IVE BEEN STUCK IN EACH PROBLEM. DONT UNDERSTAND WHY IM NOT GETTING EITHER

OF THE QUESTION RIGHT? IT'S A CLASS PROJECT AND NEED HELP.

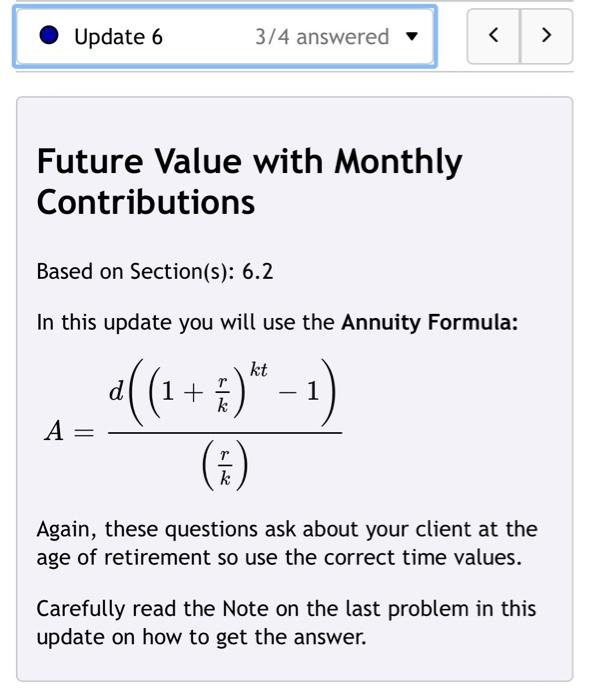

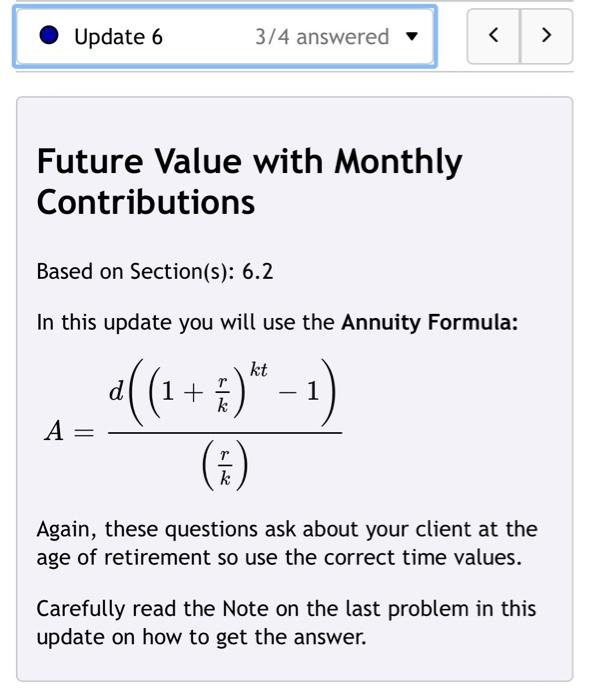

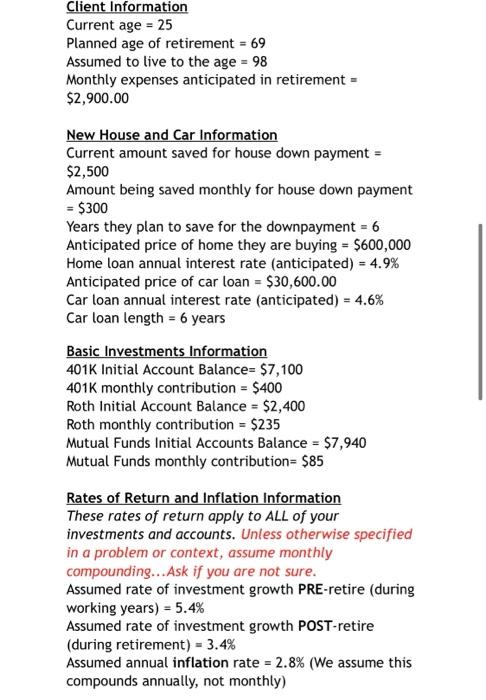

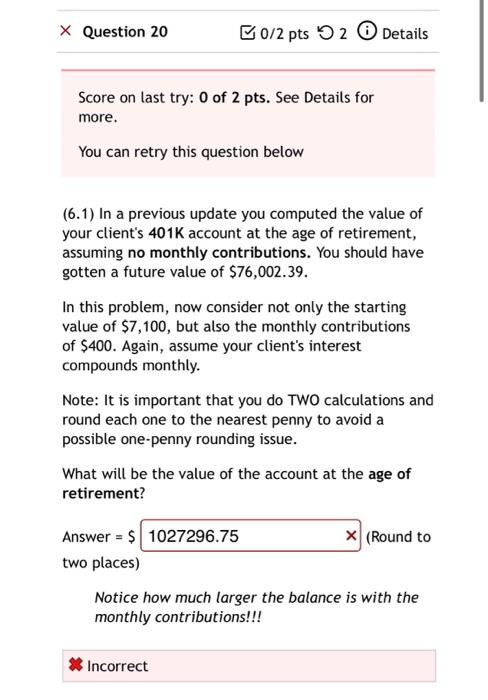

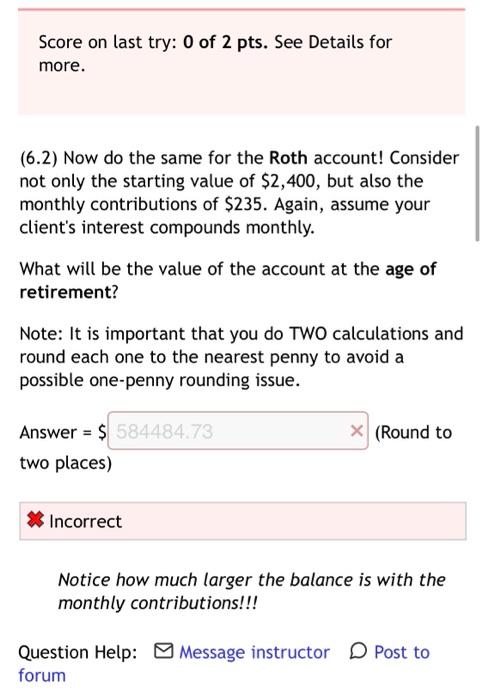

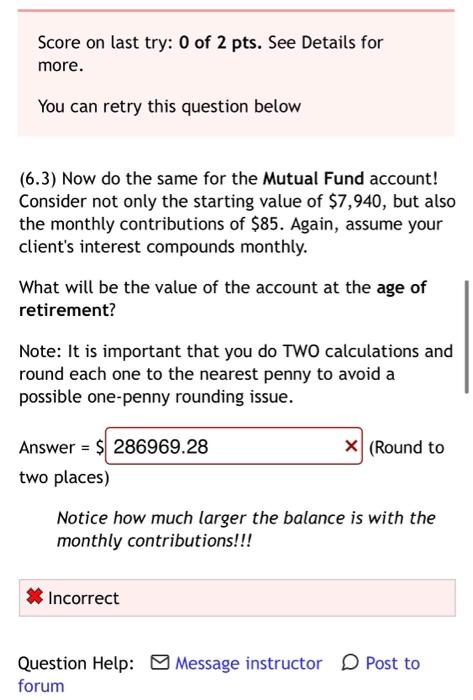

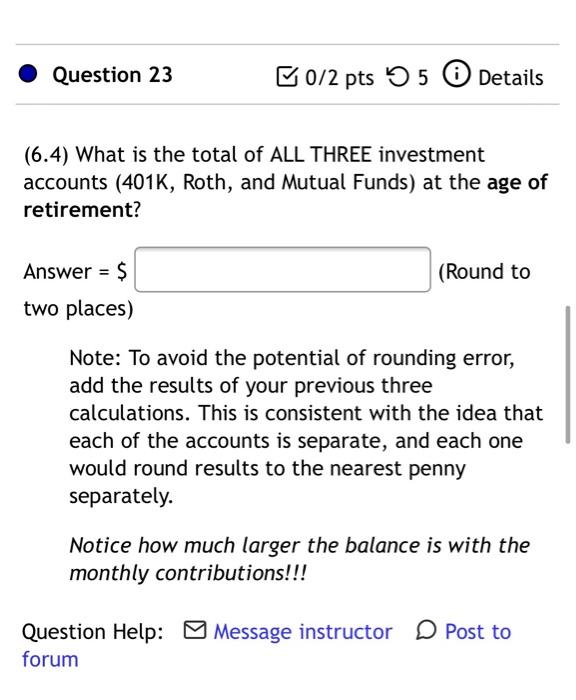

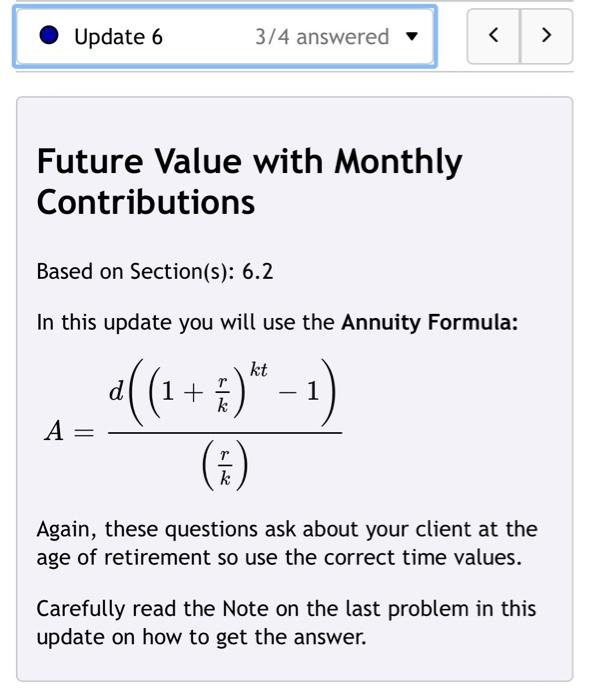

Update 6 3/4 answered Future Value with Monthly Contributions Based on Section(s): 6.2 In this update you will use the Annuity Formula: a (1 + 3)" - 1) A= k Again, these questions ask about your client at the age of retirement so use the correct time values. Carefully read the Note on the last problem in this update on how to get the answer. Client Information Current age = 25 Planned age of retirement = 69 Assumed to live to the age = 98 Monthly expenses anticipated in retirement - $2,900.00 New House and Car Information Current amount saved for house down payment = $2,500 Amount being saved monthly for house down payment = $300 Years they plan to save for the downpayment = 6 Anticipated price of home they are buying = $600,000 Home loan annual interest rate (anticipated) = 4.9% Anticipated price of car loan = $30,600.00 Car loan annual interest rate (anticipated) - 4.6% Car loan length = 6 years Basic Investments Information 401K Initial Account Balance= $7,100 401K monthly contribution = $400 Roth Initial Account Balance = $2,400 Roth monthly contribution = $235 Mutual Funds Initial Accounts Balance = $7,940 Mutual Funds monthly contribution= $85 Rates of Return and Inflation Information These rates of return apply to ALL of your investments and accounts. Unless otherwise specified in a problem or context, assume monthly compounding...Ask if you are not sure. Assumed rate of investment growth PRE-retire (during working years) = 5.4% Assumed rate of investment growth POST-retire (during retirement) - 3.4% Assumed annual inflation rate = 2.8% (We assume this compounds annually, not monthly) X Question 20 B0/2 pts 5 2 Details Score on last try: 0 of 2 pts. See Details for more. You can retry this question below (6.1) In a previous update you computed