Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ive completed 1-4 however not sure if 5-7 is correct Can you please solve 5-7 to check my work GSO Furniture, Inc. recently hired your

Ive completed 1-4 however not sure if 5-7 is correct Can you please solve 5-7 to check my work

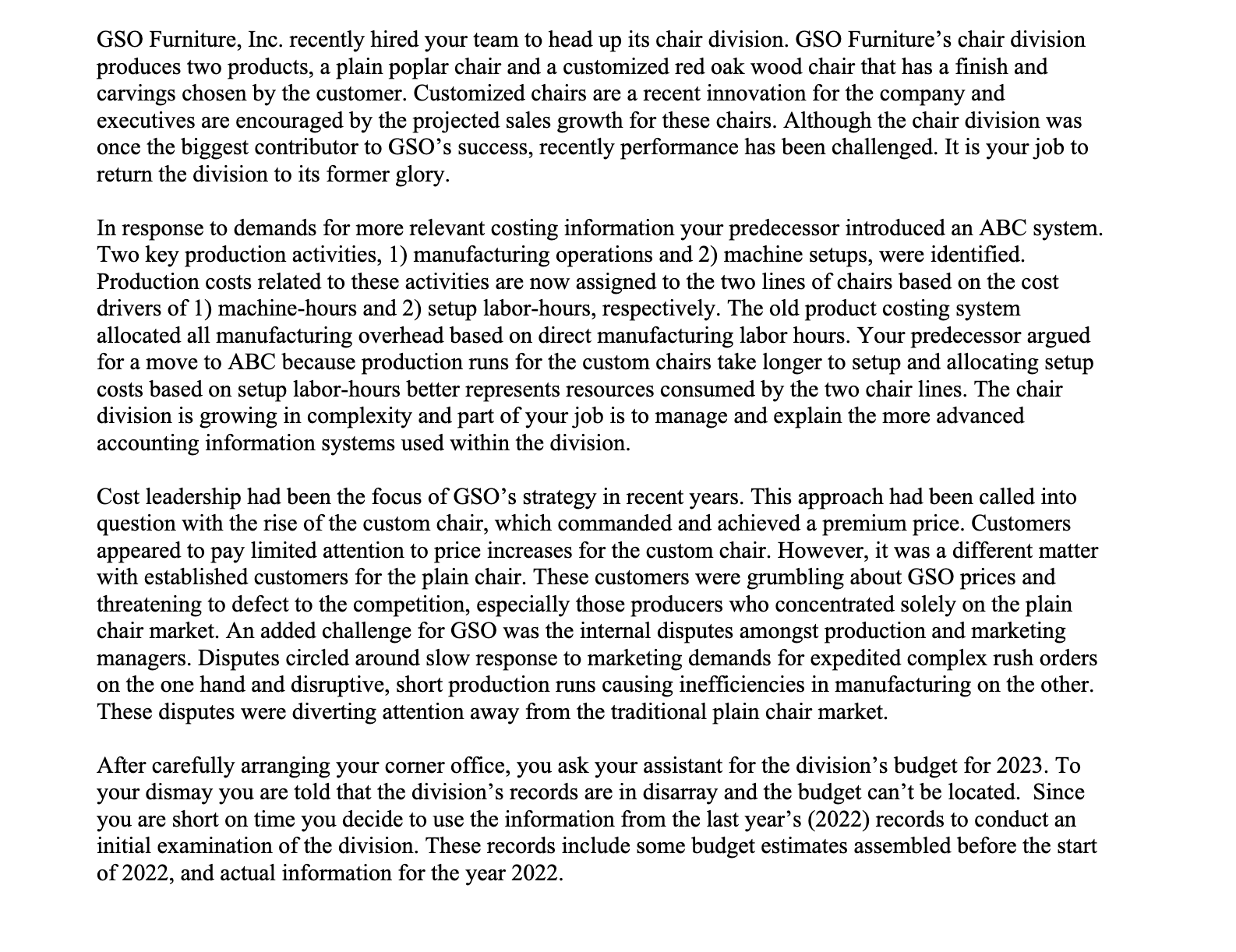

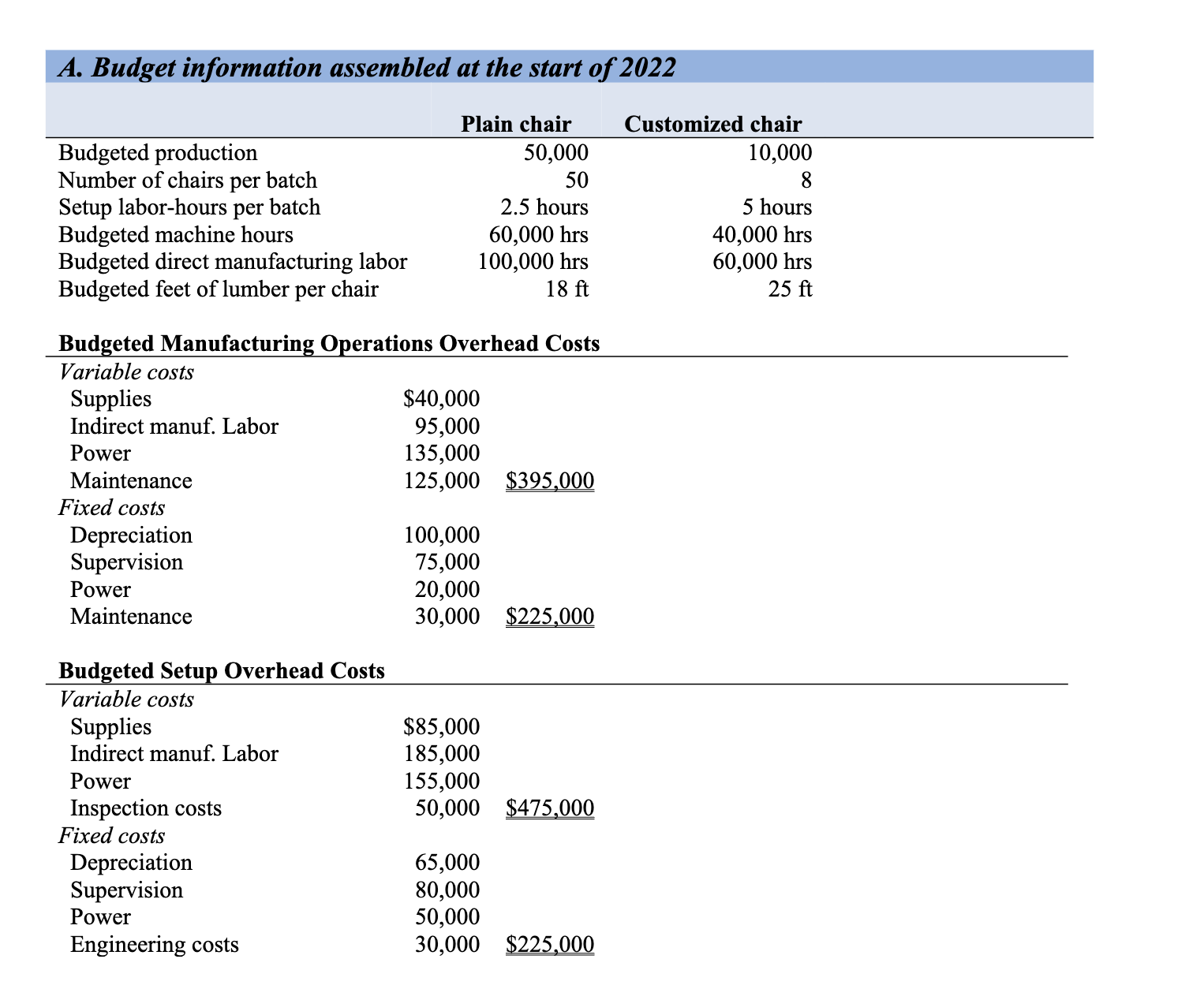

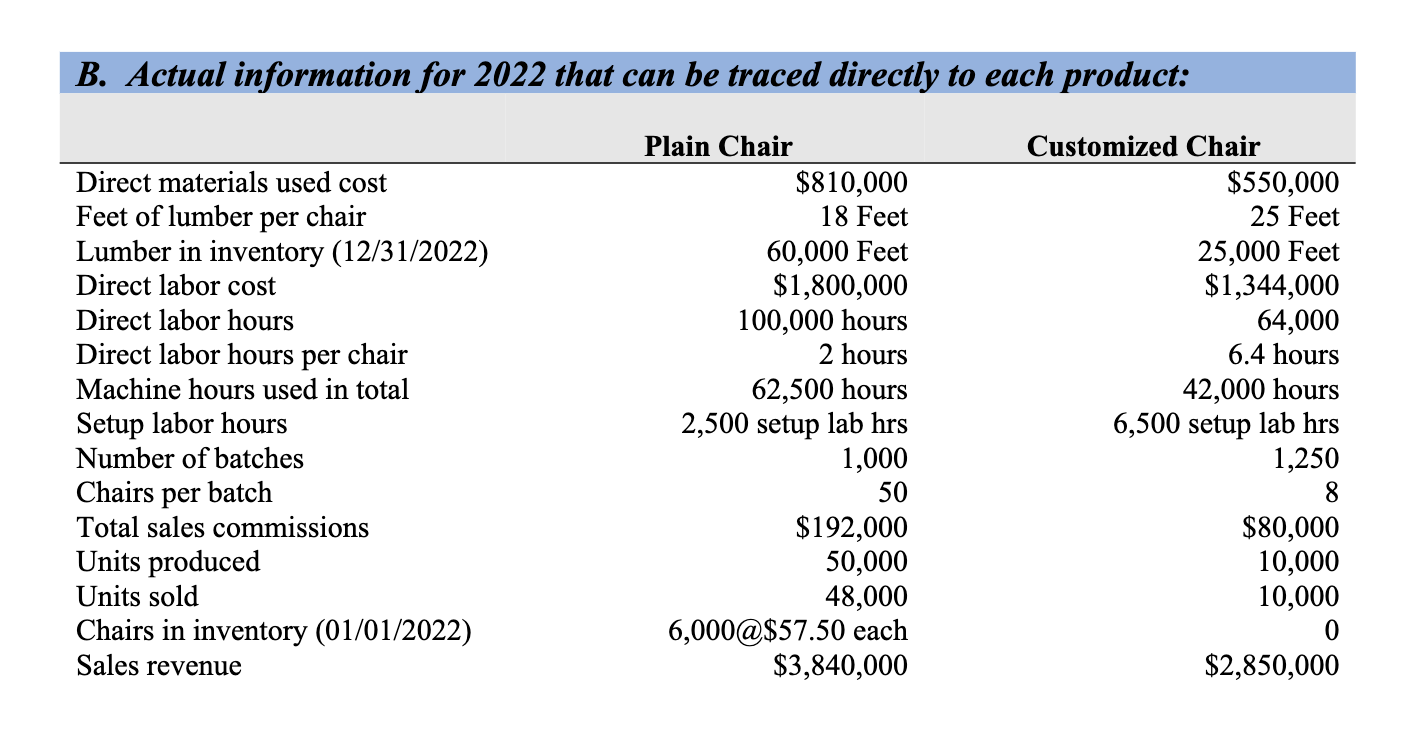

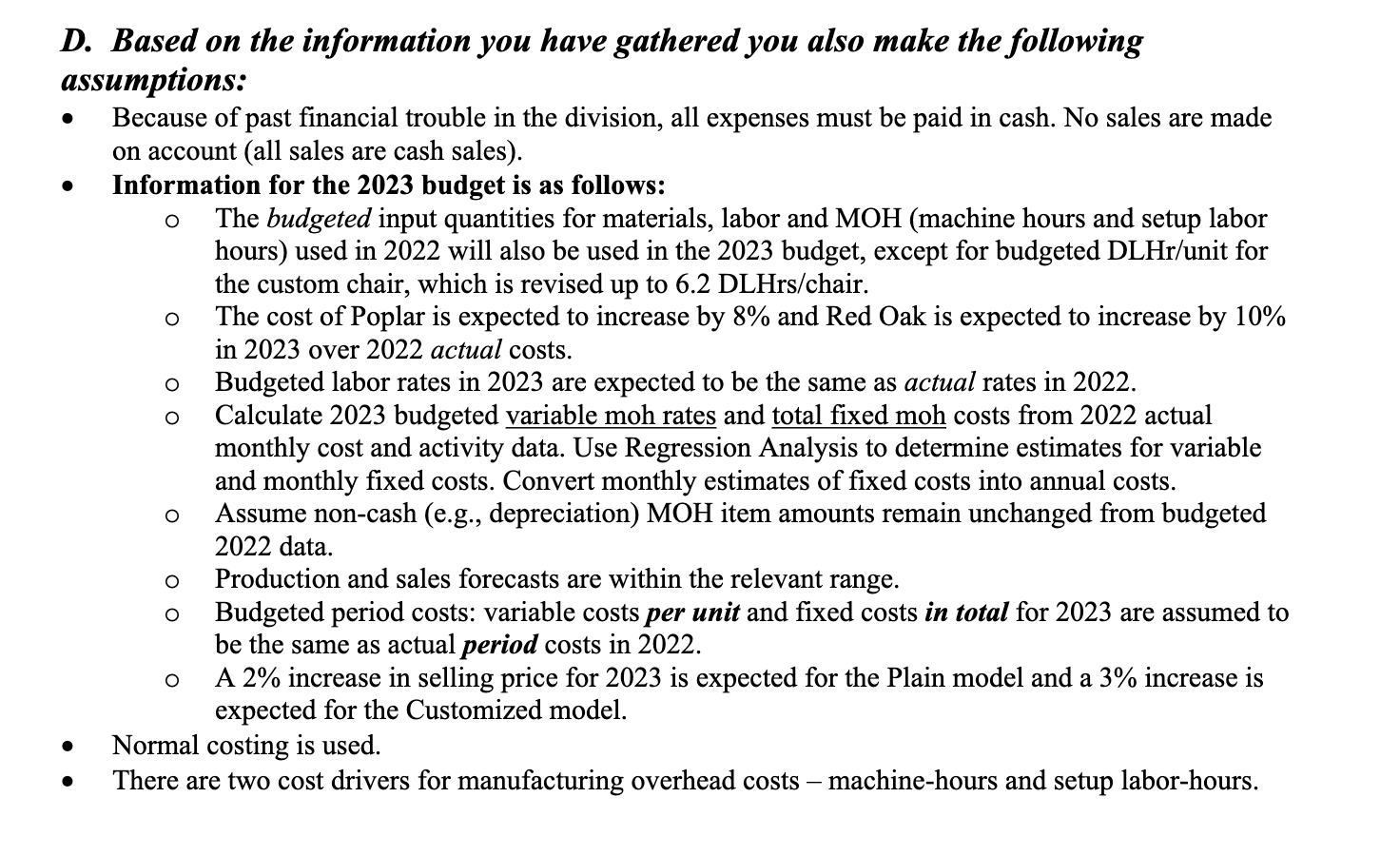

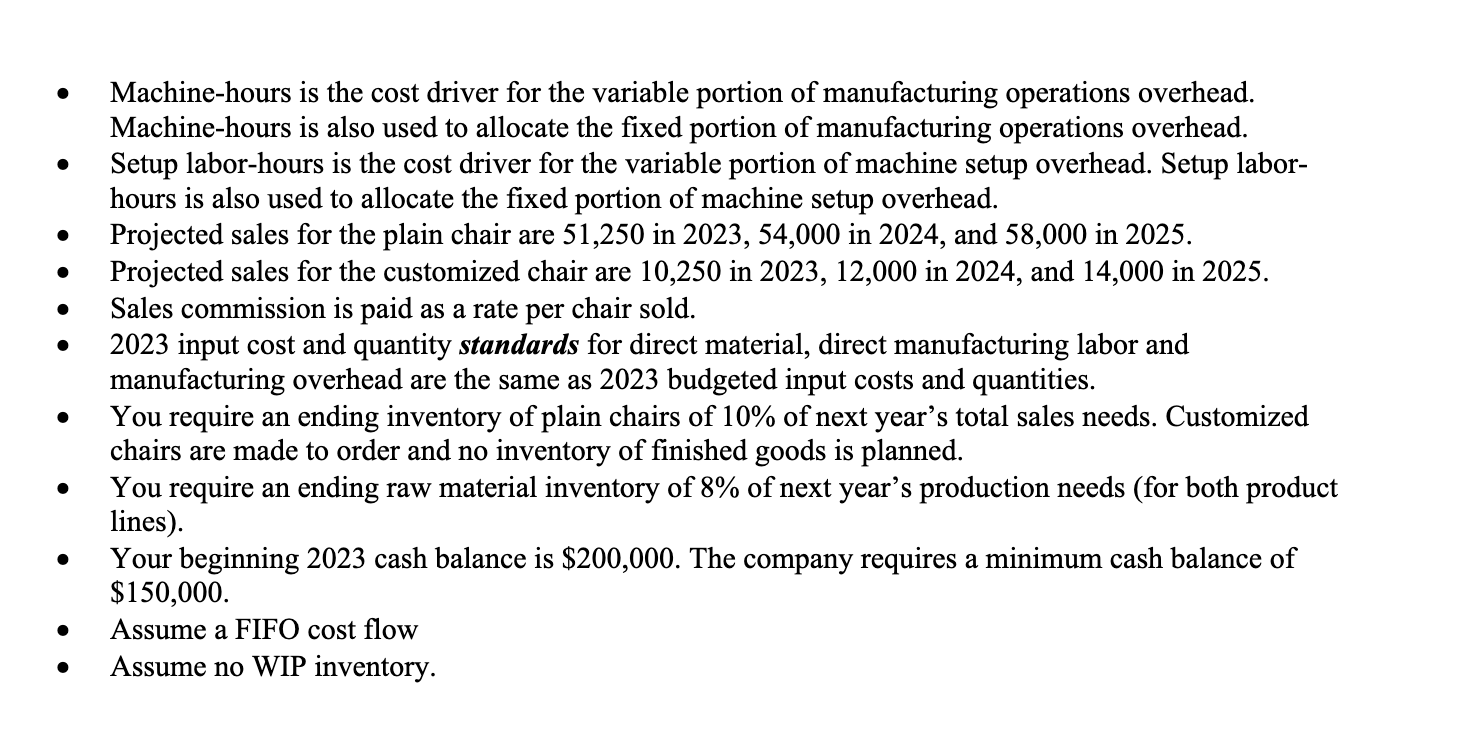

GSO Furniture, Inc. recently hired your team to head up its chair division. GSO Furniture's chair division produces two products, a plain poplar chair and a customized red oak wood chair that has a finish and carvings chosen by the customer. Customized chairs are a recent innovation for the company and executives are encouraged by the projected sales growth for these chairs. Although the chair division was once the biggest contributor to GSO's success, recently performance has been challenged. It is your job to return the division to its former glory. In response to demands for more relevant costing information your predecessor introduced an ABC system. Two key production activities, 1) manufacturing operations and 2) machine setups, were identified. Production costs related to these activities are now assigned to the two lines of chairs based on the cost drivers of 1) machine-hours and 2) setup labor-hours, respectively. The old product costing system allocated all manufacturing overhead based on direct manufacturing labor hours. Your predecessor argued for a move to ABC because production runs for the custom chairs take longer to setup and allocating setup costs based on setup labor-hours better represents resources consumed by the two chair lines. The chair division is growing in complexity and part of your job is to manage and explain the more advanced accounting information systems used within the division. Cost leadership had been the focus of GSO's strategy in recent years. This approach had been called into question with the rise of the custom chair, which commanded and achieved a premium price. Customers appeared to pay limited attention to price increases for the custom chair. However, it was a different matter with established customers for the plain chair. These customers were grumbling about GSO prices and threatening to defect to the competition, especially those producers who concentrated solely on the plain chair market. An added challenge for GSO was the internal disputes