Answered step by step

Verified Expert Solution

Question

1 Approved Answer

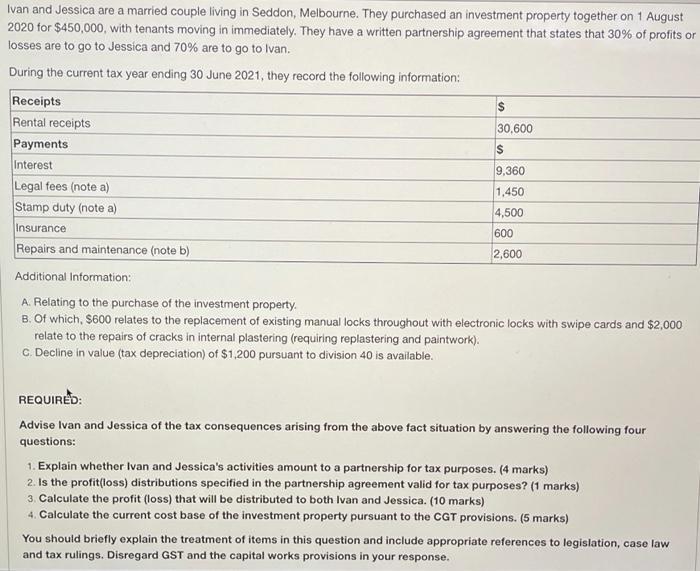

Ivan and Jessica are a married couple living in Seddon, Melbourne. They purchased an investment property together on 1 August 2020 for $450,000, with

Ivan and Jessica are a married couple living in Seddon, Melbourne. They purchased an investment property together on 1 August 2020 for $450,000, with tenants moving in immediately. They have a written partnership agreement that states that 30% of profits or losses are to go to Jessica and 70% are to go to Ivan. During the current tax year ending 30 June 2021, they record the following information: Receipts Rental receipts 30,600 Payments Interest 9,360 Legal fees (note a) Stamp duty (note a) 1,450 4,500 Insurance 600 Repairs and maintenance (note b) 2,600 Additional Information: A. Relating to the purchase of the investment property. B. Of which, $600 relates to the replacement of existing manual locks throughout with electronic locks with swipe cards and $2,000 relate to the repairs of cracks in internal plastering (requiring replastering and paintwork). C. Decline in value (tax depreciation) of $1,200 pursuant to division 40 is available. REQUIRED: Advise Ivan and Jessica of the tax consequences arising from the above fact situation by answering the following four questions: 1. Explain whether Ivan and Jessica's activities amount to a partnership for tax purposes. (4 marks) 2. Is the profit(loss) distributions specified in the partnership agreement valid for tax purposes? (1 marks) 3. Calculate the profit (loss) that will be distributed to both Ivan and Jessica. (10 marks) 4. Calculate the current cost base of the investment property pursuant to the CGT provisions. (5 marks) You should briefly explain the treatment of items in this question and include appropriate references to legislation, case law and tax rulings. Disregard GST and the capital works provisions in your response.

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A Partnership is not a taxable entity in Melbourne but it must lodge a tax return at the end of each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started