the value of your client's 401K account at the age of retirement, assuming no monthly contributions. You should have gotten a future value of $76,002.39. In this problem, now consider not only the starting value of $7,100, but also the monthly contributions of $400. Again, assume your client's interest compounds monthly. Note: It is important that you do TWO calculations and round each one to the nearest penny to avoid a possible one-penny rounding issue. What will be the value of the account at the age of retirement? Answer = $ 1027296.75 X (Round to two places) Notice how much larger the balance is with the monthly contributions!!! * Incorrect Score on last try: 0 of 2 pts. See Details for more. (6.2) Now do the same for the Roth account! Consider not only the starting value of $2,400, but also the monthly contributions of $235. Again, assume your client's interest compounds monthly. What will be the value of the account at the age of retirement? Note: It is important that you do TWO calculations and round each one to the nearest penny to avoid a possible one-penny rounding issue. X (Round to Answer = $ 584484.73 two places) Incorrect Notice how much larger the balance is with the monthly contributions!!! Question Help: Message instructor D Post to forum Score on last try: 0 of 2 pts. See Details for more. You can retry this question below (6.3) Now do the same for the Mutual Fund account! Consider not only the starting value of $7,940, but also the monthly contributions of $85. Again, assume your client's interest compounds monthly. What will be the value of the account at the age of retirement? Note: It is important that you do TWO calculations and round each one to the nearest penny to avoid a possible one-penny rounding issue. Answer = $286969.28 x (Round to two places) Notice how much larger the balance is with the monthly contributions!!! Incorrect Question Help: Message instructor D Post to forum Question 23 50/2 pts 5 5 0 Details (6.4) What is the total of ALL THREE investment accounts (401K, Roth, and Mutual Funds) at the age of retirement? (Round to Answer = $ two places) Note: To avoid the potential of rounding error, add the results of your previous three calculations. This is consistent with