Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jack is Australian resident for tax purpose, and he works for DHL as delivery man in last few years. He is now considering to

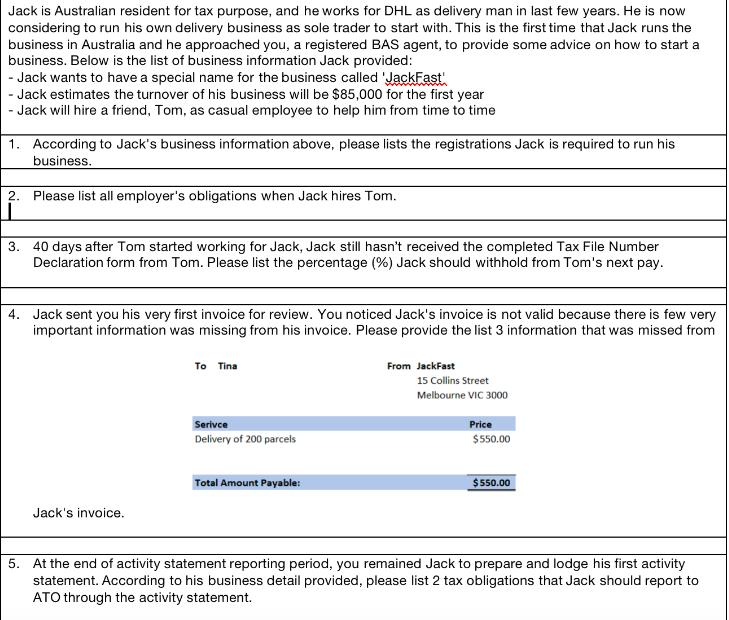

Jack is Australian resident for tax purpose, and he works for DHL as delivery man in last few years. He is now considering to run his own delivery business as sole trader to start with. This is the first time that Jack runs the business in Australia and he approached you, a registered BAS agent, to provide some advice on how to start a business. Below is the list of business information Jack provided: - Jack wants to have a special name for the business called 'JackFast' - Jack estimates the turnover of his business will be $85,000 for the first year - Jack will hire a friend, Tom, as casual employee to help him from time to time 1. According to Jack's business information above, please lists the registrations Jack is required to run his business. 2. Please list all employer's obligations when Jack hires Tom. 3. 40 days after Tom started working for Jack, Jack still hasn't received the completed Tax File Number Declaration form from Tom. Please list the percentage (%) Jack should withhold from Tom's next pay. 4. Jack sent you his very first invoice for review. You noticed Jack's invoice is not valid because there is few very important information was missing from his invoice. Please provide the list 3 information that was missed from Jack's invoice. To Tina Serivce Delivery of 200 parcels Total Amount Payable: From JackFast 15 Collins Street Melbourne VIC 3000 Price $550.00 $550.00 5. At the end of activity statement reporting period, you remained Jack to prepare and lodge his first activity statement. According to his business detail provided, please list 2 tax obligations that Jack should report to ATO through the activity statement.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 To run his business JackFast as a sole trader in Australia Jack is required to register for Austra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started