amongst production and marketing managers. Disputes circled around slow response to marketing demands for expedited complex rush orders on the one hand and disruptive, short production runs causing inefficiencies in manufacturing on the other. These disputes were diverting attention away from the traditional plain chair market. After carefully arranging your corner office, you ask your assistant for the division's budget for 2023. To your dismay you are told that the division's records are in disarray and the budget can't be located. Since you are short on time you decide to use the information from the last year's (2022) records to conduct an initial examination of the division. These records include some budget estimates assembled before the start of 2022, and actual information for the year 2022. A. Budget information assembled at the start of 2022 \begin{tabular}{|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Plain chair } & \multirow{2}{*}{ Customized chair } \\ \hline Budgeted production & & 50,000 & \\ \hline Number of chairs per batch & & 50 & 8 \\ \hline Setup labor-hours per batch & & 2.5 hours & 5 hours \\ \hline Budgeted machine hours & & 60,000hrs & 40,000hrs \\ \hline Budgeted direct manufacturing labor & & 100,000hrs & 60,000hrs \\ \hline Budgeted feet of lumber per chair & & 18ft & 25ft \\ \hline \multicolumn{4}{|c|}{ Budgeted Manufacturing Operations Overhead Costs } \\ \hline \multicolumn{4}{|c|}{ Variable costs } \\ \hline Supplies & $40,000 & & \\ \hline Indirect manuf. Labor & 95,000 & & \\ \hline Power & 135,000 & & \\ \hline Maintenance & 125,000 & $395,000 & \\ \hline \multicolumn{4}{|l|}{ Fixed costs } \\ \hline Depreciation & 100,000 & & \\ \hline Supervision & 75,000 & & \\ \hline Power & 20,000 & & \\ \hline Maintenance & 30,000 & $225,000 & \\ \hline \multicolumn{4}{|l|}{ Budgeted Setup Overhead Costs } \\ \hline \multicolumn{4}{|l|}{ Variable costs } \\ \hline Supplies & $85,000 & & \\ \hline Indirect manuf. Labor & 185,000 & & \\ \hline Power & 155,000 & & \\ \hline Inspection costs & 50,000 & $475,000 & \\ \hline \multicolumn{4}{|l|}{ Fixed costs } \\ \hline Depreciation & 65,000 & & \\ \hline Supervision & 80,000 & & \\ \hline Power & 50,000 & & \\ \hline Engineering costs & 30,000 & $225,000 & \\ \hline \end{tabular} \begin{tabular}{lrr} B. Actual information for 2022 that can be traced directly to each product: \\ & \multicolumn{1}{c}{ Plain Chair } & Customized Chair \\ \hline Direct materials used cost & $810,000 & $550,000 \\ Feet of