Answered step by step

Verified Expert Solution

Question

1 Approved Answer

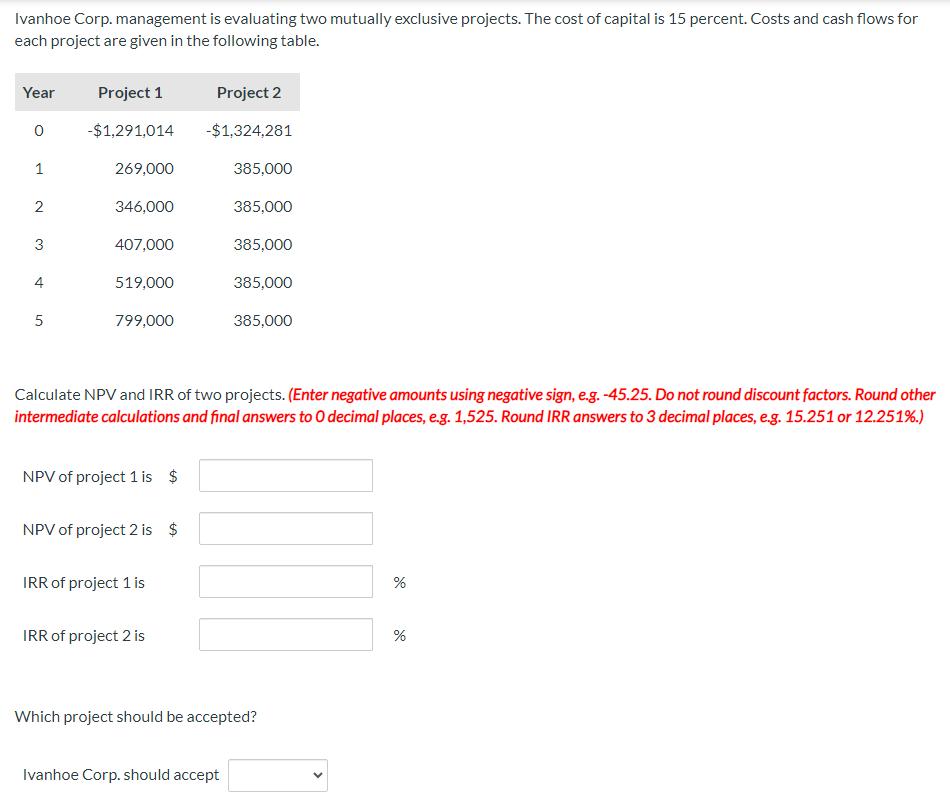

Ivanhoe Corp. management is evaluating two mutually exclusive projects. The cost of capital is 15 percent. Costs and cash flows for each project are

Ivanhoe Corp. management is evaluating two mutually exclusive projects. The cost of capital is 15 percent. Costs and cash flows for each project are given in the following table. Year 0 1 2 3 4 5 Project 1 -$1,291,014 269,000 346,000 407,000 519,000 799,000 NPV of project 1 is $ NPV of project 2 is $ IRR of project 1 is Project 2 -$1,324,281 IRR of project 2 is 385,000 Calculate NPV and IRR of two projects. (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answers to O decimal places, e.g. 1,525. Round IRR answers to 3 decimal places, e.g. 15.251 or 12.251%.) 385,000 Ivanhoe Corp. should accept 385,000 385,000 385,000 Which project should be accepted? % %

Step by Step Solution

★★★★★

3.40 Rating (178 Votes )

There are 3 Steps involved in it

Step: 1

Project 1 NPV 1291014 2690001151 3460001152 4070001153 5190001154 7990001155 88942 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started