Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I've already done all the exercises but there are some places that I'm quite having a difficult time to solve (the ones are maked as

I've already done all the exercises but there are some places that I'm quite having a difficult time to solve (the ones are maked as wrong). I don't know if I missed something. Can someone please explain/ show to me?

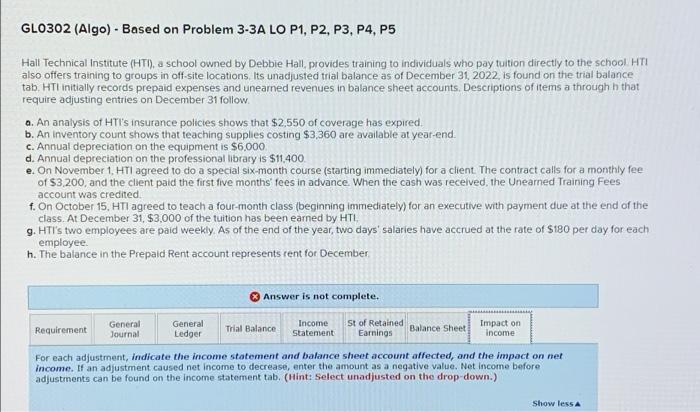

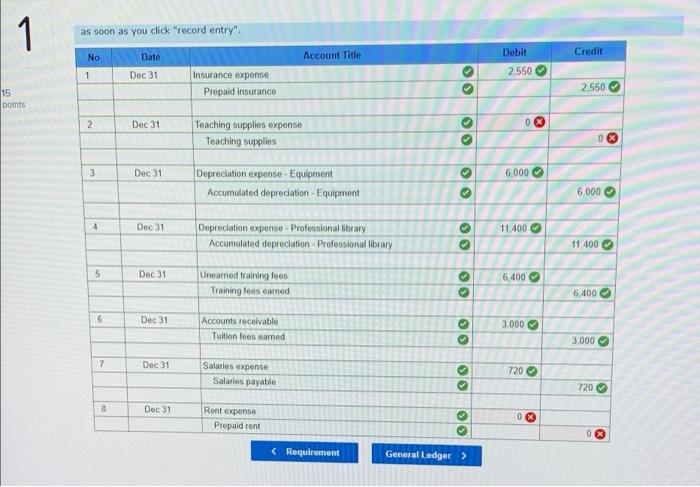

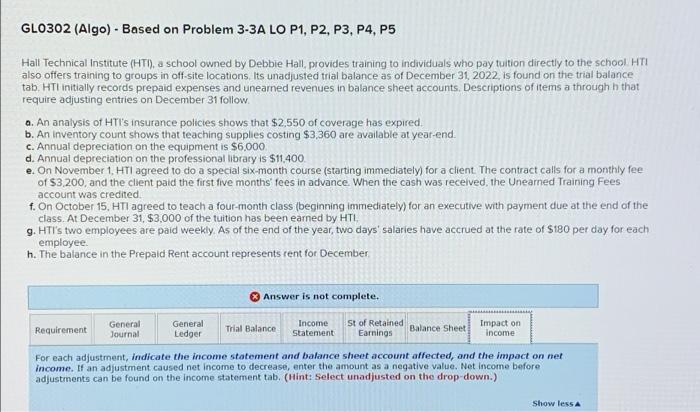

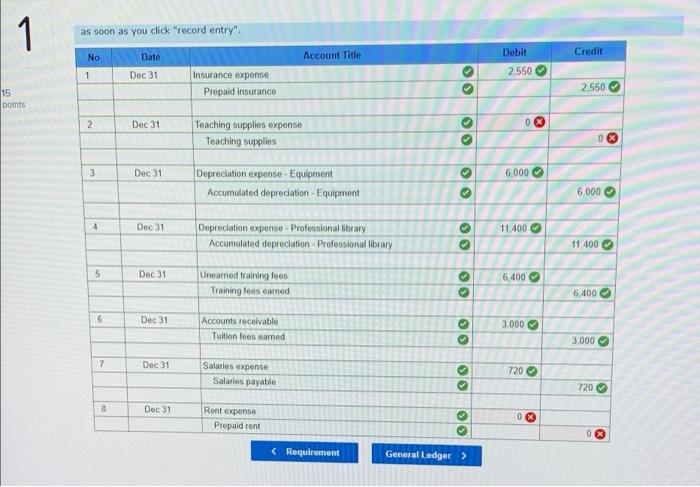

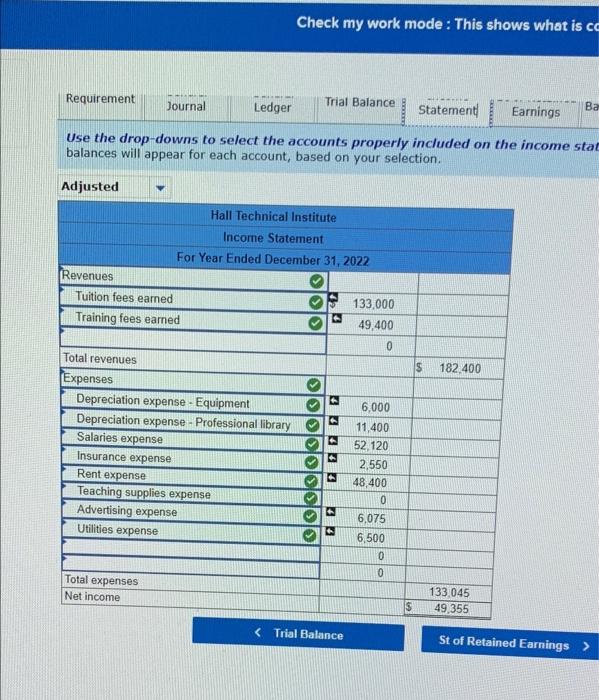

GLO302 (Algo). Based on Problem 3-3A LO P1, P2, P3, P4, P5 Hall Technical Institute (HTI), a school owned by Debbie Hall, provides training to individuals who pay tuition directly to the school HTI also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2022, is found on the trial balance tab. HTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Descriptions of items a through h that require adjusting entries on December 31 follow. a. An analysis of HTI's insurance policies shows that $2,550 of coverage has expired. b. An Inventory count shows that teaching supples costing $3,360 are available at year-end. c. Annual depreciation on the equipment is $6.000 d. Annual depreciation on the professional library is $11.400 e. On November 1, HTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a monthly fee of $3,200, and the client paid the first five months' fees in advance. When the cash was received, the Unearned Training Fees f. On October 15, HTI agreed to teach a four-month class (beginning immediately) for an executive with payment due at the end of the class. At December 31, $3,000 of the tuition has been earned by HTI 9. HTI's two employees are paid weekly As of the end of the year, two days' salaries have accrued at the rate of $180 per day for each employee h. The balance in the Prepaid Rent account represents rent for December account was credited Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St of Retained Earnings Balance Sheet Impact on Income For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net Income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the drop down.) Show less 1 1 as soon as you click "record entry". No Credit Date Account Title Debit 2.550 1 Dec 31 > Insurance expense Prepaid insurance 2,550 15 points 2 Dec 31 Teaching supplies expense Teaching supplies 83 3 Dec 31 > 6,000 $ Depreciation expense Equipment Accumulated depreciation Equipment 6.000 4 4 Dec 31 11,400 > Depreciation expense Professional library Accumulated depreciation - Professional library 11.400 5 Dec 31 6,400 Unearned training fees Training fees earned 6.400 6 Dec 31 Accounts receivable Tuition fees earned 3.000 3,000 7 Dec 31 Salaries expense Salaries payable 720 720 8 Dec 31 Rent expense 03 Prepaid rent 0 0 3 Check my work mode : This shows what is cc Requirement Journal Trial Balance Ledger Statement Ba Earnings Use the drop-downs to select the accounts