Answered step by step

Verified Expert Solution

Question

1 Approved Answer

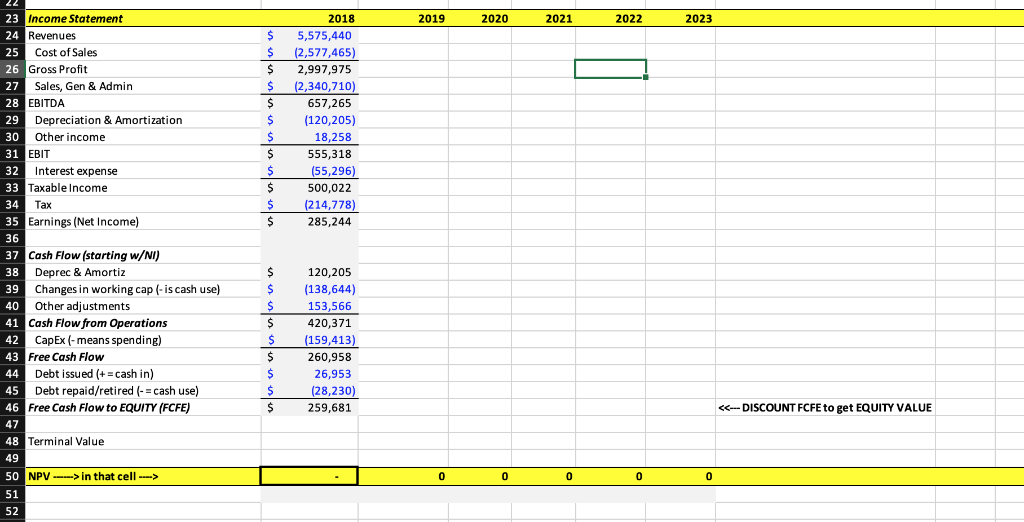

I've calculated it twice and gotten an npv of 8.8 million and 6.5 million, but don't know which is correct. 2. Make the following base-case

I've calculated it twice and gotten an npv of 8.8 million and 6.5 million, but don't know which is correct.

