Answered step by step

Verified Expert Solution

Question

1 Approved Answer

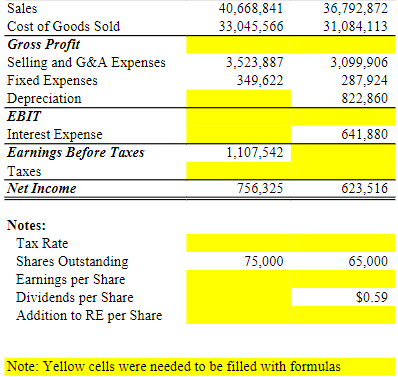

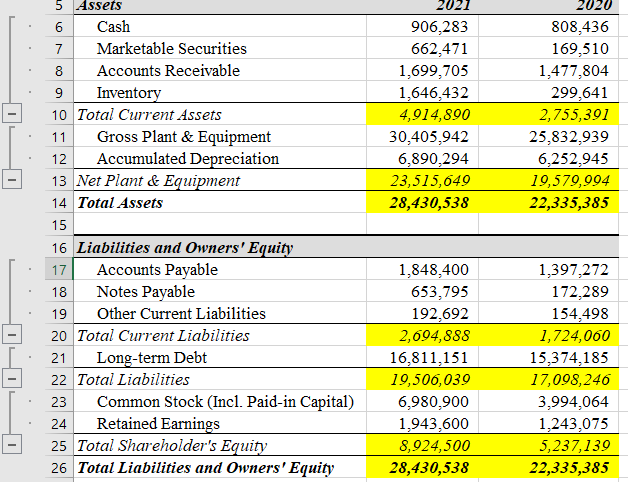

IVE INCLUDED ALL OF MY WORK FROM THE BALANCE SHEET I HOPE THIS HELPS?? PLS INCLUDE FORMULAS ALL OF THIS WILL BE USELESS IF I

IVE INCLUDED ALL OF MY WORK FROM THE BALANCE SHEET I HOPE THIS HELPS??

PLS INCLUDE FORMULAS ALL OF THIS WILL BE USELESS IF I DONT KNOW HOW TO CALCULATE ANY OF IT. THANKS

40.668,841 33,045,566 36,792,872 31,084,113 3,523,887 349,622 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net Income 3,099,906 287,924 822,860 641,880 1.107.542 756,325 623,516 Notes: Tax Rate Shares Outstanding Earnings per Share Dividends per Share Addition to RE per Share 75,000 65,000 $0.59 Note: Yellow cells were needed to be filled with formulas 6 2021 906,283 662,471 1,699,705 1,646,432 4,914,890 30,405,942 6,890,294 23,515,649 28,430,538 2020 808,436 169,510 1,477,804 299,641 2,755,391 25,832,939 6,252.945 19,579,994 22,335,385 - - 5 Assets Cash 7 Marketable Securities 8 Accounts Receivable 9 Inventory 10 Total Current Assets 11 Gross Plant & Equipment 12 Accumulated Depreciation 13 Net Plant & Equipment 14 Total Assets 15 16 Liabilities and Owners' Equity 17 Accounts Payable 18 Notes Payable 19 Other Current Liabilities 20 Total Current Liabilities 21 Long-term Debt 22 Total Liabilities 23 Common Stock (Incl. Paid-in Capital) 24 Retained Earnings 25 Total Shareholder's Equity 26 Total Liabilities and Owners' Equity 1,848,400 653,795 192,692 2,694,888 16,811,151 19,506,039 6,980,900 1,943,600 8,924,500 28,430,538 1,397,272 172,289 154,498 1,724,060 15,374,185 17,098,246 3,994,064 1,243,075 5,237,139 22,335,385Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started