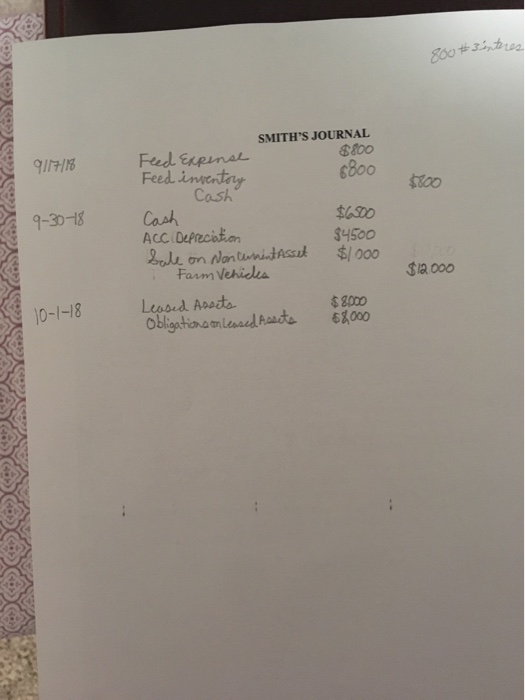

Ive done what I know how to do but now Im stuck. Can someone please help?

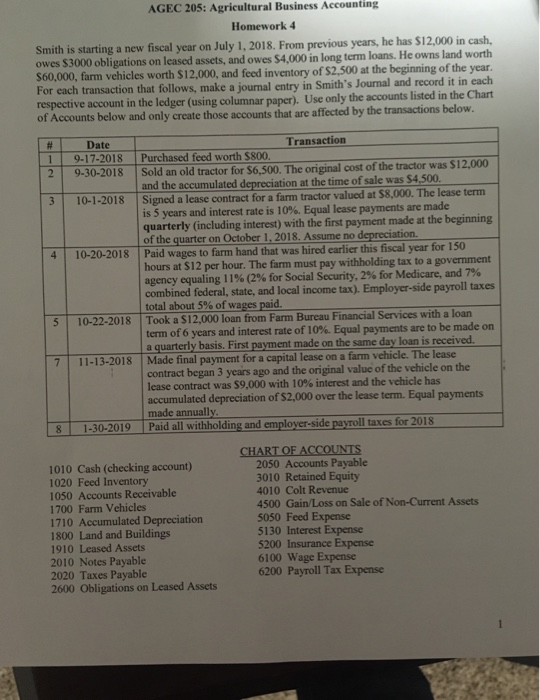

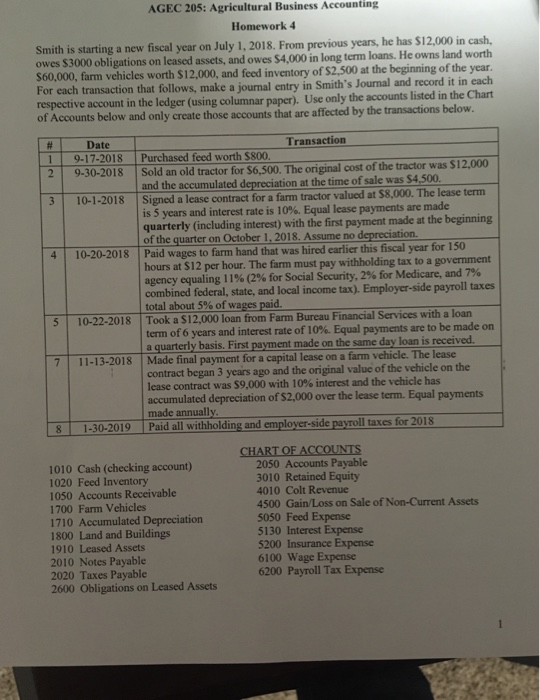

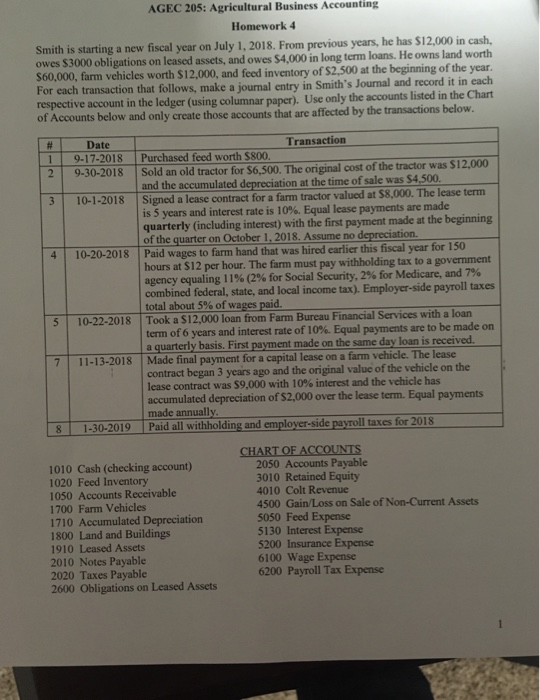

AGEC 205: Agricultural Business Accounting Homework 4 Smith is starting a new fiscal year on July 1, 2018. From previous years, he has $12.000 in cash. owes $3000 obligations on leased assets, and owes $4,000 in long term loans. He owns land worth $60,000, farm vehicles worth $12,000, and feed inventory of $2,500 at the beginning of the year. For each transaction that follows, make a journal entry in Smith's Journal and record it in each respective account in the ledger (using columnar paper). Use only the accounts listed in the Chart of Accounts below and only create those accounts that are affected by the transactions below. 1 2 9 9 Date -17-2018 -30-2018 31 10-1-2018 10-20-2018 Transaction Purchased feed worth $800. Sold an old tractor for $6.500. The original cost of the tractor was $12,000 and the accumulated depreciation at the time of sale was $4,500. Signed a lease contract for a farm tractor valued at $8,000. The lease term is 5 years and interest rate is 10%. Equal lease payments are made quarterly including interest) with the first payment made at the beginning of the quarter on October 1, 2018. Assume no depreciation. Paid wages to farm hand that was hired earlier this fiscal year for 150 hours at $12 per hour. The farm must pay withholding tax to a government