Answered step by step

Verified Expert Solution

Question

1 Approved Answer

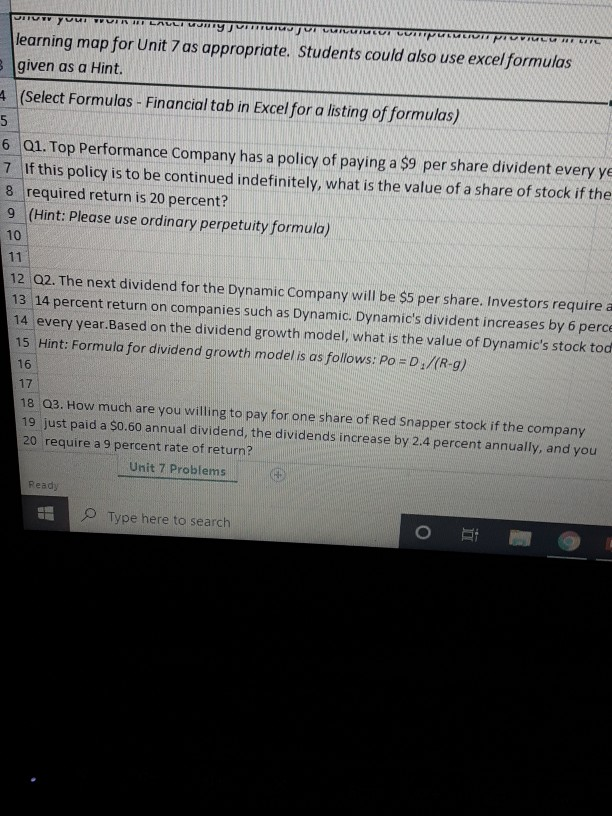

ITU. TRT LAULIUHTY J VEHTI Jearning map for Unit 7 as appropriate. Students could also use excel formulas given as a Hint (Select Formulas -

ITU. TRT LAULIUHTY J VEHTI Jearning map for Unit 7 as appropriate. Students could also use excel formulas given as a Hint (Select Formulas - Financial tab in Excel for a listing of formulas) 01. Top Performance Company has a policy of paying a $9 per share divident every ye If this policy is to be continued indefinitely, what is the value of a share of stock if the 3. required return is 20 percent? 9 (Hint: Please use ordinary perpetuity formula) 70 11 12 Q2. The next dividend for the Dynamic Company will be $5 per share. Investors require a 13 14 percent return on companies such as Dynamic. Dynamic's divident increases by 6 perc 14 every year.Based on the dividend growth model, what is the value of Dynamic's stock too 15 Hint: Formula for dividend growth model is as follows: Po#D./(R-g) 17 18 Q3. How much are you willing to pay for one share of Red Snapper stock if the company 19 just paid a $0.60 annual dividend, the dividends increase by 2.4 percent annually, and you 20 require a 9 percent rate of return? Unit 7 Problems Ready Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started