the idea that each of the accounts is separate, and each one would round results to the nearest penny separately. Notice how much larger the balance is with the monthly contributions!!! Question Help: Message instructor D Post to forum Update 6 3/4 answered Future Value with Monthly Contributions Based on Section(s): 6.2 In this update you will use the Annuity Formula: a (1 + 3)" - 1) A= k Again, these questions ask about your client at the age of retirement so use the correct time values. Carefully read the Note on the last problem in this update on how to get the answer. Client Information Current age = 25 Planned age of retirement = 69 Assumed to live to the age = 98 Monthly expenses anticipated in retirement - $2,900.00 New House and Car Information Current amount saved for house down payment = $2,500 Amount being saved monthly for house down payment = $300 Years they plan to save for the downpayment = 6 Anticipated price of home they are buying = $600,000 Home loan annual interest rate (anticipated) = 4.9% Anticipated price of car loan = $30,600.00 Car loan annual interest rate (anticipated) - 4.6% Car loan length = 6 years Basic Investments Information 401K Initial Account Balance= $7,100 401K monthly contribution = $400 Roth Initial Account Balance = $2,400 Roth monthly contribution = $235 Mutual Funds Initial Accounts Balance = $7,940 Mutual Funds monthly contribution= $85 Rates of Return and Inflation Information These rates of return apply to ALL of your investments and accounts. Unless otherwise specified in a problem or context, assume monthly compounding...Ask if you are not sure. Assumed rate of investment growth PRE-retire (during working years) = 5.4% Assumed rate of investment growth POST-retire (during retirement) - 3.4% Assumed annual inflation rate = 2.8% (We assume this compounds annually, not monthly) X Question 20 B0/2 pts 5 2 Details Score on last try: 0 of 2 pts. See Details for more. You can retry this question below (6.1) In a previous update you computed the value of your client's 401K account at the age of retirement, assuming no monthly contributions. You should have gotten a future value of $76,002.39. In this problem, now consider not only the starting value of $7,100, but also