Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its yield to maturity declined by 1%, which of the following bonds would have the largest percentage nerease in value? a 10-year zero coupon bond

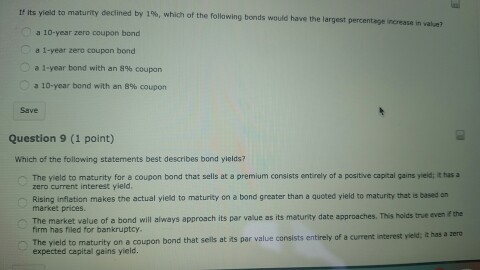

its yield to maturity declined by 1%, which of the following bonds would have the largest percentage nerease in value? a 10-year zero coupon bond a 1-year zero coupon bond a 1-year bond with an 8% coupon 0 a 10-year bond with an 8% coupon Save Question 9 (1 point) Which of the following statements best describes bond yields? The yield to maturity for a coupon bond that sells at a premium consists entirely af a positive capital gains yield; it has a zero current interest yield Rising inflation makes the actual yield to maturity on a bond greater than a market prices. The market value of a bond will always approach its par value as its maturity date approaches. This hoids true even f firm has filed for bankruptcy of a bd wil lays aproach its par value as its maturty date approaches. This hoids true even ne t sells at its par value consists entirely of a current interest vield, it has a zerc nThe yield to maturity on a coupon bond that sells at its par value consists entirely of a expected capital gains yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started