Ivanhoe Corp's sales slumped badly in 2025. For the first time in its history, it operated at a loss. The company's income statement showed

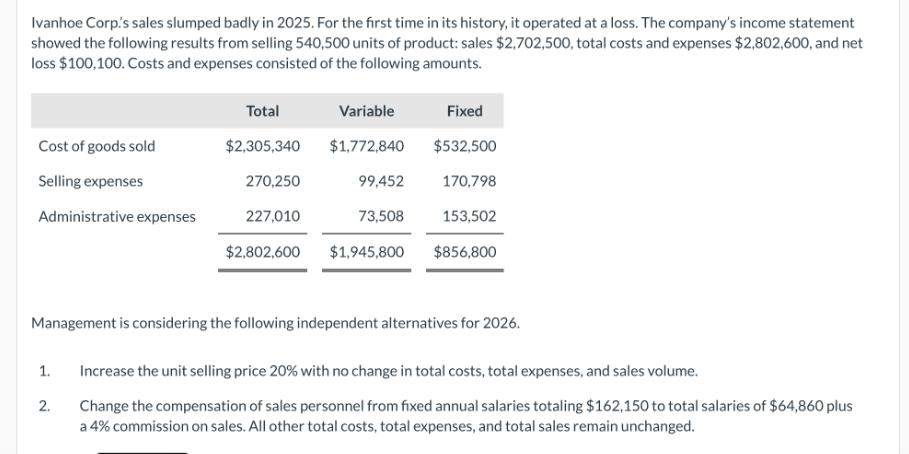

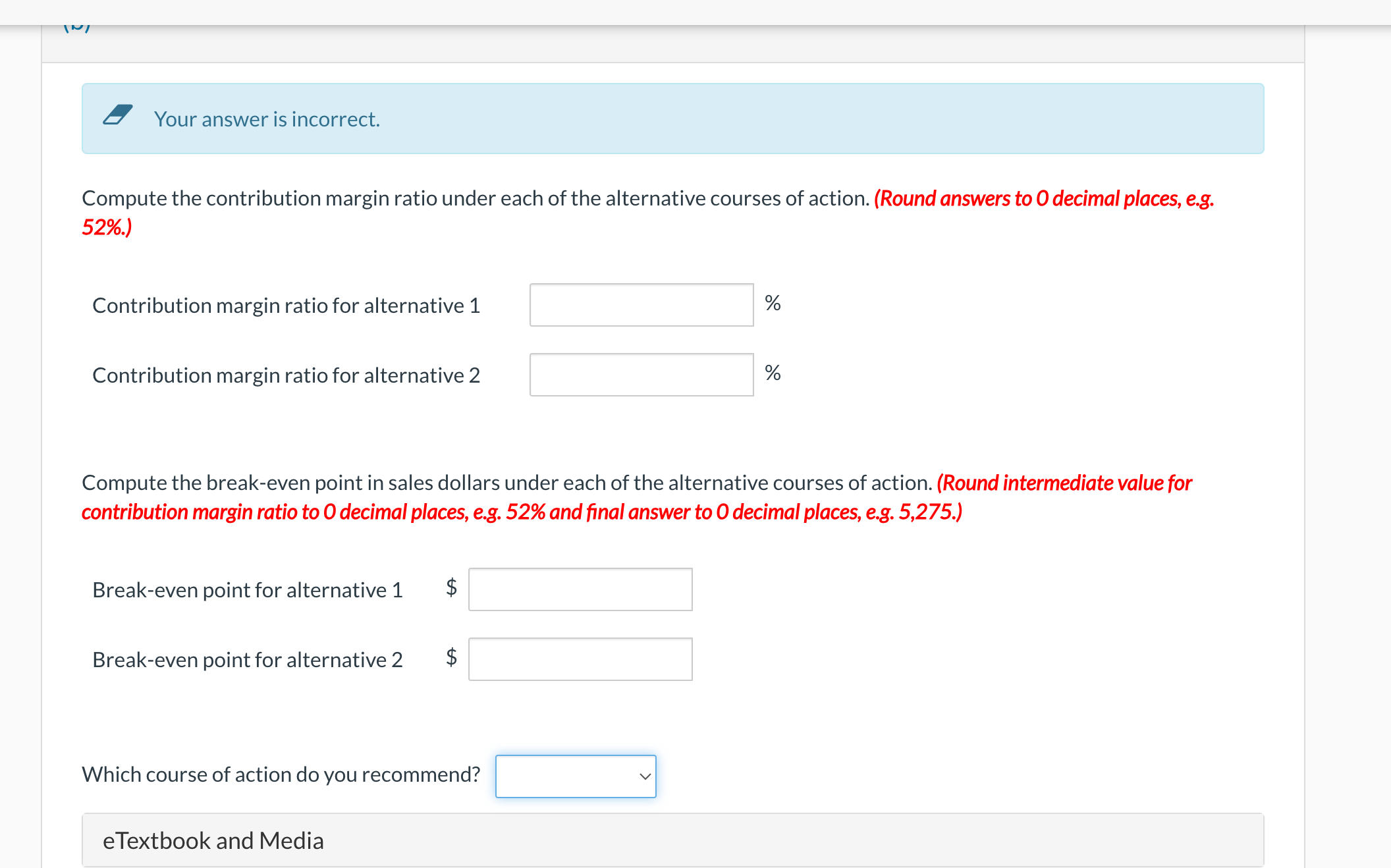

Ivanhoe Corp's sales slumped badly in 2025. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 540,500 units of product: sales $2,702,500, total costs and expenses $2,802,600, and net loss $100,100. Costs and expenses consisted of the following amounts. Total Variable Fixed Cost of goods sold Selling expenses $2,305,340 $1,772,840 $532,500 270,250 99,452 170,798 Administrative expenses 227,010 73,508 153,502 $2,802,600 $1,945,800 $856,800 Management is considering the following independent alternatives for 2026. 1. 2. Increase the unit selling price 20% with no change in total costs, total expenses, and sales volume. Change the compensation of sales personnel from fixed annual salaries totaling $162,150 to total salaries of $64,860 plus a 4% commission on sales. All other total costs, total expenses, and total sales remain unchanged. Your answer is incorrect. Compute the contribution margin ratio under each of the alternative courses of action. (Round answers to O decimal places, e.g. 52%.) Contribution margin ratio for alternative 1 Contribution margin ratio for alternative 2 % do % Compute the break-even point in sales dollars under each of the alternative courses of action. (Round intermediate value for contribution margin ratio to O decimal places, e.g. 52% and final answer to O decimal places, e.g. 5,275.) Break-even point for alternative 1 $ Break-even point for alternative 2 $ Which course of action do you recommend? eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Selling price per unit can be computed as Total sales Number of units sold Substituting the values S...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started