Answered step by step

Verified Expert Solution

Question

1 Approved Answer

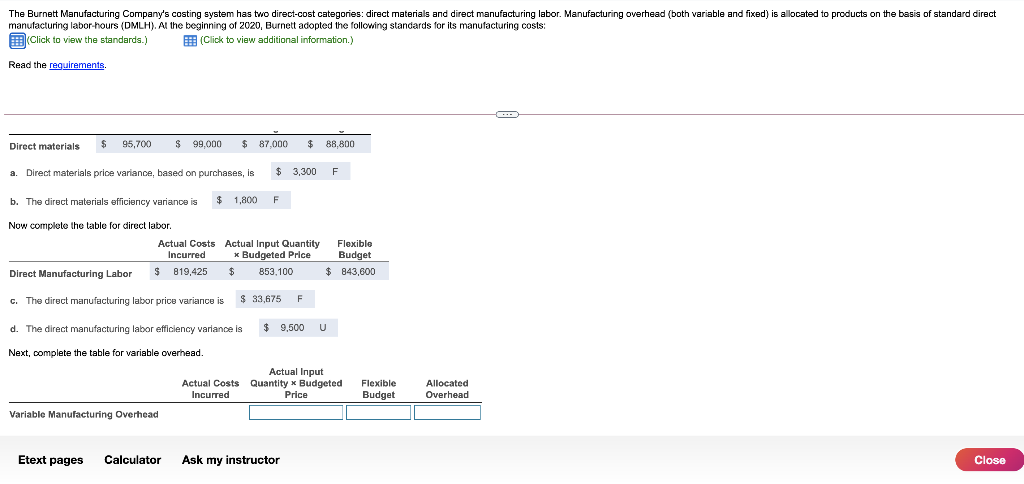

I've updated it. I've given everything that was stated. Need help with the Variable Man. Overhead table. Work shown would be appreciated. Thanks! X Data

I've updated it. I've given everything that was stated. Need help with the Variable Man. Overhead table. Work shown would be appreciated. Thanks!

