Answered step by step

Verified Expert Solution

Question

1 Approved Answer

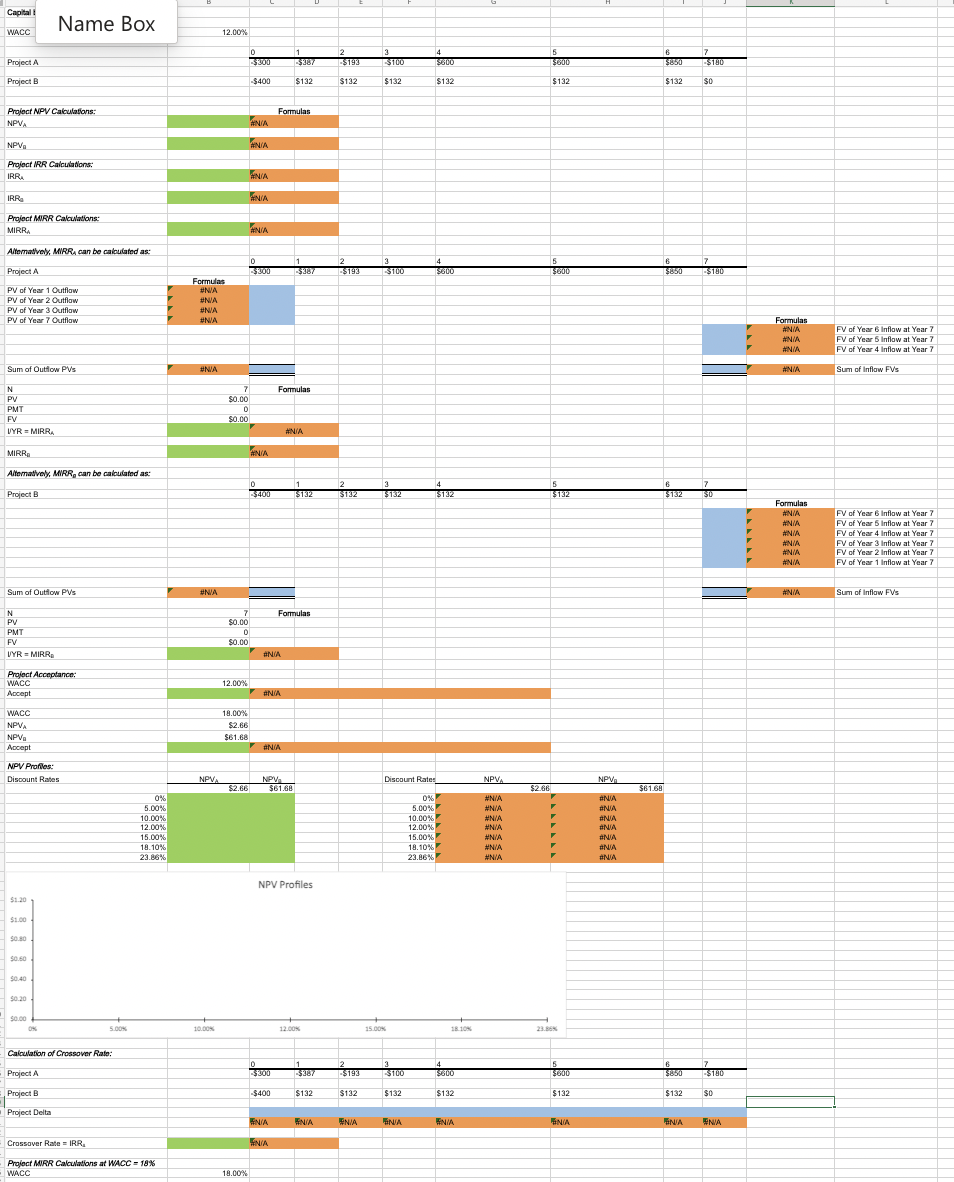

I've DONE Project A, just need PROJECT B. Capial I Name Box Project A Project B Proloct NPV Calculations: NPV VA NPV Prajoct IRR Calculations:

I've DONE Project A, just need PROJECT B.

