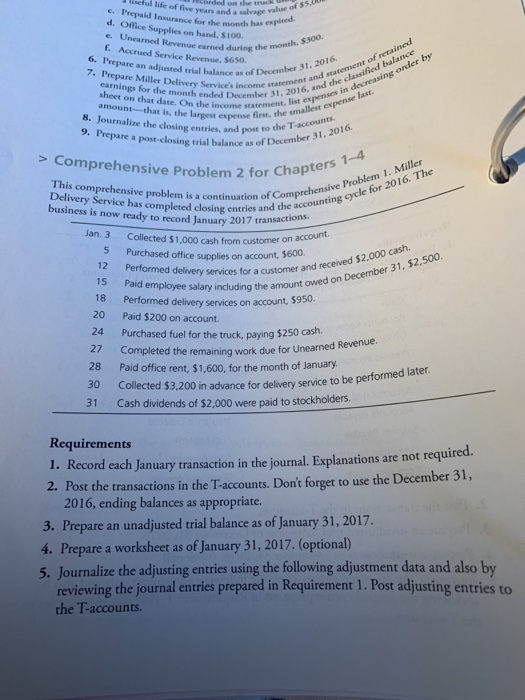

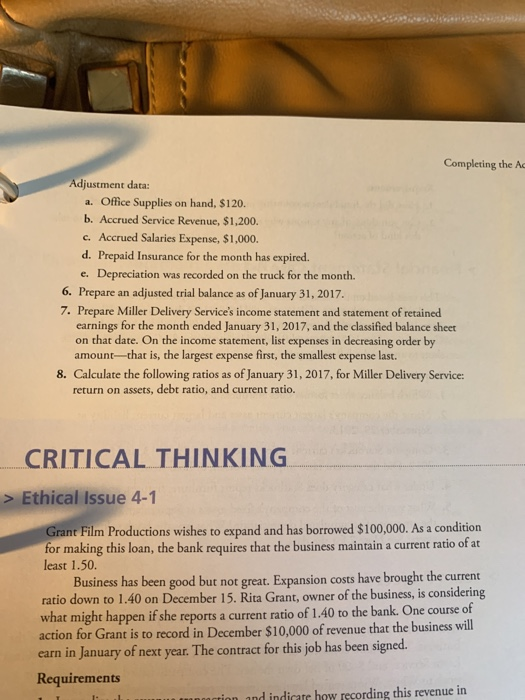

J liseful life of five years and a salvage c. Prepaid Insurance for the month has d. Office Supplies on hand, $100. e. Unearned Revenue earned during the f. Accrued Service Revenue, $650. earned during the month. Servi i1. 2016.f 7. Prepare Miller Delivery Service's income sa2016, ant 6. Prepare an adjusted trial balance as of earnings for the month ended Decembe t, list expenses in deite expense last sheet on that date. On the income statem the smallet amount-that is, the largest expense first. accoun016 eement and statement of retained 8. Journalize the closing entries, and post to 9. Prepare a post-closing trial balance as of > Comprehensive Problem 2 for December 31, 2016. Chapters 1-4 em 2 f This comprehensive problem is a continuation of Com cong Delivery Service has completed closing entries anacions business is now ready to record January 2017 transa e accounting cycle for 2016. The ntries anhenive Problem 1. Miller ct Jan. 3 Collected $1,000 cash from customer on account 5 Purchased office supplies on account, $600 12 and received S2.000 cash. owed on December 31, $2,500 Performed delivery services for a customer Paid employee salary including the amount 15 18 Performed delivery services on account. 5950. Perfomed dele slanyning 20 24 27 28 30 Paid $200 on account. Purchased fuel for the truck, paying $250 cash. Completed the Paid office rent, $1,600, for the month of January. remaining work due for Unearned Revenue Collected $3,200 in advance for delivery service to be delivery service to be performed later 31 Cash dividends of $2,000 were paid to stockholders. Requirements I. Record each January transaction in the journal. Explanations are not required. 2. Post the transactions in the Taccounts. Don't forget to use the December 31, 2016, ending balances as appropriate. 3. Prepare an unadjusted trial balance as of January 31, 2017 4. Prepare a worksheet as of January 31, 2017. (optional) 5. Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts Completing the A Adjustment data a. Office Supplies on hand, $120. b. Accrued Service Revenue, $1,200. c. Accrued Salaries Expense, $1,000. d. Prepaid Insurance for the month has expired. e. Depreciation was recorded on the truck for the month. 6. Prepare an adjusted trial balance as of January 31, 2017. 7. Prepare Miller Delivery Service's income statement and statement of retained earnings for the month ended January 31, 2017, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount-that is, the largest expense first, the smallest expense last. 8. Calculate the following ratios as of January 31, 2017, for Miller Delivery Service: return on assets, debt ratio, and current ratio. CRITICAL THINKING > Ethical Issue 4-1 t Film Productions wishes to expand and has borrowed $100,000. As a condition for making this loan, the bank requires that the business maintain a current ratio of at least 1.50. Business has been good but not great. Expansion costs have brought the current ratio down to 1.40 on December 15. Rita Grant, owner of the business, is considering what might happen if she reports a current ratio of 1.40 to the bank. One course of action for Grant is to record in December $10,000 of revenue that the business will earn in January of next year. The contract for this job has been signed. Requirements ction and indicate how recording this revenue in J liseful life of five years and a salvage c. Prepaid Insurance for the month has d. Office Supplies on hand, $100. e. Unearned Revenue earned during the f. Accrued Service Revenue, $650. earned during the month. Servi i1. 