agency equaling 11% (2% for Social Security, 2% for Medicare, and 7% combined federal, state, and local income tax). Employer-side payroll taxes total about 5% of wages paid. Took a S12,000 loan from Farm Bureau Financial Services with a loan term of 6 years and interest rate of 10%. Equal payments are to be made on a quarterly basis. First payment made on the same day loan is received Made final payment for a capital lease on a farm vehicle. The lease contract began 3 years ago and the original value of the vehicle on the lease contract was $9,000 with 10% interest and the vehicle has accumulated depreciation of S2,000 over the lease term. Equal payments made annually. Paid all withholding and employer-side payroll taxes for 2018 5 10-22-2018 7 11-13-2018 8 8 1-30-2019 1-30-2019 Paide un 1010 Cash (checking account) 1020 Feed Inventory 1050 Accounts Receivable 1700 Farm Vehicles 1710 Accumulated Depreciation 1800 Land and Buildings 1910 Leased Assets 2010 Notes Payable 2020 Taxes Payable 2600 Obligations on Leased Assets CHART OF ACCOUNTS 2050 Accounts Payable 3010 Retained Equity 4010 Colt Revenue 4500 Gain Loss on Sale of Non-Current Assets 5050 Feed Expense 5130 Interest Expense 5200 Insurance Expense 6100 Wage Expense 6200 Payroll Tax Expense 800#senteres 9117/18 Fred Expense Feed inventory - Cash SMITH'S JOURNAL $800 6800 $800 9-30-18 Cash $6500 $4500 $1000 $12000 ACC Depreciation Sale on Noncernent Asset Farm Vehicles Leased Assets obligations on leased Assets 10-1-18 $8.000 $8,000 SMITH'S LEDGER