Answered step by step

Verified Expert Solution

Question

1 Approved Answer

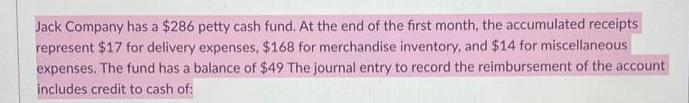

Jack Company has a $286 petty cash fund. At the end of the first month, the accumulated receipts represent $17 for delivery expenses, $168

Jack Company has a $286 petty cash fund. At the end of the first month, the accumulated receipts represent $17 for delivery expenses, $168 for merchandise inventory, and $14 for miscellaneous expenses. The fund has a balance of $49 The journal entry to record the reimbursement of the account includes credit to cash of: CCC Inc. deposits all cash receipts on the day they are received and makes all cash payments by check. The January general ledger shows $24,424 at the end of the month. A comparison of the bank statement to its general ledger cash account revealed the following: Reconciling Items NSF check deposit Deposit in transit Outstanding checks 549 2,100 1,100 Additionally, interest in the amount of $28 was earned on the bank account but had not been recorded in the general ledger. The adjusted cash balance per the book records should be:

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Determine the adjusted cash balance per the book records Bank Bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started