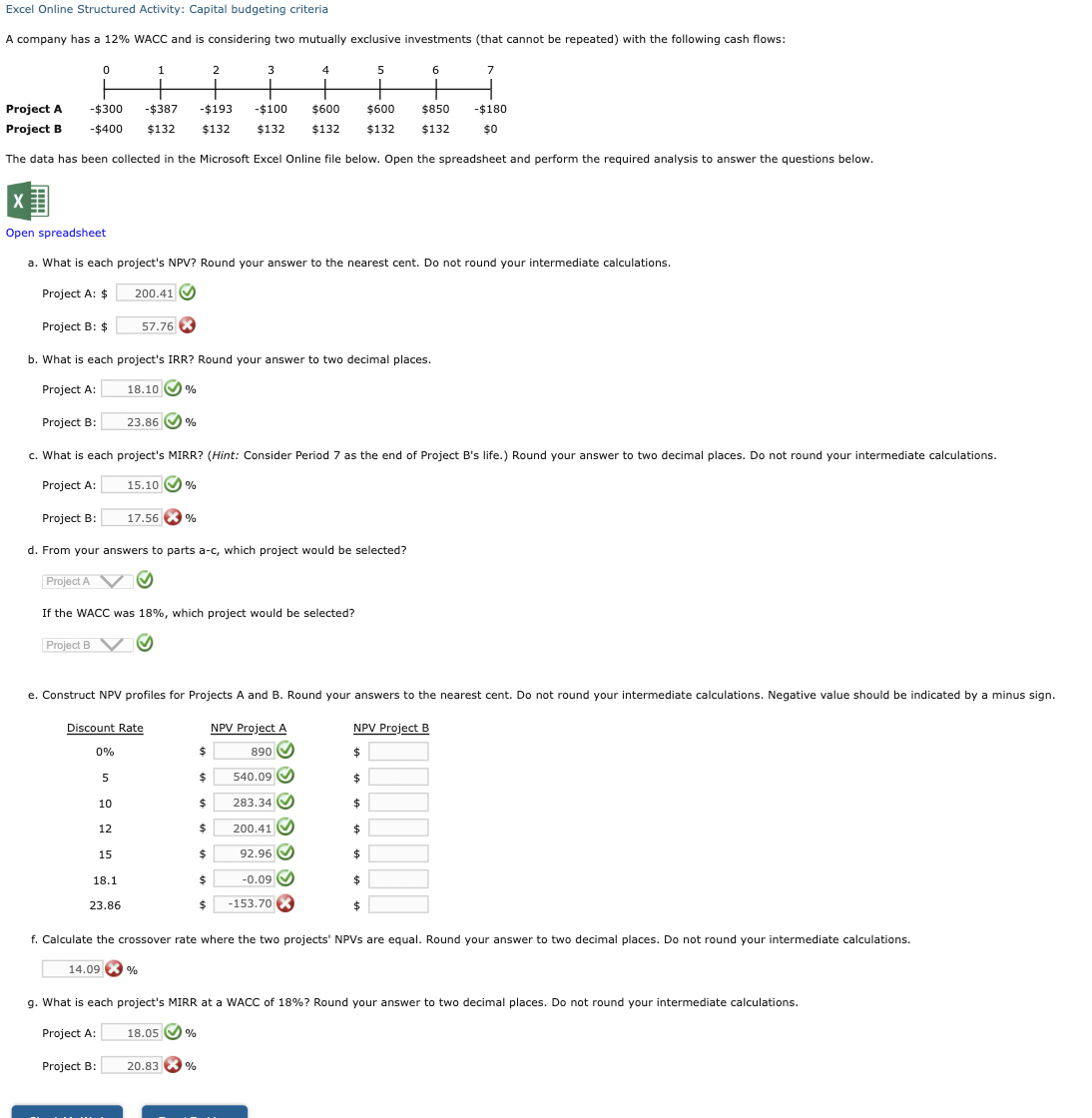

Capial I Name Box Project A Project B Proloct NPV Calculations: NPV VA NPV Prajoct IRR Calculations: IRRa IRRa Proloct MWRR Calculations: MIRR Aftematlvoly, MNRR, can be cakulated as: Project A PV of Year 1 Outflaw PV of Year 2 Outflow PV of 'Year 3 Outflaw PV of Year 7 Outflaw Sum of Outliow PV/s PVN PMT VYR=MIRRh MIRR Altomativoly, MNRR can be cakulatod as: Project B Sum of Outflow PVs PVN PMT FV Praloct Accoptance: WACC WACC NPVA NPVI Apcept NPV Prafies: Discount Rates Discount Rates = + 12.00% Formulas FNiA HNiA SWiA GNiA FNiA + + Excel Online Structured Activity: Capital budgeting criteria A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: \$ Project B: \$ b. What is each project's IRR? Round your answer to two decimal places. Project A: % Project B: % Project A: % Project B: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? % g. What is each project's MIRR at a WACC of 18% ? Round your answer to two decimal places. Do not round your intermediate calculations

Capial I Name Box Project A Project B Proloct NPV Calculations: NPV VA NPV Prajoct IRR Calculations: IRRa IRRa Proloct MWRR Calculations: MIRR Aftematlvoly, MNRR, can be cakulated as: Project A PV of Year 1 Outflaw PV of Year 2 Outflow PV of 'Year 3 Outflaw PV of Year 7 Outflaw Sum of Outliow PV/s PVN PMT VYR=MIRRh MIRR Altomativoly, MNRR can be cakulatod as: Project B Sum of Outflow PVs PVN PMT FV Praloct Accoptance: WACC WACC NPVA NPVI Apcept NPV Prafies: Discount Rates Discount Rates = + 12.00% Formulas FNiA HNiA SWiA GNiA FNiA + + Excel Online Structured Activity: Capital budgeting criteria A company has a 12% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: \$ Project B: \$ b. What is each project's IRR? Round your answer to two decimal places. Project A: % Project B: % Project A: % Project B: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? % g. What is each project's MIRR at a WACC of 18% ? Round your answer to two decimal places. Do not round your intermediate calculations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started