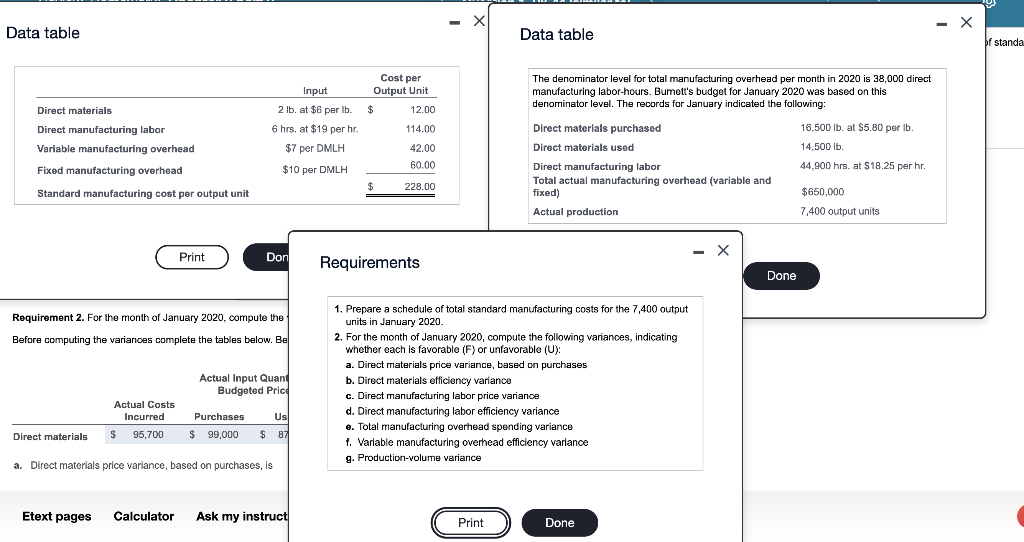

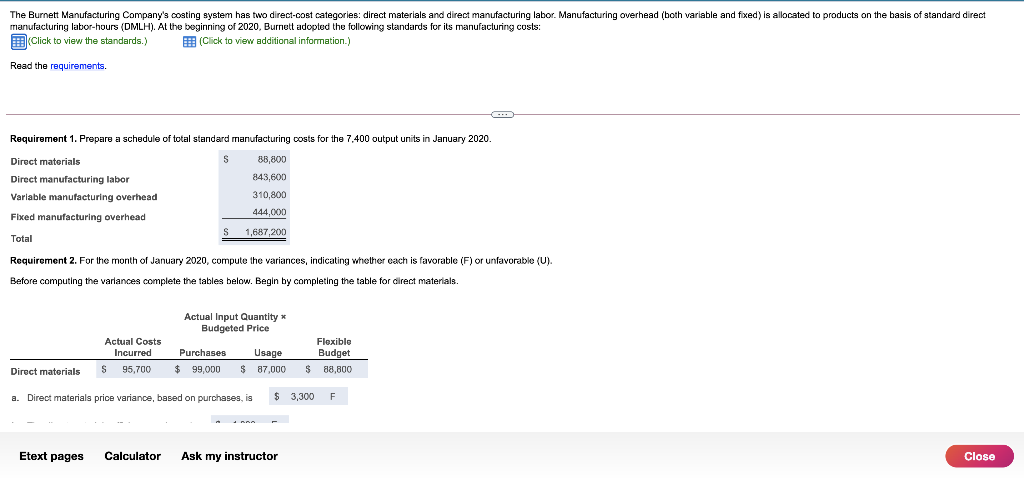

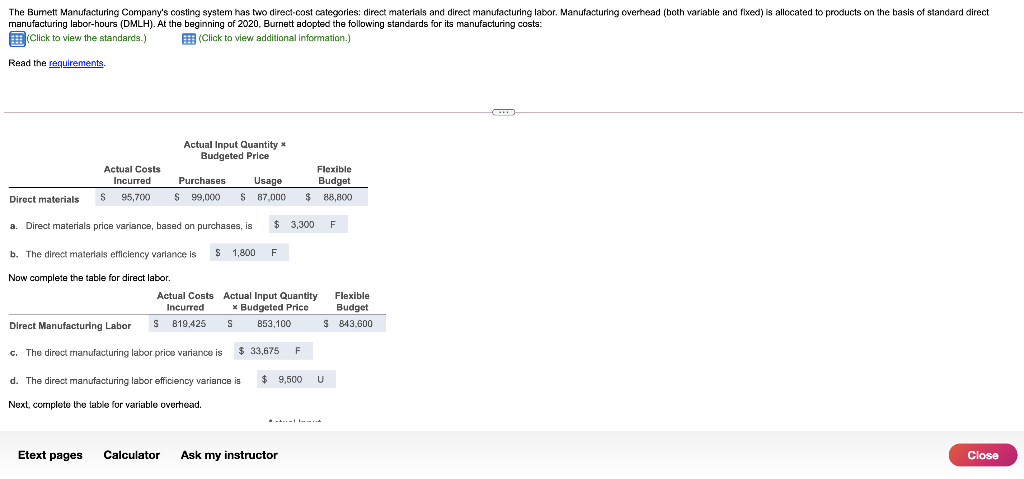

X Data table Data table bf standa Cost per Output Unit Direct materials $ 12.00 Input 2 lb. at $6 per Ib. 6 hrs. at $19 per hr $7 per DMLH 7 $10 per DMLH Direct manufacturing labor Variable manufacturing overhead 114.00 42.00 60.00 The denominator level for total manufacturing overhead per month in 2020 is 38,000 direct manufacturing labor-hours. Bumett's budget for January 2020 was based on this denominator level. The records for January indicated the following: Direct materials purchased 16.500 lb. at $5.80 per lb Direct materials used 14,500 lb. Direct manufacturing labor 44,900 hrs. at $18.25 per hr. Total actual manufacturing overhead (variable and fixed) $650,000 Actual production 7.400 output units Fixed manufacturing overhead Standard manufacturing cost per output unit $ 228.00 - X - X Print Don Requirements Done Requirement 2. For the month of January 2020, compute the Before computing the variances complete the tables below. Be Actual Input Quant Budgeted Price 1. Prepare a schedule of total standard manufacturing costs for the 7,400 output units in January 2020. 2. For the month of January 2020, compute the following variances, indicating whether each is favorable (F) or unfavorable (U): a. Direct materials price variance, based on purchases b. Direct materials efficiency variance . c. Direct manufacturing labor price variance d. Direct manufacturing labor efficiency variance e. Total manufacturing overhead spending variance f. Variable manufacturing overhead efficiency variance g. Production-volume variance Actual Costs Incurred $ 95,700 Us Purchases $ 99,000 Direct materials $ 87 a. Direct materials price variance, based on purchases, is Etext pages Calculator Ask my instruct Print Done The Burnett Manufacturing Company's coating system has two direct-cost categories: direct materials and direct manufacturing labor. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of standard direct manufacturing labor-hours (DMLH). At the beginning of 2020, Burnett adopted the following standards for its manufacturing costs: Click to view the standards.) (Click to view additional information.) Read the requirements Requirement 1. Prepare a schedule of total standard manufacturing costs for the 7.400 output units in January 2020. S 88,800 Direct materials Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead 843,600 310,800 444,000 S 1,687,200 Total Requirement 2. For the month of January 2020, compute the variances, indicating whether cach is favorable (F) or unfavorable (U). , , F Before