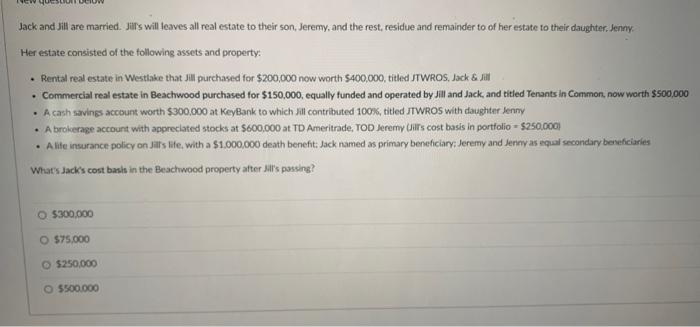

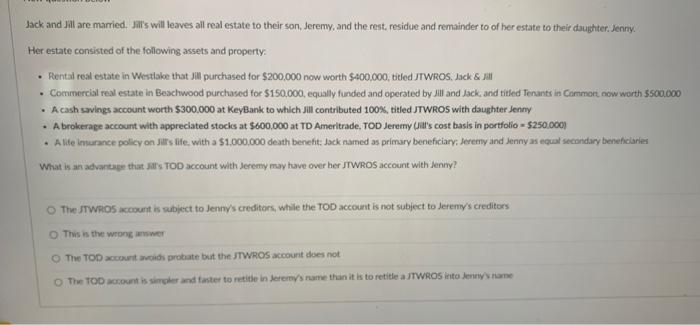

Jack and Jill are married. Jits will leaves all real estate to their son, Jeremy, and the rest, residue and remainder to of her estate to their daughter. Jenny. Her estate consisted of the following assets and property: - Rental real estate in Westlake that Jill purchased for $200,000 now worth $400,000, tithed JTWROS, Jack 8 . Jill - Commercial real estate in Beachwood purchased for $150,000, equally funded and operated by Jill and Jack, and titled Tenants in Common, now worth $500,000 - A cash savines account worth $300,000 at KeyBank to which Jill contributed 10035 titled JTWROS with daughten lenny - A brokerage account with appreclated stocks at $600,000 at TD Ameritrade, TOD Jeremy (Jilis cost basis in portfolio = 5250.000. - Alife insurance policy on Jilis life, with a $1.000.000 death benefit: Jack named as primary beneficiary: Jeremy and Jeriny as equal secondary beseficiaries What's Jack's cost basis in the Beachwood property after dill's passing? 5300,000 $75.000 5250,000 5500000 Jack and Jill are married. Jil's will leaves all real estate to their son, Jeremy, and the rest. residue and remainder to of her estate to their daughter. Jenny. Her estate consisted of the following assets and property: - Rental real estate in Wertiake that Jill purchased for $200,000 now worth $400,000, bitled JTWiROS, lack & Jal - Commercial real estate in Beachwood purchased for $150,000, equally funded and operated by lill and Jack, and titled Ienants in Commor, now worth $500,000 - A cash savings acceunt worth $300.000 at KeyBank to which Jill contributed 1002 , titled JTWROS with daughter Jenny - A brokerage account with appreciated stocis at $600,000 at TD Ameritrade, TOD Jereny (Will's cost basis in portfolio = $250.000 ) - A life inturance policy on Jirs life. with a $1,000,000 death benefit: Jack named as primary beneficiary: Jeremy and Jenny as equal secondary beneficianies What is an advantage that Jars TOD account with leremy may have over her JTWROS account with Jenmy? The STWPOS account is wubject to Jenny/s creditors, while the TOD account is not subject to lereny's creditors This is the wenge anwer The TPD accoset zroids prokate but the JTWROS accourit does not. The TOD acsocent is singler and faster to netite in Jereitys name than it is to retitle a JTWROS into denuy viame