properly included on the income stat balances will appear for each account, based on your selection, Adjusted Hall Technical Institute Income Statement For Year Ended December 31, 2022 Revenues Tuition fees earned 133,000 Training fees earned 49,400 0 $ 182,400 T 1 Total revenues Expenses Depreciation expense - Equipment Depreciation expense - Professional library Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense OSICI 6,000 11,400 52, 120 2,550 48,400 0 7 S 6,075 6,500 0 0 Total expenses Net income 133.045 49,355 IS Trial Balance 1 Requirement Journal Ledger Statement Earnings Use the drop-downs to select the accounts properly included on the incom balances will appear for each account, based on your selection. Unadjusted Ints Hall Technical Institute Income Statement For Year Ended December 31, 2022 Revenues Tuition fees eamed 130,000 Training fees earned 43,000 0 Total revenues $ 173.000 0 7 Expenses Depreciation expense - Equipment Depreciation expense - Professional library Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense ION 0 51.400 0 48,400 0 6,075 6,500 0 t 0 Total expenses Net income 112 375 60,625 $ Insurance expense Prepaid insurance 2,550 15 points 2 Dec 31 Teaching supplies expense Teaching supplies 83 3 Dec 31 > 6,000 $ Depreciation expense Equipment Accumulated depreciation Equipment 6.000 4 4 Dec 31 11,400 > Depreciation expense Professional library Accumulated depreciation - Professional library 11.400 5 Dec 31 6,400 Unearned training fees Training fees earned 6.400 6 Dec 31 Accounts receivable Tuition fees earned 3.000 3,000 7 Dec 31 Salaries expense Salaries payable 720 720 8 Dec 31 Rent expense 03 Prepaid rent 0 0 3 Check my work mode : This shows what is cc Requirement Journal Trial Balance Ledger Statement Ba Earnings Use the drop-downs to select the accounts properly included on the income stat balances will appear for each account, based on your selection, Adjusted Hall Technical Institute Income Statement For Year Ended December 31, 2022 Revenues Tuition fees earned 133,000 Training fees earned 49,400 0 $ 182,400 T 1 Total revenues Expenses Depreciation expense - Equipment Depreciation expense - Professional library Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense OSICI 6,000 11,400 52, 120 2,550 48,400 0 7 S 6,075 6,500 0 0 Total expenses Net income 133.045 49,355 IS Trial Balance 1 Requirement Journal Ledger Statement Earnings Use the drop-downs to select the accounts properly included on the incom balances will appear for each account, based on your selection. Unadjusted Ints Hall Technical Institute Income Statement For Year Ended December 31, 2022 Revenues Tuition fees eamed 130,000 Training fees earned 43,000 0 Total revenues $ 173.000 0 7 Expenses Depreciation expense - Equipment Depreciation expense - Professional library Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense ION 0 51.400 0 48,400 0 6,075 6,500 0 t 0 Total expenses Net income 112 375 60,625 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started