Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ive answered the first one need help verifying and doing the rest can someone quickly respond this is like my fourth post for this same

Ive answered the first one need help verifying and doing the rest can someone quickly respond this is like my fourth post for this same set of questions

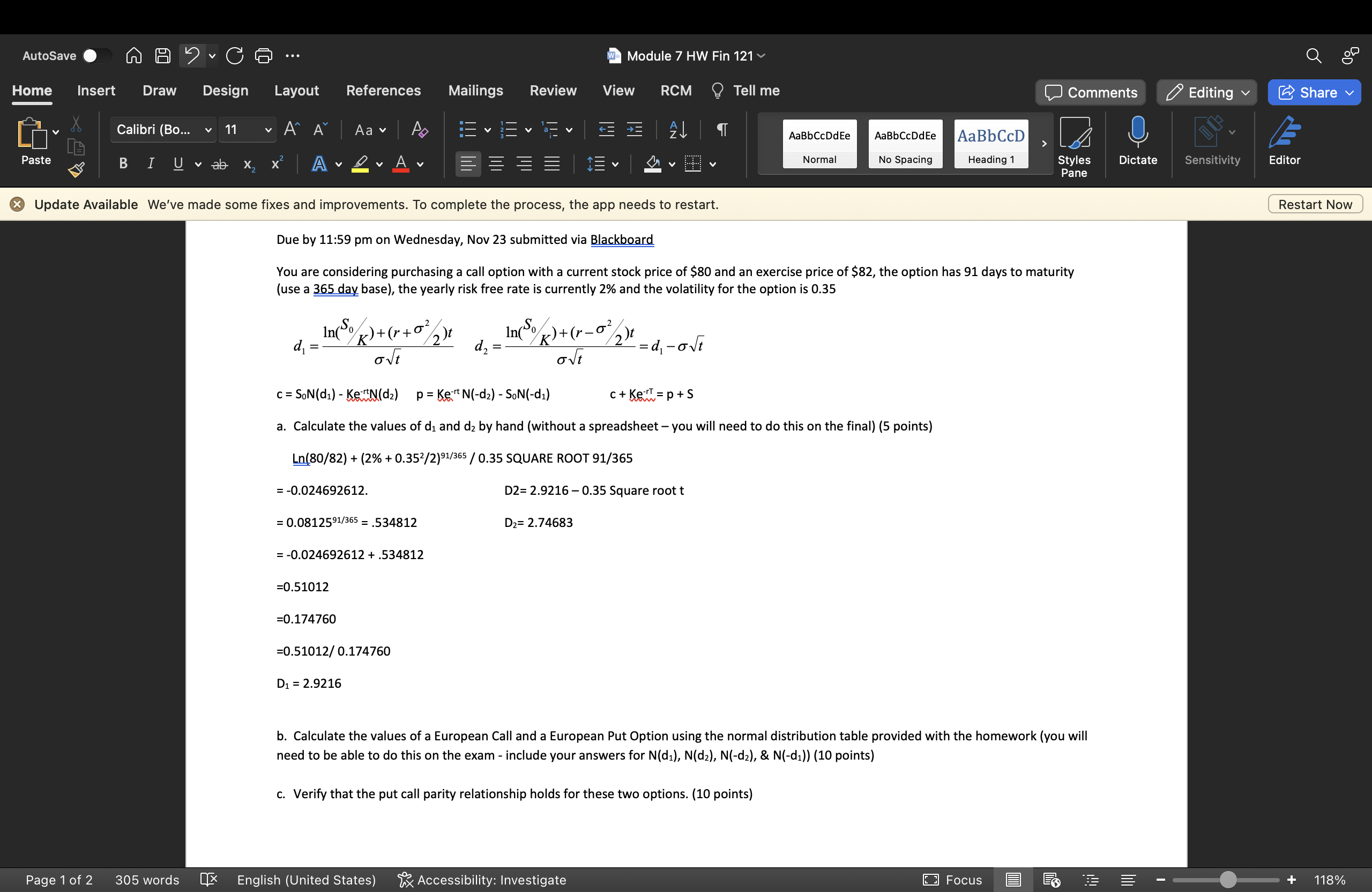

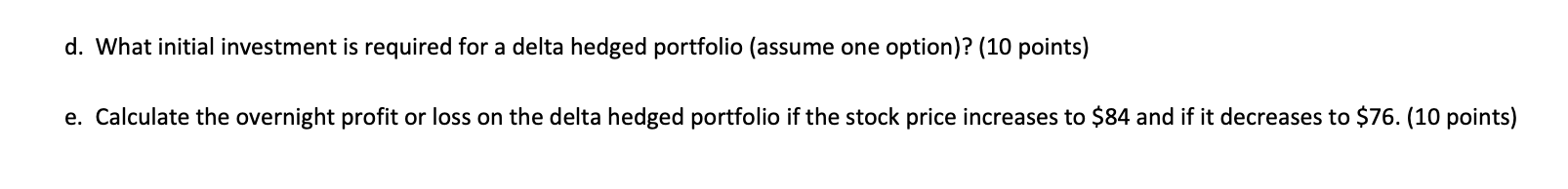

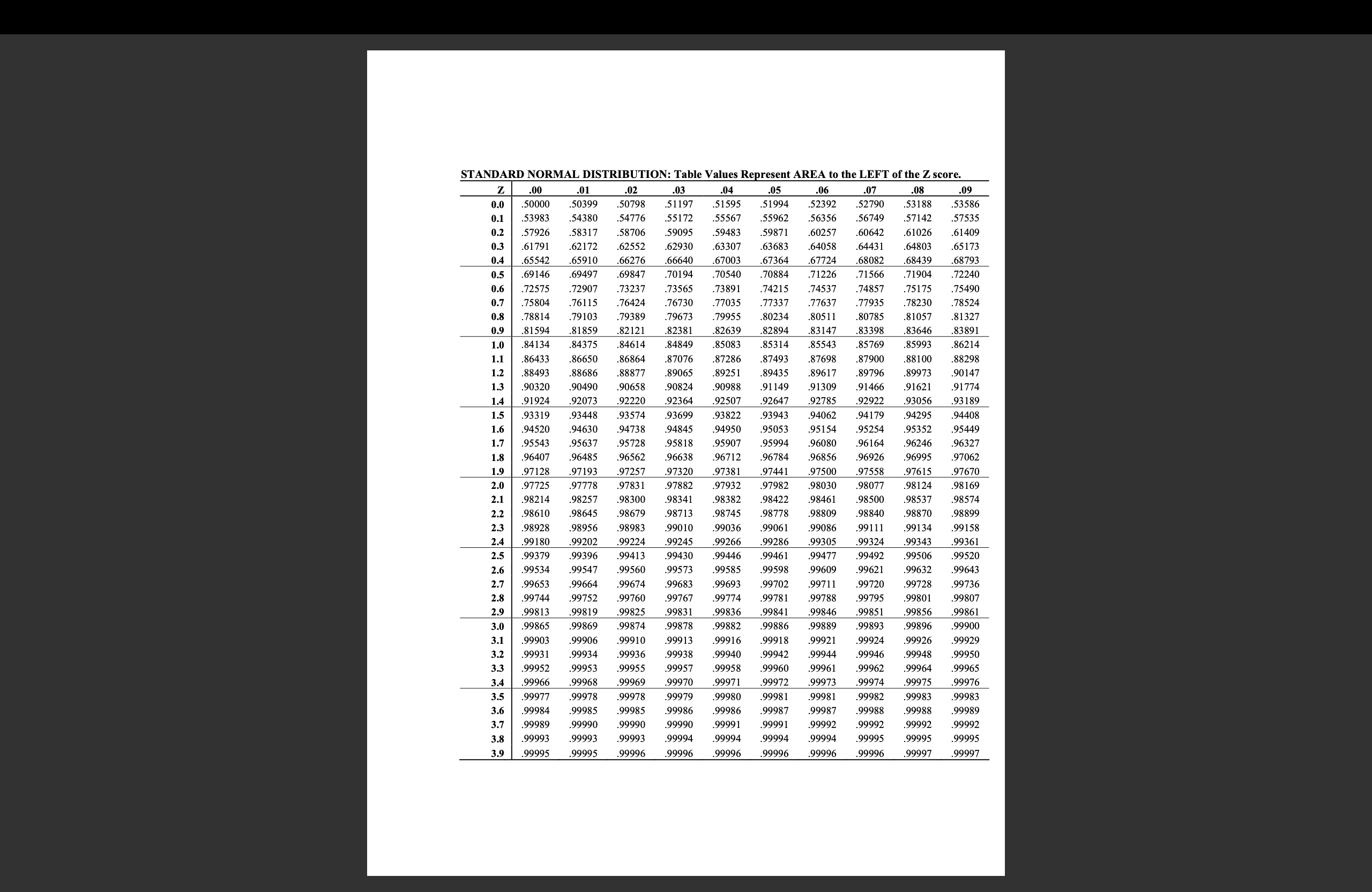

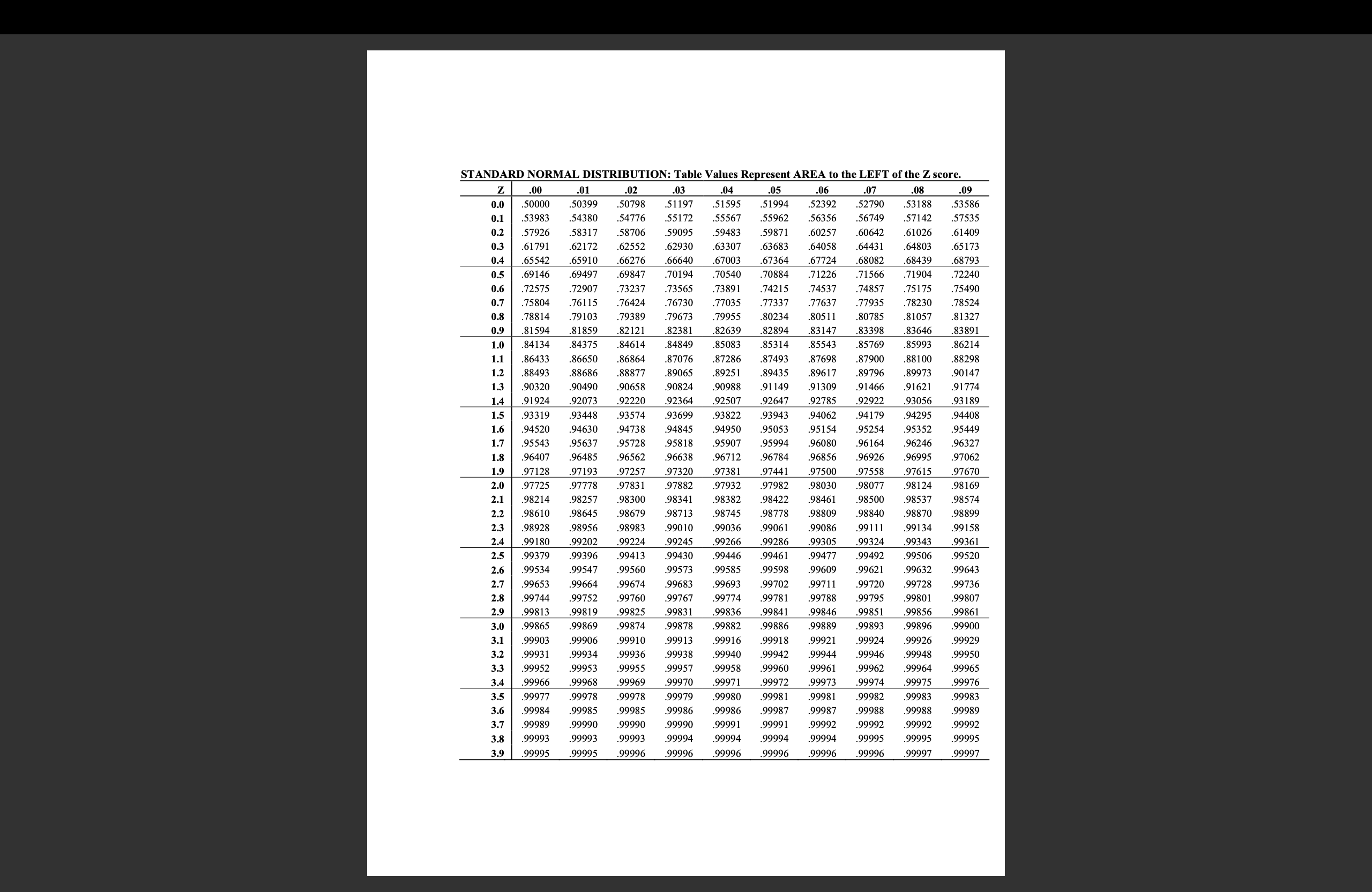

Due by 11:59 pm on Wednesday, Nov 23 submitted via Blackboard You are considering purchasing a call option with a current stock price of $80 and an exercise price of $82, the option has 91 days to maturity (use a 365dav base), the yearly risk free rate is currently 2% and the volatility for the option is 0.35 d1=tln(S0/K)+(r+2/2)td2=tln(S0/K)+(r2/2)t=d1tc=S0N(d1)KertN(d2)p=KertN(d2)S0N(d1)c+KerT=p+S a. Calculate the values of d1 and d2 by hand (without a spreadsheet - you will need to do this on the final) ( 5 points) Ln(80/82)+(2%+0.352/2)91/365/0.35SQUAREROOT91/365=0.024692612.D2=2.92160.35Squareroott=0.0812591/365=.534812D2=2.74683=0.024692612+.534812=0.51012=0.174760=0.51012/0.174760D1=2.9216 b. Calculate the values of a European Call and a European Put Option using the normal distribution table provided with the homework (you will need to be able to do this on the exam - include your answers for N(d1),N(d2),N(d2),&N(d1)) (10 points) c. Verify that the put call parity relationship holds for these two options. (10 points) d. What initial investment is required for a delta hedged portfolio (assume one option)? (10 points) e. Calculate the overnight profit or loss on the delta hedged portfolio if the stock price increases to $84 and if it decreases to $76. (10 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started