Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ivan is 37 years old and works for an IT company earning a monthly after-tax salary of $9,000. He plans to retire in exactly 28

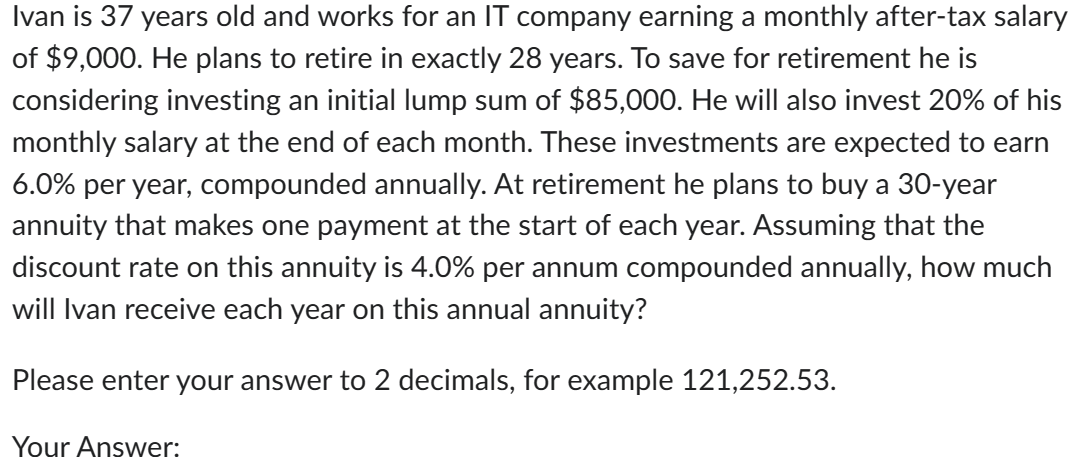

Ivan is 37 years old and works for an IT company earning a monthly after-tax salary of $9,000. He plans to retire in exactly 28 years. To save for retirement he is considering investing an initial lump sum of $85,000. He will also invest 20% of his monthly salary at the end of each month. These investments are expected to earn 6.0% per year, compounded annually. At retirement he plans to buy a 30-year annuity that makes one payment at the start of each year. Assuming that the discount rate on this annuity is 4.0% per annum compounded annually, how much will Ivan receive each year on this annual annuity? Please enter your answer to 2 decimals, for example 121,252.53

Ivan is 37 years old and works for an IT company earning a monthly after-tax salary of $9,000. He plans to retire in exactly 28 years. To save for retirement he is considering investing an initial lump sum of $85,000. He will also invest 20% of his monthly salary at the end of each month. These investments are expected to earn 6.0% per year, compounded annually. At retirement he plans to buy a 30-year annuity that makes one payment at the start of each year. Assuming that the discount rate on this annuity is 4.0% per annum compounded annually, how much will Ivan receive each year on this annual annuity? Please enter your answer to 2 decimals, for example 121,252.53 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started