Town 60 24 Et 18 Long-Time Long-Term Les 100 Long-term Tolong terms 106 250 espace 210 40 Story dhaitars Equity 250 The balance sheet for a small firm is shown above All amounts are in thousands of dollars What is this firm's Not Working Capital? $44 thousand 888 thousand O $132 thousand O $2 thousand QUESTION 5 Zom/webapps/assessmentakelaunch spicourse assessment de 107739 1&course - 70479 18 content + QUESTIONS Use the figure for the question(s) below Sales Price Units Sold Cost of Goods Net Working Capital Cost of Capital 0 NPV (millions of dollars) A consumer good companys de cing a new brand of organic compute Above is the sensitivity analysis for the product if the store on Working Capital met what will the approximate not presentato (NPV) of this produ? O $20 million O 517 million O $200.000 5750 000 QUESTION 6 The difference between scenario analysis and sensitivity analysis is Click Save and Subout toate and submit. Click Save All Answers to move all anners, Save Awe Webapps/assessment/take/launch.jsp?course, assessment_id 107739 18.course id70479 1content QUESTIONS The difference between cenno analysis and sensitivity analysis scenano analysis consider the tecton not present value (NPV) of changing multiple proportos scenano analysis is based upon the internet our (RR) and sensity is is based uponerse NPV only sensitivity analysis allows us to change estimated inputs of net present al (NPV) only scenario analysis breaks the representato (NPV) calculation into its component assuntos QUESTION 7 Abbyfon must establish a new lab for testing purposes. They will on the tab space, but will need to purchase $8 milion of new equipment The depreciated using the straight-line method over a 5-year o What is the annual depreciation (3) round to the nearest whole dollar Equipment (5) - round to the nearest whole dollar QUESTION 8 5 OOO Year 2 Revenues 3 Costs of Goods Sold 4 Gross Profit 5 Selling, General, and Administrative 6 Depreciation 7 EBIT Income Tax at 40% 9 Incremental Earnings 10 Add Back Depreciation 11 Purchase of Equipment 12 Subtract Changes in NWC 13 Incremental Free Cash Flows 1 2 3 5 13,000 13,000 13,000 13,000 -5,500 -5,500 -5,500 -5,500 7,500 7,500 7,500 7,500 -2,800 -2,800 -2,800 -2,800 0 - 1,500 -1,500 -1,500 -1,500 -1,500 3,200 3,200 3,200 3,200 -1,500 -1,280 -1,280 -1,280 -1,280 600 1,920 1,920 1,920 1,920 -900 1,500 1,500 1,500 1,500 1,500 -7,500 -1,125 0 0 0 1,125 -7,500 2.295 3,420 3,420 3,420 1,725 Based upon the chart above, calculate Ripples NPV to the nearest whole dollar Note - required return = 6% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started