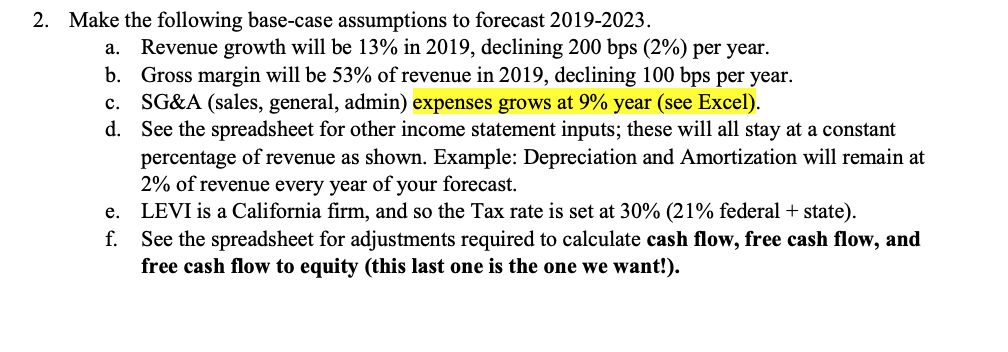

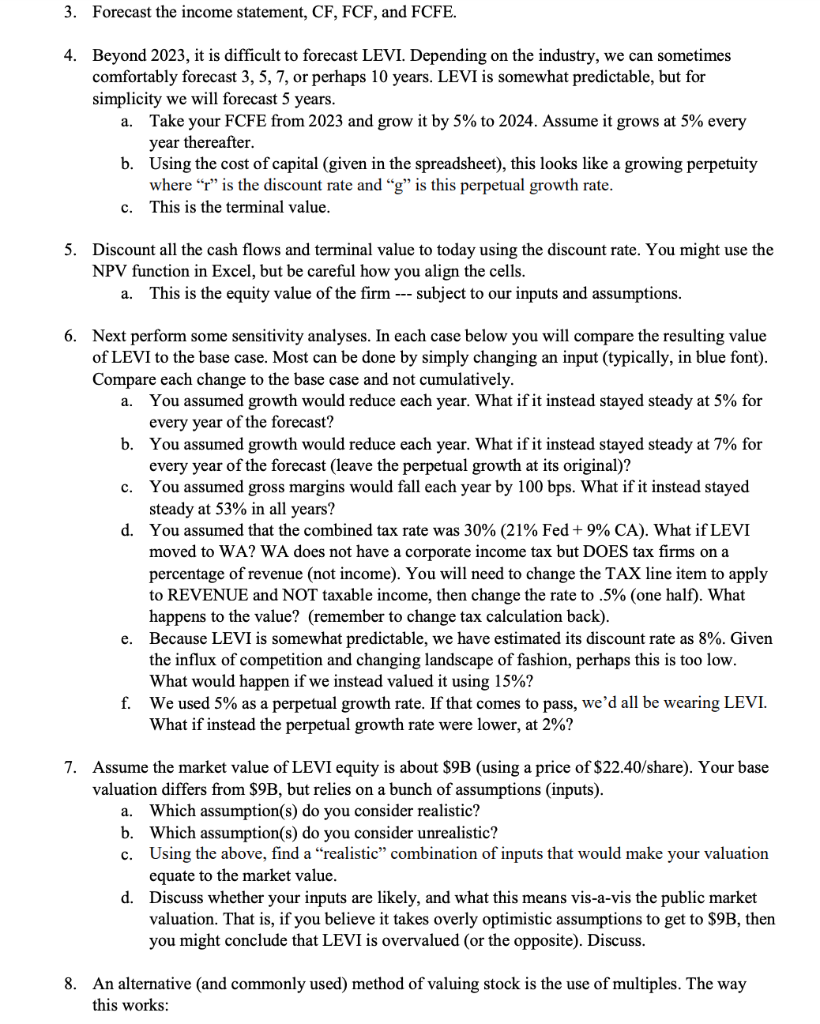

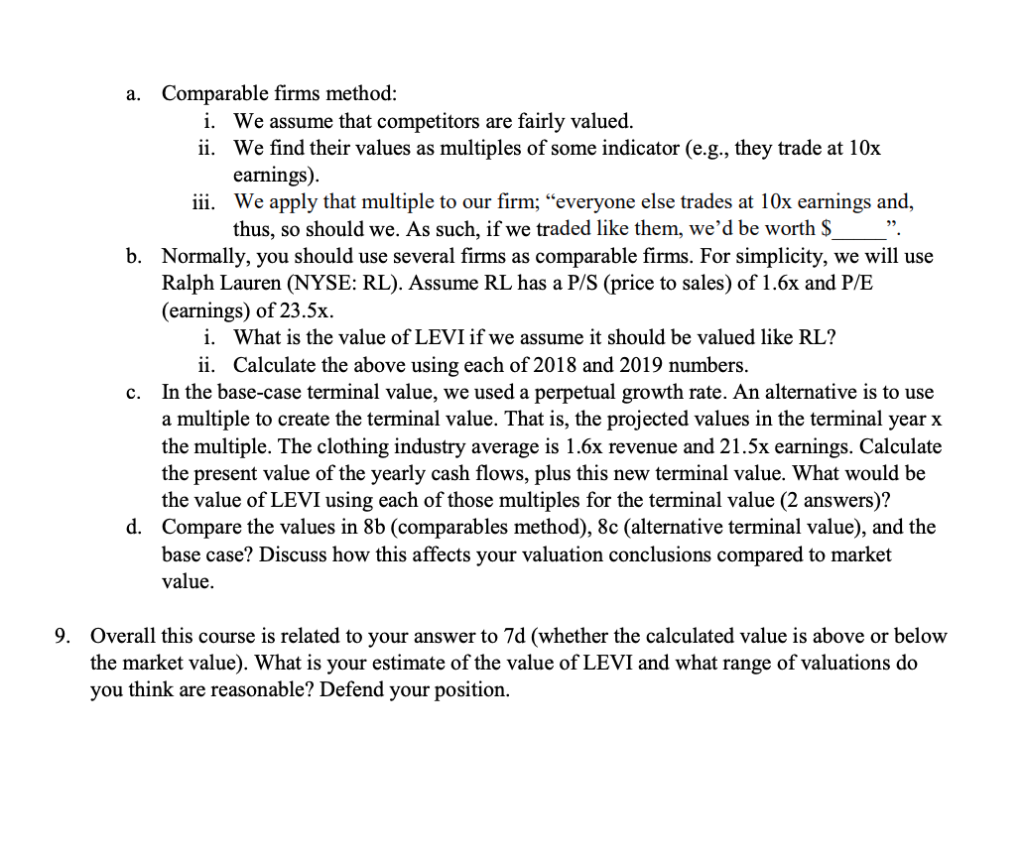

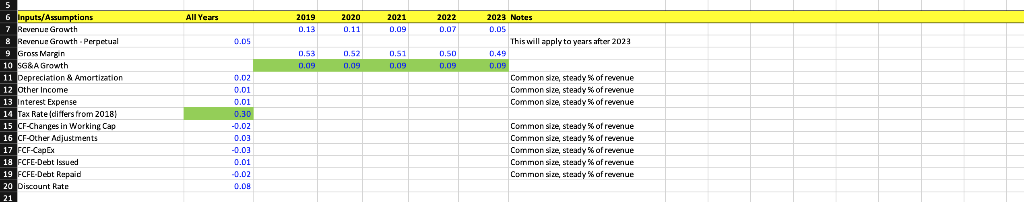

2. Make the following base-case assumptions to forecast 2019-2023. Revenue growth will be 13% in 2019, declining 200 bps (2%) per year Gross margin will be 53% of revenue in 2019, declining 100 bps per year. SG&A (sales, general, admin) expenses grows at 9% year (see Excel) See the spreadsheet for other income statement inputs; these will all stay at a constant percentage of revenue as shown. Example: Depreciation and Amortization will remain at 2% of revenue every year of your forecast. LEVI is a California firm, and so the Tax rate is set at 30% (21% federal + state) See the spreadsheet for adjustments required to calculate cash flow, free cash flow, and free cash flow to equity (this last one is the one we want!). b. c. d. f. 3. Forecast the income statement, CF, FCF, and FCFE. 4. Beyond 2023, it is difficult to forecast LEVI. Depending on the industry, we can sometimes comfortably forecast 3, 5,7, or perhaps 10 years. LEVI is somewhat predictable, but for simplicity we will forecast 5 years a. Take your FCFE from 2023 and grow it by 5% to 2024 . Assume it grows at 5% every year thereafter b. Using the cost of capital (given in the spreadsheet), this looks like a growing perpetuity where r"is the discount rate and "g" is this perpetual growth rate This is the terminal value c. 5. Discount all the cash flows and terminal value to today using the discount rate. You might use the NPV function in Excel, but be careful how you align the cells a. This is the equity value of the firm subject to our inputs and assumptions. 6. Next perform some sensitivity analyses. In each case below you will compare the resulting value of LEVI to the base case. Most can be done by simply changing an input (typically, in blue font) Compare each change to the base case and not cumulatively You assumed growth would reduce each year. What if it instead stayed steady at 5% for every year of the forecast? You assumed growth would reduce each year. What if it instead stayed steady at 7% for every year of