Answered step by step

Verified Expert Solution

Question

1 Approved Answer

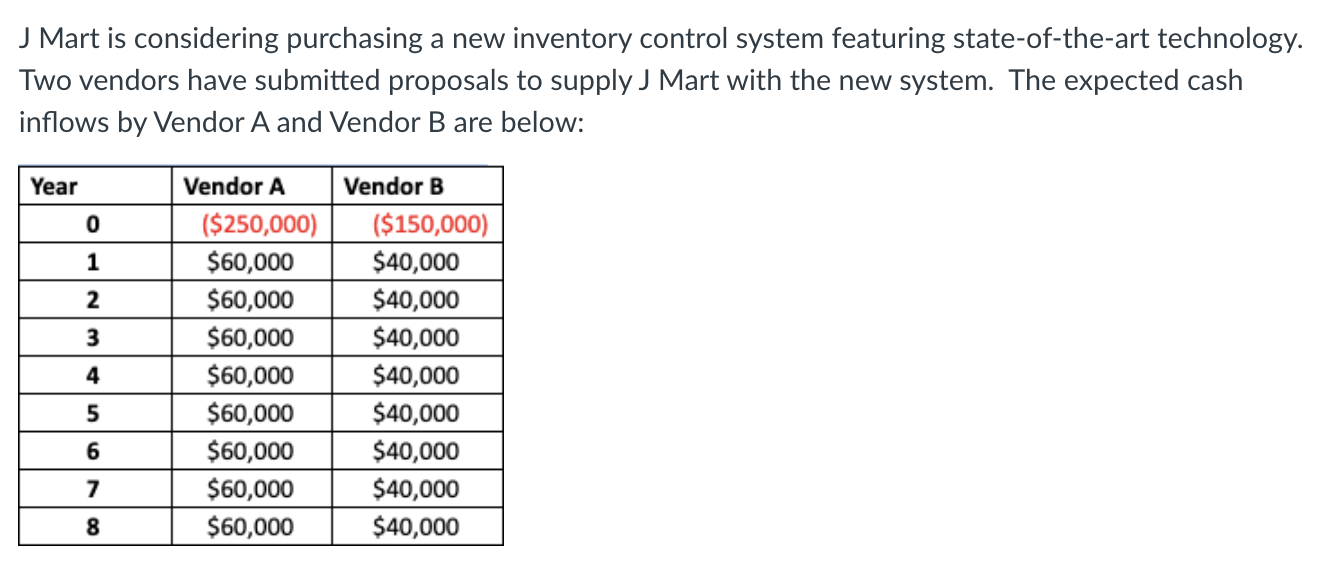

J Mart is considering purchasing a new inventory control system featuring state-of-the-art technology. Two vendors have submitted proposals to supply J Mart with the new

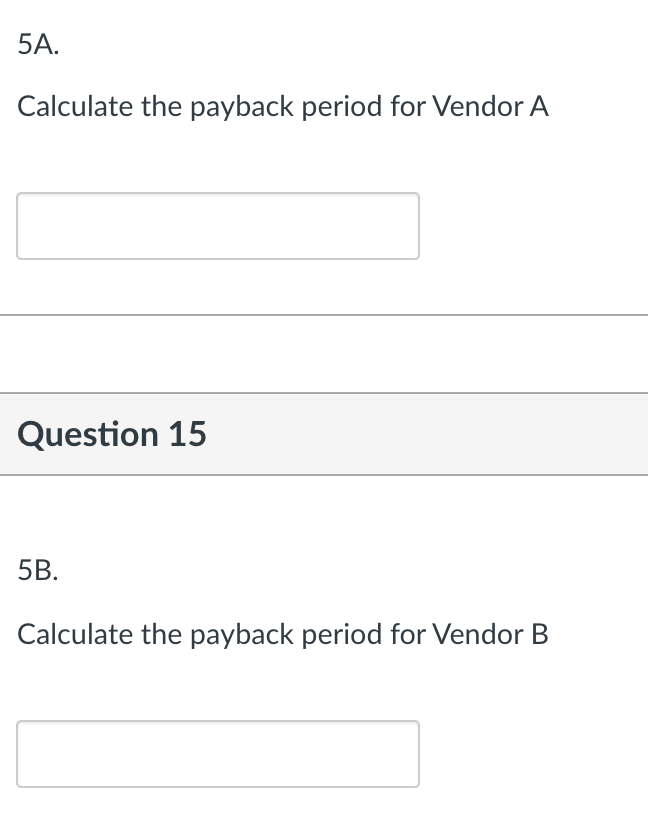

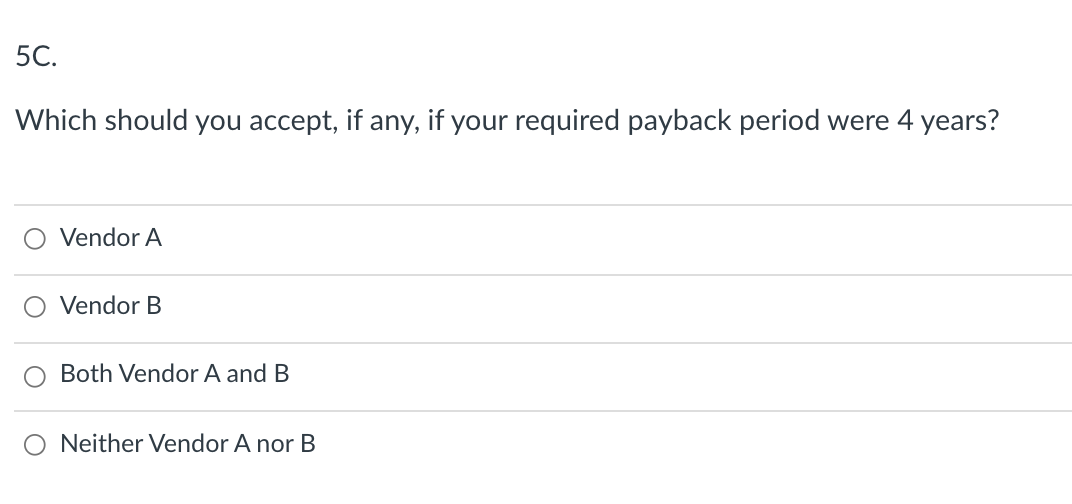

J Mart is considering purchasing a new inventory control system featuring state-of-the-art technology. Two vendors have submitted proposals to supply J Mart with the new system. The expected cash inflows by Vendor A and Vendor B are below: Year 0 1 2 3 Vendor A ($250,000) $60,000 $60,000 $60,000 $60,000 $60,000 $ 60,000 $60,000 $60,000 Vendor B ($150,000) $40,000 $40,000 $40,000 $40,000 $40,000 $40,000 $40,000 $40,000 4 5 6 7 8 5A. Calculate the payback period for Vendor A Question 15 5B. Calculate the payback period for Vendor B 5C. Which should you accept, if any, if your required payback period were 4 years? O Vendor A Vendor B Both Vendor A and B O Neither Vendor A nor B 5D. If J Mart's required rate of return is 10%, calculate the net present value for Vendor A. Question 18 8 pts 5E. If I Mart's required rate of return is 10%, calculate the net present value for Vendor B. Question 19 3 pts 5F. Should J Mart accept one or the other, neither or both systems? If one or the other, which one? Explain your reasoning

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started