lumber per chair & 18 Feet & 25 Feet \\ Lumber in inventory (12/31/2022) & 60,000 Feet & 25,000 Feet \\ Direct labor cost & $1,800,000 & $1,344,000 \\ Direct labor hours & 100,000 hours & 64,000 \\ Direct labor hours per chair & 2 hours & 6.4 hours \\ Machine hours used in total & 62,500 hours & 42,000 hours \\ Setup labor hours & 2,500 setup lab hrs & 6,500 setup lab hrs \\ Number of batches & 1,000 & 1,250 \\ Chairs per batch & 50 & 8 \\ Total sales commissions & $192,000 & $80,000 \\ Units produced & 50,000 & 10,000 \\ Units sold & 48,000 & 10,000 \\ Chairs in inventory (01/01/2022) & 6,000@$57.50 each & 0 \\ Sales revenue & $3,840,000 & $2,850,000 \end{tabular} C. Additionally, the Chair division had the following actual costs in 2022 that were not directly traced to either product: Actual Manufacturing Overhead Costs - 2022 D. Based on the information you have gathered you also make the following assumptions: - Because of past financial trouble in the division, all expenses must be paid in cash. No sales are made on account (all sales are cash sales). - Information for the 2023 budget is as follows: - The budgeted input quantities for materials, labor and MOH (machine hours and setup labor hours) used in 2022 will also be used in the 2023 budget, except for budgeted DLHr/unit for the custom chair, which is revised up to 6.2DLHrs/ chair. - The cost of Poplar is expected to increase by 8% and Red Oak is expected to increase by 10% in 2023 over 2022 actual costs. - Budgeted labor rates in 2023 are expected to be the same as actual rates in 2022. - Calculate 2023 budgeted variable moh rates and total fixed moh costs from 2022 actual monthly cost and activity data. Use Regression Analysis to determine estimates for variable and monthly fixed costs. Convert monthly estimates of fixed costs into annual costs. - Assume non-cash (e.g., depreciation) MOH item amounts remain unchanged from budgeted 2022 data. - Production and sales forecasts are within the relevant range. - Budgeted period costs: variable costs per unit and fixed costs in total for 2023 are assumed to be the same as actual period costs in 2022 . - A 2% increase in selling price for 2023 is expected for the Plain model and a 3% increase is expected for the Customized model. - Normal costing is used. - There are two cost drivers for manufacturing overhead costs - machine-hours and setup labor-hours. - Machine-hours is the cost driver for the variable portion of manufacturing operations overhead. Machine-hours is also used