the forecast (leave the perpetual growth at its original)? You assumed gross margins would fall each year by 100 bps. What if it instead stayed steady at 53% in all years? d. a. b. c. You assumed that the combined tax rate was 30% (21% Fed + 9% CA). What if LEVI moved to WA? WA does not have a corporate income tax but DOES tax firms on a percentage of revenue (not income). You will need to change the TAX line item to apply to REVENUE and NOT taxable income, then change the rate to .5% (one half, what happens to the value? (remember to change tax calculation back) Because LEVI is somewhat predictable, we have estimated its discount rate as 8%. Given the influx of competition and changing landscape of fashion, perhaps this is too low What would happen if we instead valued it using 15%? f. e. We used 5% as a perpetual growth rate. If that comes to pass, we'd all be wearing LEVI. What if instead the perpetual growth rate were lower, at 2%? 7. Assume the market value of LEVI equity is about S9B (using a price of S22.40/share). Your base valuation differs from S9B, but relies on a bunch of assumptions (inputs) a. Which assumption(s) do you consider realistic? b. Which assumption(s) do you consider unrealistic? c. Using the above, find a "realistic" combination of inputs that would make your valuation equate to the market value d. Discuss whether your inputs are likely, and what this means vis-a-vis the public market valuation. That is, if you believe it takes overly optimistic assumptions to get to $9B, then you might conclude that LEVI is overvalued (or the opposite). Discuss 8. An alternative (and commonly used) method of valuing stock is the use of multiples. The way this works Comparable firms method: a. i. We assume that competitors are fairly valued We find their values as multiples of some indicator (e.g., they trade at 10x ii. earnings iii. We apply that multiple to our firm; "everyone else trades at 10x earnings and, thus, so should we. As such, if we traded like them, we'd be worth $ " b. Normally, you should use several firms as comparable firms. For simplicity, we will use Ralph Lauren (NYSE: RL). Assume RL has a P/S (price to sales) of 