the monthly contributions of $400. Again, assume your client's interest compounds monthly. Note: It is important that you do TWO calculations and round each one to the nearest penny to avoid a possible one-penny rounding issue. What will be the value of the account at the age of retirement? Answer = $ 1027296.75 X (Round to two places) Notice how much larger the balance is with the monthly contributions!!! * Incorrect Score on last try: 0 of 2 pts. See Details for more. (6.2) Now do the same for the Roth account! Consider not only the starting value of $2,400, but also the monthly contributions of $235. Again, assume your client's interest compounds monthly. What will be the value of the account at the age of retirement? Note: It is important that you do TWO calculations and round each one to the nearest penny to avoid a possible one-penny rounding issue. X (Round to Answer = $ 584484.73 two places) Incorrect Notice how much larger the balance is with the monthly contributions!!! Question Help: Message instructor D Post to forum Score on last try: 0 of 2 pts. See Details for more. You can retry this question below (6.3) Now do the same for the Mutual Fund account! Consider not only the starting value of $7,940, but also the monthly contributions of $85. Again, assume your client's interest compounds monthly. What will be the value of the account at the age of retirement? Note: It is important that you do TWO calculations and round each one to the nearest penny to avoid a possible one-penny rounding issue. Answer = $286969.28 x (Round to two places) Notice how much larger the balance is with the monthly contributions!!! Incorrect Question Help: Message instructor D Post to forum Question 23 50/2 pts 5 5 0 Details (6.4) What is the total of ALL THREE investment accounts (401K, Roth, and Mutual Funds) at the age of retirement? (Round to Answer = $ two places) Note: To avoid the potential of rounding error, add the results of your previous three calculations. This is consistent with the idea that each of the accounts is separate, and each one would round results to the nearest penny separately. Notice how much larger the balance is with the monthly contributions!!! Question Help: Message instructor D Post to forum