computing the variances complete the tables below. Begin by completing the table for direct materials. Actual Input Quantity* Budgeted Price Actual Costs Incurred S 95,700 Flexible Budget Purchases $ 99,000 Usage $ 87,000 Direct materials $ 88,800 a. Direct materials price variance, based on purchases, is $ 3,300 F RAS Etext pages Calculator Ask my instructor Close The Bumett Manufacturing Company's costing system has two direct cost categories: direct materials and direct manufacturing labor. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of standard direct manufacturing labor-hours (DMLH). At the beginning of 2020. Burnett adopted the following standards for its manufacturing costs: Click to view the standards.) (Click to view additional information. Read the requirements, Actual Input Quantity* Budgeted Price Actual Costs Incurred S S 95,700 Purchases Usage 87,000 Flexible Budget $ $ 88,800 Direct materials $ 99,000 S $ a. Direct materials price variance, based on purchases, is $ 3,300 F b. The direct materials efficiency variance is $ 1,800 F Now complete the table for direct labor. Actual Costs Actual Input Quantity Flexible Incurred Budgeted Price Budget Direct Manufacturing Labor S 819,425 S 853,100 $ 843.600 C. The direct manufacturing labor price variance is $ 33,675 F . d. The direct manufacturing labor efficiency variance is $ 9,500 U Next, complete the table for variable overhead. Etext pages Calculator Ask my instructor Close The Burnett Manufacturing Company's costing system has two direct-cost categories: direct materials and direct manufacturing labor. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of standard direct manufacturing labor hours (DMLH). At the beginning of 2020, Burnett adopted the following standards for its manufacturing costs: Click to view the standards.) (Click to view additional information.) Read the requirements, Direct materials $ 95,700 $ 99,000 $ 87.000 $ 88,800 a. a. Direct materials price variance, based on purchases, is $ 3,300 F b. The direct materials efficiency variance is $ 1,800 F Now complete the table for direct labor. Actual Costs Actual Input Quantity Incurred * Budgeted Price Direct Manufacturing Labor $ 819,425 $ 853,100 Flexible Budget $ 843,600 $ 33,675 F C. The direct manufacturing labor price variance is d. The direct manufacturing labor efficiency variance is $ 9,500 U Next, complete the table for variable overhead. Actual Input Actual Costs Quantity * Budgeted Incurred Price Variable Manufacturing Overhead Flexible Budget Allocated Overhead Etext pages Calculator Ask my instructor CloseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started