2016.f 7. Prepare Miller Delivery Service's income sa2016, ant 6. Prepare an adjusted trial balance as of earnings for the month ended Decembe t, list expenses in deite expense last sheet on that date. On the income statem the smallet amount-that is, the largest expense first. accoun016 eement and statement of retained 8. Journalize the closing entries, and post to 9. Prepare a post-closing trial balance as of > Comprehensive Problem 2 for December 31, 2016. Chapters 1-4 em 2 f This comprehensive problem is a continuation of Com cong Delivery Service has completed closing entries anacions business is now ready to record January 2017 transa e accounting cycle for 2016. The ntries anhenive Problem 1. Miller ct Jan. 3 Collected $1,000 cash from customer on account 5 Purchased office supplies on account, $600 12 and received S2.000 cash. owed on December 31, $2,500 Performed delivery services for a customer Paid employee salary including the amount 15 18 Performed delivery services on account. 5950. Perfomed dele slanyning 20 24 27 28 30 Paid $200 on account. Purchased fuel for the truck, paying $250 cash. Completed the Paid office rent, $1,600, for the month of January. remaining work due for Unearned Revenue Collected $3,200 in advance for delivery service to be delivery service to be performed later 31 Cash dividends of $2,000 were paid to stockholders. Requirements I. Record each January transaction in the journal. Explanations are not required. 2. Post the transactions in the Taccounts. Don't forget to use the December 31, 2016, ending balances as appropriate. 3. Prepare an unadjusted trial balance as of January 31, 2017 4. Prepare a worksheet as of January 31, 2017. (optional) 5. Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts Completing the A Adjustment data a. Office Supplies on hand, $120. b. Accrued Service Revenue, $1,200. c. Accrued Salaries Expense, $1,000. d. Prepaid Insurance for the month has expired. e. Depreciation was recorded on the truck for the month. 6. Prepare an adjusted trial balance as of January 31, 2017. 7. Prepare Miller Delivery Service's income statement and statement of retained earnings for the month ended January 31, 2017, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount-that is, the largest expense first, the smallest expense last. 8. Calculate the following ratios as of January 31, 2017, for Miller Delivery Service: return on assets, debt ratio, and current ratio. CRITICAL THINKING > Ethical Issue 4-1 t Film Productions wishes to expand and has borrowed $100,000. As a condition for making this loan, the bank requires that the business maintain a current ratio of at least 1.50. Business has been good but not great. Expansion costs have brought the current ratio down to 1.40 on December 15. Rita Grant, owner of the business, is considering what might happen if she reports a current ratio of 1.40 to the bank. One course of action for Grant is to record in December $10,000 of revenue that the business will earn in January of next year. The contract for this job has been signed. Requirements ction and indicate how recording this revenue in