to allocate the fixed portion of manufacturing operations overhead. - Setup labor-hours is the cost driver for the variable portion of machine setup overhead. Setup laborhours is also used to allocate the fixed portion of machine setup overhead. - Projected sales for the plain chair are 51,250 in 2023, 54,000 in 2024, and 58,000 in 2025. - Projected sales for the customized chair are 10,250 in 2023, 12,000 in 2024, and 14,000 in 2025. - Sales commission is paid as a rate per chair sold. - 2023 input cost and quantity standards for direct material, direct manufacturing labor and manufacturing overhead are the same as 2023 budgeted input costs and quantities. - You require an ending inventory of plain chairs of 10% of next year's total sales needs. Customized chairs are made to order and no inventory of finished goods is planned. - You require an ending raw material inventory of 8% of next year's production needs (for both product lines). - Your beginning 2023 cash balance is $200,000. The company requires a minimum cash balance of $150,000. - Assume a FIFO cost flow - Assume no WIP inventory. 1. What were the 2022 budgeted indirect cost rates for the manufacturing operations activity and the machine setup activity? 2. Was overhead over- or under-applied for the year? By how much? Use @IF statements to indicate under-/over-applied MOH. 3. What was the unit product cost for the plain and customized Chairs under normal costing in 2022? 4. What was the Chair Division's operating income for 2022? Use normal costing and adjust for misapplied MOH. 5. Use the 2022 actual monthly MOH information to calculate annual estimates of cost behavior (fixed and variable components) for each MOH activity. a. Use the High-Low method to separate variable and fixed costs. For this exercise use @VLOOKUP,@MAX, and @MIN excel functions. b. Use the Regression function found under Data: Data Analysis in Excel. Place output on a separate sheet. These estimates will be used for the 2023 budget. 6. For the Manufacturing Operations overhead activity, evaluate the selected cost driver (MHrs) and compare it to the alternative of Direct Labor Hours as the cost driver. Refer to Exhibit 10-19. i.e., run a regression for DLHrs as the cost driver for the Manufacturing Operations activity and compare the results according to the criteria in Ex 10-19. You can ignore the "specification analysis of estimation assumptions' criterion. 7. Calculate the break-even point in units (calculate the number of units of each product required), and the number of units of both products that must be sold to earn an operating income of $200,000. Use 2023 budgeted information - refer to section D bullet point 2 and your results from requirement 5

