Answered step by step

Verified Expert Solution

Question

1 Approved Answer

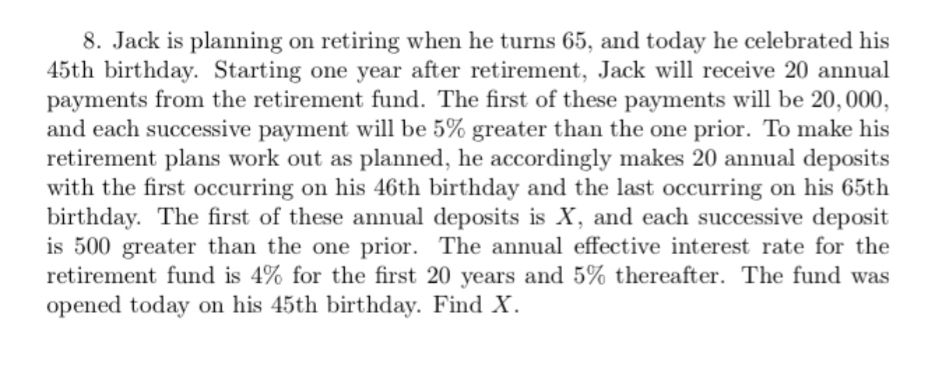

Jack is planning on retiring when he turns 6 5 , and today he celebrated his 4 5 th birthday. Starting one year after retirement,

Jack is planning on retiring when he turns and today he celebrated his th birthday. Starting one year after retirement, Jack will receive annual payments from the retirement fund. The first of these payments will be and each successive payment will be greater than the one prior. To make his retirement plans work out as planned, he accordingly makes annual deposits with the first occurring on his th birthday and the last occurring on his th birthday. The first of these annual deposits is and each successive deposit is greater than the one prior. The annual effective interest rate for the retirement fund is for the first years and thereafter. The fund was opened today on his th birthday. Find

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started