Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I've searched on Chegg for this, i see some of the examples but they don't help because when i type them in it shows as

I've searched on Chegg for this, i see some of the examples but they don't help because when i type them in it shows as wrong, i need help with 2017,2018, and 2019 Please

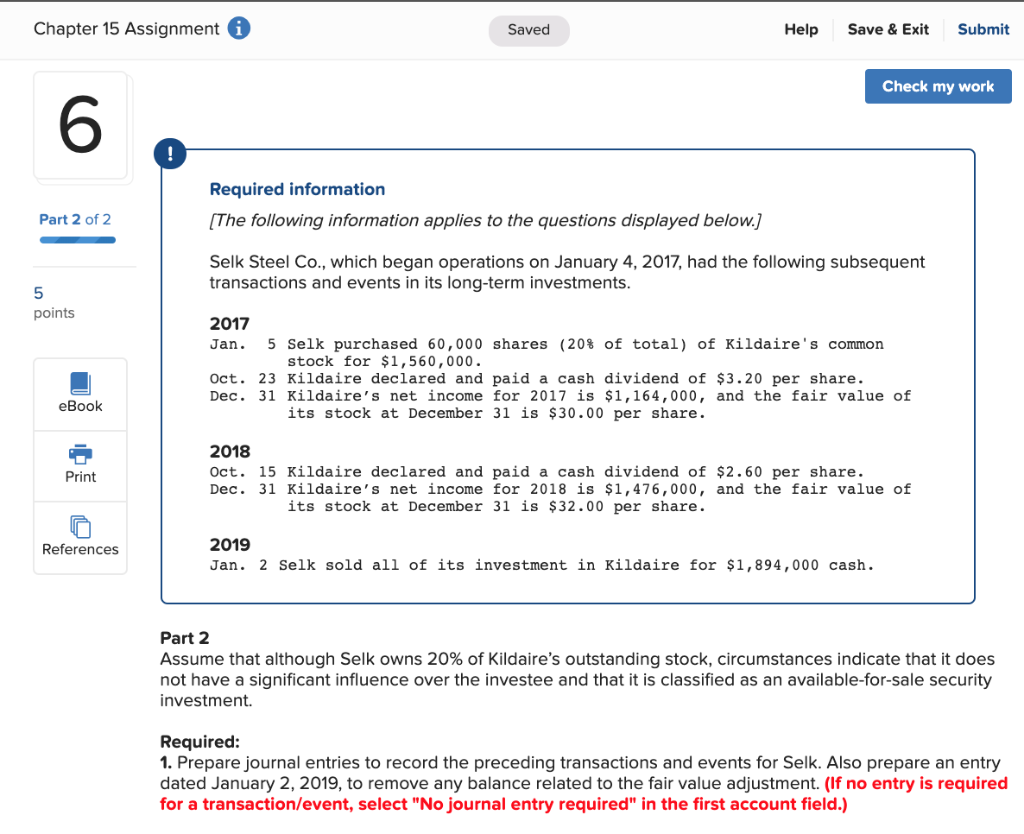

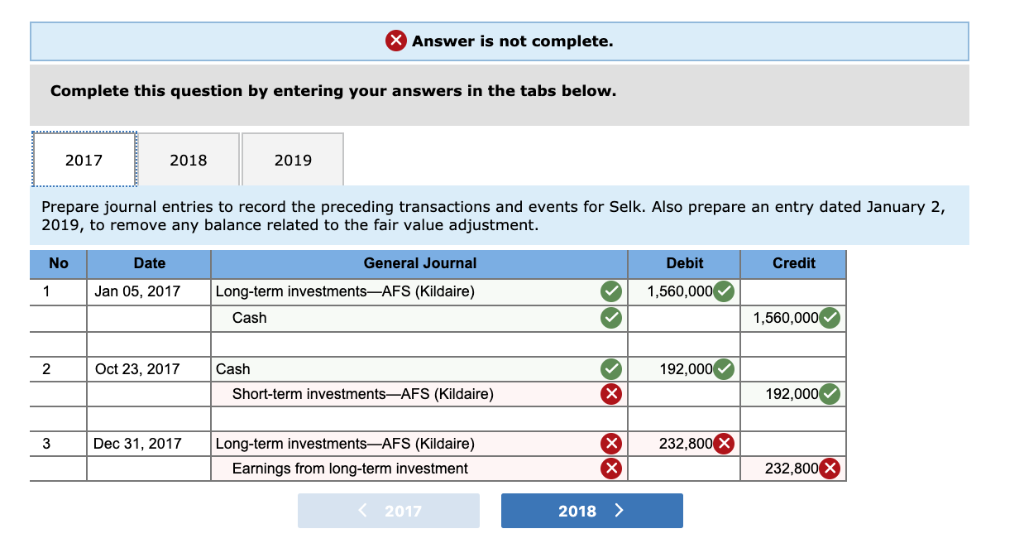

Chapter 15 Assignment i Saved Help Save & Exit Submit Check my work Required information (The following information applies to the questions displayed below.] Part 2 of 2 Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. points 2017 Jan. 5 Selk purchased 60,000 shares (20% of total) of Kildaire's common stock for $1,560,000. Oct. 23 Kildaire declared and paid a cash dividend of $3.20 per share. Dec. 31 Kildaire's net income for 2017 is $1,164,000, and the fair value of its stock at December 31 is $30.00 per share. eBook Print 2018 Oct. 15 Kildaire declared and paid a cash dividend of $2.60 per share. Dec. 31 Kildaire's net income for 2018 is $1,476,000, and the fair value of its stock at December 31 is $32.00 per share. References 2019 Jan. 2 Selk sold all of its investment in Kildaire for $1,894,000 cash. Part 2 Assume that although Selk owns 20% of Kildaire's outstanding stock, circumstances indicate that it does not have a significant influence over the investee and that it is classified as an available-for-sale security investment. Required: 1. Prepare journal entries to record the preceding transactions and events for Selk. Also prepare an entry dated January 2, 2019, to remove any balance related to the fair value adjustment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) X Answer is not complete. Complete this question by entering your answers in the tabs below. 2017 2018 2019 Prepare journal entries to record the preceding transactions and events for Selk. Also prepare an entry dated January 2, 2019, to remove any balance related to the fair value adjustment. No Credit Date Jan 05, 2017 General Journal Long-term investmentsAFS (Kildaire) Cash Debit 1,560,000 1,560,000 Oct 23, 2017 192,000 Cash Short-term investments-AFS (Kildaire) 192,000 Dec 31, 2017 + 232,800 x Long-term investments AFS (Kildaire) | Earnings from long-term investment 232,800 XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started