GSO Furniture, Inc. recently hired your team to head up its chair division. GSO Furniture's chair division produces two products, a plain poplar chair and a customized red oak wood chair that has a finish and carvings chosen by the customer. Customized chairs are a recent innovation for the company and executives are encouraged by the projected sales growth for these chairs. Although the chair division was once the biggest contributor to GSO's success, recently performance has been challenged. It is your job to return the division to its former glory. In response to demands for more relevant costing information your predecessor introduced an ABC system. Two key production activities, 1) manufacturing operations and 2) machine setups, were identified. Production costs related to these activities are now assigned to the two lines of chairs based on the cost drivers of 1) machine-hours and 2) setup labor-hours, respectively. The old product costing system allocated all manufacturing overhead based on direct manufacturing labor hours. Your predecessor argued for a move to ABC because production runs for the custom chairs take longer to setup and allocating setup costs based on setup labor-hours better represents resources consumed by the two chair lines. The chair division is growing in complexity and part of your job is to manage and explain the more advanced accounting information systems used within the division. Cost leadership had been the focus of GSO's strategy in recent years. This approach had been called into question with the rise of the custom chair, which commanded and achieved a premium price. Customers appeared to pay limited attention to price increases for the custom chair. However, it was a different matter with established customers for the plain chair. These customers were grumbling about GSO prices and threatening to defect to the competition, especially those producers who concentrated solely on the plain chair market. An added challenge for GSO was the internal disputes amongst production and marketing managers. Disputes circled around slow response to marketing demands for expedited complex rush orders on the one hand and disruptive, short production runs causing inefficiencies in manufacturing on the other. These disputes were diverting attention