1.6x and P/E (earnings) of 23.5x i. What is the value of LEVI if we assume it should be valued like RL? ii. Calculate the above using each of 2018 and 2019 numbers In the base-case terminal value, we used a perpetual growth rate. An alternative is to use a multiple to create the terminal value. That is, the projected values in the terminal year x the multiple. The clothing industry average is 1.6x revenue and 21.5x earnings. Calculate the present value of the yearly cash flows, plus this new terminal value. What would be the value of LEVI using each of those multiples for the terminal value (2 answers)? d. c. Compare the values in 8b (comparables method), 8c (alternative terminal value), and the base case? Discuss how this affects your valuation conclusions compared to market value. 9. Overall this course is related to your answer to 7d (whether the calculated value is above or below the market value). What is your estimate of the value of LEVI and what range of valuations do you think are reasonable? Defend your position. cvcnur Grawth &A Growth epreclation & Amortization common size, steady % of revenue common size, steady % of revenue common size, steady % of revenue ax Rate ldiffers from 2018 F-Changes in Working Cap common size, steady % of revenue F-Other Ad justments common size, steady % of revenue common size, steady % of revenue common size, steady % of revenue CFE-Debt Repaid 23 2018 2019 2020 2021 2022 2023 Income Statement $5,575,440 24 Revenues 25 $2,577,465) $ 2,997,975 Cost of Sales 26 Gross Profit $ 2,340,710) 657,265 27 Sales, Gen & Admin 28 EBITDA (120,205) 29 Depreciation & Amortization 18,258 30 Other income 5555,318 EBIT 32 (55,296 Interest expense TaxableIncome 500,022 (214,778) 285,244 34 Tax Earnings (Net Income) 35 36 Cash Flow (starting w/NI) 37 $120,205 $ (138,644) 38 Deprec& Amortiz Changes in working cap (-is cash use) $153,566 40 Other adjustments Cash Flow from Operations 420,371 41 42 CapEx (-means spending) $(159,413) $260,958 Free Cash Flow 43 Debt issued (cash in) 26,953 45 Debt repaid/retired cash use) Free Cash Flow to EQUITY (FCFE) 46 259,681Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started