away from the traditional plain chair market. After carefully arranging your corner office, you ask your assistant for the division's budget for 2023. To your dismay you are told that the division's records are in disarray and the budget can't be located. Since you are short on time you decide to use the information from the last year's (2022) records to conduct an initial examination of the division. These records include some budget estimates assembled before the start of 2022, and actual information for the year 2022. A. Budget information assembled at the start of 2022 \begin{tabular}{|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Plain chair } & \multirow{2}{*}{ Customized chair } \\ \hline Budgeted production & & 50,000 & \\ \hline Number of chairs per batch & & 50 & 8 \\ \hline Setup labor-hours per batch & & 2.5 hours & 5 hours \\ \hline Budgeted machine hours & & 60,000hrs & 40,000hrs \\ \hline Budgeted direct manufacturing labor & & 100,000hrs & 60,000hrs \\ \hline Budgeted feet of lumber per chair & & 18ft & 25ft \\ \hline \multicolumn{4}{|c|}{ Budgeted Manufacturing Operations Overhead Costs } \\ \hline \multicolumn{4}{|c|}{ Variable costs } \\ \hline Supplies & $40,000 & & \\ \hline Indirect manuf. Labor & 95,000 & & \\ \hline Power & 135,000 & & \\ \hline Maintenance & 125,000 & $395,000 & \\ \hline \multicolumn{4}{|l|}{ Fixed costs } \\ \hline Depreciation & 100,000 & & \\ \hline Supervision & 75,000 & & \\ \hline Power & 20,000 & & \\ \hline Maintenance & 30,000 & $225,000 & \\ \hline \multicolumn{4}{|l|}{ Budgeted Setup Overhead Costs } \\ \hline \multicolumn{4}{|l|}{ Variable costs } \\ \hline Supplies & $85,000 & & \\ \hline Indirect manuf. Labor & 185,000 & & \\ \hline Power & 155,000 & & \\ \hline Inspection costs & 50,000 & $475,000 & \\ \hline \multicolumn{4}{|l|}{ Fixed costs } \\ \hline Depreciation & 65,000 & & \\ \hline Supervision & 80,000 & & \\ \hline Power & 50,000 & & \\ \hline Engineering costs & 30,000 & $225,000 & \\ \hline \end{tabular} \begin{tabular}{lrr} B. Actual information for 2022 that can be traced directly to each product: \\ & \multicolumn{1}{c}{ Plain Chair } & Customized Chair \\ \hline Direct materials used cost & $810,000 & $550,000 \\ Feet of lumber per chair & 18 Feet & 25 Feet \\ Lumber in inventory (12/31/2022) & 60,000 Feet & 25,000 Feet \\ Direct labor cost & $1,800,000 & $1,344,000 \\ Direct labor hours & 100,000 hours & 64,000 \\ Direct labor hours per chair & 2 hours & 6.4 hours \\ Machine hours used in total & 62,500 hours & 42,000 hours \\ Setup labor hours & 2,500 setup lab hrs & 6,500 setup lab hrs \\ Number of batches & 1,000 & 1,250 \\ Chairs per batch & 50 & 8 \\ Total sales commissions & $192,000 & $80,000 \\ Units produced & 50,000 & 10,000 \\ Units sold & 48,000 & 10,000 \\ Chairs in inventory (01/01/2022) & 6,000@$57.50 each & 0 \\ Sales revenue & $3,840,000 & $2,850,000 \end{tabular} C. Additionally, the Chair division had the following actual costs in 2022 that were not directly traced to either product: Actual Manufacturing Overhead Costs - 2022 D. Based on the information you have gathered you also make the following assumptions: - Because of past financial trouble in the division, all expenses must be paid in cash. No sales are made on account (all sales are cash sales). - Information for the 2023 budget is as follows: - The budgeted input quantities for materials, labor and MOH (machine hours and setup labor hours) used in 2022 will also be used in the 2023 budget, except for budgeted DLHr/unit for the custom chair, which is revised up to 6.2DLHrs/ chair. - The cost of Poplar is expected to increase by 8% and Red Oak is expected to increase by 10% in 2023 over 2022 actual costs. - Budgeted labor rates in 2023 are expected to be the same as actual rates in 2022. - Calculate 2023 budgeted variable moh rates and total fixed moh costs from 2022 actual monthly cost and activity data. Use Regression Analysis to determine estimates for variable and monthly fixed costs. Convert monthly estimates of fixed costs into annual costs. - Assume non-cash (e.g., depreciation) MOH item amounts remain unchanged from budgeted 2022 data. - Production and sales forecasts are within the relevant range. - Budgeted period costs: variable costs per unit and fixed costs in total for 2023 are assumed to be the same as actual period costs in 2022 . - A 2% increase in selling price for 2023 is expected for the Plain model and a 3% increase is expected for the Customized model. - Normal costing is used. - There are two cost drivers for manufacturing overhead costs - machine-hours and setup labor-hours. - Machine-hours is the cost driver for the variable portion of manufacturing operations overhead. Machine-hours is also used to allocate the fixed portion of manufacturing operations overhead. - Setup labor-hours is the cost driver for the variable portion of machine setup overhead. Setup laborhours is also used to allocate the fixed portion of machine setup overhead. - Projected sales for the plain chair are 51,250 in 2023, 54,000 in 2024, and 58,000 in 2025. - Projected sales for the customized chair are 10,250 in 2023, 12,000 in 2024, and 14,000 in 2025. - Sales commission is paid as a rate per chair sold. - 2023 input cost and quantity standards for direct material, direct manufacturing labor and manufacturing overhead are the same as 2023 budgeted input costs and quantities. - You require an ending inventory of plain chairs of 10% of next year's total sales needs. Customized chairs are made to order and no inventory of finished goods is planned. - You require an ending raw material inventory of 8% of next year's production needs (for both product lines). - Your beginning 2023 cash balance is $200,000. The company requires a minimum cash balance of $150,000. - Assume a FIFO cost flow - Assume no WIP inventory. 1. What were the 2022 budgeted indirect cost rates for the manufacturing operations activity and the machine setup activity? 2. Was overhead over- or under-applied for the year? By how much? Use @IF statements to indicate under-/over-applied MOH. 3. What was the unit product cost for the plain and customized Chairs under normal costing in 2022? 4. What was the Chair Division's operating income for 2022? Use normal costing and adjust for misapplied MOH. 5. Use the 2022 actual monthly MOH information to calculate annual estimates of cost behavior (fixed and variable components) for each MOH activity. a. Use the High-Low method to separate variable and fixed costs. For this exercise use @VLOOKUP,@MAX, and @MIN excel functions. b. Use the Regression function found under Data: Data Analysis in Excel. Place output on a separate sheet. These estimates will be used for the 2023 budget. 6. For the Manufacturing Operations overhead activity, evaluate the selected cost driver (MHrs) and compare it to the alternative of Direct Labor Hours as the cost driver. Refer to Exhibit 10-19. i.e., run a regression for DLHrs as the cost driver for the Manufacturing Operations activity and compare the results according to the criteria in Ex 10-19. You can ignore the "specification analysis of estimation assumptions' criterion. 7. Calculate the break-even point in units (calculate the number of units of each product required), and the number of units of both products that must be sold to earn an operating income of $200,000. Use 2023 budgeted information - refer to section D bullet point 2 and your results from requirement 5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started